![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

78 Cards in this Set

- Front

- Back

|

Intraperiod Tax Allocation - General Rule |

Any amount not allocated to continuing operations is allocated to other I/S items, other comprehensive income, or to shareholder's equity in proportion to their individual effects on income tax or benefit for the year. Such items are shown net of their related tax effects. Continuing operations is shown gross of tax. |

|

|

Comprehensive interperiod tax allocation: Objective |

To recognize through the matching principle the amount of current and future tax related to events that have been recognized in financial accounting income. 1. Current year taxes: a. Payable (liability) OR b. Refundable (asset)

2. Future year taxes: a. Deferred tax liability OR b. Deferred tax asset/benefit |

|

|

Comprehensive Interperiod Tax Allocation: Permanent Differences |

a. Do not affect the deferred tax computation.

b. Items of revenue & expense that either: 1) Enter into pretax GAAP financial income, but never enter into taxable income (e.g. interest income on state or municipal obligations), OR

2) Enter into taxable income, but never enter into pretax GAAP financial income (e.g., dividends received deduction). |

|

|

Comprehensive Interperiod Tax Allocation: Temporary Differences |

a. Affect the deferred tax computation.

b. Items of revenue & expense that may: 1) Enter into pretax GAAP financial income in a period before they enter into taxable income.

2) Enter into pretax GAAP financial income in a period after they enter into taxable income. |

|

|

Comprehensive Allocation |

The asset & liability (sometimes referred to as the B/S Approach) method is required by GAAP for comprehensive allocation. Under comprehensive allocation, interperiod tax allocation is applied to a ll temporary differences. |

|

|

Accounting for Interperiod Tax Allocation: Calculation |

Total income tax expense or benefit = Current income tax payable or refundable as determined on the corporate tax return (+ or - ) Change in the deferred income tax asset or liability from the beginning to the end of the reporting period |

|

|

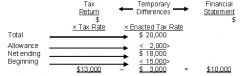

Interperiod Tax Allocation: Illustration |

|

|

|

Interperiod Tax Allocation: Pass Key |

CPA examiners frequently provide an incorrect calculation of F/S income times the current tax rate. This is an incorrect method to determine the total expense for the following reasons: - Use of F/S income (which has permanent differences) is incorrect - Use of the current tax rate ignores future changes to the enacted rate |

|

|

Permanent Differences |

No Deferred Taxes

A permanent difference is a transaction that affects on ly income per books or taxable income, but not both.

Permanent differences are either (a) nontaxable, (b) nondeductible, or (c) special tax allowances. |

|

|

Permanent Differences: Examples |

1)Tax-exempt interest (municipal, state) 2) life insurance proceeds on officer's key man policy 3) life insurance premiums when corporation is beneficiary 4) Certain penalties, fines, bribes, kickbacks, etc. 5) Nondeductible portion of meal & entertainment expense 6. Dividends-received deduction for corporations 7. Excess % depletion over cost depletion |

|

|

Temporary Differences - 4 basic causes of temporary differences, which reverse in future periods |

1. Revenues or gains included in taxable income after they being included in financial accounting income (deferred tax liability) 2. Revenues or gains included in taxable income before they are included in financial accounting income, (deferred tax asset) 3. Expenses or losses deducted from taxable income after being deducted from financial accounting income (deferred tax asset) 4. Expenses or losses deducted for taxable income, before they're deducted from financial accounting purposes (deferred tax liability) |

|

|

Temporary Differences - Additional causes of temporary differences |

a. Differences between the financial reporting & tax basis of assets & liabilities arising in a business combination accounted for as a purchase

b Differences in the tax basis of assets due to indexing, whenever the local currency is the functional currency |

|

|

Deferred Tax Liabilities and Assets Recognition: |

DTL --> Future tax accounting income > Future financial accounting income

DTA --> Future tax accounting income < Future financial accounting income |

|

|

Deferred Tax Assets |

Deferred tax assets arise when the amount of taxes paid in the current period exceeds the amount of income tax expense in the current period. They are anticipated future benefits derived from situations where future taxable income will be less than future financial accounting income due to temporary differences. |

