![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

7 Cards in this Set

- Front

- Back

|

Callable bonds |

Issuer has right to repay early These costs the issuer more (i.e., the buyer demands higher interest rate) It reveals that the issuer is confident it can repay early |

|

|

putable bonds |

Buyer has the right to demand early repayment Buyer will accept a lower interest rate Gives the issuer an incentive to perform well |

|

|

convertible bonds |

Buyer has choice of cash repayment and newly-issued shares Signal: issuing just equity gives the market less confident (typically equity is a last resort) |

|

|

What is a forward rate? |

It is an agreement today to do a transaction in the future |

|

|

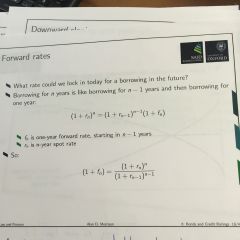

Formula for forward rate |

|

|

|

Why do CRAs exist? |

Reduce asymmetric information about issuers that investors face when making investments enhancing market liquidity |

|

|

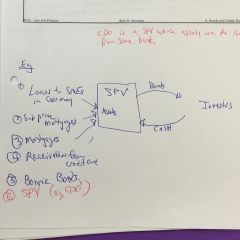

Alan's depiction of securitization |

|