![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

59 Cards in this Set

- Front

- Back

|

Required rate of return (r)

|

r = (r* + IP) + DRP + LP + MRP

r* - real risk-free rate of interesst IP - inflation premium DRP - default risk premium LP - liquidity risk premium MRP - maturity risk premium |

|

|

Risk free rate (rf)

|

rf = (r* + IP)

- usually 3-month T-bills r* - real risk-free rate of interesst IP - inflation premium |

|

|

Nominal (=)

|

nominal = r* + IP + [(r*)(IP)]

|

|

|

Pure Expectations Hypothesis (PEH)

|

yield curve depends on investors expecations about future interest rates

- if interest rates are expected to increase: L-T rates will be higher than S-T rates |

|

|

Treasury Securities MRP

|

MRP = 0

|

|

|

Risks associated with overseas investing

|

- exchange rate risk

- country risk |

|

|

bond

|

long term debt instrument in which a borrower agrees to make payments of principle and interest to holders of bond (> 12 months)

|

|

|

Par value (of a bond)

|

face amount of the bond which paid at maturity

|

|

|

coupon interest rate

|

nominal stated contract rate (annual) - what you'll get for year based on payment incraments

|

|

|

maturity date

|

years until bond must be repaid

|

|

|

issue date

|

date when the bond was issued

|

|

|

yield to maturity

|

rate of return earned on bond held until maturity

|

|

|

accrued interest

|

interest owed of due from the last interest payment due (based on last paid)

|

|

|

callable bond

|

company can buy it back (call it back)

|

|

|

sinking fund

|

forces trustee to pay off a percentage of bonds per year (reduces risk of default)

|

|

|

convertible bond

|

when stock goes up owners buy stock -> automatically move from debt to equity

|

|

|

warrant

|

L-T option to buy stated # of shares at specified price (sweeten to buy debt)

|

|

|

putable bond

|

allows holder to sell the bond back to the company prior to maturity (low quality company)

|

|

|

income bond

|

only pays interest if the company earns interest

|

|

|

indexed bond

|

interest rate paid based upon a specific index

|

|

|

catastrophic bond (cat bond)

|

amount paid at maturity is a function of some defined contingency

|

|

|

zero coupon bond

|

no interest and at end of bond like get back principle (really high rate of return)

|

|

|

discount rate (rd)

|

the rate that could be earned on alternative investments of equal risk

|

|

|

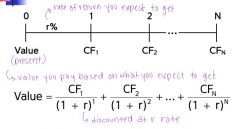

value of financial assets

|

value paid based on expected return

|

|

|

value bond with calculator

|

par value - FV

coupon - PMT _______ - PV t - I/YR time held - N |

|

|

bond values over time (if rd remains constant)

|

- value of a premium bond would decrease until par value

- value of a discount bond would increase until par value - value of par bond remains consistant |

|

|

Expected total return - Yield to maturity (YTM)

|

![YTM = [expected CY] + [expected CGY]](https://images.cram.com/images/upload-flashcards/49/05/89/4490589_m.jpg)

YTM = [expected CY] + [expected CGY]

|

|

|

YTM on calc

|

N - time held

I/YR - __________ PV - sells for (neg) PMT - par value (coupon) FV - par value |

|

|

Current Yield (CY)

|

|

|

|

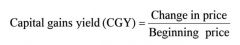

Capital gains yield (CGY)

|

|

|

|

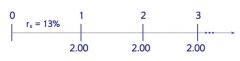

Semiannual bonds

|

- multiply years by 2 # of pds = 2N

- divide nominal rate by 2: periodic rate (I/YR) = rd/2 - divide annual coupon by 2: PMT = annual coupon/2 |

|

|

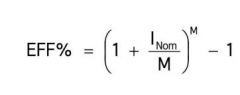

Semiannual bond's effective rate

|

|

|

|

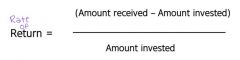

rate of return on investment

|

- number is a percentage

- rate that you are earning money |

|

|

Investment risk

|

degree of variability of possible outcomes (greater variability - greater risk)

|

|

|

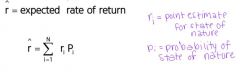

Expected rate of return (ȓ)

|

|

|

|

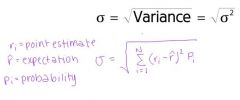

standard deviation (σ)

|

|

|

|

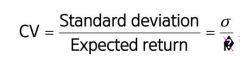

coefficient of variation (cv)

|

high CV - in order to get high rate of return you are taking on a high level of risk

|

|

|

risk aversion

|

investors dislike risk (require higher rates of return for risks)

|

|

|

risk premium

|

the difference between return on a risky asset and a riskless asset

|

|

|

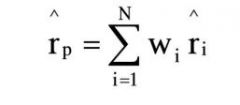

weight average (ȓp)

|

|

|

|

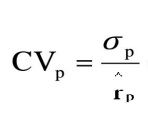

CVp

|

σp - decreases as stocks added

|

|

|

market risk

|

part of the total risk you can't get rid of

|

|

|

diversifible risk

|

part of the total risk you can get rid of

|

|

|

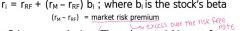

capital asset pricing model (CAPM)

& security market line |

draws a line (security market line that describes rate of return you should get (risk after diversification)

|

|

|

beta

|

measures of securities reaction

- beta = 1, security just as risky as market - beta > 1, security riskier than market - beta < 1, security is less risky than market |

|

|

common stockk

|

represents ownership; source of money to supply cash

|

|

|

intrinsic value

|

estimate of what it is worth vs. the marketplace

|

|

|

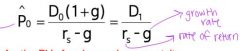

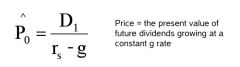

dividend growth model

|

|

|

|

constant dividend growth stock

|

stock whose dividends are expected to grow forever at a constant rate

|

|

|

if growth is constant

|

|

|

|

Constant growth rate model can only be used if...

|

- rs > g

- g is expected to be constant forever |

|

|

dividend yield

|

|

|

|

capital gains yield

|

|

|

|

total return (rs)

|

|

|

|

growth is zero

|

|

|

|

price

|

|

|

|

Corporate Value Model (CVM) - MV of equity

|

MV of equity = MV of firm - MV of debt - MV of preferred

|

|

|

Corporate Value Model (CVM) - value per share

|

MV of equity / # of shares

|

|

|

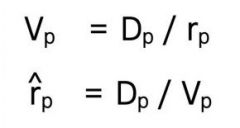

Preferred stock

|

hybrid security

|