![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

54 Cards in this Set

- Front

- Back

|

I. Four market models

|

A. Pure competition entails a large number of firms, standardized product, and easy entry (or exit) by new (or existing) firms.

B. At the opposite extreme, pure monopoly has one firm that is the sole seller of a product or service with no close substitutes; entry is blocked for other firms. C. Monopolistic competition is close to pure competition, except that the product is differentiated among sellers rather than standardized, and there are fewer firms. D. An oligopoly is an industry in which only a few firms exist, so each is affected by the price output decisions of its rivals. |

|

|

A. The characteristics of pure competition:

|

1. Many sellers means that there are enough so that a single seller has no impact on price by its decisions alone.

2. The products in a purely competitive market are homogeneous or standardized; each seller’s product is identical to its competitors’. 3. Individual firms must accept the market price; they are price takers and can exert no influence on price. 4. Freedom of entry and exit means that there are no significant obstacles preventing firms from entering or leaving the industry. 5. Pure competition is rare in the real world, but the model is important. a. The model helps analyze industries with characteristics similar to pure competition. b. The model provides a context in which to apply revenue and cost concepts developed in previous chapters. c. Pure competition provides a norm or standard against which to compare and evaluate the efficiency of the real world. The individual firm will view its demand as perfectly elastic. The demand curve is not perfectly elastic |

|

|

Average revenue is

|

the price per unit for each firm in pure competition.

|

|

|

2. Total revenue is

|

the price multiplied by the quantity sold.

|

|

|

3. Marginal revenue is

|

the change in total revenue and will also equal the unit price in conditions of pure competition.

|

|

|

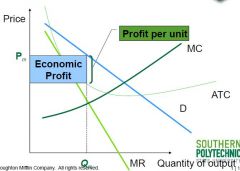

Marginal revenue—marginal cost approach

1. MR = MC |

________ rule states that the firm will maximize profits or minimize losses by producing at the point at which marginal revenue equals marginal cost in the short run.

2. Three features of this MR = MC rule are important. a. Rule assumes that marginal revenue must be equal to or exceed the minimum of average variable cost, or the firm will shut down. b. Rule works for firms in any type of industry, not just pure competition. c. In pure competition, price = marginal revenue, so in purely competitive industries the rule can be restated as the firm should produce that output where P = MC, because P = MR. |

|

|

Pure Monopoly: An Introduction

A. Definition: Pure monopoly |

______ exists when a single firm is the sole producer of a product for which there are no close substitutes.

B. There are several characteristics that distinguish ______. 1. There is a single seller so the firm and industry are synonymous. 2. There are no close substitutes for the firm’s product. 3. The firm is a “price maker,” that is, the firm has considerable control over the price because it can control the quantity supplied. 4. Entry into the industry by other firms is blocked. |

|

|

Barriers to Entry Limiting Competition

|

A. Economies of scale constitute one major barrier. This occurs where the lowest unit costs and, therefore, lowest unit prices for consumers depend on the existence of a small number of large firms or, in the case of a pure monopoly, only one firm.

B. Legal barriers to entry into a monopolistic industry also exist in the form of patents and licenses. 1. Patents grant the inventor the exclusive right to produce or license a product for twenty years; this exclusive right can earn profits for future research, which results in more patents and monopoly profits. 2. Licenses are another form of entry barrier. Radio and TV stations, taxi companies are examples of government granting licenses where only one or a few firms are allowed to offer the service. C. Ownership or control of essential resources is another barrier to entry. 1. International Nickel Co. of Canada (now called Inco) controlled about 90 percent of the world’s nickel reserves, and DeB |

|

|

Monopoly demand

|

_____ is the industry (market) demand and is therefore downward sloping.

A. Our analysis of _______ makes three assumptions: 1. The ______is secured by patents, economies of scale, or resource ownership. 2. The firm is not regulated by any unit of government. 3. The firm is a single price monopolist; it charges the same price for all units of output. B The monopolist is a price maker |

|

|

Price discrimination

|

_______ occurs when a given product is sold at more than one price and the price differences are not based on cost differences

|

|

|

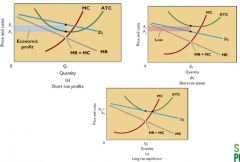

Monopolistic Competition: Characteristics, Occurrence, Price and Output Determination

|

A. Monopolistic competition refers to a market situation in which a relatively large number of sellers offer similar but not identical products.

