![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

88 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What is an income Statement |

A profit and loss account

Shows a companies income v expenditure, or, trading performance, over a given period, which may be a month, a quarter, or a financial year |

TRADING PERFORMANCE |

|

|

What is a Balance Sheet |

A snapshot in time of a companies financial position

Produced at the end of the financial year

Shows Assets, Owns, Debits, =, Liabilities, Owes, Credits |

POSITION

END

DR = CR |

|

|

What assets are displayed on a Balance Sheet |

Non Current Assets

Fixed Long Term Assets with a remaining useful life of greater than 12 months, I E, Land, Buildings, Equipment and Machinery, Plant and Vehicles

Current Assets

More Liquid assets, retained for less than 12 months, I E, Inventories, Trade Receivables, Cash and Cash Equivilent |

> 12 MONTHS

< 12 MONTHS |

|

|

What are Non-Current Assets and what are they used for |

Assets that have a remaining useful life of more than 1 year

Acquired for use within a business with a view to earning profit

Not sold during the normal course of business

|

USEFUL LIFE

EARNING PROFIT

NORMAL COURSE |

|

|

What is displayed on the liabilities section of a balance sheet |

Equity

Share Capital, Retained Earnings, Accumulated Profit

Non Current Liabilities

Borrowings, I E, long term loans

Current Liabilities

Trade Payables, Wages, Overheads, Short term borrowing, I E, Bank Overdraft |

|

|

|

What are Trade Payables |

Monies owing to suppliers for goods or services bought on credit

Can be thought of as a short term interest free loan |

CREDIT

INTEREST FREE |

|

|

5 Facts about Retained Earnings |

1. The percentage of profits not paid out to shareholder as a dividend

2. Retained by the company for re-investment or to pay off debts

3. Belongs to the shareholders

4. A businesses most important source of finance

5. Calculated at the beginning of the financial year |

PROFITS

RE-INVESTMENT

BELONGS

IMPORTANT

BEGINNING |

|

|

What is Accumulated Profit |

Similar to Retained Earnings but may include Reserve Accounts |

RESERVE |

|

|

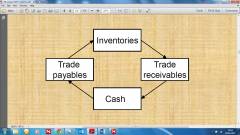

How does Cash Flow around the Working Capital Cycle |

|

|

|

|

How do we calculate the Book Value of a Company |

Book Values = Equity, minus, Current Liabilities |

|

|

|

What financial controls can be implemented for inventories |

Hold Maximum

Re-order Levels

Hold Minimum |

|

|

|

Name some of the problems associated with holding Inventories |

Too High

Increased cost of holding, Uses Working Capital, Obsolescence

Too Low - Interrupted Operations |

INCREASED

CAPITAL

OBSOLESCENCE

INTERRUPTED |

|

|

What are the main financial controls associated with giving customers credit |

Customer Credit Ratings

Company Policies

Collection Periods, I E, 30, 60, or 90 days |

RATINGS

POLICIES

COLLECTION |

|

|

What are the main problems associated with giving customers credit |

Too High

Uses working capital, issues with cash flow

Too Low

Loss of customers |

CAPITAL

ISSUES

LOSS |

|

|

In which 3 areas of the cash flow cycle can we exert financial controls |

Inventories

Trade Receivables, A, K, A, Credit

Cash |

|

|

|

What are the main financial controls associated with cash |

Budgeting

&

Forecasting, Daily, Weekly, Monthly |

|

|

|

Name 4 cash flow control systems |

RAC - Record, Analyse, Control

Pareto, the 80 20 rule

Input, Process, Output, Feedback

ABC Analysis |

|

|

|

Name 2 financial accounting standards |

the I F R S, International Financial Reporting Standards

The I A S, International Accounting Standards |

|

|

|

Explain cash accounting |

An accounting method where financial events are only recognized after cash has changed hands

Income is recorded once it has been received

Expenses are recognised when they are actually paid |

CHANGED HANDS

RECEIVED

PAID |

|

|

List 1 advantage and 1 disadvantage of cash accounting |

An advantage is that, a business may appear to be better off than it actually is

A disadvantage is that, it provides an incomplete picture of liabilities incurred but not yet paid |

