![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

97 Cards in this Set

- Front

- Back

|

Note

|

Risk in its most basic sense, may be defined s the chance of financial loss

|

|

|

Note

|

Return may be defined as the total gain or loss experienced on behalf of the owner of an asset over a given period of time

|

|

|

Note

|

Greater risk yields greater returns

|

|

|

Note

|

Risk and return are a function of both market conditions and the risk preferences o f the parties involved

|

|

|

Note

|

There are generally three basic risk preference behaviors:

1. Risk-indifferent behavior 2. Risk-averse behavior 3. Risk-seeking behavior |

|

|

Note

|

Risk-indifferent behavior reflects an attitude toward risk where an increase in the level of risk would not result in an increase in management’s required rate of return

|

|

|

Note

|

Risk-averse behavior reflects an attitude toward risk where an increase in the level of risk would result in an increase in management’s required rate of return

|

|

|

Note

|

Risk-seeking behavior reflects an attitude toward risk where an increase in the level of risk would result in a decrease in management’s required rate of return

|

|

|

Note

|

Risk averse behavior is the most common

|

|

|

Note

|

Risk seeking and Risk indifferent behaviors are less common

|

|

|

Note

|

Risk indifference is defined by the term certainty equivalent

|

|

|

Note

|

• Certainty equivalent < expected value represents risk averse behavior

• Certainty equivalent = expected value represents risk indifferent behavior • Certainty equivalent > expected value represents risk seeking behavior |

|

|

Note

|

Diversification is the process of mixing investments of different risks

|

|

|

Note

|

Risk is often reduced by diversification

|

|

|

Note

|

Total risk is the combination of the diversifiable and the nondiversifiable risk of a single asset

|

|

|

Note

|

Diversifiable risk represents the portion of a single asset’s risk that is associated with random causes and can be eliminated through diversification

|

|

|

Give me examples of the firm-specific events that lead to the diversifiable risk?

|

• Strikes

• Lawsuits • Regulatory actions • Loss of a key account |

|

|

Note

|

Diversifiable risk also referred to as:

1. Non-market risk 2. Unsystematic risk 3. Firm specific risk |

|

|

Note

|

Nondiversifiable risk is attributable to market factors that affect all firms and can’t be eliminated through diversification as war, inflation, international incidents, and political events.

|

|

|

Note

|

Nondiversifiable risk also referred to as:

1. Market risk 2. Systematic risk |

|

|

Note

|

The only relevant risk is nondiversifiable risk, because (in theory) any investor can create a portfolio of assets that eliminates all, or virtually all, diversifiable risk

|

|

|

Note

|

|

|

|

What are the various types of risk?

|

1. Interest rate risk (or yields risk)

2. Market risk 3. Credit risk 4. Default risk |

|

|

Note

|

Interest risk represents the exposure of the owner of the instrument to fluctuations in the value of the instrument in response to changes in interest rates.

|

|

|

Note

|

Market risk is the exposure of a security or firm to fluctuations in value as a result of operating within the economy is referred to as market risk

|

|

|

Note

|

Market risk is sometimes referred to as nondiversifiable risk

|

|

|

Note

|

Exposure to credit risk includes a company’s inability to secure financing or secure unfavorable credit terms as a result of poor credit ratings

|

|

|

Note

|

An organization is exposed to default risk to the extent that it is possible that its debtors may not repay the principal or interest due on their indebtedness

|

|

|

Note

|

The stated interest rate represents the rate of interest charged before any adjustment for compounding or market factors

|

|

|

Note

|

Stated interest rate is sometimes referred to as nominal interest rate

|

|

|

Note

|

The effective interest rate represents the actual finance charge associated with a borrowing after reducing loan proceeds for charges and fees related to a loan origination

|

|

|

Note

|

The annual percentage rate of interest represents a non-compounded version of the effective annual percentage rate

|

|

|

Note

|

The annual percentage rate is the rate required for disclosure by the federal regulations

|

|

|

Note

|

The effective annual percentage rate (APR) represents the stated interest rate adjusted for the number of compounding periods per year

|

|

|

Note

|

|

|

|

Note

|

Simple interest is the amount represented by interest paid only on the original amount of principal without regard to compounding

|

|

|

Note

|

Compound interest is the amount represented by interest earnings or expense that is based upon the original principal plus any unpaid interest earnings or expense

|

|

|

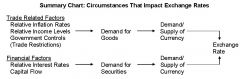

What are the trade-related factors that influence exchange rates?

|

1. Differences in inflation

2. Differences in income 3. Differences in government regulation |

|

|

What are the financial-related factors that influence exchange rates?

|

1. Differences in interest rates

2. Differences in restrictions on capital movements between companies |

|

|

Note

|

|

|

|

Note

|

Several theories are used to explain the dynamic relationship between inflation rates and interest rates in the determination of currency exchange rates including:

1. Purchasing power parity theory 2. International fisher effect 3. Interest rate parity theory |

|

|

Note

|

The purchasing power parity theory generally suggests that the price of identical goods sold in separate economies are identical when measured in a common currency, exchange rates will constantly adjust to ensure purchasing power parity (equality).

