![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

180 Cards in this Set

- Front

- Back

|

What are the Revenue Recognition requirements under U.S. GAAP? |

All 4 criteria must be met: a. Persuasive evidence of an arrangement b. Delivery has occurred or services rendered c. Price is fixed and determinable d. Collection is reasonably assured

Revenue is recognized on the date of sale (i.e. the delivery date) |

|

|

What is Research? |

Research is the planned efforts of a company to discover new information that will help either create a new product, service, process, or technique or significantly improve the one in current use. |

|

|

What is Development? |

Development takes the findings generated by research and formulates a plan to create the desired item or to improve significantly the existing one. |

|

|

What items are NOT considered research and development? |

a. Routine periodic design changes to old products or troubleshooting in production stage. b. Marketing research c. Quality control testing d. Reformulation of a chemical compound |

|

|

What is the only acceptable method of accounting for research and development costs under U.S. GAAP? |

a direct charge to expense |

|

|

What are the exceptions to expense research and development costs? |

a. Materials, equipment, or facilities that have alternate future uses (Capitalize & depreciate over their useful lives)

b. Costs of any nature undertaken on behalf of others under a contractual arrangement. |

|

|

If a research and development cost is undertaken on behalf of others under a contractual arrangement, how should it be accounted for? |

1. The purchaser will expense as R&D the amount paid & the provider will expense the costs incurred as cost of sales. 2. The conclusion for charging most R&D costs to expense under GAAP is the high degree of uncertainty of any future benefits. 3. Disclosure is required in the FS or notes of the amount of R&D charged to expense for the period. |

|

|

What is technological feasibility? |

Established up completion of: 1. A detailed program design, or

2. Completion of a working model. |

|

|

How are computer software development costs accounted for? |

1. Expense costs (planning, design, coding, and testing) incurred until technological feasibility has been established.

2. Capitalize costs (coding, testing, and producing product masters) incurred after technological feasibility has been established up to the point that the product is released for sale.

3. Inventory -- Costs incurred to actually produce the product are product costs charged to inventory. |

|

|

What are the rules for amortizing the capitalized software costs? |

Annual amortization is the greater of:

Percentage of revenue = Total capitalized amount x (Current gross revenue for period/Total projected gross revenue for product)

Straight Line = Total capitalized amount x (1/estimate of economic life) |

|

|

How are capitalized software costs reported on the balance sheet? |

At the lower of cost or market, where market is the equal to net realizable value. |

|

|

What are deferred credits? |

Unearned revenue or deferred revenue 1. Represent future income contracted for and/or collected in advance (e.g., rental income, gift certificates, magazine subscriptions collected in advance.

2. Have not yet been earned by the passage of time or other criteria.

3. Are located in the liability section of the BS. |

|

|

What is the journal entry for the collection and recognizing of earned royalties? |

DR: Cash CR: Unearned royalty --------------------------------------------- DR: Unearned royalty CR: Earned royalty |

|

|

Are costs to register a patent expensed or capitalized? |

capitalized |

|

|

Should a patent be amortized by its estimated legal life or by its estimated economic life? |

By its estimated economic life |

|

|

When should royalty revenue be recognized? |

Royalties paid should be reported as expense in the period incurred. |

|

|

Is goodwill amortized? |

NO. But it is subject to an impairment test. |

|

|

Are costs associated with maintaining, developing, or restoring goodwill capitalized? |

No. They are expensed. Also, goodwill generated internally or not purchased in an arm's length transaction is not capitalized as goodwill. |

|

|

What is goodwill? |

The representation of intangible resources and elements connected with an entity (e.g., management or marketing expertise or technical skill and knowledge that cannot be identified or valued separately). |

|

|

How is goodwill calculated? |

a. Acquisition Method Goodwill is the excess of an acquired entity's fair value over the fair value of the entity's net assets, including identifiable intangible assets.

b. Equity Method Involves the purchase of a company's capital stock. Goodwill is the excess of the stock purchase price over the fair value of the net assets acquired. |

|

|

Under U.S. GAAP, should R&D costs like pre-production prototypes and models costs, and, costs for searching for new products or new process alternatives contracted out to a third party be reported as R&D expense? |

Under U.S. GAAP, R&D contracted out to a third party, preproduction prototypes and models costs, and, costs for searching for new products or new process alternatives are reported as R&D expense. |

|

|

What is goodwill impairment? |

Goodwill impairment is determined using a different approach than other intangible assets. It's calculated at the reporting unit level. Impairment exists when the carrying amount of the reporting unit goodwill exceeds its fair value. |

|

|

What is a reporting unit? |

An operating segment or one level below an operating segment. The goodwill of one reporting unit may be impaired while the goodwill for other reporting units may not. |

|

|

How do you evaluate goodwill impairment? |

Step 1 - Identify potential impairment by comparing the fair value of each reporting unit with its carrying amount, including goodwill.

Step 2 - Measure the amount of goodwill impairment loss by comparing the implied fair value of the reporting unit's good will with the carrying amount of that good will. |

|

|

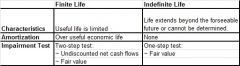

Impairment Test Rules |

|

|

|

What should you do when you see a scenario that says "evenly distributed throughout the year"? |

Multiply it by 1/2 (50%) |

|

|

Hy Corp. bought Patent A for $40,000 and Patent B for $60,000. Hy also paid acquisition costs of $5,000 for Patent A and $7,000 for Patent B. Both patents were challenged in legal actions. Hy paid $20,000 in legal fees for a successful defense of Patent A and $30,000 in legal fees for an unsuccessful defense of Patent B. What amount should Hy capitalize for patents? |

$65,000 capitalized cost for Patent A successfully defended. All costs related to Patent B are expensed because the legal defense was unsuccessful. |

|

|

On December 31, special insurance costs, incurred but unpaid, were not recorded. If these insurance costs were related to work-in-process, what is the effect of the omission on accrued liabilities and retained earnings in the December 31 balance sheet? |

Since the unrecorded liability affects work-in-process inventory (rather than cost of sales/retained earnings), there is no effect on retained earnings, but accrued liabilities (and inventory) are understated. |

|

|

Is software developed for internal use considered research and development? |

Software for internal use, unrelated to production, is not considered research and development. |

|

|

If Year 1 officers' bonuses of $62,500 were paid on January 31, Year 2. In its Year 1 income statement, should Dana include these bonuses in compensation expense? |