BETTER OFF

INCOMPLETE PICTURE |

|

|

Explain Accruals Accounting |

An accounting method that, measures the performance and financial position of a company, by recognising financial events, in the period they occur, irrespective of when cash changes hands

Income is recognized when, the right to receive consideration arrives

Expenses are recognized when, they actually occur |

FINANCIAL EVENTS

CONSIDERATION

ACTUALLY OCCUR |

|

|

When should income and expenses be recognized under accruals accounting |

When payment or part payment has been received or made

When customers agree to pay their bills

When a suppliers agreed credit period expires

|

PAYMENT

CUSTOMERS

SUPPLIERS |

|

|

When should assets and liabilities be recognized under accruals accounting |

An asset should be recognised if it has a remaining useful life of greater than 12 months

Liabilities should be recognised before the receipt of a suppliers invoice

|

USEFUL LIFE

BEFORE |

|

|

List 3 benefits of accruals accounting |

Provides a more complete picture of income earned and costs incurred

Assets and liabilities are recognized

Cash flow manipulation is removed |

COMPLETE PICTURE

RECOGNIZED

MANIPULATION |

|

|

What is an accrual |

Expenditure on goods or services for which the supplier has not yet invoiced or been paid |

NOT YET INVOICED |

|

|

How are accruals recorded in the financial statements |

Charged as an expense to the income statement

Deducted as an accrued expense from the current liabilities section of the balance sheet at the end of the financial period in which it occurred |

PAYMENT

DEBIT

CURRENT LIABILITIES |

|

|

What effect does an accrual have on expenses, liabilities and profit |

Increases expenses and liabilities

Decreases profit |

|

|

|

What is a prepayment |

Expenditure on goods or services for future benefit, which are charged to future operations, I E, insurance |

FUTURE |

|

|

How are prepayments recorded on the financial statements |

Charged as an expense to the income statement during the period in which it occurred

Added as a prepiad expense (of the relevant account) to the current assets section of the balance sheet |

PAYMENT

DEBIT

CURRENT ASSETS |

|

|

What effect does prepayments have on expenses liabilities and profit |

Decreases expenses and liabilities

Increases profit |

|

|

|

What are intangible assets |

Non financial assets which have no physical form, I E, Goodwill, Brand Names, IPR

|

NO PHYSICAL |

|

|

How are intangible assets identified and controlled |

Through custody or legal rights |

CUSTODY

LEGAL |

|

|

What is Depreciation |

A measure of the wearing out, consumption, or other loss of value, of non-current assets through, use, the passage of time, or obsolescence, due to technological or market changes |

CONSUMPTION

USE

TIME |

|

|

Name 2 methods of calculating Depreciation |

Straight Line Method

where, annual depreciation = original cost of asset minus estimated residual value, divided by expected useful life in years

Reducing Balance Method

where, Annual depreciation = Net Book Value, times, depreciation rate, expressed as a percentage |

STRAIGHT

REDUCING |

|

|

What is a Debtor |

A person or entity who owes money |

OWES |

|

|

What is a Creditor |

A person or entity to whom money is owed, for goods or services received, but not yet paid for |

OWED

NOT YET PAID |

|

|

What are Accounting Standards |

The rules under which financial accounts are prepared |

RULES |

|

|

Which body developed accounting standards in the UK |

The I,A,S,B

International Accounting Standards Board |

IASB |

|

|

How is annual depreciation recorded on financial statements |

Accumulated in the provision for depreciation account

Charged as an expense to the income statement

Deducted as annual depreciation from the Non-Current assets section of the Balance Sheet, to show, Net Book Value |

ACCUMULATED EXPENSE

DEDUCTED |

|

|

What is the formula for re-evaluating annual depreciation |

Annual Depreciation = Revised Value of Asset, minus, Residual Value, divided by Remaining Useful Life in years |

|

|

|

List 6 policies a company should have relating to offering customers credit |

1. Which customers should be offered credit

2. How much credit should they be offered

3. The length of time the credit will be offered over

4. Any discounts for prompt payment

5. Collection Policies

6. How to Manage the risk of non payment |

WHICH

HOW MUCH

LENGTH

DISCOUNT

COLLECTION

RISK |

|

|

What is a Provision for Doubtful Debt |

An estimate of of the amount of customer debt, that a company expects not to be paid, based on previous experience

