![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

Classify operating activities on a statement of cash flows |

Cash flows from operating activities correspond to the cash effects of items that determine net income (on the income statement) |

|

|

Classify investing activities on a statement of cash flows |

Cash flows from investing activities relate to increases or decreases in long-term assets and investments |

|

|

Classify financing activities on a statement of cash flows |

Cash flows from financing activities involve cash receipts and parents that affect long-term liabilities and stockholders' equity. |

|

|

Where would interest, received or paid, go on a statement of cash flows? |

Operating activities |

|

|

Where do dividends received go on a statement of cash flows? |

Operating (though IFRS allows them on either operating or financing) |

|

|

Where do dividends paid go on a statement of cash flows? |

Financing activities (though IFRS allows them on either operating or financing) |

|

|

Where does the payment of interest go on a statement of cash flows? |

Operating activities |

|

|

What order should accounts appear in the trial balance sheet? |

Assets, liabilities, equity, revenues, expenses |

|

|

What are the three key elements of accrual accounting? |

Time-period assumption, revenue recognition principle, expense recognition principle. |

|

|

Define the time-period assumption |

The accounting cycle of a business can be divided into equal (if artificial) time periods. |

|

|

Define the revenue recognition principle |

Revenue is recognized (recorded) in the period in which a company satisfies its performance obligation, regardless of when cash is received. |

|

|

Define the expense recognition principle |

An expense is recorded when it is incurred, regardless of when cash is paid. Expenses only include costs incurred to earn revenue in the same accounting period. |

|

|

What are the four types of adjusting entries |

Accrued revenues, accrued expenses, deferred (unearned) revenues, deferred (prepaid) expenses |

|

|

Define accrued revenues |

Assets resulting from revenues that have been earned but for which no cash has yet been received |

|

|

Define accrued expenses |

Liabilities resulting from expenses that have been incurred but not yet paid in cash |

|

|

Define deferred (unearned) revenues |

Liabilities arising from the receipt of cash for which revenue has not yet been earned |

|

|

Define deferred (prepaid) expenses |

Assets, arising from the payment of cash, that have not been used or consumed by the end of the period. |

|

|

What accounts have a normal debit balance |

Assets, expenses, and dividends |

|

|

What accounts have a normal credit balance |

Liabilities, stockholder equities, revenues |

|

|

What are the permanent accounts? |

Assets, liabilities, and stockholders' equity |

|

|

What are the temporary accounts? |

Revenues, expenses, dividends |

|

|

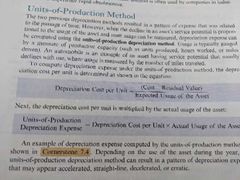

Units of production depreciation method |

|

|

|

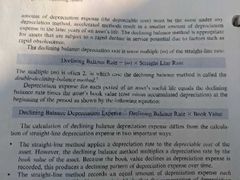

Declining balance depreciation method |

|

|

|

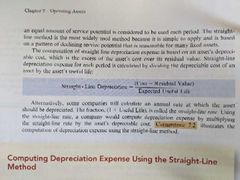

Straight-line depreciation |

|

|

|

What payroll taxes are deducted from wages (and included in wages expense)? |

Social security taxes payable, medicare taxes payable, federal income taxes withholding payable |

|

|

What payroll taxes must be paid by the employer (and balances by a matching liability payable)? |

Federal unemployment tax expense, state unemployment tax expense, social security tax expense (appears on both as same amount), medicare tax expense |

|

|

Current ratio formula |

Current assets / current liabilities |

|

|

Quick ratio |

(cash + marketable securities + accounts receivable) / current liabilities |

|

|

Cash ratio formula |

(cash + marketable securities) / current liabilities |

|

|

Operating cash flow ratio |

Cash flows from operating activities / current liabilities |

|

|

Effective interest expense formula |

Carrying value x yield rate x time (in years) |

|

|

Debt to Equity Ratio |

Total liabilities / total equity |

|

|

Debt to total assets ratio |

Total liabilities / total aasets |

|

|

Long-term debt to equity ratio |

Long-term debt / total equity |

|

|

Times interest earned ratio (accrual basis) |

Operating income / interest expense |

|

|

Times interest earned ratio (cash basis) |

Can flows from operating activities + taxes paid + interest paid / interest paid |

|

|

Gross margin calculation |

Gross profit / net sales |

|

|

Inventory turnover rayio |

COGS / Average inventory |

|

|

A stage days to sell inbentory |

365 / inventory turnover |

|

|

Gross profit |

Revenue - COGS |