![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

53 Cards in this Set

- Front

- Back

|

Discuss how firms within an oligopolistic market compete |

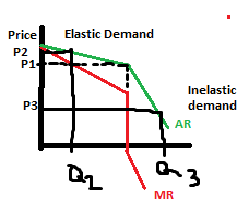

-Define Oligopoly - There is non-price competition because when a firm increases price, they lose competitiveness and revenue as PED becomes elastic and when lose price, other firms follow suit and PED becomes inelastic and so they also lose revenue (Kinked demand curve)

- However, in some cases firms in an oligopoly may compete by price cutting, even though it makes them less profit. This is because their most important long-term objective may be increasing market share. Inducing a price war could cause some firms to leave the market, which would increase the market share of that fir, reducing competition in the long run. Greater market share would allow them to benefit from economies of scale in long run (define) (diagram) However, shareholders often prefer profits and dividends to growth maximisation.

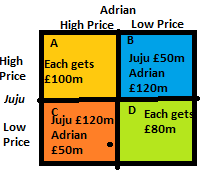

- firms may collude. Define. However, depends on whether there are high barriers to entry and small number of firms, because may get caught or may reach Nash Equilibrium

-In terms of non price discrimination, firms may try to establish stronger brand loyalty by increasing advertising and offering after sales service. Stronger brand loyalty will allow them to keep prices high. |

|

|

Definition of oligopoly |

When a few firms dominate market share. When 5 firms or fewer, have 50% or over market share. |

|

|

Kinked Demand curve |

|

|

|

Definition of collusion |

When firms tactically or formally agree to set prices or output in order to limit competition and increase the welfare gains of the firms concerned. |

|

|

Definition of Economies of Scale |

A proportionate fall in costs as a result of increased production |

|

|

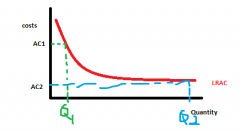

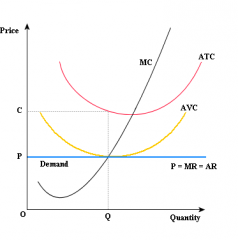

Economies of Scale diagram |

|

|

|

Discuss whether monopoly is always an undesirable form of market structure |

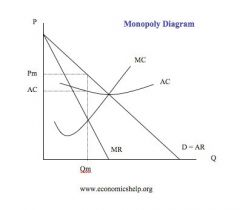

Define monopoly (1) Produces less output at higher prices. monopoly maximises profit where MR=MC so produces Q1. Here it charges P1. In a competitive market, firms would produce Q2 - the allocatively efficient amount (define) which is greater than Q1. It produces this at P2 which is less. COUNTER: - may benefit from economies of scale (define), if there is high fixed costs. This means costs would be cut and it would be better if there is just one firm. H/E. firms too large may face diseconomies of scale because harder to coordinate and motivate workers. DRAW DIAGRAM

(2) Monopolies exploit customer and suppliers. Exploit customer by reducing consumer surplus, creating a deadweight loss. Consumer is denied chance to purchase certain output at certain prices. Also, exploit supplier by making them supply at lower price as they have no other alternatives to sell to. I.E. tesco to farms. reduces farmers real income.

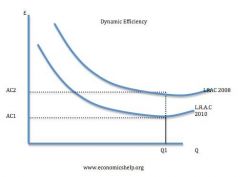

COUNTER: Schump Eter;may lower average cost through using supernormal profit to invest in research and development. Dynamic efficiency i.e. google is still efficient. H/E: likely to be more x-inefficient because do not face as much competitive pressure

(3) Do not achieve Productive efficiency and allocative efficiency in long run and short run. Define Productive efficiency. Define allocative efficiency. Draw perfect competition diagram short term and long run to demonstrate that this happens in competition

COUNTER: When there is large indivisble capital i.e. natural monopoly, may be wasteful to duplicate capital |

|

|

monopoly vs perfect competition graph |

LEARN TOMORROW MORNING |

|

|

perfect competition graph |

|

|

|

Allocative efficiency definitiion |

Is when scarce resources are used in the best possible way to maximise welfare in economy. Price = Marginal cost Socially efficient quantity of good is produced |

|

|

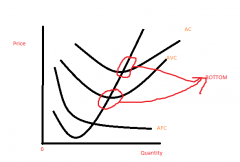

Productive efficiency definition |

Is when production takes place at the minimum average cost. Firm produces good at minimum unit cost. MC = AC |

|

|

Explain how interdependence and uncertainty could affect the behaviour of oligopolistic markets |

