![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

217 Cards in this Set

- Front

- Back

|

Unemployment rate measure |

-aggregate market labor activity and -degree that labor force is utilized |

|

|

Employment and labor force participation rate |

fraction of working population that are employed and in labor force |

|

|

Unemployment rate |

fraction of labor force -searching for a job -out of work -U/LF -includes temp. layoff and waiting to start new job |

|

|

labor force |

- 15 years and older - participate in labor market activities - E+U |

|

|

Labor force participation rate (LFPR) |

-LF/POP -fraction of eligible population that participates in labor force |

|

|

Employment rate |

E/LF |

|

|

Labor Force Survey(LFS) |

-monthly - |

|

|

Employment Insurance Claimants |

-estimate how many unemployed |

|

|

EI>LFS |

Some people collecting EI but not actively looking for work |

|

|

EI < LFS |

New job seekers EI has ended |

|

|

Measuring unemployment |

-hard to distinguish unemployed vs. not in labor force |

|

|

Marginal labor force attachment |

wish to work but not classified as unemployed |

|

|

phenomenon of discouraged workers |

recession |

|

|

claim to be unemployed |

to receive financial assistance |

|

|

Issues in Unemployment rate |

-claim to be unemployed for EI while not looking -layoff longer than 6 months -Involuntary part time workers |

|

|

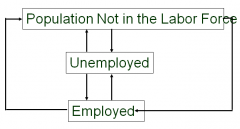

Stock flow model |

-stock for each -simultaneous flow in and out -rate of flow impact E |

|

|

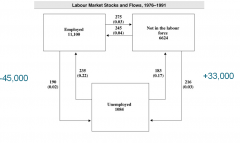

Flow |

occur each month between labor force of E, U, and not in labor force - 235000 U -> E - 190000 E -> U -ave net monthly flow 45000 |

|

|

Labor force dynamics |

|

|

|

Incidence of unemployment |

Proportion of who become unemployed in any period -probabilty of becoming unemployed |

|

|

Duration of unemployment |

length of time spent in unemployed until obtaining employment or leaving labor force -time expected to remain unemployed |

|

|

Amount of unemployed |

UR= D*I |

|

|

Unemployment in Canada |

-duration short -observed at anytime -is long term -most U is small group of workers unemployed for long D -highest U age group: longest D -very young: high prob of U -older: low U: high D -women and men similar U -avg D : 4 months |

|

|

Unemployment policy |

U caused by employment instability not shortage of jobs -most people can find acceptable job quickly -employment spells followed by job search or exit LF -still most U is the small group with longest D : concentrated |

|

|

Discrimination reasons |

- preferences - Erroneous information - Statistical judgement |

|

|

Who discriminates |

-Employers - male coworkers -Customers - unions |

|

|

Demand theories of discrimination |

demand for female labor is lower than male labor -low employment and wage -prejudice and underestimation |

|

|

Employ women if |

Wm/Wf = 1 + d d: discrimination coefficient. cost in hiring women |

|

|

Supply theories of discrimination |

Increased female supply of labor -lower productivity and low wages -Crowding hypothesis |

|

|

Crowding Hypothesis |

Females segregated to female type jobs -excess supply of female labor -lower marginal productivity and low wage |

|

|

Queing theory |

Firms pay higher than competitive wage to reduce turnover, improve moral, have queue of workers waiting to be hired at any time -women seen has higher turnover |

|

|

Statistical discrimination |

Use statistics about average to predict an individual -also used in insrurance |

|

|

Employers use a test to hire |

test may be biased |

|

|

Vicious cycle |

-Employers think women are more likely to take time off -women not promoted -opportunity cost for men becomes larger -women take time out for household -statistical discrimination |

|

|

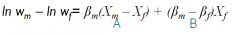

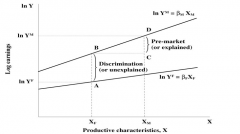

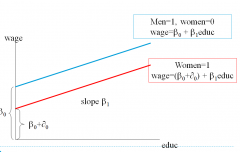

Oaxacca decomposition |

Decompose pay differential % -attributes -evaluation of attributes

|

|

|

Oaxacca decomposition graph |

|

|

|

Oaxacca decomposition limitation |

subject to omitted variable bias decomposition not unique corrective procedures developed |