Yes; the expenses reference year 1, so they should be accrued in the Year 1 income statement regardless of when they are actually paid. |

|

|

What are the revenue recognition rules when the right of return exists? |

Revenue shall be recognized if ALL conditions are met: 1. Sale price is substantially fixed 2. Buyer assumes all risks of loss 3. Buyer has paid some form of consideration 4. Amount of future returns is reasonably estimated. |

|

|

On Dec. 30, Devlin sold goods to Jensen for $10,000, under an arrangement in which (1) Jensen has unlimited right of return & (2) Jensen's obligation to pay Devlin is contingent upon Jensen's reselling the goods. Past experience shows Jensen ordinarily resells 60% & returns 40%. What amount should Devlin include in sales revenue on its December 31 income statement? |

When there is an unlimited right of return, nothing should be recorded as sales revenue unless four conditions are satisfied. The following conditions were not met: The buyer assumes all risk of loss (no information). The buyer has paid some form of consideration (no information). |

|

|

What are the requirements for computer software costs developed internally or obtained for internal use only? |

a. Expense costs incurred for preliminary project state & costs for training & maintenance. b. Capitalize costs incurred after the preliminary project state for upgrades and enhancements. c. Capitalized costs should be amortized on a straight-line basis. d. For software subsequently sold to outsiders, proceeds received should be applied to the carrying amount then recognized as revenue. |

|

|

For computer software costs developed internally or obtained for internal use only, which costs can be capitalized? |

Capitalize costs incurred after the preliminary project state for upgrades and enhancements:

1. Direct costs of materials and services 2. Costs of employees directly associated with project 3. Interest costs incurred for the project |

|

|

For franchisor accounting, what is unearned revenue? |

The present value of any contract amounts relating to future services (to be performed by the franchisor) should be recorded as unearned revenue. Unearned revenue is recognized as revenue once substantial performance on such future services has occurred. |

|

|

Under franchisor accounting, when can earned revenue from initial franchise fees be reported. |

The franchisor should report revenue from initial franchise fees when all material conditions of the sale have been "substantially performed." Generally, conditions of sale are not considered substantially performed until the franchisee's first day of operations. |

|

|

What are the "substantially performed" material conditions for a franchisor to report earned revenue? |

1. Franchisor has no obligation to refund any payment (cash or otherwise) received. 2. Initial services required of the franchisor have been performed. 3. All other conditions of the sale have been met. |

|

|

What are start-up costs? |

Expenses incurred in the formation of a corporation (e.g. legal fees). These are also considered organizational costs. These costs are expensed when incurred. |

|

|

Start-up costs include which type of one-time activities? |

1. Organizing a new entity (e.g. legal fees for preparing a charter, partnership agreement, bylaws, original stock certification, filing fees) 2. Opening a new facility 3. Introducing a new product or service 4. Conducting business in a new territory or with a new class of customer. 5. Initiating a new process in an existing facility |

|

|

Start up costs do not include: |

1. Routine, ongoing efforts to refine, enrich, or improve the quality of existing products, services, processes or facilities. 2. Business mergers or acquisitions 3. Ongoing customer acquisition |

|

|

On Jan. 2, Year 1, Lava purchased a patent for $90,000. At the time of purchase, the patent was valid for 15 years; but, the useful life was estimated to be 10 years due to the competitive nature. On Dec. 31, Year 4, the product was permanently withdrawn from sale under governmental order. What amount should Lava charge against income during Year 4, assuming amortization is recorded at the end of each year? |

The patent has been permanently impaired and a loss equal to its carrying amount should be recorded. The charge against income is: $63,000 |

|

|

How is an intangible asset amortized once it becomes worthless? |

Write off the entire remaining cost to expense if an intangible asset becomes worthless during the year (e.g., due to a technological obsolescence or due to an unsuccessful patent defense lawsuit). |

|

|

How do you account for impaired intangible asset? |

Write down the intangible asset and recognize an impairment loss if an intangible asset becomes impaired (e.g., due to a change in circumstances that indicate the full carrying amount of the asset may not be recoverable). |

|

|

How do you amortize an intangible asset if the life of an existing intangible asset is changed? |

If the life of an existing intangible asset is reduced or extended, the remaining net book value is amortized over the new remaining life. |

|

|

How do you account for an intangible asset that is sold? |

If an intangible asset is sold, simply compare its carrying value at the date of sale with the selling price to determine the gain or loss. |

|

|

How is goodwill amortized? |

Amortization of purchased goodwill is not permitted. The required approach is to test goodwill for impairment at least annually. |

|

|

What method of amortization should be used on intangible assets? |

The straight-line method of amortization should be applied unless a company demonstrates that another systematic method is more appropriate. |

|

|

Goodwill should be tested for value impairment at which of the following levels under U.S. GAAP? |

U.S. GAAP requires that goodwill be tested for impairment at the reporting unit level. |

|

|

Wind Co. incurred organization costs of $6,000 at the beginning of its first year of operations. How should Wind treat the organization costs in its financial statements? |

Expensed immediately. |

|

|

Tech Co. bought a trademark on January 2, two years ago. The carrying value at the beginning of the year was $38,000. It was determined that the cash flow will be generated indefinitely at the current level for the trademark. What amount should Tech report as amortization expense for the current year? |

$0 |

|

|

After impairment loss is recognized, adjusted carrying amount of the intangible asset is its new accounting basis. Which statement about subsequent reversal of a previously recognized impairment loss is correct under U.S. GAAP? a. It is prohibited. b. It is encouraged, but not required. c. It is required when the reversal is considered permanent. d. It must be disclosed in the notes to the financial statements.

|

Under U.S. GAAP, subsequent reversal of intangible asset impairment losses is prohibited unless the intangible asset is held for sale. |

|

|

Which of the following expenditures qualifies for asset capitalization under U.S. GAAP? a. Costs of testing a prototype and modifying its design. b. Cost of materials used in prototype testing. c. Salaries of engineering staff developing a new product. d. Legal costs associated with obtaining a patent on a new product.

|

Legal costs associated with obtaining a patent on a new product are capitalized. Research and development costs related to developing a new product, including prototype testing, design modification and engineering salaries, must be expensed. |

|

|

Sanni had $150,000 in cash-basis income for the year. At current year end, AR decreased by $20,000 & AP increased by $16,000 from previous year-end balances. Compared to accrual accounting, Sanni's cash-basis income is: a. Higher by $4,000. b. Higher by $36,000. c. Lower by $36,000. d. Lower by $4,000. |