|

|

Valuation Allowance (contra account) |

If it is more likely than not (>50%) that part or all of the deferred tax asset will not be realized, a valuation allowance is recognized. The net deferred tax asset should equal that portion of the deferred tax asset that, based on available evidence, is more likely than not to be realized. |

|

|

Uncertain Tax Positions: Defined |

An uncertain tax position is some level of uncertainty of the sustainability of a particular tax position taken by a company. US GAAP requires a more-likely-than-not level of confidence before reflecting a tax benefit in an entity's F/Ss. |

|

|

Uncertain Tax Positions: Scope |

A tax position is a filing position that an enterprise has taken or expects to take on its tax return, including: a. A tax deduction b. A decision to not file a tax return c. An allocation or shift of income between jurisdictions d. Characterization of income or a decision to exclude reporting taxable income in tax return e. A decision to classify a transaction, entity, or other position in a tax return as tax exempt |

|

|

Uncertain Tax Positions: Two-step Approach Pass Key |

Step 1: The evaluation is based on the expected outcome in the court of last resort

Step 2: The evaluation is based on the expected outcome in a settlement with the taxing authority |

|

|

Temporary Differences: Enacted Tax Rate |

Measurement of deferred taxes is based on the applicable tax rate. This requires using the enacted tax rate expected to apply to taxable items (temporary differences) in the periods the taxable item is expected to be paid (liability) or realized (asset). |

|

|

Enacted Tax Rate: Pass Key |

Use the tax rate in effect when the temporary difference reverses itself. Do not allow the CPA examiners to trick you into using the following tax rates: - Anticipated - Proposed - Unsigned |

|

|

Treatment of and Adjustment for Changes: Changes in Tax Laws or Rates |

Changes in tax laws or rates are recognized in period of change (enactment). a. The amount of adjustment is measured by the change in applicable laws/rates applied to remaining cumulative temporary differences. b. The adjustment enters into income tax expense for that period as a component of income from continuing operations. |

|

|

Temporary Differences: Net Temporary Adjustment (from beginning balance) |

The deferred tax account is adjusted for the change in deferred taxes (asset or liability), due to the current year's events. The income tax expense/benefit - deferred is the difference between the beginning balance in the deferred tax account and the properly computed ending balance in the account. |

|

|

Temporary Differences: Balance Sheet Presentation |

Under GAAP, deferred tax liabilities & assets should be classified & reported as a current amount & a noncurrent amount on the B/S. |

|

|

Temporary Differences: Balance Sheet Presentation - Rule 1 |

Deferred tax items should be classified based on the the classification of the related liability for financial reporting. For example: A deferred tax liability that relates to asset depreciation (fixed assets) would be classified as "noncurrent" because the related assets are noncurrent. |

|

|

Temporary Differences: Balance Sheet Presentation - Rule 2 (Exceptions) |

Deferred tax items not related to an asset or liability should be classifed (e.g., current or noncurrent) based on the expected reversal date of the temporary difference. |

|

|

Temporary Differences: Balance Sheet Presentation - Rule 3-5 |

3. All deferred tax assets & liabilities classified as current must be offset (netted) & presented as 1 amount (a net current asset or liability). 4. All deferred tax liabilities & assets classified as noncurrent must be offset & presented as 1 amount (a net noncurrent asset or liability) 5. Any valuation allowance for a deferred tax asset should be allocated pro rata to current & noncurrent deferred assets. |

|

|

Temporary Differences: Balance Sheet Presentation - Pass Key |

Always remember to net across (the balance sheet) not up and down (the balance sheet). |

|

|

Operating Losses |

An operating loss may be carried back 2 yrs or forward 20 yrs & be applied as a reduction of taxable income in those periods. An election must be made in the year of loss to either (1) carryback the portion of the loss that can be absorbed by the prior years' taxable income, & carryforward any excess, or (2) carryforward the entire loss. |

|

|

Operating Losses: Operating Loss Carrybacks |

(100% collectible, no valuation allowance) Tax carrybacks that can be used to reduce taxes due or to receive a refund for a prior period are a tax benefit (asset) & should be recognized (to the extent they can be used) in the period they occur. |

|

|

Operating Losses: Operating Carryforwards |

If an operating loss is carried forward, the tax effects are recognized to the extent that the tax benefit is more likely than not to be realized. 1. Tax carryforwards should be recognized as deferred tax assets (because they represent future tax savings) in the period they occur. |

|

|

Operating Losses: Operating Carryforwards - Valuation |

NOL carryforwards should be "valued" using the enacted (future) tax rate for the period(s) they are expected to be used.

