![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

Accounting Relation

|

An equation that expresses components of financial statements in terms of other components. 33

|

|

|

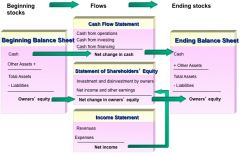

Articulation

|

The way that financial statements relate to each other. 40

|

|

|

Asset

|

An investment that is expected to produce future payoffs. 34

|

|

|

Capital Gain

|

The amount by which the price of an investment changes. 46

|

|

|

Comprehensive Income

|

The total income reported (in the income statement and elsewhere in the financial statements). 39

|

|

|

Conservative Accounting

|

The practice of recording relatively low values for net assets on the balance sheets, or omitting assets altogether. 50

|

|

|

Dirty Surplus Accounting

|

Accounting that books income in the equity statement rather than the income statement. 39

|

|

|

Expense

|

A value given up in earning revenue that is recognized in the financial statements. 34

|

|

|

Fair Value

|

The term that accountants use for the value of an asset or liability. This terms means the market value, or an estimate of market value when a liquid market does not exist. 44

|

|

|

Flows

|

Changes in stocks between two points in time in financial statements. Compare with stocks. 40

|

|

|

Historical Cost Accounting

|

Records assets and liabilities at their historical cost, then (in most cases) amortizes the cost over periods to the income statement. 44

|

|

|

Intangible Asset

|

An asset without physical form. 45

|

|

|

Liability

|

A claim on payoffs from the firm other than by the owners. 34

|

|

|

Mark-to-market Accounting

|

Records assets and liabilities at their market value. 44

|

|

|

Market value added

|

The amount by which shareholder wealth increases in the market, plus any dividend received. It is equal to the stock return. 46

|

|

|

Matching Principle

|

The accounting principle by which expenses are matched with the revenues for which they are incurred. 46

|

|

|

Net Payout

|

Cash distributed to shareholders. 39

|

|

|

Reliability Criterion

|

The accounting principle that requires assets, liabilities, revenues, and expenses to be booked only if they can be measured with reasonable precision based on objective evidence. 49

|

|

|

Revenue

|

Value received from customers that is recognized in the financial statements. 34

|

|

|

Revenue recognition principle

|

The accounting principle by which revenues are recognized in the income statement. 46

|

|

|

Shareholder value added

|

The (intrinsic) value added to shareholders' wealth during a period. 44

|

|

|

Stock return

|

the return to holding a share, equal to the capital gain plus dividend. 46

|

|

|

Stockholders' equity

|

The claim on payoffs by the owners (the stockholders) of the firm. 34

|

|

|

Stocks

|

Balances at a point in time in the financial statements. Compare with flows. 40

|

|

|

Shareholder’s equity

|

= Assets – Liabilities

|

|

|

Net income

|

= Revenue – Expenses

|

|

|

Net revenue – Cost of goods sold =

|

= Gross margin

|

|

|

Gross margin – Operating expenses =

|

= Earnings before interest and tax (ebit)

|

|

|

Earnings before interest and tax – Net interest expense =

|

= Income before taxes

|

|

|

Income before taxes – Income taxes =

|

Income after taxes (and before extraordinary items)

|

|

|

Income before extraordinary items + Extraordinary items =

|

=Net income

|

|

|

Net income – Preferred dividends =

|

=Net income available to common

|

|

|

Cash from operations + Cash from investment + Cash from financing =

|

=Change in cash

|

|

|

Ending equity =

|

=Beginning equity + Total (comprehensive) income – Net payout to shareholders

|

|

|

Comprehensive income =

|

= Net income + Other comprehensive income

|

|

|

Intrinsic premium =

|

= Intrinsic value of equity – Book value of equity

|

|

|

Market premium =

|

Market price of equity – Book value of equity

|

|

|

Value added for shareholders =

|

= Ending value – Beginning value + Dividend

|

|

|

Articulation of the Financial Statements

|

|

|

|

Accounting Relations

|

|