![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

43 Cards in this Set

- Front

- Back

|

Breakup value

|

Is the amount a firm is worth if assets (net of liabilities) are sold off. 84

|

|

|

Contrarian stocks

|

Is a stock that is out-of-favor and trades at low multiples (viewed by contrarian investors as undervalued). 80

|

|

|

Cost of capital

|

The opportunity cost of having money tied up in an investment. Also referred to as the normal return, the required return, or, when calculating values, as the discount rate or capitalization rate. 87

|

|

|

Cum-dividend price

|

Is the price inclusive of the dividend received while holding the investment. Compare with ex-dividend price, which is price without the dividend. 79

|

|

|

Debt financing irrelevance

|

Means the the value of a firm is not affected by debt financing activities, that is, by issuing debt. 96

|

|

|

Dividend irrelevance

|

Means that paying dividends does not generate value for shareholders. 95

|

|

|

Finite-horizon forecasting

|

Refers to forecasting for a fixed (finite) number of years. 92

|

|

|

Forecast horizon

|

Is a point in the future to which forecasts are made. 92

|

|

|

Fundamental analysis

|

The method of analyzing information, forecasting payoffs from that information, and arriving at a valuation based on those forecasts. 84

|

|

|

Glamour stock

|

A stock that is fashionable and trades at high multiples (viewed by contrarian investors as overvalued). Sometimes referred to as growth stock. 80

|

|

|

Going-concern investment

|

Is one which is expected to continue indefinitely. Compare with terminal investment. 90

|

|

|

Growth stock

|

A term with many meanings but, in the context of screening, it is a stock with a high multiple that is contrasted with a value stock with a low multiple. 80

|

|

|

Homemade dividends

|

Dividends a shareholder creates for himself by selling some of his shares, thus substitution dividends for capital gains. 95

|

|

|

Investment horizon

|

The period for which an investment is likely to be held. 90

|

|

|

Liquidity discount

|

A reduction in the value of an investment due to difficulty in converting value in the investment into cash. 95

|

|

|

Parsimony (in valuation)

|

The ability to value a firm from a reduced amount of information. 93

|

|

|

Pro forma analysis

|

Is the preparation of forecasted financial statements for future years. 86

|

|

|

Risk premium

|

Is the expected return on an investment over the risk-free return. 87

|

|

|

Terminal investment

|

Is an investment that terminates at a point of time in the future. Compare with going-concern investment. 90

|

|

|

Unlevered measures

|

Measures not affected by how a firm is financed. 79

|

|

|

Valuation model

|

The architecture for fundamental analysis that directs what is to be forecasted as a payoff, what information is relevant for forecasting, and how forecasts are converted to a valuation. 88

|

|

|

Value added (or value created or value generated)

|

The value from anticipated payoffs to an investment (fundamental value) in excess of value given up in making the investment (the cost of the investment). 86

|

|

|

Value stock

|

A stock that trades at low multiples (viewed by value investors as undervalued). Compared with growth stock. 80

|

|

|

Unlevered price/sales

|

pg 79

|

|

|

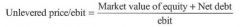

Unlevered price/ebit

|

pg 79

|

|

|

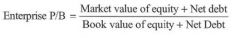

Enterprise price/book

|

pg. 79

|

|

|

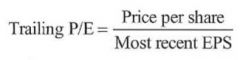

Trailing P/E

|

pg 79

|

|

|

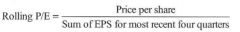

Rolling P/E

|

pg 79

|

|

|

Unlevered Price/ebitda

|

pg 79

|

|

|

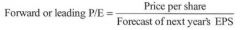

Forward or leading P/E

|

pg 79

|

|

|

Dividend adjusted P/E

|

pg 79

|

|

|

Value of a bond

|

pg 90

|

|

|

Value of a project

|

pg 91

|

|

|

Cash flow from operations - Net interest payments (after tax) + Accruals =

|

= Earnings (From CF from Ops)

|

|

|

Free cashflow - Net interest payments (after tax) + Accruals + Investments =

|

= Earnings (From FCF)

|

|

|

Discounted Cash Flow Advantages

|

Easy Concept: Cash flows are "real" and easy to think about; they are not affected by accounting rules.

Familiarity: Cash flow valuation is a straightforward application of familiar present value techniques. |

|

|

Discounted Cash Flow Disadvantages - Hint: Concept

|

Suspect Concept: FCF does not measure value added in the short run; value gained is not matched with value given up.

Free cash flow fails to recognize value generated that does not involved cash flows. Investment is treated as a loss of value. FCF is partly a liquidation concept; firms increase FCF by cutting back on investments. |

|

|

Discounted Cash Flow Disadvantages - Hint: Horizons

|

Forecast Horizons: Typically, long forecast horizons are required to recognize cash inflows from investments, particularly when investments are growing. Continuing values have a high weight in the valuation.

|

|

|

Discounted Cash Flow Disadvantages - Hint: People Forecast

|

Not aligned with what people forecast: Analysts forecast earnings, not FCF; adjusting earnings forecasts to FCF forecasts requires further forecasting of accruals.

|

|

|

Displacement

|

Transference of emotions from the original object to some substitute or symbolic representation. Can be a factor in phobias.

|

|

|

Dividend Discount Analysis Advantages

|

Easy Concept: Dividends are what shareholders get, so forecast them.

Predictability: Dividends are usually fairly stable in the short run so dividends are easy to forecast (in the short run). |

|

|

Dividend Discount Analysis Disadvantages

|

Relevance: Dividend payout is not related to value, at least in the short run; dividend forecasts ignore the capital gain component of payoffs.

Forecast horizons: Typically requires forecasts for long periods. |

|

|

When Dividend Discount Analysis Works Best

|

When payout is permanently tied to the value generation in the firm. For example, when a firm has a fixed payout ratio (dividends/earnings).

|