Cash basis pretax income would be $36,000 higher than accrual basis income |

|

|

Stam Co. incurred research and development project costs during the current year for equipment purchased for current and future projects totaling $100,000. The equipment has a five-year useful life and is depreciated using the straight-line method. What amount should Stam recognize as research and development expense at year end under U.S. GAAP? |

$20,000. Research and development expense does not include the amount paid for the equipment purchased for current and future projects because the equipment has alternate future uses. This equipment will be capitalized, but the related depreciation expense will be allocated to R&D while the equipment is being used for R&D. |

|

|

The matching principle: a. Matches revenues against expenses in the same accounting period. b. Matches revenues and gains against expenses and losses in the same accounting period. c. Matches expenses and losses against revenues and gains in the same accounting period. d. Matches expenses against revenues in the same accounting period. |

Matches expenses against revenues in the same accounting period. Expenses are necessarily incurred to generate revenues. All expenses incurred to generate a particular revenue should be recorded in the same period in which the revenue is recorded. |

|

|

An entity incurred the following costs related to a patent purchased during the current year: Patent purchase price $ 300,000 Nonrefundable VAT taxes $3,000 Research expenditures related to the patent $25,000 Legal costs to register the patent $12,000 Training production staff on the use of the patent $5,000 Under IFRS, the entity should recognize a patent asset of: |

Capitalized costs: Patent asset = $300,000 + 3,000 + 12,000 = $315,000. VAT taxes (value added taxes) are similar to sales taxes. Research expenditures must be expensed under IFRS (and U.S. GAAP). Staff training and administrative salaries must also be expensed. |

|

|

Which of the following expenditures related to internally generated intangible assets is most likely to be capitalized, rather than expensed as incurred, under IFRS? a. Research costs associated with the development of a new trademark for the company. b. Legal costs related to the unsuccessful defense of an internally developed patent. c. Costs to maintain goodwill acquired in a business combination. d. Development costs incurred in designing a product that has just been granted a patent. |

Under IFRS, development costs may be capitalized if certain criteria are met. If the patent has been granted, it is generally appropriate to capitalize the related design costs. |

|

|

Under IFRS, research costs related to an internally developed intangible asset must be expensed, but an intangible asset arising from development is recognized if the entity can demonstrate all of the following: |

1. Technological feasibility is established 2. The entity intends to complete the intangible asset. 3. The entity has the ability to use or sell the intangible asset. 4. The intangible asset will generate future economic benefits. 5. Adequate resources are available to complete the development & sell or use the asset. |

|

|

Goodwill should be tested for impairment at which of the following levels under IFRS?

a. Entire business as a whole. b. Each cash-generating unit. c. Each reporting unit. d. Each acquisition unit. |

Under IFRS, goodwill impairment is analyzed at the cash-generating unit level. |

|

|

With respect to IFRS, what is a cash-generating unit? |

the smallest identifiable group of assets that generates cash inflows that are largely independent of the cash inflows from other assets or groups of assets. |

|

|

Goodwill impairment is calculated at which unit level under IFRS? Under U.S. GAAP? |

Goodwill impairment is reported at the cash generating unit under IFRS and at the reporting unit level under GAAP. |

|

|

How many steps are in the goodwill impairment evaluation under IFRS? |

One-step test in which the carrying value of a CGU is compared to the CGU's recoverable amount, which is the greater of the CGU's fair value less costs to sell and its value in use (PV of future cash flows expected from the CGU).

Impairment loss = Recoverable Amount - Carrying value |

|

|

How are intangible assets valued under U.S. GAAP? |

Under GAAP, finite life intangible assets are reported at cost less amortization & impairment. Indefinite life intangible assets are reported at cost less impairment. |

|

|

How are intangible assets valued under IFRS? |

Under IFRS, intangible assets can be reported under either the cost model or the revaluation model. |

|

|

What is the cost model for IFRS valuation of intangible assets? |

Under the cost model, intangible assets are reported at cost adjusted for amortization (finite life intangible assets only) and impairment. |

|

|

What is the revaluation model for IFRS valuation of intangible assets? |

Revaluation model carrying value = Fair value on revaluation date - Subsequent amortization - Subsequent impairment. If an intangible asset is accounted for using the revaluation model, all other assets in its class must also be revalued unless there is no active market for the intangible assets. |

|

|

What are revaluation losses (IFRS) and how are they reported? |

(fair value on revaluation date < carrying value before revaluation) Reported on the I/S, unless the revaluation loss reverses a previously recognized revaluation gain (in this case, the loss is recognized in OCI & reduces the revaluation surplus in accumulated OCI. |

|

|

What are revaluation gains (IFRS) and how are they reported? |

(fair value on revaluation date > carrying value before revaluation) Reported in OCI & accumulated in equity as revaluation surplus, unless the revaluation gain reverses a previously recognized revaluation loss. Revaluation gains are reported on the I/S to the extent that they reverse a previously recognized revaluation loss. |

|

|

How are revalued intangible assets that subsequently become impaired valued and reported under IFRS? |

If revalued intangible assets subsequently become impaired, the impairment is recorded by reducing any revaluation surplus in equity to zero w/ further impairment losses reported on the I/S. |

|

|

Northstar Co. acquired a trademark for $600,000. The trademark has a remaining legal life of 5 yrs, but can be renewed every 10 yrs for a nominal fee. Northstar expects to renew the trademark indefinitely. What amount of amortization expense should Northstar record in the current year? |

Zero. Because the trademark is expected to be renewed indefinitely, there will be no amortization expense on the books. Amortization is only recorded for intangible assets with a definite life. |

|

|

A company acquired a copyright with a remaining legal life of 30 yrs. An analysis of market trends indicated that the copyrighted material will generate positive cash flows for approximately 25 years. What is the remaining useful life, if any, over which the company can amortize the copyright for accounting purposes? |

25 years. Intangible assets should be amortized over the lesser of the useful economic life or the legal life. The useful economic life is 25 years and the legal life is 30 years, so the copyright will be amortized over 25 years. |

|

|

A company reported $6 million of goodwill in last year's statement of financial position. How should the company account for the reported goodwill in the current year? |

At a reporting unit level, when the fair value is less than the carrying amount, a loss on impairment is booked on the income statement (a debit) and a reduction in goodwill (credit) is booked to the balance sheet. |

|

|

How do IFRS & GAAP differ in calculating impairment loss for a patent (or any other intangible asset except goodwill)? |