Tax credit carryforwards should be "valued" at the amount of tax payable to be offset in the future. |

|

|

Operating Losses: Operating Carryforwards - Impact on Income Statement |

The deferred tax asset (DR) will reduce tax payable in a future period.

The tax benefit (CR) would reduce the net operating loss of the current period. |

|

|

Investee's Undistributed Earnings - Income Tax Return |

Taxable income is the dividend received. There is a dividend received deduction (exclusion) based upon the % of ownership in the stock of the other corporation: Ownership 0 -19% = 70% exclusion Ownership 20% - 80% = 80% exclusion Ownership over 80% = 100% exclusion |

|

|

Investee's Undistributed Earnings - GAAP Financial Statement |

(% of sub's income)

Report percentage of investee's income using the equity method for an investment between 20% & 50%. |

|

|

Investee's Undistributed Earnings - Temporary Difference |

It should be presumed that all undistributed earnings will ultimately be distributed to the investor/parent at some future time (REVERSE). |

|

|

Income Tax Disclosures - Balance Sheet Disclosures |

1. Components of a net deferred tax liability or asset is disclosed, including total: a. All deferred tax liabilities b. All deferred tax assets c. Valuation allowance for deferred tax assets

2. Other B/S disclosures include: a. Net change in the total valuation allowance b. Tax effect of each type of temporary difference & significant carryforward. |

|

|

Income Tax Disclosures - Income Statement Disclosures |

The amount of income tax expense (or benefit) allocated to continuing operations and the amount(s) separately allocated to other item(s) must be disclosed. |

|

|

Income Tax Disclosures - Income Statement Disclosures: Significant components of income tax expense attributable to continuing operations |

Disclose: a. Current tax expense or benefit b. Deferred tax expense or benefit c. Investment tax credits d. Government grants (that cause a reduction of income tax expense) e. Benefits of NOL carryforwards f. Tax expense allocated to shareholders' equity items g. Adjustments of deferred taxes from changes in tax law or rates h. Adjustments of the beg. year deferred tax asset valuation due to changes in expectations |

|

|

Under current generally accepted accounting principles, which approach is used to determine income tax expense? a. "With and without" approach. b. Periodic expense approach. c. Asset and liability approach. d. Net of tax approach. |

The approach used in GAAP to determine income tax expense is the asset and liability approach (sometimes referred to as the balance sheet approach). The asset and liability approach is used to squeeze out the amount of income tax expense after the amount of deferred tax assets and liabilities have been determined. |

|

|

Hut has temporary taxable differences that will reverse during the next year and add to taxable income. These differences relate to noncurrent assets. Deferred income taxes based on these temporary differences should be classified in Hut's B/S as: a. Noncurrent asset. b. Current asset. c. Noncurrent liability. d. Current liability. |

Hut's temporary taxable differences add to taxable income, making them deferred tax liabilities. Under U.S. GAAP, deferred tax liabilities are classified in the balance sheet based on the classification of the related assets. In this case, the related asset is a noncurrent asset, so the deferred tax liability is classified as a noncurrent liability. |

|

|

At December 31, Bren Co. had the following deferred income tax items: A deferred income tax liability of $15,000 related to a noncurrent asset. A deferred income tax asset of $3,000 related to a noncurrent liability. A deferred income tax asset of $8,000 related to a current liability. How should the assets & liabilities be reported in the noncurrent section of its Dec 31 B/S? |

Under U.S. GAAP, the noncurrent liability of $12,000 should be reported in the noncurrent section of the balance sheet. Rule 1: All current deferred tax liabilities & assets must be offset & presented as one amount. Rule 2: All noncurrent deferred tax liabilities and assets of a particular tax jurisdiction must be offset and presented as one amount. |

|

|

For year ended Dec 31, Tyre reported pretax FS income of $750,000. Its taxable income was $650,000. The difference is due to accelerated depreciation for income tax purposes. Tyre's effective income tax rate is 30%, & Tyre made estimated tax payments during the year of $90,000. What should Tyre report as current income tax expense on December 31? |