|

|

Women differ because |

-Shorter market participation -higher turnover rate -absenteeism -household responsibilities |

|

|

Women choose |

-education -social work -soft people skill jobs Lower pay |

|

|

Combat discrimination policies |

-Conventional equal pay -Equal value, pay equity, comparable worth -Equal employment opportunity -Affirmative action/Employment equity -Facilitating policies |

|

|

Conventional equal pay |

within same job within same establishment |

|

|

Equal value, pay equity, or comparable worth |

between jobs of equal value -comparable worth has reduced the earning gap |

|

|

Equal employment opportunities |

may benefit new recruits |

|

|

Affirmative action/Employment equity |

Federal workers |

|

|

Equal pay across jobs |

- Generic factors ex.skills effort responsibility - Scaling - Levels with compensatable factors |

|

|

Policy initiatives impact |

-limited impact and scope -inconclusive |

|

|

Ethnic groups earning differentials |

-less evidence than female -measurement difficulty-immigrants |

|

|

women discrimination conclusions |

-wage diff between women and men, white and non-white -differences get small with characteristics -but discrimination may happen at market entry -not enough research for ethnic group |

|

|

Discrimination |

same ability inferior treatment |

|

|

Gender differences in human capital |

women less investment in human capital -take time out of labor force -benefits lost in earlier life -childbearing years are the highest return years -shorter worklife

|

|

|

Outcomes of gender gap |

-hs graduation -college -graduate -work experience |

|

|

wage gap and college major |

men in lucrative women in unlucrative |

|

|

gender diff in ed |

girls better in many men better in maths science |

|

|

sources of gender pay gap |

-diff occupations -within occupations earning gap still -gap small when controlled |

|

|

Immigration policy levers |

-number of admitted -Who is admitted |

|

|

immigration policy goals |

-max national welfare (skills) -evolve existing population (family unification) -humanitarian concerns |

|

|

Immigration classes |

- assessed - non-assessed |

|

|

Assessed |

-likely contribution and success -point system |

|

|

Non-assessed |

families and refuge |

|

|

Point system criterias |

Work experience Minimum funds Minimum score(educ, language, age, work exp, arranged emp) |

|

|

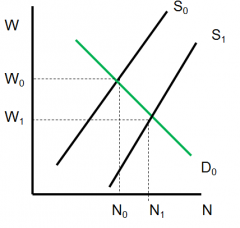

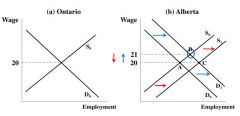

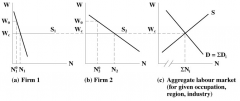

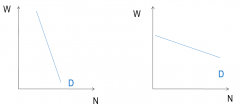

Impact of immigration on Employment and wages - supply only |

|

|

|

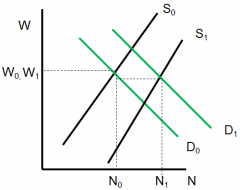

Impact of immigration on Employment and wages - supply and demand |

|

|

|

impact of immigration on consumers |

cheap labor -cheaper goods |

|

|

Impact of immigration on Employers |

greater profitability capital investment employment opportunities |

|

|

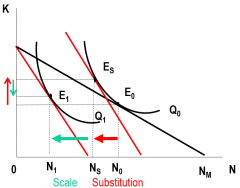

Immigration scale and substitution effect |

scale effect large enough to dominate substitution effect -complementary labor gains |

|

|

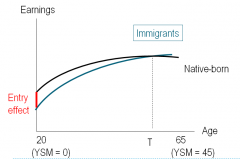

Entry effect |

immigrant suffer earning penalty -earnings rise over time -disparity can offset by short catch up period |

|

|

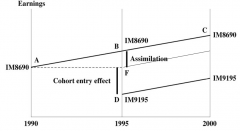

Assimilation profile |

|

|

|

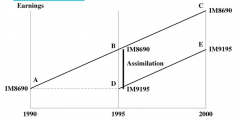

Only assimilation effect, no entry effect |

|

|

|

Assimilation effect and no entry effect |

|

|

|

Empirical evidence on assimilation |

-entry effect worsening over time - return to education lower for immigrants - assimilation rates too low to catch up - |

|

|

US family reunification vs. Canada point system |

-point system reduces admission from less dev. countries -more skills -independent immigrants fare better |