Define Oligopoly interdependence Define interdependence

(1) Could stop firms from changing price, leading to price stability (Kinked diagram) Sticky prices, as do not want to enter price war which would decrease industry profits

(2) Could lead to non-price competition

(3) Could cause firms to collude - or break collusion (Game theory) |

|

|

Define interdependence |

The actions of one firm will impact others in the same industry i.e. lowers price so others lower price as well |

|

|

Evaluate the view that only producers and not consumers, benefit when oligopolistic firms collude to try and reduce the uncertainty they experience |

Define oligopolistic Define collusion When they collude they effectively become monopolies

(1) Make supernormal profit - consumers lose consumer surplus as made to pay higher price for lower output (diagram). Don't benefit from economies of scale like monopolies. COUNTER: may allow firms to survive which grants consumers with greater consumer choice.

(2) Producers can become x-inefficient - COUNTER: Edward Schump dynamic efficiency

(3) HELP |

|

|

Explain why contestable markets generally function more efficiently than non-contestable markets |

- Increases allocative efficiency because firms are likely to keep prices low to discourage newer firms from entering - who will be attracted by supernormal profit. Keeps price closer to marginal cost -Increases X-efficiency because firms will reduce average cost and remain efficient so that they do not become unprofitable because of competition. -Increases greater efficiencies of scale through use of economies of scale (draw diagram). Contestable markets do not have to be like perfectly competitive ones where there are hundreds of different firms. |

|

|

Explain various barriers to entry to a market and how these barriers might affect market structure |

Define barriers to entry

(1) Economies of scale - define. If an industry has high fixed costs, the new firms will face higher average costs than the incumbent firm. If a firm enters the market and sells Q1 then it cannot compete with firms already producing Q2 at ... They are common industries that require large investment i.e. car and plane

(2) Advertising costs - these pose huge sunk costs (define), which a new firm may not have the capital to finance. Also, despite advertising, it requires a large amount of time to develop same branding. I.e pepsi and cocacola

(3) Predatory Pricing - an incumbent firm may try and kill of new competition by lowering its price below average cost. It will be able to afford this because of previous reserves of supernormal profit - something a new firm will not have. Similar with limit pricing - prevents new firms from entering

(4) Mergers and takeovers - increase the concentration ratio within a market.

(5) ownership of key outlets or factories |

|

|

Define contestable |

Where there are no barriers to entry or exit |

|

|

Define X-efficiency |

When firm has incentive to control costs by keeping average cost down |

|

|

Define Dynamic efficiency |

When productive efficiency of a firm is improved through the implementation of new production processes which reduces its cost curves. |

|

|

In the past, utility industries such as the postal service, electricity and gas, have been heavily protected by entry barriers. Evaluate the possible effects on efficiency and resource allocation of removing these barriers |

Entry barriers (define). Removal of them leads to greater competition in the market

(1) Leads to market becoming more allocatively efficient. Define. This is because more competition, reduces prices in order for firms to gain more market share. This lowers the prices closer to marginal cost and so enables greater allocative efficiency. COUNTER; usually in these industries, fixed costs are very high and so it is unlikely that there will be perfect allocative efficiency

(2) Leads to greater dynamic efficiency - the threat of entry may encourage innovation to make their product more unique COUNTER: because of high sunk costs, new competitors may not enter market which has danger of creating a private monopoly, which charges higher prices. H/E: regulation

(3)Leads to less X-inefficiency |

|

|

Define Entry barriers |

Factors that prevent new firms from entering the market or firms from leaving the market quickly. |

|

|

Explain the meaning of price discrimination and the conditions necessary for price discrimination |

Define Price discrimination Third degree price disc means charging different prices to different groups i.e. old people Second degree price disc means charging different prices for different quantity bought First degree price dic means charging the maximum price that customers are willing to pay: ebay

First condition is that there must be monoply power to some extent - so there is a downward sloping demand curve. The firm must be a price maker

Second condition is that there are two or more seperate markets with different P.E.D |

|

|

Define Price discrimination |

Involves selling the same good to different groups at different prices. |

|

|

Evaluate the view that because price discrimination enables firms to make more profit, firms, but not consumers, benefit from price discrimination |

Define price discrimination Price discrimination makes profit for businesses

(1) It can remove all consumer surplus from consumers and some customers will lose out and pay a price higher than marginal cost (allocative efficiency) H/E; theoretical, not true COUNTER: some customers will benefit - may consumer higher proportion for more vulnerabl in sociert enables a fairer distribution of resources in society - H/E not possible to use on grounds of income