$650,000 x 30% = 195,000 |

|

|

Quinn reported a net deferred tax asset of $9,000 in its Dec 31, Yr 1, B/S. For Year 2, Quinn reported pretax FS income of $300,000. Temporary differences of $100,000 resulted in taxable income of $200,000 for Year 2. At Dec 31, Year 2, Quinn had cumulative taxable differences of $70,000. Quinn's effective income tax rate is 30%. In its Dec 31, Year 2, I/S, what should Quinn report as deferred income tax expense? |

Deferred tax expense is equal to the current period temporary differences times the enacted future tax rate: $100,000 × 30% = $30,000. |

|

|

In its Yr 1 I/S, Cere reported income before income taxes of $300,000. Cere estimated that, because of permanent differences, taxable income for Yr 1 would be $280,000. During Yr 1 Cere made estimated tax payments of $50,000, which were debited to income tax expense. Cere is subject to a 30% tax rate. What amount should Cere report as income tax expense? |

$84,000 income tax expense. |

|

|

Because Jab uses different methods to depreciate equipment for FS & income tax purposes, Jab has temporary differences that will reverse during the next year & add to taxable income. Under GAAP, deferred income taxes based on these temporary differences should be classified in Jab's B/S as a: a. Contra account to current assets. b. Contra account to noncurrent assets. c. Current liability. d. Noncurrent liability. |

Noncurrent liability. Noncurrent deferred tax liability because the items causing the temporary differences (equipment depreciation) are noncurrent fixed assets. |

|

|

In its first 4 yrs of operations ending Dec 31, Yr 4, Alder's depreciation for income tax purposes exceeded its depreciation for FS purposes. This temporary difference was expected to reverse in Year 5, 6, and 7. Alder had no other temporary difference. Under GAAP, Alder's Year 4 B/S should include: a. Both current/noncurrent deferred tax assets. b. A noncurrent deferred tax liability only. c. A current deferred tax liability only. d. Noncurrent contra asset for effects of the difference between asset bases for FS & income tax purposes. |

Choice "b" is correct. Future taxable income will be greater than future accounting income since future taxable expenses will be less than future accounting expenses. Under U.S. GAAP, the related deferred tax liability is classified according to the related asset which is a noncurrent asset. |

|

|

West leased a building & received $36,000 annual rental payment on June 15 of the current year. The beg. of the lease was July 1. Rental income is taxable when received. West's tax rates are 30% for current year & 40% thereafter. West had no other permanent or temporary differences. West determined that no valuation allowance was needed. What amount of deferred tax asset should West report in its B/S for current year ended Dec 31? |

Taxable income includes $36,000 and book income should be 1/2 of $36,000 for the current year. The $18,000 difference results in a deferred tax asset at the tax rate in the year of reversal. $18,000 x 40% = $7,200. |

|

|

Stone began operations in Yr 1 & reported $225,000 in income before taxes for the year. Stone's Yr 1 tax depreciation exceeded its book depreciation by $25,000. Stone also had nondeductible book expenses of $10,000 related to permanent differences. Stone's tax rate for Yr 1 was 40%, & the enacted rate for yrs after Yr 1 is 35%. In its Dec 31, Yr 1, B/S, what amount of deferred income tax liability should Stone report? |

$8,750 deferred tax liability at 12/31.

$25,000 x 35% = $8,750. |

|

|

Orleans, a cash basis taxpayer, prepares accrual basis FSs. In its Yr 2 B/S, Orleans' deferred income tax liabilities increased compared to Yr 1. Which of the following would cause this increase? I. An increase in prepaid insurance. II. An increase in rent receivable. III. An increase in warranty obligations. |

I and II. I - Prepaid insurance would be deducted for tax purposes in the year in which it was paid, but for book purposes in the subsequent year for the period covered by the policy. II - Rent receivable represents income earned but not yet received in cash. Taxes will be paid in the following year when the receivable is collected. |

|

|

Which of the following items should affect current income tax expense for Year 3? a. Change in income tax rate for Year 4. b. Change in income tax rate for Year 3. c. Penalties on a Yr 1 tax deficiency paid in Yr 3. d. Interest on a Yr 1 tax deficiency paid in Yr 3. |

