![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

6 Cards in this Set

- Front

- Back

|

Suppose that Glitter Gulch, a gold mining firm, increased its sales revenues on newly mined gold from $125 million to $250 million between one year and the next. Assuming that the price of gold increase by 100% over the same period, by what numerical amount did Glitter Gulch's real output change?

If the price of gold hadn't changed, what would've been the change in Glitter Gulch's real output? |

0

$125 million |

|

|

A mathematical approximation called the rule of 70 tells us that the number of years that it will take something that is growing to double in size is approximately equal to the number 70 divided by its percentage rate of growth. Thus, if Mexico’s real GDP per person is growing at 7 percent per year, it will take about 10 years (= 707) to double. |

fdf |

|

|

Apply the rule of 70 to solve the following problem. Real GDP per person in Mexico in 2005 was about $12,000 per person, while it was about $48,000 per person in the United States. If real GDP per person in Mexico grows at the rate of 10 percent per year, how long will it take Mexico’s real GDP per person to reach the level that the United States was at in 2005? (Hint: How many times would Mexico’s 2005 real GDP per person have to double to reach the United States’ 2005 real GDP per person?) |

14 years |

|

|

Assume that a national restaurant firm called BBQ builds 10 new restaurants at a cost of $1 million per restaurant. It outfits each restaurant with an additional $200,000 of equipment and furnishings. To help partially defray the cost of this expansion, BBQ issues and sells 200,000 shares of stock at $30 per share. 1) What is the amount of economic investment that has resulted from BBQ's actions?

2) How much purely financial investment took place?

|

1) $12 million 2) $6 million |

|

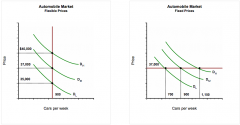

Assume that price is fixed at $37,000 and that Buzzer Auto needs 4 workers for every 1 automobile produced.

1) If demand is DM, and Buzzer wants to perfectly match its output and sales, how many cars will Buzzer produce?

2) How many workers will it hire?

3) If instead, demand unexpectedly falls from DM to DL, how many fewer cars will Buzzer sell?

4) How many fewer workers will it need if it decides to match production to these lower sales? |

1) 900 2) 3,600 3) 200 4) 800 |

|

An expansion exists between points ___ & ___.

A recession is defined between points ___ & ___. |

A & B B & D |