|

|

|

Note

|

The absolute form of the purchasing power parity theory is referred to as the “law of one price”, it asserts that identical goods sold in separate economies will command equal prices when denominated in a common currency, and the differences are self-adjusting.

|

|

|

Note

|

The relative form of the purchasing power parity theory holds to the basic theory of the absolute form but accounts for transportation and government regulation (such as tariffs and quotas).

|

|

|

Note

|

International fisher effect is an economic theory that states that an expected change in the current exchange rate between any two currencies is approximately equivalent to the difference between the two countries’ nominal interest rates for that time, for example if country A’s interest rate is 10% and country B’s interest rate is 5%, country B’s currency should appreciate roughly 5% compared to country A’s currency.

|

|

|

Note

|

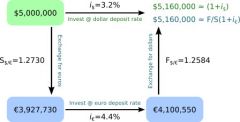

Covered interest arbitrage is a currency swap in which the counterparties exchange currencies at both the spot and forward rates simultaneously. The swap restores currency exposures to the original position without a currency gain or loss, making this a way to adjust exposure to a narrowing or widening of interest rate differentials.

|

|

|

Note

|

There are 3 exposure risks when dealing in foreign currency:

1. Transaction exposure 2. Economic exposure 3. Translation exposure |

|

|

Note

|

Transaction exposure is defined as the potential that an organization could suffer economic loss or experience economic gain upon settlement of individual transactions as a result of changes in the exchange rates.

|

|

|

Note

|

Transaction exposure is generally measured in relation to currency variability or currency correlation

|

|

|

Note

|

Measurement of transaction exposure is generally done in two steps:

1. Project foreign currency inflows and foreign currency outflows. 2. Estimate the variability (risk) associated with the foreign currency. |

|

|

Note

|

Currency variability deals with a single foreign currency

|

|

|

Note

|

Currency correlation scenarios anticipate the settlement of future transactions in multiple foreign currencies.

|

|

|

Note

|

The value-at-risk method computes the maximum one day loss based on exchange rate fluctuations using both variability and correlation measurements

|

|

|

Note

|

Economic exposure is defined as the potential that the present value of an organization’s cash flows could increase or decrease as a result of changes in the exchange rates.

|

|

|

Note

|

Currency appreciation or depreciation refers to the strengthening (appreciation) or weakening (depreciation) of a currency in relation to other currencies

|

|

|

Note

|

Example on Economic exposure of exchange rate risk

|

|

|

Note

|

Translation exposure is defined as the potential that assets, liabilities, equity, or income of a consolidated organization that includes foreign subsidiaries will change as a result of changes in the exchange rates and defines the effect of exchange rate fluctuations on financial position and operations.

|

|

|

Note

|

Translation exposure is generally defined by the following:

1. Degree of foreign involvement, 2. The location of foreign subsidiaries, 3. The accounting methods used. |

|

|

Note

|

The translation exposure to exchange rate risk increases as the proportion of foreign involvement by subsidiaries increases

|

|

|

Note

|

The exposure of the parent company to translation risk is impacted by the stability of the foreign currency in comparison to the parent’s domestic currency.

|

|

|

What are the accounting methods used to account for the translation risk exposure?

|

1. Temporal method (remeasurement method)

2. Current method (translation method) |

|

|

Note

|

The temporal method assumes that the functional currency is the currency of the parent, and translation gains or losses flow through the income statement

|

|

|

Note

|

The current method assumes that the functional currency is the currency used by the foreign subsidiary, and translation gains and losses flow through other comprehensive income.

|

|

|

Note

|

Net transaction exposure is the amount of gain or loss that might result from either a favorable or an unfavorable settlement of a transaction

|

|

|

What are the techniques for transaction exposure mitigation?

|

1. Futures hedge

2. Forward hedge 3. Money market hedge |

|

|

Note

|

Hedging is a financial risk management technique in which an organization, seeking to mitigate the risk of fluctuations in value, acquires a financial security whose financial behavior is opposite that of the hedged item.

|

|

|

Note

|

A futures hedge entitles its holder to either purchase or sell a particular number of currency units of an identified currency for a negotiated price on a stated date.

|

|

|

Note

|

Futures hedges are denominated in standard amounts and tend to be used for smaller transactions.

|

|

|

Note

|

A futures hedge contract to buy the foreign currency at a specific price at the time the account payable is due will mitigate the risk of a weakening domestic currency

|

|

|

Note

|

A futures hedge contract to sell the foreign currency received in satisfaction of the receivable at a specific price at the time the accounts receivable is due will mitigate the risk of a strengthen domestic currency.

|

|

|

Note

|

A forward hedge is similar to a futures hedge in that it entitles its holders to either purchase or sell currency units of an identified currency for a negotiated price at a future point in time.

|

|

|

Note

|

while futures hedges tend to be used for smaller transactions, forward hedges are contracts between businesses and commercial banks and normally are larger transactions.

