![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

73 Cards in this Set

- Front

- Back

|

Accrual

|

A noncash value flow recorded in the financial statements. See also income statement accrual and balance sheet accrual. 127

|

|

|

Annuity

|

The annual amount in a constant stream of payoffs. 117

|

|

|

Continuing value

|

The value calculated at a forecast horizon that captures value added after the horizon. 120

|

|

|

Dividend conundrum

|

Refers to the following puzzle: The value of a share is based on expected dividends but forecasting dividends (over finite horizons) does not yield the value of the share. 118

|

|

|

Historical cost accounting

|

Measures investments at their cash cost and adjusts the cost with accruals. 134

|

|

|

Matching principle

|

The accounting principle that recognizes expenses when the revenue for which they are incurred is recognized. 128

|

|

|

Perpetuity

|

A periodic payoff that continues without end. 117

|

|

|

Terminal value

|

What an investment is expected to be worth in the future when it terminates or when it may be liquidated. 116

|

|

|

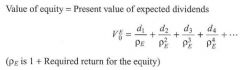

Value of equity

|

pg 116

|

|

|

Value of equity (longer version)

|

pg 116

|

|

|

Perpetuity dividend model

|

pg 116

|

|

|

Dividend growth model

|

pg 117

|

|

|

Value of a perpetual dividend stream

|

pg 117

|

|

|

Value of a dividend growing at a constant rate

|

pg 117

|

|

|

Value of the firm (with PV FCF)

|

pg 119

|

|

|

Value of the equity (with PV FCF - Net debt value)

|

pg 120

|

|

|

If free cash flow after T are forecasted to be a (constant) perpetuity,

|

pg 120

|

|

|

If free cash flows are forecasted to grow at a constant rate after the horizon,

|

pg 120

|

|

|

Cash flow from operations

|

pg 125

|

|

|

Cash investment in operations

|

pg 126

|

|

|

Revenue

|

pg 129

|

|

|

Expense

|

pg 130

|

|

|

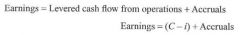

Earnings (answer w/ Leveraged cash flow)

|

pg 130

|

|

|

Earnings

|

pg 130

|

|

|

Cash flow from operations - Net interest payments (after tax) + Accruals =

|

= Earnings (From CF from Ops)

|

|

|

Free cashflow - Net interest payments (after tax) + Accruals + Investments =

|

= Earnings (From FCF)

|

|

|

Discounted Cash Flow Advantages

|

Easy Concept: Cash flows are "real" and easy to think about; they are not affected by accounting rules.

Familiarity: Cash flow valuation is a straightforward application of familiar present value techniques. |

|

|

Discounted Cash Flow Disadvantages - Hint: Concept

|

Suspect Concept: FCF does not measure value added in the short run; value gained is not matched with value given up.

Free cash flow fails to recognize value generated that does not involved cash flows. Investment is treated as a loss of value. FCF is partly a liquidation concept; firms increase FCF by cutting back on investments. |

|

|

Discounted Cash Flow Disadvantages - Hint: Horizons

|

Forecast Horizons: Typically, long forecast horizons are required to recognize cash inflows from investments, particularly when investments are growing. Continuing values have a high weight in the valuation.

|

|

|

Discounted Cash Flow Disadvantages - Hint: People Forecast

|

Not aligned with what people forecast: Analysts forecast earnings, not FCF; adjusting earnings forecasts to FCF forecasts requires further forecasting of accruals.

|

|

|

Displacement

|

Transference of emotions from the original object to some substitute or symbolic representation. Can be a factor in phobias.

|

|

|

Dividend Discount Analysis Advantages

|

Easy Concept: Dividends are what shareholders get, so forecast them.

Predictability: Dividends are usually fairly stable in the short run so dividends are easy to forecast (in the short run). |

|

|

Dividend Discount Analysis Disadvantages

|

Relevance: Dividend payout is not related to value, at least in the short run; dividend forecasts ignore the capital gain component of payoffs.

Forecast horizons: Typically requires forecasts for long periods. |

|

|

Cash flow from operations - Net interest payments (after tax) + Accruals =

|

= Earnings (From CF from Ops)

|

|

|

Free cashflow - Net interest payments (after tax) + Accruals + Investments =

|

= Earnings (From FCF)

|

|

|

Discounted Cash Flow Advantages

|

Easy Concept: Cash flows are "real" and easy to think about; they are not affected by accounting rules.

Familiarity: Cash flow valuation is a straightforward application of familiar present value techniques. |

|

|

Discounted Cash Flow Disadvantages - Hint: Concept

|

Suspect Concept: FCF does not measure value added in the short run; value gained is not matched with value given up.

