![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

19 Cards in this Set

- Front

- Back

|

Formula for Big Dividend |

Beginning Owners Equity +Comprehensive Income - End Owners' Equity |

|

|

Formula for Estimated Value per Share |

Estimated Value /Shares Outstanding |

|

|

Formula for Dividend Discount Model |

Estimated Value at time zero = Forecasted dividend for period/ (1 + cost of equity capital)^period |

|

|

Formula for Book Value |

Book Value of owner's equity at time t = Book Value at time t-1 + Comprehensive Income - Big Dividend |

|

|

Dividend Discount Model |

The dividend discount model (DDM) is a method of valuing a company's stock price based on the theory that its stock is worth the sum of all of its future dividend payments, discounted back to their present value. |

|

|

"Big Dividends" |

Dividends used to value firms |

|

|

Book Value |

Book value of an asset is the value at which the asset is carried on a balance sheet and calculated by taking the cost of an asset minus the accumulated depreciation. |

|

|

Weighted average cost of capital |

is the average rate of return a company expects to compensate all its different investors. The weights are the fraction of each financing source in the company's target capital structure. |

|

|

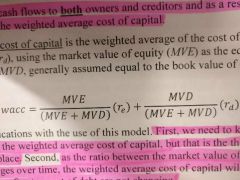

Formula for weighted average cost of capital |

|

|

|

Formula for Cash Flow |

Cash Flow = Big Dividend + After-tax Interest Expense - Change in Long Term Debt |

|

|

Cost of Equity Capital |

The return that investors expect to receive from an equity investment. |

|

|

Capital Asset Pricing Model - CAPM |

The capital asset pricing model (CAPM) is a model that describes the relationship between systematic risk and expected return for assets, particularly stocks. |

|

|

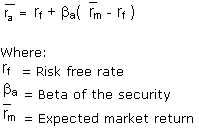

Formula for Capital Asset Pricing Model - CAPM |

|

|

|

What are "transitionary" components of income? |

Components of income not expected to recur. |

|

|

What are "persistent" components of income? |

Components of income which are expected to recur. |

|

|

What are Discontinued Operations |

When a company decides to sell or dispose of a part of its business and the disposal represents a strategic shift that has a major effect on an entities operations and financial results. |

|

|

Special Items |

A transaction or an event that is relatively unusual or expected to be non-recurring that affects net-imcome |

|

|

What are Restructurings |

A restructuring is a package of changes to the company's operations intended to improve efficiency and profitability. |

|

|

Pro Forma (Non - GAAP) Income |

Alternative Measures of income that don't abide by Generally Accepted Accounting Principles. |