Choice "b" is correct, change in income tax rate for Year 3 will affect current income tax expense for Year 3. |

|

|

Jan 2, Yr 1, Ross purchased a machine for $70,000. This machine has a 5-yr useful life, a residual value of $10,000, and is depreciated using the SL method for FS purposes. For tax purposes, depreciation expense was $25,000 for Yr 1 & $20,000 for Yr 2. Ross' Yr 2 income, before income taxes & depreciation expense, was $100,000 & its tax rate was 30%. If Ross had made no estimated tax payments during Yr 2, what amount of current income tax liability would Ross report in Dec 31, Yr 2, B/S? |

$24,000. Current income tax liability is based upon taxable income and current tax rates.

$100,000 - 20,000 = 80,000 $80,000 × 30% = 24,000

|

|

|

Justification for the method of determining periodic deferred tax expense is based on: a. Matching of periodic expense to periodic revenue. b. Recognition of assets and liabilities. c. Objectivity in calculation of periodic expense. d. Consistency of tax expense measurements with actual tax planning strategies.

|

Choice "b" is correct. The justification for the method of determining periodic deferred tax expense is based on recognition of assets and liabilities. |

|

|

At end of yr 1, Cody reported profit on a partially completed construction contract by applying the %-of-completion method. By end of yr 2, total estimated profit on the contract at completion in yr 3 had been drastically reduced from the amount estimated at end of yr 1. Consequently, in yr 2, a loss equal to 1/2 of the year 1 profit was recognized. Cody used the completed-contract method for income tax purposes & had no other contracts. Yr 2 B/S should include a deferred tax: Asset/Liability/or both? |

Liability.

Rule: Whenever income is recognized in the FS before it is reported as taxable income, a deferred tax liability should be reported. Even though a loss was recognized in year 2, on a cumulative basis the financial statement have recognized income which has not yet been recognized for tax purposes. Accordingly, a deferred liability will still exist at the end of year 2 (however, it will be less than the deferred liability reported at the end of year 1). |

|

|

Lake reported pretax FS income of $100,000 for the current year. Among the items reported in Lake's I/S are the following: Premium on officer's life insurance with Lake as owner and beneficiary $15,000 Interest received on municipal bonds 20,000 The enacted tax rate for the current year is 30% & 25% thereafter. In its Dec 31 B/S, Lake should report a deferred income tax liability of: |

$0 deferred income tax liability. As both the premium on an officer's life insurance (when the co. is the beneficiary) as well as interest on municipal bonds are permanent differences. Deferred taxes are not affected by either, accordingly the correct answer is $0. |

|

|

Shear began operations in Yr 1. Included in Shear's Yr 1 FSs were bad debt expenses of $1,400 & profit from an installment sale of $2,600. For tax purposes, the bad debts will be deducted & the profit from the installment sale will be recognized in Yr 3. The enacted tax rates are 30% in Yr 1 & 25% in Yr 3. In its Yr 1 I/S, what amount should Shear report as deferred income tax expense? |

$300 deferred income tax expense December 31, Year 1.

(1400)+2600 = 1200 x 25% = $300 |

|

|

Under U.S. GAAP, a temporary difference arises when which of the following extraordinary items is included for tax purposes this year after having been recognized in financial income last year? Extraordinary gain? Extraordinary loss? Both? Neither? |

Yes - Yes. Both extraordinary gains and extraordinary losses would be considered temporary differences if they enter into the determination of taxable income and GAAP basis income in different periods. Choices "c", "d", and "a" are incorrect. Both extraordinary gains and losses could give rise to timing differences. |

|

|

At the end of its first year of operations, Gold Co. reported a current deferred tax asset. Will reversal of current temporary differences result in taxable or deductible amounts, and did Gold have a Year 1 profit or loss for tax purposes? |

Deductible. Loss. Reversal of the current temporary differences will result in future deductible amounts because a deferred tax asset represents future tax savings. These tax savings will be realized in the form of future tax deductions reducing the amount of future taxes owed. Gold Co. must have had a taxable profit in Yr 1 because it is reporting a deferred tax asset on the B/S. If Gold Co. had reported a taxable loss in Yr 1, it would have recorded a full valuation allowance against its deferred tax asset. |

|

|

June 30, Yr 1, Ank prepaid a $19,000 premium on an annual insurance policy. The premium payment was a tax deductible expense in Ank's Yr 1 cash basis tax return. The accrual basis I/S will report a $9,500 insurance expense in Yr 1 & Yr 2. Ank's tax rate is 30% in Yr 1 & 25% thereafter. In Ank's Dec 31, Yr 1, B/S, what amount related to the insurance should be reported as a deferred income tax liability? |

