![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

36 Cards in this Set

- Front

- Back

|

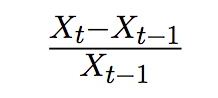

One-year Growth Rate |

(growth) |

|

|

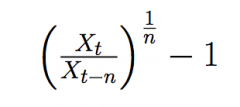

Compound Average Growth Rate (CAGR) |

(growth) |

|

|

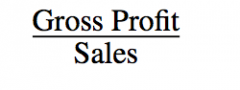

Gross Margin |

(profitability) |

|

|

Operating Margin |

(profitability) |

|

|

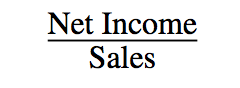

Net Margin |

(profitability) |

|

|

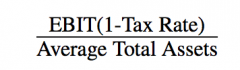

Return on Assets (ROA) |

(profitability) measures asset productivity |

|

|

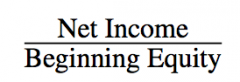

Return on Beginning Equity (ROBE) |

(profitability) |

|

|

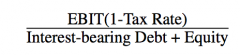

Return on Invested Capital (ROIC) |

(profitability) |

|

|

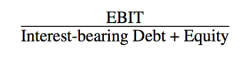

Pretax Return on Invested Capital |

(profitability) |

|

|

Return on Beginning Equity (ROBE) Use |

Measures the profits earned by shareholders in a given period to their equity investment |

|

|

Return on Invested Capital Use |

Measures the return earned on all capital, not just equity |

|

|

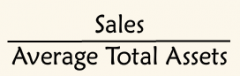

Asset Turnover |

(efficiency) |

|

|

Net Working Capital Turnover |

(efficiency) |

|

|

Net working capital |

Current assets - Current Liabilities |

|

|

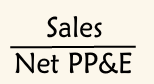

Fixed Asset Turnover |

(efficiency) |

|

|

Net PP&E definition |

Net Property Plant and Equipment. Property Plant and Equipment is the value of all buildings, land, furniture, and other physical capital that a business has purchased to run its business. The term "Net" means that it is "Net" of accumulated depreciation expenses. |

|

|

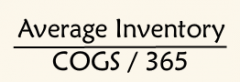

Days in Inventory (In Days) |

(effiency) |

|

|

Inventory Turnover (In Times) |

(efficiency) Low inventory turnover may signal poor efficiency, obsolete inventory or overstocking |

|

|

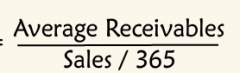

Collection Period (In Days) |

(effiency) amount owed by customers |

|

|

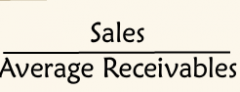

Receivables Turnover (in times) |

(effiency) a high number is equivalent to low average collection period |

|

|

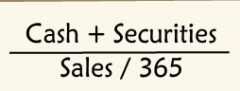

Days' Sales in Cash |

(efficiency) |

|

|

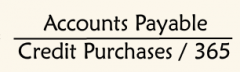

Payables Period (In Days) |

(efficiency) how long it takes to pay suppliers |

|

|

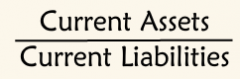

Current Ratio |

(liquidity) |

|

|

Quick Ratio |

(liquidity) without regard for inventory |

|

|

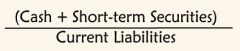

Cash Ratio |

(liquidity) |

|

|

Interval Measure (In Days) |

(liquidity) days in cash business has to finance operations |

|

|

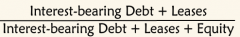

Debt Ratio |

(leverage) debt to capital |

|

|

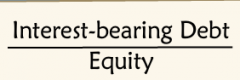

Debt to Equity Ratio |

(leverage) creditors vs shareholders |

|

|

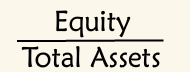

Equity to Asset Ratio |

(leverage) |

|

|

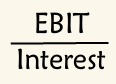

Time interest earned |

(leverage) interest paying covered by earnings |

|

|

Time Interest Earned (Cash Flow) |

(leverage) Cash flow instead of profits |

|

|

EBITDA |

Earnings Before Interest, Taxes, Depreciation and Amortization |

|

|

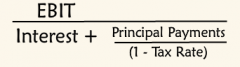

Times-burden covered |

(leverage) Ability to cover interest and principle |

|

|

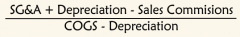

Fixed to Variable Costs |

(risk) higher = more risk |

|

|

Sales to fixed costs |

(risk) |

|

|

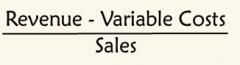

Contribution Margin |

(risk) |