![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

9 Cards in this Set

- Front

- Back

|

26. In order to buy a car, you borrow $25,000 from a friend at 12 percent/year compounded monthly 4 years. You plan to repay the loan w/ 48 equal monthly payments. a) How much are the monthly payments? b) How much interest is in the twenty-third payment? c) What is the remaining balance after the thirty-seventh payment? d) Three and a half years after borrowing the money, you decide to pay off the loan. You have not yet made the payment due at the time. What is the payoff amount for the loan? |

a) $658.35. c) $6,825.49 b) $150.07. d) $4,473.11 |

|

|

a) $1,178.08. c) $437.14 ; $740.94. e) $14,437.43 b) $1,178.07; $0.00. d) $183.34 ; $994.74 |

|

|

Pay $6,500 instead of PW=$6,872.76 |

|

|

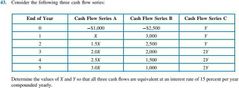

x= 908.622 y=$768.091 |

|

|

$12,663.26 |

|

|

Coupon rate (C) = 0.100008 or 10.00% |

|

|

a) $3,692.51 b) $3.97721% |

|

|

a) $13,734.43 b) $9,685.09 c) $3,770.68 |

|

58. You have $2,000 that you want to invest at the beginning of each of 5 years. The following alternatives are available to you: |

The 2nd alternative at $11,818.72 |