Can be thought of as a safety net

Helps avoid claiming profits which fail to materialise |

ESTIMATE

SAFETY NET

AVOID |

|

|

How do we record the provision of bad/doubtful debts on the financial statements |

If no provision already exists the full amount is taken as an expense into the Income Statement If a provision exists from the previous year

An increase will be taken into the income statement as and expense

A decrease will be taken into the Income Statement as an income

The full amount will be deducted from the trade and other receivables figure in the current liabilites section of the balance sheet |

EXPENSE

EXPENSE

INCOME

DEDUCTED |

|

|

What are Bad Debts |

Debts written off when it becomes reasonably certain the customer will never pay. The outstanding amount is written off as a bad debt |

CERTAIN

CUSTOMER

OUTSTANDING |

|

|

What is debt factoring |

An arrangement to have customer debts collected by a factoring company who advance the business a proportion of the total amount due to be collected |

PROPORTION

TOTAL |

|

|

What are the 3 main methods used to value inventories |

LIFO - Last In First Out

FIFO - First In First Out

AVCO - Average Cost |

|

|

|

List 6 costs associated with holding inventories |

1. Cost of Capital

2.Warehousing and Handling

3. Deterioration

4. Obsolescence

5. Insurance

6. Pilferage

|

|

|

|

What are the costs associated with procuring inventories |

Ordering Costs

Delivery Costs |

|

|

|

What are the costs associated with a shortage of inventories |

Profit from lost sales

Additional cost of emergency inventories |

PROFIT

EMERGENCY |

|

|

What assumptions are made when using the EOQ inventory management model |

Demand is constant,

Inventory is used up evenly over time, and, topped up just as it runs out |

CONSTANT

EVENLY

TOPPED UP |

|

|

What is the purpose of the EOQ inventory management model |

to determine the optimum inventory order level I, E, the amount of inventory to be ordered at one time, to ensure annual inventory costs are minimised

Formula

EOQ = Square Root (2 x Co x D) / Ch

where

Co = cost of placing one order

D = inventory usage in units for one period (demand)

Ch = holding cost per unit of inventory for one period |

OPTIMUM

MINIMISED

PLACING

USAGE

PER UNIT |

|

|

What sources of finance are available to a business |

Internal and External

Long Term and Short Term |

|

|

|

List 3 short term internal sources of finance |

Reduced inventory levels

Delayed payment of trade payables

Tighter credit controls

|

REDUCED

DELAYED

TIGHTER |

|

|

List a long term, internal source of finance |

Retained earnings |

RETAINED |

|

|

List 2 short term, external sources of finance |

Bank overdraft

Debt Factoring |

|

|

|

List 2 long term, external sources of finance |

Equity, e.g. ordinary shares

Debt, e.g. borrowings

|

|

|

|

List and explain 2 other forms of Borrowing |

Finance Lease Like a loan agreement for the purchase of Capital assets in installments

Sale and Lease Back Where a company raises finance by selling off a fixed asset to a financial institution and agreeing to lease it back so it can continue to use it |

FINANCE

INSTALLMENTS

LEASE BACK

SELLING OFF

|

|

|

List 4 things that should be considered when comparing Long Term v Short Term Borrowings |

Matching

Flexibility

Renewals

Interest Rates |

|

|

|

Describe 5 factors which should be considered when using borrowing as a primary source of finance for a business |

1. It is a cheaper source of finance than equity

2. Tax relief can be claimed on loan interest payments

3. Borrowings are secured on company assets

4. The lender has first claim on assets should the company go into liquidation

5. Repayments must be made as scheduled, irrespective of the company's financial postion |

CHEAPER

TAX

SECURED

LENDERS

REPAYMENTS |

|

|

List 3 advantages of a company being listed on the stock market |

1. Access to a wider pool of finance

2. Improved company image

3. Improved marketability of shares

|

FINANCE

IMAGE

MARKETABILITY |

|

|

List 3 disadvantages of a company being listed on the stock market |

1. More vulnerable to market fluctuations

2. Increased risk of hostile takeover

3. Subject to additional regulatory requirements |

VULNERABLE

RISK

SUBJECT TO |

|

|

List 4 ways in which a shareholder benefits from investing in shares of a company |

