![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

43 Cards in this Set

- Front

- Back

|

Variance terms

|

N

|

|

|

Covariance Terms

|

N^2 - N

(but only half are unique) |

|

|

MVP when p = 1

|

=(varB - p*SDa*SDb) / (varA + varB - 2*p*SDa*SDb)

|

|

|

MVP when p = 0

|

= varB / (varA + varB)

|

|

|

MVP when p = -1

|

= SDb / (SDa + SDb)

|

|

|

Expected Return on Portfolio

|

= Xa*Ra + Xb*Rb

|

|

|

Variance Portfolio

|

= VARa*Xa^2 + VARb*Xb^2 + 2(Xa*Xb*p*SDa*SDb)

|

|

|

Covariance (A,B)

|

= p*SDa*SDb

|

|

|

CML Equation

|

E(r) = Rf + (Rm - Rf)*SDstock/SDm

|

|

|

Sharpe Ratio

|

(Rm - Rf) / SDmkt

|

|

|

SML Equation

|

E(r) = Rf + Beta(Rm-Rf)

|

|

|

Beta

|

cov(stock,market) / variance mkt

|

|

|

How else can you represent Beta?

|

= p*SDstock / SDmkt

|

|

|

Simple idea of Beta in portfolio

|

Xa(Ba) + Xb(Bb) = Beta Port, and if market port = 1

|

|

|

Covariance calculation when 2 stocks make up market portfolio and we want the covariance with the market for each

|

Cov(A, M) = cov (A, 0.6A + 0.4B)

= .6(varA) + .4(p*SDa*SDb) This tells you the covariance of A with the market. Then you rearrange the weights in the equation for B. |

|

|

Covariance of portfolio with the market (stock and risk free comprise portfolio)

|

=cov(Xrf + (1-Xrf), M) = (1-x)*cov(port, market)

|

|

|

S.D. portfolio (well-diversified =

|

beta * S.D. market

|

|

|

Annual Percentage Rate?

|

1 + APR = (1+Rm)^12

1 + APR = (1+Rs)^2 1 + APR = (1+Rq)^4 |

|

|

Real interest rate =

|

(1 + Nominal) / (1 + Inflation)

|

|

|

PV of stock with EOY Div

|

= (FVstock + Div) / (1+r)^n

|

|

|

PV of Bond with Probability of Corporate Default

|

PV = [(1-prob default) * FV] / (1+r)^n

|

|

|

PV stock with div perpetuity

|

= Div / r

|

|

|

Growing annuity dividend (e.g.$5 next year and growing for so many years after)

|

PV = C/r*[ ((1+g)^n / (1+r)^n) - 1 ]

|

|

|

Growth rate of stocks =

|

g = ROE * plowback

|

|

|

Payout ratio =

|

Payout ratio= Div / EPS

|

|

|

ROE =

|

NI / Book Equity = EPS / Eq per share = NI/Sales * Sales / Assets * Assets / Equity

|

|

|

PVGO =

|

PVGO = -Div + (Div * perpet ROR) / r

|

|

|

EPS =

|

EPS = NI / # shares outstanding

|

|

|

Price of stock with growth opportunities

|

P = (EPS/r) + PVGO

|

|

|

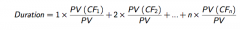

Duration

|

|

|

|

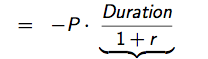

Volatility

|

|

|

|

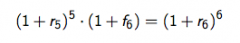

Forward Rate (one period)

|

|

|

|

What's the forward rate for r1?

|

f1 = r1

|

|

|

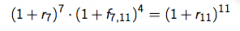

Multi-Period Forward rate

|

|

|

|

Value of a Call =

|

Value Put + Share price - PV (Exercise Price)

|

|

|

How would you do option valuation?

|

(1) You would determine a return in both cases (return - exercise price / exercise price)

(2) You would calculate E(r) in each case, needing a probablity of each happening (3) Then you calculate expected value at the end (prob case 1 * option value) + (prob case 1 * option value) (4) That gives you value at end, so you use Rf rate to discount back to the present |

|

|

Regular annuity formula

|

PV = C [ (1-(1+r)^-n) / r ]

|

|

|

When would you be indifferent between 2 different coupon bonds with the same C but different N?

|

When the coupon rate = discount rate

|

|

|

With respect to duration, the higher the interest rate, the _______ the weight of current-versus-future cash flows. Hence, the _____ the duration.

|

higher ; lower

|

|

|

What is the duration on a strip?

|

It's maturity, or n, because all cash flows are weighted on the last payment.

|

|

|

Why doesn't an annuity have a duration equal to the n?

|

Because the annuity is giving you the same payment every year ; however, the present value of the payments received later will be smaller than the present value of the payments received earlier, so it will be less than the N overall.

|

|

|

Why would a 5 year coupon bond have a YTM between the 5-year annuity and the 5- year zero coupon?

|

The yield to maturity of the strip is the 5-year spot rate r5 = 6%, since the unique payment is made at maturity. On the other extreme, the yield to maturity of the annuity, which is y = 5:75%, constitute a weighted average of all spot rates r1 to r5 in which all rates carry an almost equal weight.1 The cash flows of the bond in part (b) is the sum of the cash áows of the annuity in part (e) and the 5-year strip with $100 face value. As such, its yield to maturity would be closer to the strip (which carries higher weight due to the much higher cash áow), but strictly lower, since there are coupon payments at earlier times.

|

|

|

Why would the yield to maturity on a 10% coupon bond be smaller than the YTM on a 5% coupon bond when they have the same N, face value, and weight?

|

The yield to maturity is the constant interest rate that would lead to the same present value of a stream of cash áows as that in which each cash áow is discounted at the corre- sponding spot rate. Intuitively, the yield to maturity is a weighted average of spot rates, the weight of a given spot rate t being directly proportional to the cash áow at t .

In this case, the spot rates are increasing in time. The yield to maturity of the stream in (c) is lower than that of the stream in (b) because in the former there are higher cash áows accrued earlier (10 versus 5), hence discounted at lower spot rates |