|

|

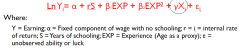

Wage depends on |

- education - work experience - Unobserved ability or luck - Other characteristics |

|

|

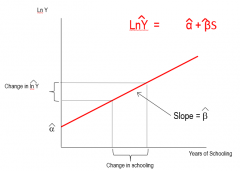

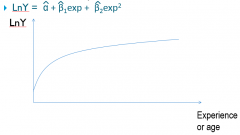

Earnings function |

|

|

|

|

|

|

Why wage differentials |

Wages should be same across all regions - firms move to lower wage regions -workers move to higher wage regions -Mobility |

|

|

Effect of an oil shock on regional wages |

|

|

|

Reasons for wage differentials |

- compensating differentials - Immobility across sectors - Short run vs long run - Unobserved individual differences - non competitive factors |

|

|

Regional wage differentials |

- geographic preference - Compensating differences - non competitive factors |

|

|

Compensating differences |

cost of living remoteness climate pollution congestion |

|

|

Noncompetitive factors |

cost of moving artificial barriers policy barriers |

|

|

Interoccupational wage differential compensation for |

Nonpecuniary differences human capital investment endowed skills |

|

|

interoccupational wage differential Short Run adjustments |

demand for skilled labor |

|

|

Interoccupational noncomeptitive factors |

licensing unions legislations |

|

|

Interindustry wage differentials Non pecuniary aspects |

unpleasant/unsafe seasonal cyclinical |

|

|

Interindustry wage differential Short run demand factors |

reallocation technology changes free trade global competition |

|

|

Interindustry wage differential noncompetitve factors |

Monopoly rents unions licensing |

|

|

Offer above market wage to get |

-Improved morale -lower turnover -Discourage unionization -cost savings when not having to react to market changes |

|

|

Efficiency wage theory |

higher wage means valued effort this value > cost of higher wages

|

|

|

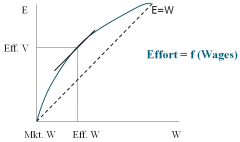

Efficiency wage model |

|

|

|

Effort gain occured by |

-avoidence of shirking -unemployment creates incentive -reservation wage and selection |

|

|

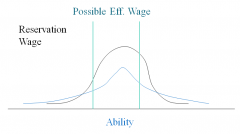

Selection and reservation wages |

Higher wages attract higher ability workers |

|

|

Large firms are wage enhancing |

- unionized - Need more skilled workers - Monopoly rents shared with employees - Undesirable work conditions - use of efficiency wage to reduce monitoring - unobserved individual heterogenuity |

|

|

Human capital model and training |

-inc. worker productivity -initial costs and future returns - returns lost in separation |

|

|

Should the firm invest in training |

- Not if the skills are portable |

|

|

Should the worker invest in training |

-Not if the skills are firm-specific |

|

|

General training |

usable to all firms |

|

|

Specific training |

- usable only at the training firm |

|

|

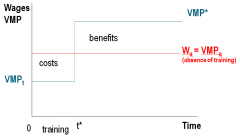

Cost benefit and financing of training -training absent |

|

|

|

When skills are transferable |

employees should bear cost -wages lower during training VMPt -after training employers offer market wage VMP* -training increases wage |

|

|

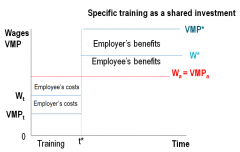

Training as shared investment |

|

|

|

Firm specific training but uncertainty about employment |

-wage premium to reduce turnover and recoup investment costs -lower the wage while training -shared costs and benefits |

|

|

Private markets training may not be socially optimal |

-imperfect information -regulations |

|

|

Government training subsidies |

increase working hours raise wages above the poverty line |

|

|

Regression line |

|

|

|

For every additional unit of variable s |

Log Y changes by beta unit. -dependent variable changes by beta unit variable |

|

|

Non linear effect regression |

controlling for other variables |

|

|

Why use Wages in Ln |

-allows interpretation of parameter as % change -distribution of earning is skewed |

|

|

Why use Log for regression |

-pulls very large numbers and minimizes their diff. with other values -stretches out low values -better distribution |

|

|

Returns to education |

7-10% returns to an additional year of education -if pure experience then sum of % of earnings from each course -measurement issues & omitted ability bias |