(2) Unfair to make profit at expense of customer

(3) Enables firms to spread demand more evenly over a season , reducing overcrowding in peak times

(2) It can be said it |

|

|

Define Premium pricing |

When more qualtiy products are priced at a level (compared to the economy version) much higher than the Marginal Cost of production |

|

|

Define Natural Monopoly |

Most efficient number of firms is one. I.e high fixed costs in delivering tap water so deregulation would not encourafe a new firm to enter because a new firm would never be able to compete an set up a network of pipes. Would create a private monopoly |

|

|

Evaluate the different ways in which governments could make markets more competitive |

(1) Deregulation - removing any legal barriers to entry COUNTER: tend to be natural monopolies

(2) Make Office of Fair Trading investigate any potential anti-competitve prsctises i.e. collusion o predatory pricing COUNTER: OFT already do this and difficult to spot practises

(3) Gov subsidies for new firms to enter COUNTER: may have to raise tax

(4) Gov could break up monopolies into smaller firms. I.E. US gov considered breaking up Microsoft bc too much market power COUNTER: smaller firms cant benefit from economies of scale |

|

|

Define Total Revenue |

Price x Quantity |

|

|

Define Average Revenue |

Total Revenue / Quantity |

|

|

Define Marginal Revenue |

Change in total revenue earned from selling one extra unit of output.

Change in total revenue / change in quantity |

|

|

PERFECT COMPETITION TOTAL REVENUE AND MARGINAL REVENUE CURVE - price is constant |

sheet |

|

|

Imperfect competition total revenue and marginal revenue curve - price is not constant graphs |

sheet |

|

|

Law of diminishing returns |

States that in the short run when a variable factor is added to a stock of fixed factors, marginal product will initally rise but then fall because in the short run, there will not be enough fixed factors to compliment the variable ones.

Makes assumption that the variable factor is homogenous. May not work as different workers have different levels of productivity

Law makes the assumption that |

|

|

Marginal product |

The change in total product as variable factor is increased by one unit. It is the gradient of total product.

|

|

|

Law of diminishing returns graph |

sheet |

|

|

Total Costs |

Total costs = total variable costs + total fixed costs

note TVC vary with output so when TP = 0 TVC = 0

In short run TFC cannot rise as all fixed factors cannot rise or fall |

|

|

Average Fixed Costs |

TFC / Q |

|

|

Average Variable Costs |

TVC/Q |

|

|

AC (or ATC) = |

AC = TC/Q or AFC+AVC |

|

|

MARGINAL COST |

MC = CHANGE IN TC / CHANGE IN Q

MC = CHANGE IN TVC / CHANGE IN Q |

|

|

AC GRAPH |

|

|

|

Features of perfect competition |

(1) Many buyers and sellers (2) Firms are price takers (3) Goods are homogenous - and undifferentiated (4) There is perfect knowledge (5) No barriers to entry in the long run |

|

|

Normal Profit |

Normal Profit is the minimum award necessary to persuade an entrepeneur to stay in a market. It is determined by the enrepreneur's opportunity cost - i.e. how much he could earn in next best occupation |

|

|

Monopoly diagram |

|

|

|

Perfect competition shutdown point |

In short run If making loss will keep running if: AR is greater than AVC because it will be able to make a contribution to TFC Indifferent if AR = AVC

In long run will shut down if TR is less than TC Indifferent if TR=TC |

|

|

Perfect competition shutdown point diagram |

|

|

|

Monopoly shutdown point help |

help |

|

|

Monopolistic competition |

Is a market that is made up of a large number of small firms that have characteristics of both perfect competition and monopoly

- Many buyers and sellers - Sell differentiated goods that cannot be perfect substitutes for one another - No long run barriers to entry - Imperfect market knowledge - independence - each firm has small share of market

In shortrun: -AR and MR more elastic than in monopoly because more substitutes are available -can make supernormal profit longrun: - more firms enter industry so supernormal profit gets competed away. each firm loses market share so demand (AR) shifts left and becomes tangential with AC curve |

|

|

game theory TABLE |

|

|

|

Monopolistic competition diagram |

|

|

|

PROFITS ARE MAXIMISED AT OUTPUT WHERE |

MC = MR draw diagram |

|

|

REVENUE IS MAXIMISED AT OUTPUT WHERE |

MR = 0 draw diagram |

|

|

SALES ARE MAXIMISED AT THE OUTPUT WHERE |

AC=AR (breakeven) draw diagram |