![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

31 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What is the national debt? |

The sum of all the annual deficits accumulated since 1776 |

Sum... |

|

|

How much is the national debt? |

Over 17 trillion dollars |

|

|

|

What is budget surplus? |

When the government takes in more money then it can spend. |

|

|

|

What is budget deficit? |

Any single year the government spends more then it borrows. (i.e., revenue) from taxes, fees, and tariffs |

|

|

|

What is trade deficit? |

When the county value of goods and services imported is greater than the value of goods and services exported. |

|

|

|

What causes the national debt? |

Paying for wars, increased government spending during recessions, tax decreases not accompanied by decrease government spending |

|

|

|

What is inflation? |

The steady rising of prices |

|

|

|

Causes of inflation |

Demand pull, cost-push, and wage price spiral. Demand pull (too much consumer buying to meet supply, resulting in shortages), Cost-push (cost of resources goes up), Wage-price spiral (workers wants more wages and this drives up wages and it just keeps going up and up) |

|

|

|

Who are the winners of inflation? |

The borrowers. (also debtors and gov). The money they borrow now will be paid back with money worth less than when it was borrowed. |

|

|

|

Who are the losers of inflation? |

The savers (also the fixed-income receivers, savers, and creditors). The money out in the bank will not be worth less later when they with drawal it. |

|

|

|

What are kinds of unemployment? |

Frictional, structural, and seasonal

Frictional is when people are between jobs Structural is when jobs are no longer needed. Seasonal is when jobs may be available only at certain times |

|

|

|

What would be an acceptable unemployment rate? |

5% |

|

|

|

The goal of the Fed with regards to production |

They can influence what we think. Wants there to be money out there and productive capability |

|

|

|

The criteria that taxers must meet |

Equal, simple, and efficient |

|

|

|

Basic principles of taxation |

Benefit Principle- The more you benefit from something, the more you should pay. Taxes on gasoline. Ability to Pay- The more you make the more you should pay. |

|

|

|

Proportional Tax |

Regardless of income, the same tax rate is imposed upon everyone. Another term for a proportional tax is a flat tax. STRAIGHT LINE!!!!! |

|

|

|

Progressive Tax |

People with higher incomes pay a higher % in taxes. Federal and State income tax are progressive taxes. LINE GOING UP!!!!!! |

|

|

|

Regression Taxes |

The lower the income the higher the %age paid in taxes. Example- Sales tax. LINE GOING DOWN!!!!!!! |

|

|

|

Tax Freedom Day |

The day you will have earned enough money to pay for all of your federal, state, and local taxes. Ussally takes 4 months. |

|

|

|

What is fiscal policy? |

Changes in federal government spending or tax revenues designed to promote full employment, price stability, and reasonable rates of economic growth. |

|

|

|

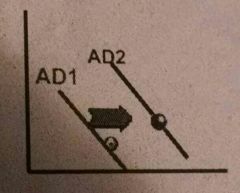

What is Expansionary Fiscal Policy? |

And increase in government spending and/or a decrease in taxes designed to increase aggregate demand. The goal is to increase the GDP and decrease unemployment. |

|

|

|

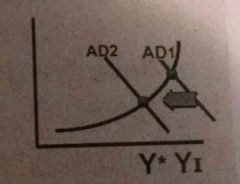

What is Contractionary Fiscal Policy? |

A decrease in government spending and/or an increase in taxes designed aggregate demand in the economy. The intent is to control inflation. |

|

|

|

What are Multiplier effects? |

The idea that spending by consumers, businesses, or government becomes income for someone else, leading to increase production in the economy. |

|

|

|

Supply side economics |

-Stability and growth achieved increasing the supply of goods and services. Aggregate (total) supply -When Aggregate (total) supply increases -Mor workers hired -Lower unemployment rate -Workers spend more money |

|

|

|

Demand side economics |

-Have the government focus on increasing aggregate demand -Believed that the market forces alone could not increase aggregate demand during bad times -Active government involvement needed!!!!! |

|

|

|

John Maynard Keynes |

the "father" of demand side economics |

|

|

|

Tools of Fiscal Policy |

-Tax rates=increase or decrease -Tax incentives=tax break for businesses, increase or decrease -Government spending and borrowing, increase or decrease -Public transfer payments= increase safety nets |

|

|

|

Fiscal policy during recessions |

Expansion Fiscal Policy= G⬆(up) and T⬇(down) |

|

|

|

Fiscal Policy During Inflationis |

Contractionary Fiscal Policy= G⬇(down) and T⬆(up) |

|

|

|

Problems with fiscal policy |

-Wealthy benefit from tax cuts -Government spending cuts hurts the people who depend on social programs and services -Unpredictable behavior |

|

|

|

What is monetary policy? |

It is one of the ways that the U.S. government attempts to control the economy. If the money supply grows too fast, the rate of inflation will increase; if the growth of the money supply is slowed too much, then economic growth may also slow |

|