Free cash flow fails to recognize value generated that does not involved cash flows. Investment is treated as a loss of value. FCF is partly a liquidation concept; firms increase FCF by cutting back on investments. |

|

|

Discounted Cash Flow Disadvantages - Hint: Horizons

|

Forecast Horizons: Typically, long forecast horizons are required to recognize cash inflows from investments, particularly when investments are growing. Continuing values have a high weight in the valuation.

|

|

|

Discounted Cash Flow Disadvantages - Hint: People Forecast

|

Not aligned with what people forecast: Analysts forecast earnings, not FCF; adjusting earnings forecasts to FCF forecasts requires further forecasting of accruals.

|

|

|

Displacement

|

Transference of emotions from the original object to some substitute or symbolic representation. Can be a factor in phobias.

|

|

|

Dividend Discount Analysis Advantages

|

Easy Concept: Dividends are what shareholders get, so forecast them.

Predictability: Dividends are usually fairly stable in the short run so dividends are easy to forecast (in the short run). |

|

|

Dividend Discount Analysis Disadvantages

|

Relevance: Dividend payout is not related to value, at least in the short run; dividend forecasts ignore the capital gain component of payoffs.

Forecast horizons: Typically requires forecasts for long periods. |

|

|

When Dividend Discount Analysis Works Best

|

When payout is permanently tied to the value generation in the firm. For example, when a firm has a fixed payout ratio (dividends/earnings).

|

|

|

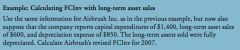

Accrual Accounting: Examples of how affects Balance Sheet and Income Statement

|

|

|

|

Articulation of Financial Statements through the Recording of Cash Flows and Accruals between Time 0 and 1

|

|

|

|

Calculating FCFF from net income. FCFF is calculated from net income as:

|

|

|

|

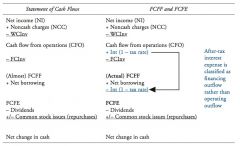

Calculating FCFF and FCFE Using the Statement of Cash Flows Figure 2:

|

Free cash flow to the firm is the operating cash flow left after the firm makes working

capital and fixed capital investment. |

|

|

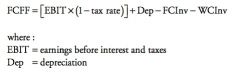

Calculating FCFF from EBIT. FCFF can also be calculated from earnings before

interest and taxes (EBIT): |

If we start with earnings before interest and taxes (EBIT), we have to add back

depreciation because it was subtracted out to get to EBIT. However, because EBIT is “before interest and taxes” we don’t have to take out interest (remember that it’s a financing cash flow). We do have to adjust for taxes, though, by computing after-tax EBIT, which is EBIT times one minus the tax rate. We also make the same adjustments as we did before by subtracting out fixed capital and working capital investment. |

|

|

Calculating FCFF from EBITDA

|

Remember that EBITDA is “before depreciation,” so we only have to add back

the depreciation tax shield, which is depreciation times the tax rate. Even though depreciation is a noncash expense, the firm reduces its tax bill by expensing it, so the free cash flow available is increased by the taxes saved. |

|

|

Calculating FCFF from CFO.

|

Cash flow from operations is equal to net income plus noncash charges less working

capital investment. We have to add back to CFO the after-tax interest expense to get to FCFF because interest expense (and the resulting tax shield) was reflected on the income statement to arrive at net income. We also have to subtract out fixed capital investment since CFO only includes changes in working capital investment. |

|

|

Which FCFF formula should you use on the exam?

|

I suggest that, at

a minimum, you memorize the first one (that starts with net income) and the last one (that starts with cash flow from operations). That way, given either an income statement or a cash flow statement, you can calculate FCFF. However, don’t be surprised if you’re required to know the other two as well. |

|

|

Calculating FCFE from FCFF.

|

If we start with FCFF, we have to adjust for the two cash flows to bondholders to

calculate FCFE: the after-tax interest expense and any new long- or short-term borrowings. We only subtract the after-tax interest expense because paying interest reduces the firm’s tax bill and reduces the cash available to the shareholders by the interest paid minus the taxes saved. |

|

|

Calculating FCFE from net income.

|

We can also calculate FCFE from net income by

making some of the usual adjustments. The two differences between this “FCFE from net income” formula and the “FCFF from net income formula” are (1) after-tax interest expense is NOT added back and (2) net borrowing is added back. |

|

|

Calculating FCFE from CFO.

|

Finally, we can calculate FCFE from CFO by subtracting

out fixed capital investment (which reduces cash available to shareholders) and adding back net borrowing (which increases the cash available to shareholders). |

|

|

Firm Value Equation- The value of the firm is the present value of the expected future FCFF discounted at the