Under IFRS, an impairment is calculated using a one step model, comparing the carrying value to the recoverable amount. GAAP uses the 2-step model. IFRS allows the reversal of impairment losses. |

|

|

How does IFRS define the "recoverable amount"? |

The greater of the asset's fair value less costs to sell and the asset's value in use. Value in use is the present value of the future cash flows expected from the intangible asset. |

|

|

Brand incurred the following R&D costs: Equipment purchased for current and future projects $ 100,000 Equipment purchased for current projects only $200,000 Research and development salaries for current project $400,000 Equipment has a 5 yr life and is depreciated using the straight-line method. What amount should Brand record as depreciation for R&D projects at December 31? |

$20,000. Under GAAP, the only acceptable method of accounting for R&D is a direct charge to expense, except for items that have alternate future uses that are capitalized and depreciated. Only the equipment purchased for current and future projects will be capitalized and depreciated: $100,000 / 5 years = $20,000 |

|

|

How should NSB, Inc. report significant research and development costs incurred? |

Expense all costs in the year incurred. Under U.S. GAAP, the only acceptable method of accounting for research and development costs is a direct charge to expense, except for materials, equipment, or facilities that have alternate future uses that are capitalized and depreciated over their useful lives. |

|

|

A company should recognize goodwill in its balance sheet at which of the following points? a. Costs have been incurred in the development of goodwill. b. Goodwill has been created in the purchase of a business. c. The fair market value of the company's assets exceeds the book value of the company's assets. d. The company expects a future benefit from the creation of goodwill. |

Choice "b" is correct. Goodwill is recognized in the balance sheet when it has been created from a business acquisition. |

|

|

The Premium on 3-yr insurance policy expiring Dec. 31, Yr 3 was paid in total on Jan. 2, Year 1. If the company has a 6-month operating cycle, then on Dec. 31, Year 1, the prepaid insurance reported as a current asset would be for: a. 24 months. b. 12 months. c. 18 months. d. 6 months. |

Choice "b" is correct. The minimum operating cycle for purposes of reporting a "prepaid" current asset is one year (or 12 months). |

|

|

In Yr 3, a company incurred $500,000 of legal costs defending patents. Included was $400,000 for successful outcomes and $100,000 for unsuccessful outcomes. What amount should the company expense for Yr 3? a. $400,000 b. $100,000 c. $0 d. $500,000

|

$100,000. Legal costs associated with unsuccessfully defending a patent are immediately expensed. |

|

|

Which of the following items would be classified as a research and development cost? a. Periodic design changes to an existing product. b. Legal work in connection with a patent application. c. Engineering follow-up in an early phase of commercial production. d. Testing in search of product or process alternatives. |

Choice "d" is correct. Testing in search of a product or process alternatives would be classified as a research and development cost. |

|

|

How does the completed contract method recognize profit and loss? |

This method recognizes income only on completion (or substantial completion) of the contract. A contract is regarded as substantially complete if the remaining costs are insignificant. Losses, however, should be recognized in full in the year they are discovered. |

|

|

When is it acceptable to use the completed contract method? |

1. It is difficult to estimate the costs of a contract in progress. 2. There are many contracts in progress so that about an equal number are completed each year & an unequal recognition of income does not result. 3. The projects are of short duration & collections are not assured. |

|

|

Is the "completed contract method" permitted under IFRS? |

Nope. The percentage of completion method must be used unless the final outcome of the project cannot be reliably estimated, in which case the cost recovery method is required. Under cost recovery method, revenue can only be recognized to the extent that cash collected exceeds the costs incurred. |

|

|

How should costs calculated using the completed contract method be presented on the balance sheet? |

The excess of accumulated costs over related billings should be reflected in the balance sheet as a current asset, and the excess of accumulated billings over related costs should be reflected as a current liability. |

|

|

Balance sheet Presentation for "completed contract method": |

1. Current Asset Accounts a. Due on accounts (receivable). b. Cost of uncompleted contracts in excess of progress billings (construction in progress) OR 2. Current Liability Account Progress billings on uncompleted contracts in excess of cost. |

|

|

Accounting for the "completed contract method" (important points to remember): |

1. Applicable overhead & direct costs is charged to a construction in progress account (asset). 2. Billings &/or cash received is credited to advances on construction in progress account (liability). 3. At completion of the contract, gross profit or loss is recognized as follows: contract price -Total costs = Gross profit or loss |

|

|

How is an expected loss on the total contract determined (complete contract method)? |

Losses are recognized in full the year they are discovered. 1. Adding estimated costs to complete to the recorded costs to date to arrive at total costs. 2. Adding to advances any additional revenue expected to arrive at total contract revenue. 3. Subtracting (2) from (1) to arrive at total estimated loss on contract. |

|

|

What are the advantages/disadvantages of the "completed contract method"? |

Advantage: It's based on final results rather than on estimates. Disadvantage: It does not properly reflect the matching principle when the period of the contract extends over more than one accounting period. |

|

|

When is it appropriate to use the "percentage of completion" method? |

When collection is assured and the entity's accounting system can: 1. Reasonably estimate profitably; and 2. Provide a reliable measure of progress toward completion. |

|

|

When is revenue recognized under the "percentage of completion method"? |

Income is recognized as work progresses on the contract. Accounting for long term construction contract by the % of completion method is an exception to the basic realization principle. The exception is based on the evidence that the ultimate proceeds are available and the consensus that a better measure of periodic income results. |

|

|

Balance sheet presentation for "percentage of completion" method: |

1. Current Asset Accounts a. Due on accounts (receivable). b. Cost & estimated earnings of uncompleted contracts in excess of progress billings OR 2. Current Liability Account Progress billings on uncompleted contracts in excess of cost & estimated earnings on uncompleted contracts. |

|

|

What are the advantages/disadvantages of using the "percentage of completion" method? |

Advantages: accurate reporting of the status of the uncompleted contracts & the periodic recognition of income currently (rather than irregularly) as contracts are completed. Disadvantages: the necessity of relying on estimates of the ultimate costs. |

|

|

How should costs calculated using the percentage of completion method be presented on the balance sheet? |

Journal entries are the same as the completed contract method except that the amount of estimated gross profit earned in each period is recorded by charging the construction in progress account and crediting realized gross profit. Also, an estimated loss is recognized immediately in the year it is discovered. |

|

|

How to calculate gross profit (GP) using the "percentage of completion" method? |

Step 1: Contract price - Estimated total cost = GP Step 2: Total cost to date/Total est. cost = % Step 3: Step 1 x Step 2 = Profit to date (PTD) Step 4: PTD at current FYE - PTD at beg. = Current YTD Gross Profit