$2,375. Rule: Deferred taxes should be computed based upon the enacted tax rates when the difference will reverse: $9500 x 25% = 2,375 |

|

|

Senlo recognized profits for both FS & tax purposes during its 2 years of operation. Depreciation for tax purposes exceeded depreciation for FS purposes in each year. These temporary differences are expected to reverse in Yrs 3, 4, and 5. At end of Year 2 the deferred tax liability shown as a noncurrent liability is based on the: a. Tax rate for Year 2. b. Tax rates for Years 1 and 2. c. Enacted tax rates for Years 3, 4, and 5. d. Enacted tax rate for Year 3. |

at the end of Year 2, the deferred tax liability shown as a noncurrent deferred liability is based on the enacted tax rate expected to apply to annual income for Years 3, 4, and 5 (the years when the liability is expected to be settled). |

|

|

Nala reported deferred tax assets & deferred tax liabilities at end of Yr 1 & at end of Yr 2. For year ended Yr 2, Nala should report deferred income tax expense or benefit equal to the: a. Decrease in the deferred tax assets. b. Sum of the net changes in deferred tax assets and deferred tax liabilities. c. Increase in the deferred tax liabilities. d. Amount of the income tax liability plus the sum of the net changes in deferred tax assets and deferred tax liabilities. |

sum of net changes in deferred tax assets and deferred tax liabilities. |

|

|

Cahn applies straight-line amortization to its organization costs for income tax purposes, but expenses all costs as incurred for FS reporting. For tax purposes a 15-yr period is used. Cahn has no other temporary differences, has an operating cycle of less than 1 yr, & has taxable income in all years. Cahn should report both current and noncurrent deferred income tax assets at the end of: Year 1? Year 14? Both? Neither? |

Yes - Year 1; No - Year 14. Since there is no related balance sheet account the deferred income tax asset is classified based upon its expected reversal date. In Year 1 a portion of the deferred income tax asset will reverse during the year, therefore it must be classified, as current while the balance will reverse in subsequent years. In Year 14 the remaining deferred income tax asset is classified as current since no deferred income tax asset will reverse in more than one year. |

|

|

No deferred tax asset was recognized in the Yr 1 FS by Chaise when a loss from discontinued segments was carried forward for tax purposes. Chaise had no temporary differences. Tax benefit of the loss carried forward reduced current taxes payable on Year 2 continuing operations. Yr 2 I/S would include tax benefit from the loss brought forward in: a. Gain or loss from discontinued segments. b. Cumulative effect of accounting changes. c. Extraordinary gains. d. Income from continuing operations. |

Since the tax benefit of the loss carried forward reduced current taxes payable on Year 2 continuing operations, the Year 2 income statement would include the benefit of the loss in income from continuing operations.

|

|

|

Dodd is preparing its Dec 31 FSs & must determine the proper accounting treatment for the following situations: For year ended Dec 31, Dodd has a loss carry forward of $180,000 available to offset future taxable income. However, there are no temporary differences. Dec 30, Dodd received a $200,000 offer for its patent. Dodd's management is considering whether to sell the patent. The offer expires Feb 28 of the next year. The patent has a carrying amount of $100,000 at Dec 31. Assume a current and future income tax rate of 30%. In its I/S, Dodd should recognize an increase in net income of: |

$0 increase in net income. U.S. GAAP does permit recognition of "net operating loss carry forward" in year of loss, but the deferred asset should be reduced by a "valuation allowance" based on the "more likely or not" test of expected realization. In this case, there does not appear to be enough evidence to support realization. |

|

|

Dec 2 of the current year, Huff received a condemnation award of $450,000 as compensation for the forced sale of land purchased 5 yrs earlier for $300,000. The gain was not reported as taxable income on its income tax return for the year ended Dec 31 because Huff elected to replace the land within the allowed replacement period for at least $450,000. Huff has a tax rate of 25% for the current year, & an enacted rate of 30% for future years. There were no other temporary differences. In its Dec 31 B/S sheet, Huff should report a deferred income tax liability of: |

$45,000. Rule: Establish deferred tax using enacted annual tax rate (current tax rate for the related years) when temporary differences (will) reverse.

