![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

13 Cards in this Set

- Front

- Back

|

Crowding out |

May occur with government deficit spending. It may increase the interest rate and reduce private spending, which weakens or cancels the stimulus of fiscal policy |

|

|

Discretionary fiscal policy |

Deliberate manipulation of taxes and government spending by Congress to alter red domestic output and employment, control inflation, and stimulate economic growth |

|

|

Expansionary fiscal policy |

Used to combat a recession. During a recession, aggregate demand is too low, so increasing gov't spending and/or reducing taxes increases aggregate demand. This creates a deficit. |

|

|

Fiscal policy |

Automatic adjustment of gov't expenditures and tax revenues when the economy moves through the business cycle phases. |

|

|

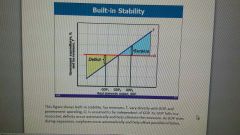

Built-in stability |

Arises because net taxes change with GDP. Auto stability reduces instability but does not eliminate economic instability. |

|

|

Progressive/Regressive Tax |

Progressive = average tax rate rises with GDP. Regressive = average tax rate falls as GDP rises. Tax revenues will rise under progressive and proportional, but may rise, fall, or stay the same under regressive. |

|

|

Contractionary fiscal policy |

Uses decreases on gov't spending, increases in taxes, or both, to reduce demand-pull inflation. |

|

|

Functions of money |

Medium of exchange and a store of value. Unit of account in measuring GDP et al. Without money, trade would be difficult. Consistent way to compare business values. Money allows for wealth w/o the need to store actual products. |

|

|

M1 |

Currency, checkable deposits. |

|

|

Coins(currency) are token money |

The face value of the currency is unrelated to its intrinsic value. |

|

|

M2 |

M1 + near-monies. Savings deposits incl. money market deposit accounts. Small-denominated time deposits(less than $100,000). Money market mutual funds. |

|

|

Distribution of M1 & M2 |

|

|

|

Basic functions of Federal Reserve Banks |

Stability, worry more about overall economy than personal wealth. 12 banks. Independent. |