![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

|

Horizon premium

|

The difference between the value and book value expected at a forecasted horizon. 155

|

|

|

Implied earnings forecast

|

A forecast of earnings that is implicit in the market price. 177

|

|

|

Implied expected return

|

The expected rate of return implicit in buying at the current market price. 175

|

|

|

Implied residual earnings growth rate

|

The perpetual growth in residual earnings that is implied by the current market price. 175

|

|

|

Normal price-to-book ratio

|

Applies when price is equal to book value, that is, the P/B ratio is 1.00. 153

|

|

|

Residual earnings

|

Comprehensive earnings less a charge against book value for required earnings. Also referred to as residual income, abnormal earnings, or excess profit. 150

|

|

|

Residual earnings driver

|

A measure that determines residual earnings; the two primary drivers are rate of return on common equity (ROCE) and growth in book value. 153

|

|

|

Residual earnings model

|

A model that measures value added to book value from forecasts of residual earnings. 151

|

|

|

Steady-state condition

|

A permanent condition in forecast amounts that determines a continuing value. 163

|

|

|

Target price

|

A price expected in the future. 164

|

|

|

Terminal premium or horizon premium

|

The premium at a forecast horizon (and is equal to the continuing value for the residual earnings valuation). 164

|

|

|

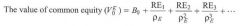

The value of common equity

|

pg 153

|

|

|

Residual earnings

|

pg 153

|

|

|

Residual earnings

|

pg. 156

|

|

|

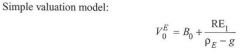

Simple valuation model

|

pg 159

|

|

|

Simple valuation case 1.

|

pg 161

|

|

|

Simple valuation case 2 valuation

|

pg 163

|

|

|

Simple valuation case 3 valuation

|

pg 163

|

|

|

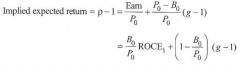

Implied expected return

|

pg 175

|

|

|

Earnings forecast

|

pg 177

|