1. They are effectively the owners of the company

2. They share in the profits of the business through dividend payments

3. They have voting rights

4. They have limited liability should the company go into liquidation |

OWNERS

DIVIDEND

VOTING

LIMITED LIABILITY |

|

|

List 2 drawbacks of investing in shares of a company |

Shareholders have last claim on the companies assets in the event of liquidation

Value of investment can rise or fall depending on the stock market |

ASSETS

INVESTMENT |

|

|

What is a bonus share issue |

An issue of new shares in a company at no cost to the shareholders |

NEW

NO COST |

|

|

Explain how a bonus share issue works |

The shares are issued by converting some reserves (e.g. share premium) into capital

The new shares are issued at no cost to the shareholders and distributed in proportion to their existing shareholdings

No cash is raised by the company during the process |

PREMIUM

PROPORTION

NO CASH |

|

|

What is a rights issue |

An issue of new shares in a company for cash

Initially offered to existing shareholders in proportion to their current shareholdings

The issue price of the new shares is always below current market value of shares already in circulation |

CASH

PROPORTION

BELOW |

|

|

What is Share Capital |

Equity generated from the issue of shares in a company, which, can be in the form of cash, or, other considerations |

EQUITY

CASH

OTHER |

|

|

What is a share premium |

The excess paid to a company for a share over and above its nominal value

Share price = £7

Nominal value = £5

Share premium = £7 - £5 = £2 |

EXCESS

NOMINAL |

|

|

Explain Weighted Average Cost of Capital |

WACC is the average cost of a companies finance, weighted against the relative size of each element, compared to the total output

WACC = (% of Equity x Cost of Equity) + (% of Debt x Cost of Debt)

Cost of equity is the rate of return required by the ordinary shareholders on their investment

Cost of debt is the interest rate of a companies loans |

AVERAGE

WEIGHTED

RELATIVE

RATE OF RETURN

INTEREST RATE

|

|

|

What type of ratio is Return on Capital Employed (ROCE) |

A profitability ratio |

|

|

|

What type of ratio is the Liquid Assets ratio |

A liquidity ratio |

|

|

|

What type of ratio is Revenues Generation |

A profitability ratio |

|

|

|

What type of ratio is the Current Ratio |

A liquidity ratio |

|

|

|

What type of ratio is the Borrowing Ratio |

A gearing ratio |

|

|

|

What type of ratio is Profit Margin |

A profitability ratio |

|

|

|

What is the Liquid Assets Ratio also known as |

The acid test |

|

|

|

What type of ratio is Inventories Turn |

A liquidity ratio |

|

|

|

What type of ratio is the Income Gearing Ratio |

A gearing ratio |

|

|

|

What type of ratio is Trade Receivables Weeks |

A liquidity ratio |

|

|

|

What is Trade Receivables Weeks also known as |

Debt Collection Period |

|

|

|

What does Return on capital Employed indicate |

The overall return a company generates for every £1 invested |

RETURN |

|

|

What does Profit Margin indicate |

The average profit a company generates for every £1 of revenues |

REVENUES |

|

|

What does Revenues Generation indicate |

The revenues generated for every £1 of capital employed |

CAPITAL |

|

|

What does the Current Ratio indicate |

A companies ability to pay its way, in the short term

i.e. a liquidity test |

SHORT TERM |

|

|

What does trade receivables weeks indicate |

The length of time in weeks a company takes to collect its debts |

TIME |

|

|

What does Inventory Turn indicate |

The average number of times per year a company turns over its inventories |

AVERAGE |

|

|

What is the Acid Test Ratio |

A more stringent liquidity test |

STRINGENT |

|

|

What does the Borrowing Ratio Indicate |

The overall gearing of a company, or the number of times borrowing exceeds equity

i.e. a value of 8 indicates the company has borrowed £8 for every £1 invested |

GEARING |