1. Each firm has a small percentage of the total market. 2. Collusion is nearly impossible with so many firms. 3. Firms act independently; the actions of one firm are ignored by the other firms in the industry. B. Product differentiation and other types of non-price competition give the individual firm some degree of monopoly power that the purely competitive firm does not possess. C. Similar to pure competition, under monopolistic competition firms can enter and exit these industries relatively easily. D. Examples of real world industries that fit this model include grocery stores, restaurants, medical care, and real estate sales. |

|

|

Product differentiation

|

1. Product differentiation may be physical (qualitative).

2. Services and conditions accompanying the sale of the product are important aspects of product differentiation. 3. Location is another type of differentiation. 4. Brand names and packaging lead to perceived differences. 5. Product differentiation allows producers to have some control over the prices of their products. |

|

|

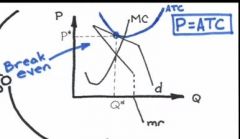

Allocative efficiency

|

occurs when price = marginal cost, i.e., where the right amount of resources are allocated to the product.

|

|

|

Productive efficiency

|

occurs when price = minimum average total cost, i.e., where production occurs using the least-cost combination of resources.

|

|

|

Pricing

Excess capacity will tend to be a feature of monopolistically competitive firms |

1. Price exceeds marginal cost in the long run, suggesting that society values additional units that are not being produced.

2. Firms do not produce the lowest average-total-cost level of output 3. Average costs may also be higher than under pure competition, due to advertising and other costs involved in differentiation. |

|

|

C. Monopolistic Competition: Product Variety

|

1. A monopolistically competitive producer may be able to postpone the long-run outcome of just normal profits through product development and improvement and advertising.

2. Compared with pure competition, this suggests possible advantages to the consumer. a. Developing or improving a product can provide the consumer with a diversity of choices. b. Product differentiation is at the heart of the tradeoff between consumer choice and productive efficiency. The greater number of choices the consumer has, the greater the excess capacity problem. |

|

|

Oligopoly: Characteristics and Occurrence

|

A. Oligopoly exists where a few large firms producing a homogeneous or differentiated product dominate a market.

1. If there are dominant firms that can be clearly identified, and few enough that firms are mutually interdependent in their pricing and output decisions, then you’ve got oligopoly. 2. Some oligopolistic industries produce standardized products whereas others produce differentiated products 3. Oligopolies exert some control over price, but mutual interdependence requires strategic behavior – self-interested behavior that accounts for the reactions of others. B. Barriers to entry 1. Economies of scale may exist due to technology and market share. 2. The capital investment requirement may be very large. 3. Other barriers to entry may exist, such as patents, control of raw materials, preemptive and retaliatory pricing, substantial advertising budgets, and traditional brand loyalty. C. Although some firms have become dominant as a result of internal growth, other |

|

|

Oligopoly models are used to explain oligopolistic price-output behavior.

graph |

A. The kinked-demand model assumes a noncollusive oligopoly.

1. The individual firms believe that rivals will match any price cuts. Therefore, each firm views its demand as inelastic for price cuts, which means they will not want to lower prices since total revenue falls when demand is inelastic and prices are lowered. 2. With regard to raising prices, there is no reason to believe that rivals will follow suit because they may increase their market shares by not raising prices. Thus, without any prior knowledge of rivals’ plans, a firm will expect that demand will be elastic when it increases price. From the total-revenue test, we know that raising prices when demand is elastic will decrease revenue. Therefore, the non colluding firm will not want to raise prices. 3. This analysis is one explanation of the fact that prices tend to be inflexible in oligopolistic industries. |

|

|

Price leadership

|

is a type of gentleman’s agreement that allows oligopolists to coordinate their prices legally; no formal agreements or clandestine meetings are involved. The practice has evolved whereby one firm, usually the largest, changes the price first and, then, the other firms follow.

1. Several price leadership tactics are practiced by the leading firm. a. Prices are changed only when cost and demand conditions have been altered significantly and industry-wide. b. Impending price adjustments are often communicated through publications, speeches, and so forth. Publicizing the “need to raise prices” elicits a consensus among rivals. c. Leaders try to avoid price wars that reduce profits. However, leaders may sometimes reduce price below the short-run profit-maximizing level to discourage new entrants. |

|

|

A market

|

is an institution or mechanism that brings together buyers (demanders) and sellers (suppliers) of particular goods and services.

4. Product market involves goods and services. 5. Resource market involves factors of production. |

|

|

Demand is

|

a schedule or curve that shows the various amounts of a product that consumers will purchase at each of several possible prices during a specified time period.

2. The schedule shows how much the buyer is willing and able to purchase at five possible prices. 3. The demand schedule alone does not tell us the market price; that depends on both demand and supply. 4. To be meaningful, the demand schedule must have a period of time associated with it. |

|

|

Law of demand

|

1. All else equal, as price increases, the corresponding quantity demanded falls.

2. Restated, there is an inverse relationship between price and quantity demanded. 3. Note the “other-things-equal” assumption refers to consumer income and tastes, prices of related goods, and other things besides the price of the product being discussed. 4. The law of demand is consistent with common sense and observed behaviors. |

|

|

Individual vs. market demand:

|

1. Transition from an individual to a market demand schedule is accomplished by summing individual quantities at various price levels.