|

|

Downward bias in education estimate |

-some not measured in higher wage -non-monetary benefits -creates attenuation bias |

|

|

Omitted Ability Bias |

- can't control for unobservable innate ability/talent ex.motivation

|

|

|

Additional Measurements of returns to education |

-Bachelors or masters relative to high school - field of study |

|

|

Compensating differenctials |

workers differ in preferences for job characteristics -firms differ in working conditions that they offer -match and mate in labor market |

|

|

Hedonic Wage model |

-Earning varies due to differences in nonpecuniary benefits - less pleasant conditions ex |

|

|

Hedonic wage model assumptions |

-Utility maximization -Worker information -Worker mobility |

|

|

Utility Maximization |

-compensating wage differentials occur if people prefer lower paying but more pleasant |

|

|

Worker information |

-workers aware of job characteristics of potential importance |

|

|

Workers mobility |

-range of job offers -employers offering dangerous work has to raise wages |

|

|

Employer's side |

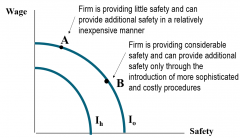

Isoprofit schedule |

|

|

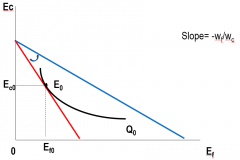

Isoprofit schedule |

combinations of wages and safety that firm can provide and maintain same level of profit -diminishing marginal rate of transformation between wages and safety |

|

|

Isoprofit schedule |

|

|

Different firms with different safety technologies |

-different abilities at given cost to provide safety -different isoprofit curves for different firms |

|

|

Different firms with different safety technologies |

|

|

|

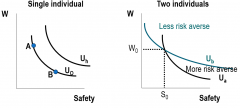

Individual's preference |

Iso-utility (indifference curve) may be willing to give up safety for compensating risk premium |

|

|

Worker indifference Curves |

|

|

|

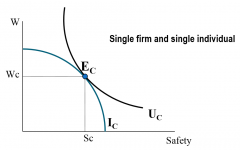

Equilibrium with Single Firm and a Single Individual |

Tangency between the iso-utility curve and isoprofit curve -Yields the optimal wage and safety |

|

|

Equilibrium with Single Firm and a Single Individual |

|

|

|

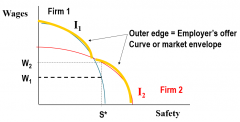

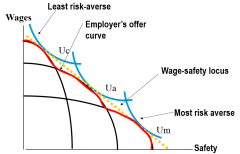

Equilibrium with many firms |

perfect competition -sort themselves into firms of different risks -compensating wages -wage safety locus |

|

|

wage-safety locus |

various equilibrium combinations of wages and safety |

|

|

Many firms and Many individuals |

|

|

|

Wage-Safety Locus |

Slope is negative -can change for different leves of safety -determined by preference and firms technology for safety |

|

|

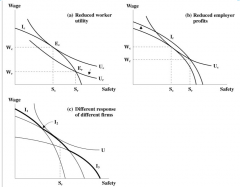

Effects of Safety Regulation |

Perfect information -safety regulations have no effect if already in safe jobs -lower the utility for high risk/wage jobs

|

|

|

Responses to Safety Standards |

|

|

|

Need for safety regulation |

-workers underestimate the risk -people are irrational -Negative externalities with worker injuries -worker compensation leads to accepting too much risk |

|

|

aggregate Labor Demand and Supply |

|

|

|

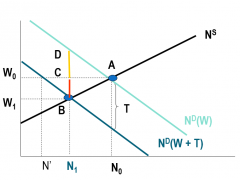

Unit payroll tax |

tax levied on employers proportional to firm's payroll often considered job killers |

|

|

Unit payroll tax examples |

CPP/QPP Worker's compensation Unemployment insurance Health insurance |

|

|

Effect of a Payroll tax on employment and wages is divided between employers and worker |