($450,000-300,000) x 30% = 45,000 |

|

|

For its 1st yr of operations, Cable recorded a $100,000 expense in its tax return that will not be recorded in its accounting records until next year. There were no other differences between its taxable & FS income. Cable's effective tax rate for the current year is 45%, but a 40% rate has already been passed into law for next year. In its year-end B/S, what amount should Cable report as a deferred tax asset (liability)? |

Pre-tax income was $100,000 more than taxable income for the current period, resulting from the timing difference which is to be settled next year. Next year's enacted tax rate will be 40%. Cable must recognize a $40,000 ($100,000 × 40%) tax liability in the current period which will be paid (settled) next year. Choice "d" is incorrect. Taxes were not paid in advance. |

|

|

Brass Co. reported income before income tax expense of $60,000 for Year 2. Brass had no permanent or temporary timing differences for tax purposes. Brass has an effective tax rate of 30% and a $40,000 net operating loss carryforward from Year 1. What is the maximum income tax benefit that Brass can realize from the loss carryforward for Year 2? |

Brass Co.'s Year 2 taxable income of $60,000 exceeds the $40,000 net operating loss carryforward from Year 1, so the entire net operating loss carryforward can be utilized in Year 2. The $40,000 carryforward will be used to offset $40,000 of Brass' taxable income, for an income tax benefit of $12,000 ($40,000 × 30%). |

|

|

Ajax has an effective tax rate of 30%. On January 1, Ajax purchased equipment for $100,000. The equipment has a useful life of 10 years. What amount of current tax benefit will Ajax realize during the first year by using the 150% declining balance method of depreciation for tax purposes instead of the straight-line method? |

Use of 150% declining balance method in the 1st year will result in a tax deduction for depreciation of $15,000 ($100,000 cost of equipment × 1/10 × 150%) & tax savings of $4,500 ($15,000 tax deduction × 30% effective tax rate). The use of the SL method would result in a tax deduction for depreciation of $10,000 ($100,000 cost of equipment / 10 years) & tax savings of $3,000 ($10,000 tax deduction × 30% tax rate). The 150% declining balance method will result in a current tax benefit $1,500 higher ($4,500 tax benefit under 150% DB − $3,000 tax benefit under SL) than the benefit realized under the SL method. |

|

|

On its Dec 31, Yr 2, B/S, Shin had income taxes payable of $13,000 & a current deferred tax asset of $20,000 before determining the need for a valuation account. Shin had reported a current deferred tax asset of $15,000 at Dec 31, Yr 1. No estimated tax payments were made during Yr 2. At Dec 31, Yr 2, Shin determined that it was more likely than not that 10% of the deferred tax asset would not be realized. In its Year 2 I/S, what amount should Shin report as total income tax expense? |

$10,000

|

|

|

As a result of differences between depreciation for FS & tax purposes, the financial reporting basis of Noor's sole depreciable asset, acquired in Yr 1, exceeded its tax basis by $250,000 at Dec 31, Yr 1. This difference will reverse in future years. The enacted tax rate is 30% for Yr 1, & 40% for future years. Noor has no other temporary differences. In its Dec 31, Yr 1, B/S, how should Noor report the deferred tax effect of this difference? |

as a deferred tax liability of $100,000, since tax depreciation exceeds book depreciation. The 40% tax rate for the period(s) the difference is expected to reverse should be used. |

|

|

Hut has temporary differences that will reverse during the next year & decrease taxable income. These differences relate to current assets. Under IFRS, the deferred income taxes based on these temporary differences should be classified in Hut's balance sheet as a: a. Current liability. b. Noncurrent asset. c. Noncurrent liability. d. Current asset.