DO NOT take % of losses. Recognize in full. |

|

|

When calculating gross profit (GP) using the "percentage of completion" method, what do you do if income from a previous period has already been recognized? |

Subtract the previously recognized income from the current YTD gross profit (the amount calculated in step 4 [the last step]). |

|

|

When is revenue recognized under the "Completed contract" method? |

When a company uses the U.S. GAAP "completed contract" method to account for a long-term construction contract, revenue is recognized when the job is completed, not when progress billings are collected or when they exceed recorded costs. |

|

|

When is revenue recognized under the "percentage of completion" method? |

When the "percentage of completion" method of recording revenue is used, engineering estimates of completion or "costs incurred to date" vs. "total estimated costs" is the basis for recognizing revenue, not progress billings. |

|

|

The calculation of the income recognized in the third year of a five-year construction contract accounted for using the percentage-of-completion method includes the ratio of: a. Total costs incurred to date to total estimated costs. b. Costs incurred in year 3 to total estimated costs. c. Total costs incurred to date to total billings. d. Costs incurred in year 3 to total billings. |

Choice "a" is correct. The formula to calculate the percentage of completion is: |

|

|

When is the "installment method of accounting" acceptable? |

Only when there is no reasonable basis for estimating the degree of collectibility. Revenue is not recognized at the time a sale is made but rather when cash is actually collected. |

|

|

What are the problem solving formulas for the "installment method of accounting"? |

Gross profit = sales - cost of goods sold Gross Profit Percentage = Gross profit/Sales Earned gross profit = Cash collections x GP% Deferred gross profit = receivable x GP % |

|

|

What is the cost recovery method? |

Under this method, no profit is recognized on a sale until all costs have been recovered. At the time of sale, the expected profit on the sale is recorded as deferred gross profit. Cash collections are first applied to the recovery of product costs. Collections after all costs have been recovered are recognized as profit. |

|

|

How does the cost recovery method compare to other methods of accounting for long-term projects? |

It's similar to the installment sales method in that it may only be used when receivables are collected over an extended period and there is no reasonable basis for estimating their collectibility. Because no profit is recognized until all costs have been recovered, the cost recovery method is the most conservative method of revenue recognition. |

|

|

According to the installment method of accounting, gross profit on an installment sale is recognized in income: a. On the date of sale. b. On the date the final cash collection is received. c. In proportion to the cash collection. d. After cash collections equal to the cost of sales have been received. |

Choice "c" is correct. Under the installment method, total gross profit is deferred until cash payments are received. Realized gross profit equals the gross profit percentage on the sale times the cash received. |

|

|

When should the 'cost recovery method" be used? |

If collection is in doubt, the "cost recovery" method should be used, not the installment sales method. There must also exist no reasonable basis for estimating their collectibility. |

|

|

When does an exchange have "commercial substance"? |

If the future cash flows change as a result of the transaction. The change can either be in the areas of risk, timing, or amount of cash flows (if the economic position of the two parties changes because of the exchange). A fair value approach is used. |

|

|

How are gains and losses recognized for exchanges having "commercial substance"? |

Gains and losses are always recognized in exchanges having commercial substance and are computed as the difference between fair value and book value of the asset given up. |

|

|

How does GAAP & IFRS differ on the subject of "nonmonetary exchanges"? |

Under IFRS, exchanges of dissimilar assets are regarded as exchanges to generate revenue & are accounted for in the same manner as exchanges having commercial substance under GAAP. Exchanges of similar assets are not regarded as exchanges that generate revenue & no gains are recognized. |

|

|

When do exchanges lack "commercial substance"? |

If projected cash flows after the exchange are not expected to change significantly, the n the exchange lacks commercial substance. |

|

|

What is the accounting treatment for exchanges that lack "commercial substance"? |

Gains: 1. No Boot is Received = No Gain 2. Boot is Paid = No Gain 3. Boot is Received - Recognize Proportional Gain (<25% rule) 4. Boot is >= 25% of Total Consideration = Recognize all gains & losses Losses: Always recognize the loss |

|

|

How do you account for gain or loss for an involuntary conversion? |

Whenever a nonmonetary asset is involuntarily converted (e.g. fire loss, theft, or condemnation) to cash, the entire gain or loss is recognized.

|

|

|

What is the tax treatment for involuntary conversions? |

If a gain is recognized for financial purposes in one period and for tax purposes in another period, a temporary difference will result. Interperiod tax allocation will be necessary. |

|

|

How do you account for a nonmonetary exchange that has commercial substance? |

The transaction is accounted for using the fair value of the asset surrendered or received, whichever is more evident, as the value for the exchange. |

|

|

When should the exchange of nonmonetary assets be measured based on the amount of the nonmonetary asset surrendered? a. The timing of future cash flows of the asset received differs significantly from the future cash flows of the asset transferred. b. When the entity's future cash flows are expected to change as a result of the exchange. c. When the transaction lacks commercial substance. d. When the transaction has commercial substance. |

Choice "c" is correct. When a transaction involving a nonmonetary exchange lacks commercial substance, the reported amount of the nonmonetary asset surrendered is used to record the newly acquired asset. If the transaction has commercial substance, the fair value approach is used. |

|

|

What is a foreign currency transaction? |

Transactions with a foreign entity (e.g. buying from and selling to) denominated in (to be settled in) a foreign currency. |

|

|

What is a foreign currency translation? |

The conversion of financial statements of a foreign entity into financial statements expressed in the domestic currency (the dollar). |

|

|

What is the purpose of the standards for foreign currency accounting? |

Reflect in consolidated financial statements the financial results and relationships of the affiliated entities as measured in the currency of the primary economic environment in which each entity operates (called the "Functional Currency"). |

|

|

What impact do the standards for foreign currency accounting have on cash flows? |