BC paid by workers |

|

|

Payroll Taxes effect |

depends on elasticity of labor |

|

|

if inelastic supply(vertical S) |

no employment change -incidence of patroll tax falls largely on workers -disemployment effects small |

|

|

Monopsony |

Large firm relative to the size of labor market |

|

|

Monopsony hires more workers |

needs to raise wages |

|

|

Monopsony Supply schedule |

upward sloping |

|

|

Monoposony if wages are decreased |

will not lose al workers |

|

|

Monopsony situations can happen |

-any firm in the short run -LR mobility costs -LR one industry town -LR very specialized |

|

|

Monopsony examples |

-nurse in a large hospital in small isolated town -mining company in small town -professional sports |

|

|

labour supply curve under perfect competition |

|

|

|

labour supply curve under monopsony |

|

|

|

profit maximization |

MRP=MC |

|

|

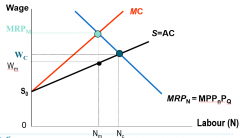

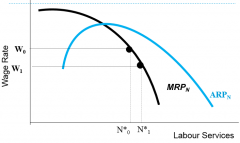

Monopsony profit maximization |

MC =/= w -doesn't take w as given

|

|

|

Monopsony hires an additional unit of labor |

must increase the wages paid to all workers |

|

|

Labour demand for monopsony |

|

|

|

Monopsony employment |

lower than in compteititve situation |

|

|

Monopsony employment restricted |

because hiring additional labor is costly |

|

|

Wage set by monopsonist |

lower than it would be if there was competition |

|

|

Sports owners |

small interconnected group can band together and act as monopsonist can set wages |

|

|

The greater is a league's monopsony power |

lower player salaries |

|

|

players will be paid |

below MRP |

|

|

Minimum wages proponent |

Ensure a living wage make employment more attractive |

|

|

Minimum wages opponent |

increase unemployment minimum wage earners do not live in impoverished households |

|

|

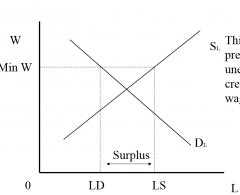

Uniform coverage model |

some unemployment created |

|

|

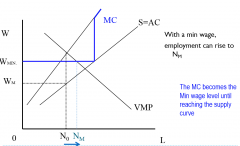

Monopsony minimum wage |

|

|

|

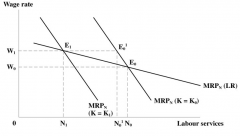

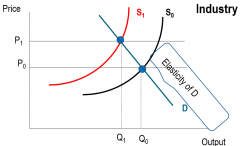

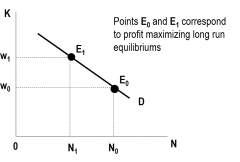

Short run |

Amount of capital fixed no SE |

|

|

Long run |

Capital varies response to wage change larger |

|

|

The demand for labor in the short and the long run |

|

|

|

Demand for labor decreases as |

wages increase -negative function |

|

|

wage increases |

adverse effect on employment |

|

|

Magnitude of the effect |

can be seen by elasticity of demand |

|

|

Elasticity of Demand |

Measures the responsivesness of labor quantity

|

|

|

Elasticity of labor curve depends on |

size of substitution and scale effect |

|

|

Factors affecting Elasticity |

1.degree of substitution between factors of production 2. Elasticity of substitute input supply 3. Price elasticity of output demand 4. labour costs to total costs ratio |

|

|

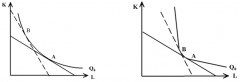

Degree of substitution between production factors |

|

|

|

The greater the degree of substitution between L and K |

flatter the labor demand curve greater wage elasticity of LR labor demand |

|

|

degree of factor substitution |

depends on state of technology unions |

|

|

If substitutes are relatively inelastic in supply |

If increasing demand drives up the price it may choke the usage |

|

|

Wage elasticity of labor demand |

depends on price elasticty of output demand |

|

|

labor demand |

derived demand |

|

|

Scale effect in labor demand |

depends on price elasticity of output demand |

|

|

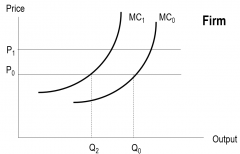

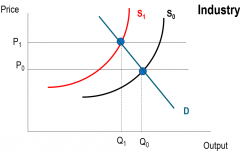

increase in wage rate |

marginal cost cure rises |

|

|

if product demand very inelastic |

reduction in output very small very small scale effect on labor demand |

|

|

Cost increase on output |

|

|

|

If ratio of labor costs to toal costs is low |

increase in wage rate has small effect on total costs -> small scale effect -> labor demand curve very inelastic |

