![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

60 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Leverage ratio |

Leverage ratio of 2.5 means the buyer is using 1/2.5 i.e. 40% his own money. 60% is borrowed. |

|

|

|

Market order |

Immediate execution at best price |

|

|

|

Limit order |

Minimum execution prices on sale Maximum execution prices on buy |

|

|

|

Limit vs. Stop instructions |

Limit is ceiling Stop is floor |

|

|

|

Quote driven vs order driven |

Quote driven market is made by dealers. Order driven is actual orders driven. |

|

|

|

Market efficiency |

|

|

|

|

Perfectly efficient market strategy |

Passive investment because active investment market will underperform due to transaction cost |

|

|

|

Weak form of market strategy |

Technical analysis cannot achieve positive risk adjusted return. |

|

|

|

Semi strong form of market strategy |

Positive risk adjused returns cannot be achived using fundamental analysis |

|

|

|

Calendar anamolies |

Window dressing selling in december Tax loss selling in january |

|

|

|

Overreaction and momentum anomalies |

|

|

|

|

Value vs growth stocks |

Value stock outperforming growth stocks as risk of value stock is not captured. |

|

|

|

Precedence of order in order system |

Price Display vs hidden Time or arrival |

|

|

|

Margin call formula |

If equity in stock is (1- margin%)... How much is 100%. The answer is your price level for margin call |

|

|

|

Statutory voting |

Each share represents one vote |

|

|

|

Cumulative preference share |

Unpaid dividends are accrued and must be paid in full in future. Non cumulative pref shares have no such provision. |

|

|

|

Participating pref share |

Entitled to share in profit over and above the preference dividend. |

|

|

|

Depositiry receipts |

Trades like an ordinary share on a local exchange and represents an economic interest in a foreign company. Local depository bank acts as a custodian and registrar. |

|

|

|

Sponsored vs unsponsered ADR |

Sponsored is when the foreign company has a direct involvement in the DR. |

|

|

|

GDR |

Issued outside US and issuers home country Issued in usd. Not subject to capital flow restrictions |

|

|

|

ADR |

issued in usd and in the usa by a foreign company. |

|

|

|

Global registered shares |

Common shares traded on different stock exchanges in diff currency. |

|

|

|

Basket of listed depositiry receipts |

Portfolio of depository receipts |

|

|

|

Return on equity |

Net income on T / Book value of equity on T-1 |

|

|

|

Divisor of an index |

Dynamic number chosen and changed frequently to insulate the index value from non price changes for e.g. adding a new constituent |

|

|

|

Calculation of index over mulitple time periods |

|

|

|

|

Price weighting |

Simplest of all weighing

Weight of sec x = price of sec x / sum of price of all constituent. Is adjusted for stock splits and merge Adv simplicity Disadv arbitrary weights |

|

|

|

Equal weighting |

Weight of x = 1/ no. Of constituents Adv simplicity Disadv frequent rebalancing. Not true representation of securities |

|

|

|

Market capitalization weighting |

True representation of change in investor wealth Does nt require adjustments for stock splits |

|

|

|

Market float |

Market cap weighting where only publicly available shares are considered for calculation. Controlling shares by owners are not. |

|

|

|

Free float |

Market cap weighting where market float exclude shares that are not available to foreign buyers |

|

|

|

Float adjusted market cap weighted index |

Weights are proportional to no. Of shares available of the security compared to total no. Of shares available for all constituent. Adv representation of total market value Disadv overvaled stocks get higher weight and vice versa |

|

|

|

Fundamental weighting |

Weight based on one or more fundamental measures like earnings dividends or cash flow |

|

|

|

Calculating changes on equal weighted |

Sum of percentage return on each security / number of secirities |

|

|

|

Calculating price weighted change |

(New price sum - old price sum) / old price sum |

|

|

|

Calculating market valuation index change |

( new sum valuation - old sum valuation)/ old sum valuation |

|

|

|

Real estate indices can be categorized into |

Appraisal indices Repeat sales indices Real estat investment trust indices |

|

|

|

Rebalancing vs reconstitution of index |

Rebal is adjusting weights

Recon is changing securities |

|

|

|

Which type of index needs frequent rebal |

Equal |

|

|

|

Industry lifecycle model |

|

|

|

|

Sector rotation strategy |

Timing investment to take advantage of business cycle conditions |

|

|

|

Major categories of equity valuation |

Present value model - dividend discount model - free cash flow to equity Multiplier models Asset based valuation model |

|

|

|

Dividend discount model |

NPV of (dividends + final sale value) |

|

|

|

Free cash flow to equity (FCFE) |

Cash flow generated available to common share holders Fcfe = operating cash flow - fixed capital investment + net borrowing |

|

|

|

Present value of perpetuity |

Payment amount / discount rate |

|

|

|

Gordon growth model |

Growth rate = retention rate - ROE

Value = dividend 0 (1+growth)/ (rate - growth) We can replace dividend 0 (1+growth) with dividend1. |

|

|

|

Assumption of gordon growth rate |

|

|

|

|

Justified forward PE |

P/E = p / (r-g) |

|

|

|

P/E is inversely related to |

Required rate of return Positively related to growth rate |

|

|

|

P/E based on fundamentals |

D/E / (r-g) |

|

|

|

Market value of equity (enterprise value calc) |

Enterprise value minus Market value of debt and preferred stock plus Short term investments |

|

|

|

Issue with using EV |

Market value of debt often not available |

|

|

|

Enterprise value multiple |

EV / EBITDA operating income can be used instead of ebitda Book value cannot be used instead of market value |

|

|

|

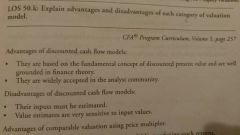

Adv & disadv of equity val discounted cash flow method |

|

|

|

|

Adv of comparable val using price multiplier |

|

|

|

|

Disadv of comparable val using price multiplier |

|

|

|

|

Adv and disadv of price muliple valuation based on fundamentals |

|

|

|

|

Adv of asset based models |

|

|

|

|

Disadv of asset based models |

|

|

|

|

Margin call price |

|

|