![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

42 Cards in this Set

- Front

- Back

|

Short run |

Period in which at least 1 F.O.P. is fixed |

|

|

Long run |

Period in which all F.O.Ps are variable |

|

|

Production takes place in |

Short run |

|

|

Planning takes place in |

Long run |

|

|

TP |

Total product - output with fixed/variable factors in time period |

|

|

AP |

Average product = TP/V - production per variable F.O.P. unit |

|

|

MP |

Marginal Product = change in TP/change in variable factor |

|

|

Diminishing marginal returns |

As extra variable F.O.P. factors are added, MP eventually diminishes |

|

|

Diminishing average returns |

As extra variable F.O.P. factors are added, AP eventually diminishes |

|

|

Economic Cost |

Explicit costs (F.O.P. purchased for production) + Implicit cost (opportunity cost of using F.O.P. in production) |

|

|

Short Run Costs |

TC = TFC + TVC |

|

|

AFC and relation to q |

AFC = TFC/q Falls with increasing q as it is constant in short run |

|

|

AVC and relation to q |

AVC = TVC/q Falls to a point, then rises As MP decreases, cost per unit rises |

|

|

ATC and relation to q |

ATC = ATC + AVC ATC = TC/q Falls and eventually rises |

|

|

MC and relation to q |

MC = change in TC/change in q Falls and eventually rises Hypothesis of eventually finishing marginal returns - marginal returns (change in q) eventually falls |

|

|

Profit (accounting and economic) |

Accounting - Profit = TR-TC Economic - Profit = TR-economic cost |

|

|

Normal profit |

TR = TC (economic) 0 economic profit |

|

|

Abnormal profit |

TR > TC (economic) Economic profit |

|

|

Loss |

TR < TC (economic) Negative economic profit |

|

|

Shut down price |

Where TR < TVC Or P < AVC As ceasing production incurs variable costs, when revenue is less, loss is minimised by not producing in short run |

|

|

Break even price |

Where P = ATC Or TR = TC (Economic costs) |

|

|

Profit maximising output |

Where MR > MC |

|

|

Assumptions of Perfect Competition |

1. Large number of firms 2. Small firms can't effect industry 3. Homogenous goods (all the same) 4. No barriers to entry/exit 5. Perfect knowledge of producers/consumers (prices, costs, etc.) |

|

|

Perfect competition supply/demand curves |

Industry - normal Firms - perfectly elastic at industry price (price takers) |

|

|

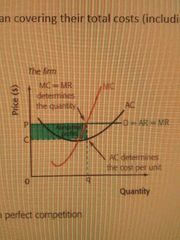

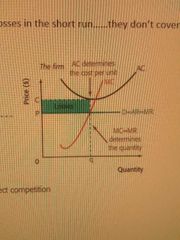

Quantity in perfect competition |

Where MC curve cuts MR (demand curve) |

|

|

PC Short run abnormal profit |

|

|

|

PC short run losses |

|

|

|

PC short to Long Run - profits |

More firms enter industry (supply curve shifts out) Equilibrium price decreases MR/D increases till MR = AC |

|

|

PC short to Long Run - losses |

Firms exit market Supply curve shift in, industry price increases till MR = AC |

|

|

Productive efficiency |

Resources used is least costly manner Where P=minimum ATC PC long run equilibrium - prices forced down to minimum ATC Firms not productively efficient - lower ATC (improve efficiency) - experience loss and shut down |

|

|

Allocative efficiency |

Where P (value to consumers) = MC (cost to producers) Best allocation of resources for producers and consumers In PC - allocative equilibrium achieved through profit maximization |

|

|

Monopoly Characteristics |

1. Single seller 2. No close substitutes 3. Price maker 4. High barriers to entry |

|

|

Sources of monopoly |

1. Economies of scale - Bulk buying - Specialisation - Financial economies 2. Natural monopolies - large fixed costs 3. Legal barriers - parents 4. Brand loyalty 5. Anti competitive behaviour - Large firm sustains short period losses in price war |

|

|

Monopoly profit maximisation |

MR=MC for quantity, price at AR Can control price or quantity |

|

|

Monopoly abnormal profits |

|

|

|

Monopoly losses |

|

|

|

Oligpoply |

Dominated by a few firms (can be other smaller) |

|

|

Oligopoly assumptions |

1. Few large firms 2. Barriers to entry 3. Differentiation can vary 4. Interdependence (reaction to other firms) 5. Strategic thinking (collusion vs. competition) |

|

|

Collusive oligopoly acts like |

Monopoly |

|

|

Non price competiton |

- undercutting generally lowers all profits - brand names, packaging, sponsorship etc increase brand loyalty |

|

|

Disceconomies of scale |

Control/communication problems, alienation/loss of id |

|

|

Natural monopoly curve |

|