![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

13 Cards in this Set

- Front

- Back

|

Callable bonds |

Issuer has right to repay early These costs the issuer more (i.e., the buyer demands higher interest rate) It reveals that the issuer is confident it can repay early |

|

|

putable bonds |

Buyer has the right to demand early repayment Buyer will accept a lower interest rate Gives the issuer an incentive to perform well |

|

|

convertible bonds |

Buyer has choice of cash repayment and newly-issued shares Signal: issuing just equity gives the market less confident (typically equity is a last resort) |

|

|

What is a forward rate? |

It is an agreement today to do a transaction in the future |

|

|

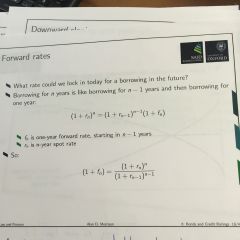

Formula for forward rate |

|

|

|

Why do CRAs exist? |

Reduce asymmetric information about issuers that investors face when making investments enhancing market liquidity |

|

|

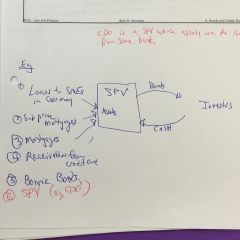

Alan's depiction of securitization |

|

|

|

duration |

duration is a measurement of how long, in years, it takes for the price of a bond to be repaid by its internal cash flows. It is an important measure for investors to consider, as bonds with higher durations carry more risk and have higher price volatility than bonds with lower durations. |

|

|

Longer the maturity, ________ the duration |

longer |

|

|

Higher the coupon rate, __________ the duration |

shorter |

|

|

Expectations theory |

There should be no difference between (i) a two year bond and (ii) two one-year bonds (with the second bond reinvested at year 1). (Absent transaction costs) |

|

|

What is 'Immunization'? |

Immunization is a strategy that matches the durations of assets and liabilities thereby minimizing the impact of interest rates on the net worth. |

|

|

What determines default risk? |

b |