1. Provide information regarding the effects of exchange rate changes on an enterprise's cash flow and equity.

2. Recognize in income from continuing operations the effects (gain or loss) of adjustments for currency exchange rate changes that impact cash flows and exclude from net income adjustments that do not impact cash flows. |

|

|

What are the 2 ways in which the exchange rate can be expressed? |

1. Direct Method: the domestic price of one unit of another currency. E.g., one euro costs $1.47.

2. Indirect Method: The foreign price of one unit of the domestic currency. E.g., 0.68 euros buys $1.00. |

|

|

What is the current exchange rate? |

The exchange rate at the current date, or for immediate delivery of currency, often referred to as the spot rate. |

|

|

What is the forward exchange rate? |

The exchange rate existing now for exchanging two currencies at a specific future date. |

|

|

What is the historical exchange rate? |

The rate in effect at the date of issuance of stock or acquisition of assets. |

|

|

What is the weighted average exchange rate? |

It's calculated to take into account the exchange rate fluctuations for the period. The average rate, when applied to a transaction normally assumed to have occurred evenly throughout the period, approximates the effect of separate translations of each item. |

|

|

What is the functional currency? |

The currency of the primary economic environment in which the entity operates, usually the local currency or the reporting currency. |

|

|

What is foreign currency remeasurement? |

The restatement of foreign FSs from the foreign currency to the entity's functional currency in the following situations: 1. Reporting currency is the function currency

2. FSs must be restated in the entity's functional currency prior to translating the FSs from the functional currency to the reporting currency. |

|

|

What are the steps in restating foreign financial statements? |

1. Prepare in accordance with GAAP/IFRS 2. Determine the functional currency 3. Determine appropriate exchange rates 4. Remeasure and/or translate the financial statements |

|

|

What adjustments are made to the following measurement methods:

Historic Cost/Nominal Dollars Historic Cost/Constant Dollars Current Cost/Nominal Dollars Current Cost/Constant Dollars |

Historic Cost/Nominal Dollars - Neither Historic Cost/Constant Dollars - Inflation Current Cost/Nominal Dollars - Appreciation Current Cost/Constant Dollars - Both |

|

|

Historic Cost/Nominal Dollars |

based on historic prices w/o restatement for changes in the purchasing power of the dollar. This method is the basis for GAAP |

|

|

Historic Cost/Constant Dollars |

Based on historic prices adjusted for changes in the general purchasing power of the dollar. This method uses a general price index to adjust historic cost; it retains the historic cost basis. |

|

|

Current Cost/Nominal Dollars |

Based on current cost without restatement for (or recognition of) changes in the general purchasing power of the dollar. |

|

|

Current Cost/Constant Dollars |

Based on current cost adjusted for (giving recognition to) changes in the general purchasing power of the dollar. This method may use specific price indexes or direct pricing to determine current cost and will use a general price index to measure general purchasing power effects. |

|

|

Define monetary: |

Assets or liabilities that are fixed or denominated in dollars regardless of changes in specific prices or the general price level (e.g. accounts receivable). Holding monetary assets during periods of inflation will result in a loss of purchasing power and holding monetary liabilities will result in a gain in purchasing power. |

|

|

Define Non-monetary: |

Assets and liabilities that fluctuate in value with inflation and deflation. Holders of nonmonetary items may lose or gain w/ the rise or fall of the CPI if the nonmonetary item does not rise or fall in proportion to the change (i.e., it's affect by (1) the rise or fall of the CPI & (2) the increase or decrease in the fair value of the nonmonetary item. |

|

|

What are examples of monetary items? |

Assets: Cash, bonds-non convertible, accounts receivable (and allowance), long-term receivables, demand bank deposits

Liabilities: Accounts and notes payable, accrued expenses, bonds/notes payable, advances to consolidated subsidiaries |

|

|

What are examples of nonmonetary items? |

Assets: marketable common stock, inventory, investment in subsidiary (equity), PP&E (and accumulated depreciation), intangible assets (patents & trademarks)

Liabilities: Deferred charges and credits

Equities: Preferred stock, common stock |

|

|

Deecee adjusted its historical cost income statement by applying specific price indexes to its depreciation expense and COGS. Deecee's adjusted income statement is prepared according to: a. Fair value accounting. b. Current cost accounting. c. Current cost/general purchasing power accounting. d. General purchasing power accounting. |

Choice "b" is correct. Under current cost accounting, specific price indexes may be used to restate financial statements items. |

|

|

During a period of inflation in which a liability account balance remains constant, which of the following occurs? a. A purchasing power loss, if the item is a nonmonetary liability. b. A purchasing power gain, if the item is a monetary liability. c. A purchasing power gain, if the item is a nonmonetary liability. d. A purchasing power loss, if the item is a monetary liability. |

Choice "b" is correct. Purchasing power gains and losses are associated with monetary assets and liabilities. During periods of inflation, current dollars purchase less so any liability would then be settled with dollars with lower purchasing power. Thus, a purchasing power gain is recognized. |

|

|

What is a forward exchange contract? |

An agreement to exchange at a future specified date and rate a fixed amount of currencies of different countries. |

|

|

What is a reporting currency? |

The currency of the entity ultimately reporting financial results of the foreign entity. |

|

|

Denominated or Fixed in a Currency: |

A transaction is denominated or fixed in the currency used to negotiate and settle the transaction, either in U.S. dollars or a foreign currency. |

|

|

Under GAAP, in preparing consolidated FSs of a U.S. parent company with a foreign subsidiary, the subsidiary's functional currency is the currency: a. Of the country in which the subsidiary is located. b. Of the environment in which the subsidiary primarily generates and expends cash. c. Of the country in which the parent is located. d. In which the subsidiary maintains its accounting records. |

Choice "b" is correct. Rule: Functional currency depends on the environment where the entity generates and expends cash (unless required by law to use another currency).The functional currency can't be the local currency if the foreign entity operates in a highly inflationary environment (i.e., approximately 100% over three years). |

|

|

Park's subsidiary, Schnell, maintains its accounting records in German marks. All of Schnell's branch offices are in Switzerland, & its functional currency is the Swiss franc. Remeasurement of Yr 4 FSs showed $7,600 gain, and translation showed $8,100 gain. What should Park report as foreign exchange gain in its income statement at Dec. 31, Year 4? |

$7,600 gain from remeasurement. Rule: "Translation adjustments" are not included in determining net income but are disclosed and accumulated in OCI in consolidated equity until disposed of. Gains or losses from remeasuring the foreign subsidiary's FSs from the local currency to the functional currency are included in ICO of the parent company. |

|

|

In what part of the financial statements are remeasurement adjustments displayed? |

Conversion adjustments associated with remeasurement of financial statements is displayed in income. |

|

|

In what part of the financial statements are translation adjustments displayed? |

Conversion adjustments associated with translation of financial statements are displayed in accumulated other comprehensive income. |

|

|

The reporting currency is the functional currency and the remeasurement method must be used when: |

1. The foreign subsidiary is highly integrated with the parent & serves primarily as a sales outlet for the parent. Day-to-day operations of the subsidiary depend on the reporting currency.