WACC (this is so important we’re going to repeat it as a formula): |

The weighted average cost of capital is the required return on the firm’s assets. It’s a

weighted average of the required return on common equity and the after-tax required return on debt. Technically, what we’ve called firm value is actually the value of the operating assets (the assets that generate cash flow). Significant nonoperating assets, such as excess cash (not total cash on the balance sheet), excess marketable securities, or land held for investment should be added to this estimate to calculate total firm value. Most of the time the value of these assets is small in relation to the present value of the FCFFs, so we don’t lose much by ignoring it. If you are asked to calculate the value of the firm using the FCFF approach, calculate the present value of the FCFFs and then look for any additional information in the problem that specifically says “excess cash and marketable securities” or “land held for investment.” |

|

|

The value of the firm’s equity is the present value of the expected future FCFE

discounted at the required return on equity: |

|

|

|

Given the value of the firm, we can also calculate equity value by simply subtracting out

the market value of the debt: |

This is an

extremely important concept, so memorize it now. |

|

|

FCFF and FCFE Exhibits

|

|

|

|

The amount that’s left after the firm has met all its obligations to its other investors is

called ____. However, the board of directors still has discretion over what to do with that money. It could pay it all out in dividends to its common shareholders, but it might decide to only pay out some of it and put the rest in the bank to save for next year. That way, if FCFE is low the next year, it won’t have to cut the dividend payment. So ____ is the cash available to common shareholders after funding capital requirements, working capital needs, and debt financing requirements. |

free cash flow to equity (FCFE)

|

|

|

Cash flows into the firm in the form of

revenues as it sells its product, and cash flows out as it pays its cash operating expenses (e.g., salaries and taxes, but not interest expense, which is a financing and not an operating expense). The firm takes the cash that’s left over and makes short-term net investments in working capital (e.g., inventory and receivables) and long-term investments in property, plant, and equipment. The cash that remains is available to pay out to the firm’s investors: bondholders and common shareholders (let’s assume for the moment that the firm has not issued preferred stock). That pile of remaining cash is called ______ because it’s “free” to pay out to the firm’s investors (see Figure 1). The formal definition of ____ is the cash available to all of the firm’s investors, including stockholders and bondholders, after the firm buys and sells products, provides services, pays its cash operating expenses, and makes short- and long- term investments. Taxes paid are included in the definition of cash operating expenses for purposes of defining free cash flow, even though taxes aren’t generally considered a part of operating income. |

free cash flow to the firm (FCFF)

|

|

|

What does the firm do with its FCFF?

|

First, it takes care of its bondholders because

common shareholders are last in line at the money store. So it makes interest payments to bondholders and borrows more money from them or pays some of it back. However, making interest payments to bondholders has one advantage for common shareholders: it reduces the tax bill. |

|

|

Common Mistakes with FCF Valuation

|

Using the wrong discount rate or the

wrong cash flow definition. Remember, always discount FCFF at the WACC to find firm value and FCFE at the required return on equity to estimate equity value! |

|

|

Differences between FCFF and FCFE

|

The differences between FCFF and FCFE account for differences in capital structure

and consequently reflect the perspectives of different capital suppliers. FCFE is easier and more straightforward to use in cases where the company’s capital structure is not particularly volatile. On the other hand, if a company has negative FCFE and significant debt outstanding, FCFF is generally the best choice. We can always estimate equity value indirectly by discounting FCFF to find firm value and then subtracting out the market value of debt to arrive at equity value. |

|

|

Noncash charges. Noncash charges are added back to net income to arrive at FCFF

because they represent expenses that reduced reported net income but didn’t actually result in an outflow of cash. The most significant noncash charge is usually depreciation. Here are some other examples of noncash charges that often appear on the cash flow statement: |

|

|

|

Fixed capital investment. Investments in fixed capital do not appear on the income

statement, but they do represent cash leaving the firm. That means we have to subtract them from net income to estimate FCFF. Fixed capital investment is a net amount: it is equal to the difference between capital expenditures (investments in long-term fixed assets) and the proceeds from the sale of long-term assets: |

Both capital expenditures and proceeds from long-term asset sales (if any) are likely to

be reported on the firm’s statement of cash flows. If no long-term assets were sold during the year, then capital expenditures will also equal the change in the gross PP&E account from the balance sheet. Note that if long-term assets were sold during the year, any gain or loss on the sale is handled as a non-cash item as previously discussed. So what is the Level 2 candidate supposed to do on exam day to calculate FCInv? Let’s examine two cases: first, if no long term assets were sold during the year, and second, if the company did sell long term assets. |

|

|

If no long term assets were sold during the year, then FCInv is simply equal to the change

in the gross PP&E account: |

|

|

|

If long term assets were sold during the year, then:

|

|

|

|

|

|

|

|

|

|

Revenue for a period is calculated as:

|

Revenue = Cash receipts from sales + New sales on credit - Cash received for previous periods' sales - Estimated sales returns - Deferred revenue for cash received in advance of sale + Revenue previously deferred to the current period

|

|

|

Cash payments are modified by accruals as follows:

|

Expense = Cash paid for expenses + Amounts incurred in generating revenues but not yet paid - Cash paid for generating revenues in future periods + Amounts paid in the past for generating revenues in the current period.

|

|

|

Reported cash flows from operations are after interest, so Earnings are:

|

Earnings = Levered cash flow from operations + Accruals

Earnings = (C-i) + Accruals |

|

|

Earnings based off of value generated from Investments . The value lost in operations occurs after the cash flow:

|

Earnings = Free Cash flow - Net cash interest + Investments + Accruals

Earnings = (C-I) - i - I + Accruals |