2. Market curve is horizontal sum of individual curves (Figure 3.2). |

|

|

There are several determinants of demand or the “other things,” besides price, which affect demand. Changes in determinants cause changes in demand and shift the demand curve.

|

1. Figure 3.3 illustrates changes in demand.

a. Consumer tastes—-favorable changes lead to increases in demand; unfavorable changes decrease demand. b. Number of buyers—more buyers lead to an increase in demand; fewer buyers lead to a decrease. c. Income—more leads to an increase in demand; less leads to decrease in demand for normal (or superior) goods. Goods whose demand varies inversely with income are called inferior goods. d. Prices of related goods also affect demand. i. Substitute goods (those that can be used in place of each other): The price of the substitute good and demand for the other good are directly related. If the price of Coke rises (because of a supply decrease), demand for Pepsi should increase. ii. Complementary goods (those that are used together like tennis balls and rackets): When good e. Expectations—consumer views about future prices, product availability, and income can shift demand. (These expectations can also become a self-fulfilling prophecy – |

|

|

Law of supply

|

1. Producers will produce and sell more of their product at a high price than at a low price.

2. Restated: There is a direct relationship between price and quantity supplied. 3. Explanation: Given product costs, a higher price means greater profits and thus an incentive to increase the quantity supplied. 4. Beyond some production quantity producers usually encounter increasing costs per added unit of output, and must be offered a higher price to induce greater production. Note: A detailed explanation of diminishing returns is probably not necessary at this point and can be delayed until a later consideration of the costs of production. |

|

|

Determinants of supply:

|

1. A change in any of the supply determinants causes a change in supply and a shift in the supply curve. An increase in supply involves a rightward shift, and a decrease in supply involves a leftward shift. Many supply shifts involve changes in production costs, so another way to sort out the effect of a particular change is to ask, “how does this affect the cost of production?”

2. Six basic determinants of supply, other than price. (See an illustration of curve shifts in Figure 3.5) a. Resource prices b. Technology c. Taxes and subsidies d. Prices of related goods e. Expectations f. Number of sellers |

|

|

surplus and shortage

|

1. At prices above this equilibrium, note that there is an excess supply or surplus.

2. At prices below this equilibrium, note that there is an excess quantity demanded or shortage. |

|

|

Equilibrium Price

|

D. Market clearing or market price is another name for equilibrium price.

E. Graphically, note that the equilibrium price and quantity are where the supply and demand curves intersect (See Figure 3.6). This is an IMPORTANT point for students to recognize and remember: it is NOT correct to say supply equals demand! |

|

|

A. Changing demand with supply held constant:

|

1. Increase in demand will have effect of increasing equilibrium price and quantity

(Figure 3.7a). 2. Decrease in demand will have effect of decreasing equilibrium price and quantity (Figure 3.7b). |

|

|

B. Changing supply with demand held constant:

|

1. Increase in supply will have effect of decreasing equilibrium price and increasing quantity (Fig 3.7c).

2. Decrease in supply will have effect of increasing equilibrium price and decreasing quantity (Fig 3.7d). |

|

|

C. Complex cases—when both supply and demand shift:

|

1. If supply increases and demand decreases, price declines, but the new equilibrium quantity depends on the relative sizes of shifts in demand and supply.

2. If supply decreases and demand increases, price rises, but the new equilibrium quantity depends again on the relative sizes of shifts in demand and supply. 3. If supply and demand change in the same direction (both increase or both decrease), the change in equilibrium quantity will be in the direction of the shift but the change in equilibrium price now depends on the relative shifts in demand and supply. |

|

|

Government-set prices

|

prevent the market from reaching the equilibrium price and quantity, usually because the government has been persuaded that market prices are unfairly high to buyers, or unfairly low to sellers.

|

|

|

1. What is economic freedom?

|

q

|

|

|

2. What is a market failure?

1. Define externality and give examples of positive and negative externalities. |

Externalities and market failure: Market failures result from the absence of well-defined property rights.

|

|

|

3. What are externalities?

3. Provide solutions to the externality problem |

Private costs are those costs borne by the individual involved in the transaction that created the costs (internal). Social costs are those costs borne by someone not involved in the transaction (negative externality).