|

Noncurrent asset. A temporary difference that decreases future taxable income results in the recognition of a deferred tax asset, which will be reported as noncurrent under IFRS. Under IFRS, all deferred tax assets (DTA) and deferred tax liabilities (DTL) are reported as noncurrent on the balance sheet. |

|

|

In Yr 2, Ajax reported taxable income of $400,000 & pretax FS income of $300,000. The difference resulted from $60,000 of nondeductible premiums on Ajax's officers' life insurance and $40,000 of rental income received in advance. Rental income is taxable when received. Ajax's effective tax rate is 30%. In its Year 2 I/S, what amount should Ajax report as income tax expense-current portion? |

Income tax expense-current portion only accounts for the taxable income multiplied by the tax rate. For Ajax, that is $400,000 x 30% = $120,000. |

|

|

When accounting for income taxes, a temporary difference occurs in which of the following scenarios? a. The accrual method of accounting is used. b. An item is included in the calculation of net income in one year & in taxable income in a different year. c. An item is included in the calculation of net income, but is neither taxable nor deductible. d. An item is no longer taxable due to a change in the tax law. |

Choice "b" is correct. A temporary difference arises in situations where items of revenue and expense enter into pretax GAAP financial income in a period before or after they enter into taxable income. |

|

|

White Industries started their operations on Jan 1, Yr 1 & recorded $400,000 in warranty expense during the year. Warranty expense was the only difference between the company's pretax financial income & its tax return income of $900,000. White will be required to pay these warranties at a rate of $100,000/yr beg. Yr 2. Although White fully expects to earn in excess of $100,000 in Yr 2 & 3, the company believes it is more likely than not that it will incur a loss after Yr 3. The enacted tax rate is 25% in current & future periods. What will White record as its income tax expense in Year 1? |

$175,000. White's current provision for income taxes will equal the amount of the current taxes payable, net of the deferred tax assets associated with the temporary difference related to recorded warranties, and adjusted for the valuation allowance: |

|

|

For yr ended Dec 31, Laramie Industries has a depreciation expense per its tax return > its FS tax expense & recorded warranty expense (associated w/ a 1-yr guarantee on products) in its FSs. Pretax income is less than tax return income as a result of these reconciling items. Under U.S. GAAP, Laramie will display: a. A net noncurrent tax asset. b. A noncurrent deferred tax asset and a current deferred tax liability. c. A net current tax asset. d. A current deferred tax asset and a noncurrent deferred tax liability. |

A current deferred tax asset and a noncurrent deferred tax liability. Current items are netted against like classifications (i.e., other current items) & noncurrent items are netted against like classifications. Since these two transactions come from different classifications, they are not netted against one another. |

|

|

Erika's Surf Shop had taxable income in Yr 2 of $500,000 & pretax FS income of $600,000. The company had a cumulative $200,000 difference between its taxable income & pretax FS income at Dec 31, Yr 1. These differences were solely related to accelerated depreciation methods used for income tax purposes. The enacted tax rate increased to 30% in Yr 2 compared to an enacted rate of 20% in the prior year. At Dec 31, Yr 2, the company would record a deferred tax expense of: |

$50,000. Erika's Surf Shop will record a deferred tax expense equal to the cumulative temporary differences at the current enacted tax rate, net of the previously recorded deferred tax liability. |

|

|

Which should be disclosed in a company's financial statements related to deferred taxes? I. The types and amounts of existing temporary differences. II. The types and amounts of existing permanent differences. III. The nature and amount of each type of operating loss and tax credit carryforward. |

I and III only. There are no deferred taxes for permanent differences. So the types and amounts of exiting permanent differences do not have to be disclosed.

|

|

|

Which of the following items is not subject to the application of intraperiod income tax allocation? a. Operating income. b. Extraordinary gains and losses. c. Income from continuing operations. d. Discontinued operations. |

GAAP does not require intraperiod income tax allocation to operating income. Only select items on the income statement are shown "net of income tax," and operating income is not one of them. |

|

|

A deferred tax liability may result from which of the following items? a. Life insurance proceeds received on the death of key employees. b. Depreciation of tangible assets. c. Penalties paid for legal violations. d. Interest on municipal bonds. |

Choice "b" is correct. A deferred tax liability may result from depreciation of tangible assets because the MACRS depreciation method used for tax purposes is an accelerated method. The depreciation expense taken on the tax return may be in excess of the depreciation taken on the income statement, which will result in a deferred tax liability. |