![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

what does owner equity consist of?

|

1.capital stock aka legal capital ( PAR VALUE FOR COMMON AND PREFER STOCK)

2. APIC for common, prefer and other 3. Retain earning 4. AOCI 5. treasure stock is DEDUCTED FROM OE |

|

|

formula for book value per common share

|

|

|

|

JE to record prefer stock and its conversion to common stock

|

dr cash, cr prefer, cr apic prefer

to convert: dr prefer, apic prefer, cr common at par and cr apic c/s |

|

|

what to remember when allocate cash dividends to cumulative prefer and common

|

allocate to dividends in arrears by its percentage, current year prefer div by its %, and common stock by the same% as prefer div if it's fully participating and the rest is PRORATED

|

|

|

what's the formula for retained earning

|

|

|

|

what's je to record treasury stock when repurchased, reissued, what to remember when doing that cost method?

|

always record G/L when repurchased and retained earning NEVER CREDIT, RE ONLY DEBIT WHEN IT'S A LOSS which caused APIC T/s to reverse everytime.

|

|

|

je to record par value method for treasury stock

|

remember to recognize G/L every time you repurchased stock, and APIC C/S always DR doesn't matter if it's a gain or loss, r/e never credit, difference goes to apic treasury stock when it's a gain. when you sell it, credit apic common stock

|

|

|

no je to record stock rights or warrant when you issued it but what about when your exercise?

|

|

|

|

Je to record issuing small stock

|

at FMV

|

|

|

Je to record issuing large stock

|

at par

|

|

|

je to record amortization of compensation expense and its exercise

|

|

|

|

what's the formula to calculate basic EPS?

|

(net income - preferred dividends )/WACSO

note: preferred dividends are current year not PRIOR YEAR noncummulative divs declared and cummulative div-doesnt matter if declared or paid |

|

|

what if there's a net loss instead of net income in calculating basic EPS?

|

net loss will be added with current year noncummulative when it's declared and cumulative even if not declared

|

|

|

what to include and not include in calculating WACSO?

|

include contingent shared and conversion effect of preferred stock to common stock

NOT include NON convertible cumulative preferred stock, just ignored it |

|

|

what of stock slip or stock div happened after year end and before financial statements are issued?

|

included those into EPS calculation of outstanding

|

|

|

formula for WACSO

|

|

|

|

example for calculating wacso if there's stock div

|

|

|

|

another wacso calculation example

|

|

|

|

diluted eps formula

|

for numerator is the same as basic eps but added back any preferred div e.g. non cummulative div declared and add back interest expense of bond after tax and

denomination is using wat if, increasing shares outstanding when converted |

|

|

what's treasury bill that mature within 90 days

|

it's cash equivalent so you don't include anywhere on the cash statement

|

|

|

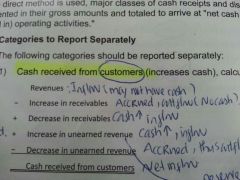

what are the categories for cash inflow under direct method

|

|

|

|

what are the categories for cash inflow under direct method

|

interest received, dividends received, other cash receipt such as insurance proceeds and lawsuit settlement, sale of trading securities if classified under current asset

|

|

|

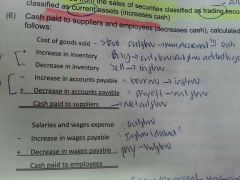

what are the categories for cash outflow under direct method

|

|

|

|

what are the categories for cash inflow under direct method

|

|

|

|

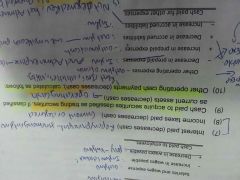

what do you disclose under indirect method

|

cash paid for interest and income tax paid

|

|

|

what are the steps to calculate cash from operating under indirect method

|

|

|

|

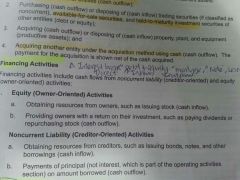

what are the steps to calculate cash from investing under indirect method

|

|

|

|

what are the steps to calculate cash from investing under indirect method

|

|

|

|

what are the steps to calculate cash from financing under indirect method

|

|

|

|

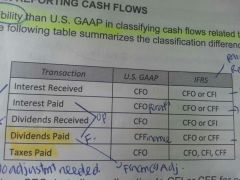

what's the diagram for differences bw ifrs and gaap in term of interest, tax, and dividends

|

us gaap: it's all operating except dividend outflow is financing

irfs: all operating, if it's a receipt it's investing, if it's paid, financing. and taxes paid is all three |

|

|

what are non cash transaction must be disclosed under indirect method

|

|

|

|

je for issuing common stock for land

|

Dr land at stock market price

cr common stock at par cr apic difference |

|

|

je to record property dividends

|

dr retained earning at fair market value

cr carrying value of inventory or equipment cr gain or debit loss |

|

|

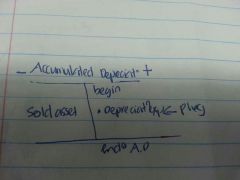

how to derive depreciation expense for statement of cash flow from accumulated depreciation

|

|

|

|

how depreciation increase from one period to the next one affect operation statement of cash flow of direct method?

|

no impact cuz we just concern about depreciation expense

|

|

|

for direct method operating cash flow do we recognize interest income?

|

no just care about what they told you about interest received or dividend receive not the income which is the accrued

|

|

|

account receivable turnover

|

|

|

|

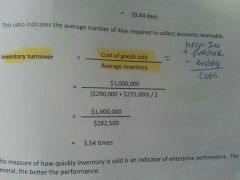

inventory turnover

|

|

|

|

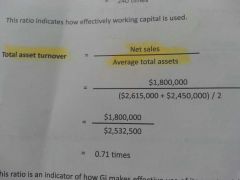

total asset turn over

|

|

|

|

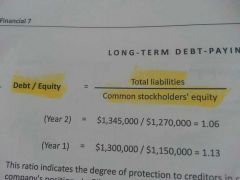

debt/equity

|

|