![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

24 Cards in this Set

- Front

- Back

|

Tangible goods intended to be sold to produce revenue |

Inventory |

|

|

Inventory is the total of tangible personal property |

1. Held for sale in the ordinary course of business 2. In the form of work-in-process to be completed and sold in the ordinary course of business 3. To be used up currently in producing goods or services for sale |

|

|

Sources of Inventories |

1. Retailing 2. Manufacturing |

|

|

Retailing |

1. Merchandise is purchased to be resold without substantial modification 2. COGS= Beg. merch. inventory +Purchases - Ending merch. inventory |

|

|

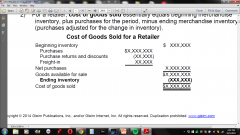

COGS Formula (Retailer) |

|

|

|

Manufacturing |

1. An entity that acquires goods for conversion into substantially different products has inventories of goods consumed directly or indirectly in production, goods in the course of production, and goods awaiting sale (direct materials and supplies, work-in-process, finished goods) |

|

|

COGS (Manufacturer) |

= Beg. finished goods inventory + COGS manufactured - Ending finished goods inventory |

|

|

Cost of goods manufactured |

=Beg. work-in-process + current manufacturing costs (direct materials+direct labor+production overhead) -ending work-in-process (current manufacturing costs adjusted for the change in work-in-process) |

|

|

Inventory Accounting Systems |

1. Perpetual 2. Periodic |

|

|

Entities that require continuous monitoring of inventory use which system? |

Perpetual system |

|

|

Entities that don't require continuous monitoring of inventory use which system? |

Periodic |

|

|

In a perpetual system, purchases, purchase returns and allowances, purchase discounts, and freight-in are charged directly to _________. |

inventory |

|

|

In a perpetual system, what accounts are adjusted as sales occur? |

Inventory and cost of goods sold |

|

|

When the physical count is less (greater) than the balance in the perpetual records, inventory over-and-short is______. |

debited (credited) |

|

|

Acquisition and Return (perpetual) |

Dr. Inventory Cr. A/P |

|

|

Sale (perpetual) |

Dr. A/R Cr. Sales Dr. COGS Cr. Inventory |

|

|

Closing (perpetual) |

Inventory over-and-short (Dr. Cr.) Inventory (Cr. Dr.) Dr. COGS Cr. Inventory over-and-short (other exp. and losses) or Dr. Inventory over-and-short Cr. COGS (other revenues and gains) |

|

|

In a periodic system, the beginning inventory balance remains___________ during the accounting period. |

unchanged

|

|

|

Acquisition and returns (perpetual) |

Dr. Purchases Cr. A/P Dr. Freight-in Cr. Cash Dr. A/P Cr. Purchase returns |

|

|

Sales (perpetual) |

Dr. A/R Cr. Sales |

|

|

Closing (perpetual) |

Dr. Inventory Dr. COGS Dr. Purchase returns Cr. Purchases (total for period) Cr. Inventory (beginning balance) Cr. Freight-in |

|

|

FOB shipping point |

Title and risk of loss pass to the buyer when the seller makes a proper tender of delivery of the goods to the carrier. Buyer includes the goods in inventory at the time of carrier's possession |

|

|

FOB destination |

Title and risk of loss pass to the buyer when the seller makes a proper tender of delivery of the goods at the destination Seller includes the goods in inventory until that time. |

|

|

Installment sales |

1. Seller often retains title until full payment has been made 2. Should not be counted in seller's inventory if uncollectible accounts expense can be reasonably estimated.3. Substance of the transaction is that control of the goods has passed to the buyer |