2. The foreign subsidiary operates in a highly inflationary economy. |

|

|

The foreign currency is the functional currency and the translation method must be used when: |

The foreign subsidiary is relatively self-contained and independent and operates primarily in local markets. Day-to-day operations of the subsidiary do not depend on the reporting currency. |

|

|

When the functional currency of the subsidiary differs from both the subsidiary's local currency and the reporting currency: |

The subsidiary's financial statements must first be remeasured from the local currency to the functional currency and then must be translated from the functional currency to the reporting currency. |

|

|

Remeasurement Method (temporal method) -- If the FSs of the foreign subsidiary are not in the subsidiary's functional currency, the FSs are remeasured to the functional currency starting with the balance sheet: |

(1) Balance Sheet - Monetary items = Current/Year-end rate - Non-monetary items = Historical rate (2) Income Statement - Non-balance sheet items =Weighted Av. Rate - Balance sheet related items = Historical rate * Depreciation/PP&E * COGS/Inventory * Amortization/bonds and intangibles (3) Gain or Loss: Displayed in net income |

|

|

Translation Method (current rate method) -- If the financial statements of the foreign subsidiary are in the subsidiary's functional currency, the FSs are translated to the reporting currency starting with the income statement: Foreign currency = Functional currency |

(1) Income Statement - All income statement items = Wtd. Aver. Rate - Transfer net income to retained earnings (2) Balance Sheet - Assets = Current/year-end rate - Liabilities = Current/ year-end rate - Common stock/APIC = Historical rate - Retained earnings = Roll forward (3) Gain or Loss: Plug into OCI |

|

|

What are Other Comprehensive Bases of Accounting (OCBOA)? |

Non-GAAP presentations that have widespread understanding & support. Presentations include: - The cash basis & modified cash basis of acctg. - The tax basis of accounting - A definite set of criteria have substantial support that is applied to all material FS elements, e.g., price level adjusted FSs. - A regulatory basis of accounting |

|

|

What are the general Other Comprehensive Bases of Accounting (OCBOA) presentation guidelines? |

1. FS titles should differentiate the OCBOA FSs from accrual basis financial statements. 2. Required FSs are the equivalents of the accural basis balance sheet and income statement. 3. The FSs should explain changes in equity 4. A statement of cash flows is not required 5. Disclosures in OCBOA FSs should be similar to those in GAAP FSs & include: (a) summary of significant accounting policies, (b) Informative disclosures for all FS items similar to those in GAAP FSs, (c) Disclosures related to items not shown on the face of the FSs, e.g. related party transactions, subsequent events, uncertainties |

|

|

What types of entities typically use cash basis financial statements? |

Estates & trusts, civic ventures, and political campaigns and committees. |

|

|

What are the presentation guidelines for cash basis financial statements? |

(1) State of Cash & Equity: cash is the only asset, no liabilities are recorded, & equity = cash. (2) Statement of Cash Receipts & Disbursements includes: (a) Revenues received, (b) Debt & equity proceeds, (c) Proceeds from asset sales, (d) Expenses paid, (e) Debt repayments, (f) Dividend payments, (g) Payments for purchases of assets |

|

|

What are common modifications to cash basis financial statements? |

1. Capitalizing & depreciating fixed assets 2. Accrual of income taxes 3. Recording liabilities for long-term & short-term borrowings & the related interest expense 4. Capitalizing inventory 5. Reporting investments at fair value & recognizing unrealized gains & losses |

|

|

What are the presentation guidelines for Modified Cash Basis financial statements? |

Include a statement of assets & liabilities--modified cash basis or a statement of assets & liabilities arising from cash transactions & a statement of revenues & expenses & retained earnings-- modified cash basis or a statement of revenues collected & expenses paid. The specific elements included in the FSs depend on the modifications made by the entity. |

|

|

How do tax basis financial statements contrast with cash basis financial statements? |

Unlike cash basis financial statements, tax basis financial statements are well-suited for entities that have complex operations. |

|

|

What special accounting treatment must be given to nontaxable revenues & expenses not reported on the tax return when an entity presents income tax basis financial statements? |

Nontaxable revenues & expenses must be recognized in tax basis financial statements in the period received or paid for cash basis taxpayers & in the period accruable for accrual-basis tax payers. They are reported as: 1.separate line items in revenue & expense sections of statement of revenues & expenses 2. Additions & deductions to net income, or 3. A disclosure in a note |

|

|

What are the presentation guidelines for Tax Basis financial statements? |

Include a statement of assets & liabilities & equity - income tax basis or a balance sheet - income tax basis & a statement of revenues & expenses & retained earnings - income tax basis or a statement of income - income tax basis. The specific elements included in an entity's tax basis financial statements depend on the income & deductions reported on the tax return. |

|

|

What are personal financial statements? |

Financial statements of individuals or groups of related individuals (families) and are generally prepared to organize & plan financial affairs. Such statements can be used for obtaining credit and for tax, estate, and retirement planning purposes. |

|

|

What are the presentation guidelines for personal financial statements? |

1. Statement of financial condition that presents assets & liabilities at current values & recognize them on the accrual basis. Personal net worth is total assets - total liabilities. 2. Statement of changes in net worth (optional): distinguishes between realized & unrealized changes in net worth. 3. Disclosure: should include enough to make them adequately informative & might include: (a) the individuals covered by the statements, (b) methods used in determining current values, (c) description of intangible assets, (d) face amount of life insurance policies, etc. |

|

|

Income tax-basis FSs differ from GAAP statements in that income tax-basis financial statements: a. Recognize some revenues & expenses in different reporting periods. b. Include detailed info about current & deferred income tax liabilities. c. Don't include nontaxable revenues & nondeductible expenses in determining income. d. Contain no disclosures about capital and operating lease transactions. |

Choice "a" is correct. Income tax-basis FSs recognize events when taxable income or deductible expenses are recognized on the entity's tax return. Non-taxable income & non-deductible expenses are shown on the FS & included in the determination of income (and become M-1 adjustments to arrive at taxable income). |

|

|

In FSs prepared on the income-tax basis, how should the nondeductible portion of expenses such as meals and entertainment be reported? a. Excluded from the determination of income but included in the determination of retained earnings. b. Excluded from the financial statements. c. Included in a separate category in the determination of income. d. Included in the expense category in the determination of income. |