|

|

Outsourcing |

MRPnational=p*NPPnational MRPforeign=p*MPPforeign

Optimal condition: MPPnational/MPPforeign=Wnational/Wforeign |

|

|

Foreign and domestic labor |

tend to complement |

|

|

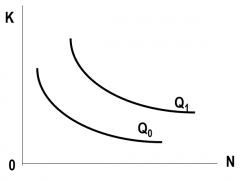

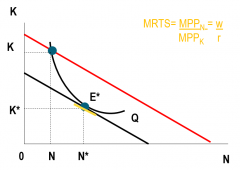

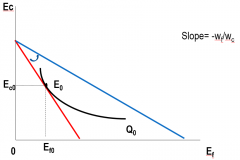

Isoquants |

Combinations of labor and capital used to produce a given amount of output -Marginal rate of technical substitution |

|

|

Isoquants |

|

|

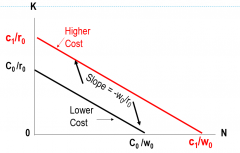

Isocost Line |

All combinations of capital and labor that can be bought for a given total cost C= rK+ wN |

|

|

Isocost Line |

|

|

Cost-Minimizing |

|

|

|

LR labor demand |

determined by LR profit maximizing labor requirements |

|

|

Effect of a Cost Increase on Output under perfect competition - firm |

|

|

|

Effect of a Cost increase on output under perfect competition-industry |

|

|

|

Substitution effect |

firm substitutes cheaper inputs for more expensive labor |

|

|

Scale effect |

Firm would reduce its scale of operations because of the cost increase associated with the increase in wage |

|

|

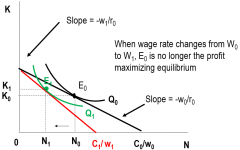

Wage Increase on labor demand |

only substitution effect |

|

|

wage increase with substitution and scale effect |

|

|

|

Derived LR Labor demand schedule |

|

|

|

If foreign wages drop while outsourcing -close substitutes |

|

|

|

If foreign wages drop while outsourcing -low degree of substitution |

|

|

|

Demand for labor |

derived by output produced by firm |

|

|

Firm objective |

Profit maximization |

|

|

Firm constraints |

-market structure - Demand for the product - Factor prices - Production function(maximum output) - Decision making time frame(SR/LR) |

|

|

Production function assumptions |

Labor (N) Capital (K) - fixed in SR produce (Q)

|

|

|

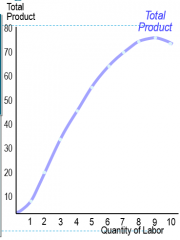

Total product |

Total product produced using given combination |

|

|

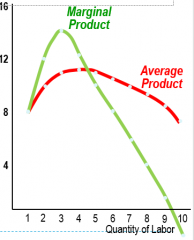

Average product |

APn =TP/N |

|

|

Marginal product of labor |

Additional output produced with one additional unit of labor |

|

|

Law of diminishing returns |

|

|

|

Marginal Product and average product |

|

|

|

Costs |

- Fixed ( sunk cost) - Variable |

|

|

Decision Rule 1 |

Operate as long as variable costs are covered TR=TVC |

|

|

DEcision Rule 2 (competitive) |

MC = MR which is wage = p |

|

|

Marginal revenue product of labor |

MRPn - extra revenue generated by selling one additional unit that can be attributed to labor = MR * MPn which is = p * MPn |

|

|

Decision rule for employment |

Hire to MRPn=MCn MRPn > MCn increase employment MRPn < MCn decrease employment - Increase MCn til MRPn=MCn |

|

|

Characteristics of a firm in a competitive market |

- price taker - can hire labor w/o impacting market wage - MC= w - Hire until MRP = w (MC) - SR labor demand curve is MRP curve |

|

|

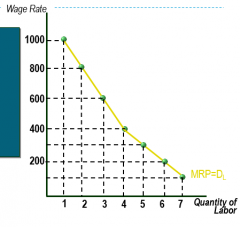

SR demand for labor |

|

|

|

MRP is a labor demand curve because |

firm only hires worker if it adds more to revenues than it adds to wage costs -slopes down |

|

|

SR labor demand

|

|

|

|

SR labor demand |

downward sloping because of diminishing marginal returns to labor -wage down demand up

|