![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

26 Cards in this Set

- Front

- Back

|

what is IR in relation to saving and borrowing? |

Interest rate is both the return to saving and the cost of borrowing |

|

|

S=I+NCO |

Each dollar saved=a dollar that can be used to finance purchase of a domestic capital or the purchase of an asset abroad |

|

|

Where does the supply of Loanable funds come from |

savings |

|

|

where does the demand of loanable funds come from |

investments + net capital outflow |

|

|

What is the impact of interest rates on SI? |

high interest rate encourages savings and discourages investments lower interest rate encourages investment and discourages investments |

|

|

What happens to NX when foreigners are buying more goods and services than Americans? |

NX>0 (surplus) |

|

|

What happens to NX when foreigners are spending more on foreign goods than they are earning from selling abroad? |

NX<0 (deficit) |

|

|

What happens to Exports and imports when US Real interest rate increases? |

US goods become more expensive relative to foreign goods, imports increase and exports decrease, therefore net exports decreases as well. |

|

|

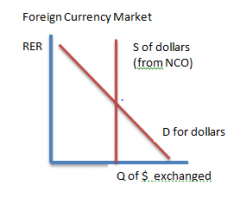

Graph for Foreign currency market |

|

|

|

What does a higher exchange value of a dollar do to the price of foreign goods and assets? |

a higher exchange value of a dollar makes the price of foreign goods and assets less expensive |

|

|

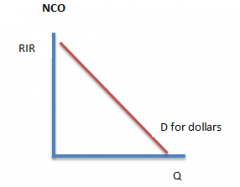

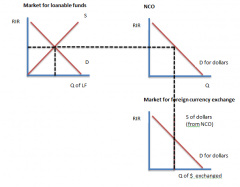

What is the variable that links the market for loanable funds and the the market for foreign currency exchange? |

Net capital outflow |

|

|

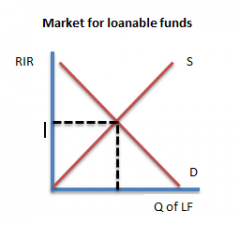

Market for loanable funds graph |

|

|

|

What determines real interest rate? |

Supply and demand in the market for loanable funds |

|

|

What determines net capital outflow? |

real interest rate |

|

|

what determines the supply of money for foreign currency? |

net capital outflow |

|

|

Net capital outflow graph |

|

|

|

Simultaneous Markets graphs |

|

|

|

trade policy |

a government policy that directly influences the quantity of goods and services a country imports/exports |

|

|

tarrif |

a tax on imported goods |

|

|

import quota |

limit on the quantity of goods produced abroad that can be sold domestically |

|

|

What is the impact of an import quota on MLF, NCO, NX, MFE, trade balance, and SI? |

MLF: nothing NCO: nothing NX: increases D for $ in MFE: increase trade balance: nothing SI: nothing |

|

|

capital flight |

a large and sudden reduction in the demand for assets located in a country |

|

|

open capital flows |

no restrictions on where your citizens can invest/citizens from other countries investing in you |

|

|

independent monetary policy |

country's central bank can control its currency in such a way as to benefit their country |

|

|

exchange rate stability |

no fluctuations in exchange rate |

|

|

the great trilemma |

a country can only have 2 of the following: 1. open capital flows 2. independent monetary policy 3. exchange rate stability |