![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

40 Cards in this Set

- Front

- Back

|

Financial system |

a group of institutions that help to match one person's savings with another person's investments |

|

|

financial markets |

financial institutions through which savers can directly provide funds to borrowers |

|

|

Bond |

a certificate of indebtedness that specifies the obligations of the borrower to the holder of the bond |

|

|

why do businesses/the government provide bonds to the public |

bonds are businesses and the government's ways of borrowing directly from the public |

|

|

what is the relationship between bonds and interest rates |

value of bond moves in the opposite direction of interest rates |

|

|

date of maturity |

the time at which the loan will be repaid |

|

|

principal |

promise of interest and eventual repayment of the amount borrowed |

|

|

which bond is riskier, long term or short term? |

long term bonds are riskier than short term bonds, so they have higher interest rates |

|

|

debt finance |

sale of a bond |

|

|

stock |

a claim to partial ownership in a firm |

|

|

equity finance |

sale of a stock |

|

|

when do stockholders experience the most benefit from their investment |

when the business they invested in is successful |

|

|

what are stock prices a clean example of |

supply and demand |

|

|

financial intermediaries |

financial institutions through which savers can indirectly provide funds to borrowers |

|

|

characteristics of a saver |

high interest safety liquidity |

|

|

Characteristics of a borrower |

little interest time risk |

|

|

what is the primary job of a bank |

to take deposits from people who want to save and lend them out to people who want to borrow |

|

|

What are 3 cool things that banks do for borrowers and savers |

facilitate purchases of goods and services create a medium of exchange store of value |

|

|

mutual funds |

an institution that sells shares to the public and uses the proceeds to buy a portfolio of stocks and bonds |

|

|

GDP equation |

Y=C+I+G+NX |

|

|

Investment equation |

I=Y-C-G |

|

|

S=I |

savings = investment |

|

|

T= |

taxes |

|

|

Savings (in total) equals |

S=(Y-T-C) + (T-G)

Private saving minus public saving |

|

|

Private saving |

the income that households have leftover after paying for taxes and consumption |

|

|

public saving |

tax revenue that the government has leftover after paying for its spending |

|

|

budget surplus |

if T (taxes) exceeds G (government spending) there is a budget surplus |

|

|

budget defecit |

shortfall of tax revenue from government spending. G exceeds T. |

|

|

investment |

purchase of new capital (equipment, buildings) |

|

|

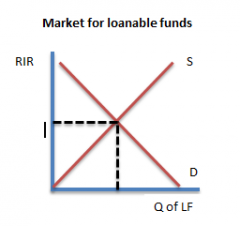

Market for loanable funds |

the market in which those who want to save supply funds and those who want to borrow demand funds |

|

|

Where does supply come from in the MLF |

people with extra income |

|

|

where does demand come from in MLF |

people who want to borrow |

|

|

Example of MLF graph |

|

|

|

The IR is the |

price of the loan |

|

|

higher interest rates encourage |

savings |

|

|

Higher interest rate discourages |

borrowing |

|

|

nominal interest rate |

the interest rate as usually reported, monetary return of saving to borrowing |

|

|

Real interest rate |

nominal interest rate corrected for inflation

Real interest rate=Nominal IR - inflation |

|

|

what are some incentives to save? |

finance future production finance future consumption

|

|

|

crowding out |

fall in investment that results from government borrowing |