Solutions to the externality problem: The solution is to ensure that all costs of a transaction are borne by those involved in the transaction. 1. Pollution tax: The tax is a way the government forces the polluter to internalize the externality. 2. Command: The command approach provides no incentive for the firm to utilize any new technology that might reduce waste beyond the mandated amount. 3. Marketable pollution permits: By issuing permits, the government specifies the quantity of pollutants it will allow for a particular area. |

|

|

4. Why are chickens not listed as an endangered species?

|

a

|

|

|

5. Why do governments create, own, and run national parks?

|

a

|

|

|

6. Why are ingredients required to be listed on food packaging?

|

a

|

|

|

7. What is rent seeking?

|

spending wealth on political lobbying to increase one's share of existing wealth without creating wealth

|

|

|

4. Discuss the Coase theorem.

|

The Coase theorem: No matter if A or B is assigned the property right, pollution (externality) will be at the level where the marginal opportunity cost to A equals the marginal opportunity cost to B (the polluter). This is an application of the Coase theorem.

1. Outcomes when negotiation is not efficient: Laws solve the externality problem when negotiation is not practicable. |

|

|

5. State the principle of mutual exclusivity.

|

the occurrence of one event is not influenced or caused by another event. In addition, it is impossible for mutually exclusive events to occur at the same time.

|

|

|

6. Define and give examples of private property rights.

|

Specialization according to comparative advantage followed by trade allows everyone to acquire more of the goods they want. Private property rights are necessary for trade to occur and refer to the laws, courts, and police required to enforce laws against theft and murder.

A market failure may result because of the absence of well-defined rights to claim ownership of an item. A. Market failure and the problem of common ownership: With some goods and services, ownership is not clear-cut. B. Solutions to lack of private property rights: The solution is to create and enforce private property rights. |

|

|

7. Define and give examples of public goods.

|

Public Goods

These are goods for which the principle of mutual exclusivity does not apply; we all use public goods, such as air and water. A. The problem: With public goods, people can be free riders, that is, use a good without paying for it. B. Solutions to public good problems: The solution for the free-rider problems of public goods is to have the government finance or provide public goods. 1. Government financing or provision of public goods: Government provision of a public good makes sense only if there is no other, less costly way of providing that good. |

|

|

8. Discuss adverse selection and moral hazard.

|

Adverse selection: Adverse selection occurs when unobservable qualities are misvalued because of a lack of information.

Moral hazard: When verification of trades or contracts is difficult and when people can change their behavior from what was anticipated at the time a trade or contract was initially made, a moral hazard exists. Solutions to the asymmetric information issue: Adverse selection and moral hazard problems are often resolved privately with co-payments, deductibles, and other arrangements, thus reducing the incentives to change behavior or not reveal information. 1. Co-payments and deductibles: Sharing costs can sometimes reduce a moral hazard |

|

|

9. Discuss government inefficiencies.

|

a

|

|

|

adverse selection

|

It refers to a market process in which undesired results occur when buyers and sellers have asymmetric information (access to different information); the "bad" products or services are more likely to be selected

|

|

|

logrolling

|

The exchanging of political favors, especially the trading of influence or votes among legislators to achieve passage of projects that are of interest to one another

|

|

|

The Definition of Economics

|

Economics is the study of how people choose to allocate their resources among unlimited wants.

A. Scarcity: Scarcity means that there is not enough of an item to satisfy everyone who wants it. 1. Free goods and resources: A free good is a good for which there is no scarcity. An economic good is any item that is scarce, and an economic bad is any item for which we would have to pay less. The ingredients of goods are called resources, or factors of production. The three categories of resources are land, labor, and capital. B. Choices: Economics is the study of how people choose to use their scarce resources to attempt to satisfy their unlimited wants. C. Rational self-interest: This is the term that economists use to describe how people make choices. |

|

|

Positive and normative analysis:

|

Positive analysis studies what is.

Normative analysis studies what ought to be. A theory (model) is a simplified story based on positive analysis used to explain an event. |

|

|

An opportunity cost is

|

the highest-valued alternative that must be forgone when a choice is made. The opportunity cost of going to college is the money income forgone during four years of study.

|

|

|

The production possibilities curve:

|

describes the nature of social choices between alternatives. It shows the maximum quantity of goods and services that can be produced when the existing resources are used fully and efficiently.

1. Points inside the production possibilities curve: These points represent underutilized resources. 2. Points outside the production possibilities curve: These points are unattainable given the current technology and resources of the economy. 3. Shifts of the production possibilities curve: The PPC shifts if a nation obtains more resources or if the existing resources become more efficient. |

|

|

Comparative advantage:

|

This is the ability of one person or nation to do something with a lower opportunity cost than another.

|

|

|

Consumer sovereignty

|

Through their buying decisions, consumers determine what the market system will produce.

Profit and the allocation of resources: Resources will be used in endeavors that generate profits to the producer (which derive from meeting consumer wants). The flow of resources: Profit incentives ensure that resources flow to their most productive use. The determination of income: Income is determined according to the returns that people receive from their resources. |

|

|

Households

|

The household, one of the basic units in economics, consists of persons of any relationship who share a unit of housing.

A. Number of households and household income B. Household spending: Known as consumption, household spending accounts for about two-thirds of total spending in the U.S. economy. |