Choice "d" is correct. In financial statements prepared on the income-tax basis, the nondeductible portion of expenses (such as meals and entertainment) should be included in the expense category in the determination of income. |

|

|

Green is preparing a personal statement of financial condition as of April 30, Year 2. Green's Yr 1 income tax liability was paid in full on April 15, Year 2. Green's tax on income earned between Jan & April Yr 2 is $20,000. In addition, $40,000 is estimated for income tax on the differences between the estimated current values and current amounts of Green's assets and liabilities and their tax bases at April 30, Yr 2. No withholdings or payments have been made towards the Yr 2 income tax liability. In Green's April 30, Yr 2, statement of financial condition, what amount should be reported, between liabilities and net worth, as estimated income taxes? |

$40,000. On a personal statement of financial condition, estimated income taxes equals the difference between fair values and tax bases of assets and liabilities. |

|

|

For the purpose of estimating income taxes to be reported in personal financial statements, assets and liabilities measured at their tax bases should be compared to assets and liabilities measured at their: |

Assets: Estimated current value

Liabilities: Estimated current amount |

|

|

Personal financial statements usually consist of: |

Personal financial statements usually include a statement of financial condition (similar to a balance sheet) and a statement of changes in net worth (similar to an income statement). |

|

|

A business interest that constitutes a large part of an individual's total assets should be presented in a personal statement of financial condition as: |

A business interest that constitutes a large part of an individual's total assets should be presented in a personal statement of financial condition as a single amount equal to the estimated current value of the business interest. |

|

|

Which of the following is not a common modification used to prepare modified cash basis financial statements? a. Accrual of income taxes. b. Recognizing revenues when earned. c. Recording long-term liabilities. d. Capitalizing inventory. |

If revenues are recognized when earned, rather than when received, then the financial statements are prepared using the accrual basis. Recording long-term liabilities, accrual of income taxes, and capitalization of inventory are all common modifications made to cash basis financial statements. |

|

|

On December 31, a building owned by Carr, Inc. was destroyed by fire. Carr paid $12,000 for removal and clean-up costs. The building had a book value of $250,000 and a fair value of $280,000 on December 31. What is the loss on this involuntary conversion? |

$262,000 loss on involuntary conversion (fire). Rule: Gains or losses on fixed assets (including involuntary conversions) are always recognized during the period incurred based on recorded amount (NBV) plus any costs associated with the transaction. |

|

|

Lano's forestland was condemned. Compensation for the condemnation exceeded the forestland's carrying amount. Lano purchased similar replacement forest land for an amount greater than the condemnation award. As a result, what is the net effect on the carrying amount of forestland reported in Lano's balance sheet? |

The net effect on the carrying amount of forestland would be equal to the excess of the replacement forestland's cost over the condemned forestland's carrying amount. Rule: When a fixed asset is sold (voluntarily or involuntarily) gain or loss is recognized (proceeds vs. carrying amount) as part of income from continuing operations. The carrying amount of the replacement property is equal to the FV of the consideration paid for it. |

|

|

Journal entries for Percentage of Completion Method & Completed Contract Method: |

1) Record Costs Incurred Dr: Construction in Progress Cr: Cash 2) Record Billings on Contract Dr: Contracts Receivable Cr: Progress billings 3) Record Payments Received Dr: Cash Cr: Contracts Receivable 4) Record Revenue/cost during construction Dr: Construction Expense Cr: Construction in Progress 5) Balance sheet at the end of the year Construction in progress - Progress billings

|

|

|

Final journal entry for Completed Contract Method: |

Dr: Progress billings.....Total for Project Cr: Revenue...................Total for Project

Dr: Construction Expense:........Total for Project Cr: Construction in Progress.....Total for Project

|

|

|

Journal entries for Cost Recovery Method: |

1) Record sale Dr: Cost recovery receivable Cr: Inventory Cr: Deferred gross profit 2) Record payments received Dr: Cash Cr: Cost recovery receivable 3) Record gross profit Dr: Deferred gross profit Cr: Realized gross profit |

|

|

On Jan. 1 of the current year, Jambon purchased equipment for use in developing a new product. Jambon uses the straight-line depreciation method. The equipment could provide benefits for 10 yrs. But, the new product development is expected to take five years, and the equipment can be used only for this project. Jambon's current year expense equals: |

The total cost of the equipment. Since the equipment can be used only for this project it should be expensed immediately, even though the project is expected to take 5 years. It would be capitalized over its useful life, only if the equipment had an alternative use. |

|

|

Research and development costs are expensed as incurred under U.S. GAAP except if for: |

Costs to be reimbursed by another company. Costs for a long lived tangible asset with alternate uses. |

|

|

Buc Co. receives deposits from its customers to protect itself against nonpayments for future services. These deposits should be classified by Buc as: a. A deferred credit deducted from accounts receivable. b. A contra account. c. Revenue. d. A liability. |

Liability (called "advances [or deposits] from customers"). |

|

|

According to the FASB's conceptual framework, the amount of deferred gross profit relating to collections 12 months beyond the balance sheet date should be reported in the: a. Noncurrent liability section as a deferred revenue. b. Current asset section as a contra account. c. Current liability section as a deferred revenue. d. Noncurrent asset section as a contra account. |

Current asset section as a contra account. |

|

|

Under a royalty agreement, a company will receive royalties from a patent for three years. Royalties received are reported as revenue: a. At the date of the royalty agreement. b. In the period earned. c. In the period received. d. Evenly over the life of the royalty agreement.

|

In the period earned. |

|

|

A company that wishes to disclose information about the effect of changing prices should report this information in: a. Management's report to shareholders. b. Supplementary information to the financial statements. c. The notes to the financial statements. d. The body of the financial statements. |

supplementary information to the financial statements. |

|

|

Gains from remeasuring a foreign subsidiary's FSs from the local currency, which is not the functional currency, into the parent company's currency should be reported: a. As a component of other comprehensive income. b. As an extraordinary item, net of income taxes. c. As part of continuing operations. d. As a deferred foreign exchange gain. |

Part of continuing operations |

|

|

How is a gain or loss from a forward exchange contract for speculation calculated? |

A gain or loss from a forward exchange contract for speculation (e.g., does not relate to a specific transaction) is equal to the difference in the forward rate at the date the contract is purchased and the forward rate at the BS date. |

|

|

How is a gain or loss from a forward exchange contract for hedges of firm commitments calculated? |

Gains or losses on hedges of firm commitment's for a future purchase (or sale) are recognized in current income. Also, the firm commitment is adjusted to fair value with the resulting gain or loss recognized in current income. The difference between the gain or loss on the hedge contract and the gain or loss on the firm commitment is the net effect on current income. |