|

|

|

Note

|

While a futures hedge might hedge a particular transaction, a forward hedge would anticipate a company’s needs to either buy or sell a foreign currency at a particular point in time.

|

|

|

Note

|

A forward hedge contract to buy the foreign currency at a specific price at the time accounts payable are due for an entire subsidiary will mitigate the risk of a weakening domestic currency.

|

|

|

Note

|

A forward hedge contract to sell the foreign currency received in satisfaction of the receivables at a specific price at the time the accounts receivable are due or on the monthly cycle of a particular subsidiary will mitigate the risk of a strengthening domestic currency.

|

|

|

Note

|

A money market hedge uses domestic currency to purchase a foreign currency at current spot rates and invest them in securities timed to mature at the same time as related payables.

|

|

|

Note

|

Currency option hedges use the same principles as forward hedge contracts and money market hedge transactions. However, instead of requiring a commitment to a transaction, the currency option hedge gives the business the option of executing the option contract or purely settling its originally negotiated transaction without the benefit of the hedge, depending on which result is most favorable.

|

|

|

Note

|

A call option [an option to buy] is the currency option hedge used to mitigate the transaction exposure associated with exchange rate risk for payables.

|

|

|

Note

|

The business has the option (not the obligation) to purchase the security at the option (strike) price. The business evaluates the relationship between the option price and the exchange rate at the settlement date. Generally, if the option price is less than the exchange rate at the time of settlement, the business will exercise its option. If the option price is more than the exchange rate at the time of settlement, the business will allow the option to expire. While premiums are used to compute any net savings associated with option transactions, they are a sunk cost and are irrelevant to the decision to exercise the options.

|

|

|

Note

|

A put option (an option to sell) is the currency option hedge used to mitigate the transaction exposure associated with exchange rate risk for receivables.

|

|

|

Note

|

The business has the option (not the obligation) to sell the collected amount of the foreign currency from the receivable at the option (strike) price. The business evaluates the relationship between the option price and the exchange rate at the settlement date. Generally, if the option price is more than the exchange rate at the time of settlement, the business will exercise its option. If the option price is less than the exchange rate at the time of settlement, the business will allow the option to expire. While premiums are used to compute any net preserved values associated with option transactions, they are a sunk cost and are irrelevant to the decision to exercise the options.

Note: The option premium is not included in the decision to exercise the option. Note: The nominal cost of hedging a foreign currency is the known exchange rate for the currency times the underlying. |

|

|

Note

|

The nominal cost of not hedging a foreign currency represents the expected value of a transaction settlement given a range of exchange rates and associated probabilities.

|

|

|

Note

|

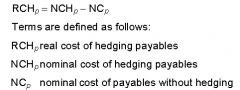

Real cost of hedging payables

|

|

|

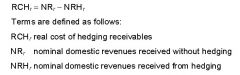

Note

|

Real cost of hedging receivables

|

|

|

Note

|

: Negative results indicate that the business should enter into a hedge transaction, while positive results indicate that the business should not hedge the transaction

|

|

|

Note

|

Limitations on Hedging are:

1. Uncertainty 2. Continual Short-term Hedging |

|

|

Note

|

Other Techniques for Transaction Exposure Mitigation - Long-term Transactions include:

1. Long-term Forward Contracts 2. Currency Swaps 3. Parallel Loan |

|

|

Note

|

Parallel loan can be defined as two firms may mitigate their transaction exposure to long-term exchange rate loss by exchanging or swapping their domestic currencies for a foreign currency and simultaneously agreeing to re-exchange or repurchase their domestic currency at a later date.

|

|

|

Note

|

Other Techniques for Transaction Exposure Mitigation - Alternative Hedging

Techniques include: 1. Leading and Lagging 2. Cross-Hedging 3. Currency Diversification |

|

|

Note

|

The entity that is owed may bill in advance if the exchange rate warrants (leading) or possibly wait until the exchange rate is favorable before settling (lagging).

|

|

|

Note

|

Cross-hedging can be defined as hedging one instrument's risk with a different instrument by taking a position in a related derivatives contract.

|

|

|

Note

|

Economic exposure is defined by the degree to which cash flows of the business can be impacted by fluctuations in exchange rates.

|

|

|

Note

|

Techniques for Economic Exposure Mitigation include:

• Restructuring the sources of income and expense to the consolidated entity which include: 1. Decreases in Sales in the country that have a depreciated currency 2. Increases in Expenses in the country that have a depreciated currency |

|

|

Note

|

Restructuring tends to be more difficult than ordinary hedges

|

|

|

Note

|

Political risks that are disruptive to financial operations include:

1. Bureaucracies and related inefficiencies or barriers to trade. 2. Corruption 3. Host government attitude toward foreign firms. 4. Attitude of consumers toward foreign firms. 5. Inconvertibility of foreign currency. 6. War. |

|

|

Note

|

Transfer prices should be set up to maximize consolidated benefit, reduce income in countries with higher taxes, and maximize the tax shield in countries with lower taxes.

|

|

|

Note

|

Intercompany cash transfers are often managed through use of leading and lagging.

|