![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

29 Cards in this Set

- Front

- Back

|

What does the Solow Growth Model show?

|

How saving, population growth, and technological progress affect the level of output and growth overtime.

|

|

|

What does the Solow Growth Model assume about the production function?

|

That there is constant returns to scale.

|

|

|

Per worker terms in the Solow Growth Model are denoted by what?

|

Lowercase letters.

so, y = Y/L - output per worker k = K/L - capital per worker |

|

|

Slope of the production function in the Solow Growth Model is called what and is denoted how?

|

Marginal Product of Capital (MPK):

MPK = f(k+1) - f(k) **same as the MPL back in the early chapters** |

|

|

output per worker (y) is separated into what two portions?

|

Consumption per worker (c) and investment per worker (i).

|

|

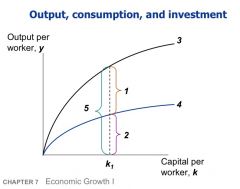

What are the labeled areas?

|

1. consumption per worker

2. investment per worker 3. Output, f(k) 4. Investment, sf(k) 5. output per worker |

|

|

Which two forces influence capital stock?

|

Investment (expenditure on new plant and equipment)

Depreciation (wearing out of old capital) |

|

|

investment per worker is expressed as

|

i = sy

where i = investment per worker s = savings per worker y = output per worker |

|

|

Why is investment expressed as sf(k)?

|

because f(k) substitutes in for y and shows that workers invest the portion of their output that they save.

|

|

|

δ represents what?

|

The certain fraction of capital stock that wears out every year.

Depreciation rate. |

|

|

How do you express the impact of investment and depreciation on capital stock?

|

Δk = i - δk, but since i = sf(k), the equation becomes:

Δk = sf(k) - δk |

|

|

δk is ____________ per ______

|

depreciation; worker

|

|

|

k* is the _____-_____ level of _______ ___ ______

|

steady-state

capital per worker |

|

|

k* is where which two things intersect?

|

The depreciation per worker function (δk) and investment per worker (sf(k)).

so the steady-state capital per worker is a state where depreciation = investment |

|

|

y = sqrt(k) is what?

|

the per worker production function

(this is where Ashley wanted to 'memorize the end of the story.') |

|

|

Steady-state k* is when investment per worker equals depreciation per worker, so how else is steady-state k* recognized?

|

when Δk = 0.

|

|

|

According to the Solow Growth Model, the ______ ____ is a key determinant of the ______-_____ _______ _____.

|

saving rate; steady-state capital stock.

|

|

|

If savings rates are high, capital stock grows. True or false.

|

True. Output also increases.

|

|

|

What is the golden rule of capital?

|

k*gold

It is the steady-state value of k that maximizes consumption. Can be found by drawing a tangent line on the steady-state output curve f(k*) |

|

|

How do you find the steady-state consumption per worker?

|

c* = f(k*) - δk*

steady-state consumption is what is left after paying steady-state depreciation on steady-state output. |

|

|

Below the Golden Rule point, what happens if steady-state capital is raised?

|

steady-state consumption increases.

|

|

|

Above the Golden Rule point, what happens if steady-sate capital is raised?

|

steady-state consumption decreases.

|

|

|

Golden Rule is expressed as k*gold but also as:

|

MPK = δ

|

|

|

When the economy begins above the Golden Rule state, does reaching the Golden Rule state produce higher consumption?

|

Yes. At all times.

|

|

|

The basic Solow Growth Model shoes that what by itself cannot explain sustained economic growth?

|

Capital Accumulation

|

|

|

What are two more sources of growth in the Solow Growth Model (outside of capital accumulation)?

|

Technology advances

Population growth |

|

|

True or False: in the Solow Growth Model, population and labor force are fixed.

|

False.

Population and Labor Growth grow at a constant rate (n) each year in the Solow Growth Model. |

|

|

What is the equation for change in capital stock per worker when one factors in population growth?

|

Δk = i - (δ + n)k.

Substitute sf(k) for i. |

|

|

How does population growth impact the steady-state of capital stock?

|

It reduces it because it shifts the depreciation/population growth (δ + n)k up without moving the per worker investment.

|