![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

31 Cards in this Set

- Front

- Back

|

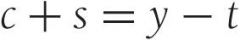

Equation : The consumer’s current-period budget constraint:

|

|

|

|

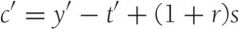

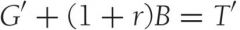

Equation: The consumer’s future-period budget constraint:

|

|

|

|

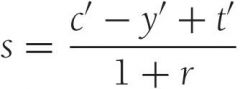

Solve the future-period budget constraint for s:

|

|

|

|

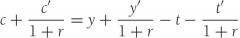

Substitute in the current-period budget constraint obtaining lifetime budget constraint:

|

|

|

|

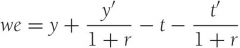

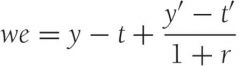

Equation: Consumer’s lifetime wealth:

|

|

|

|

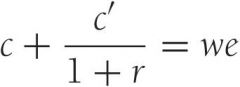

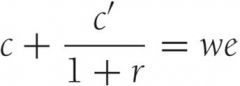

Equation 8.6Simplified lifetime budget constraint for the consumer:

|

|

|

|

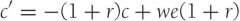

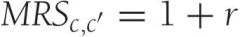

Equation : Lifetime budget constraint in slope-intercept form

|

|

|

|

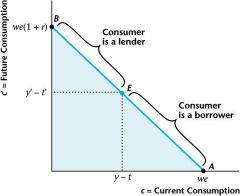

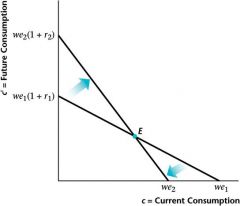

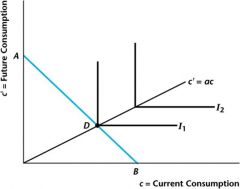

Figure 8.1 Consumer’s Lifetime Budget Constraint

|

|

|

|

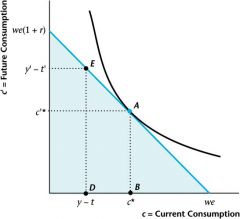

Equation : Marginal condition that holds when the consumer is optimizing:

|

|

|

|

Figure 8.4 A Consumer Who Is a Borrower

|

|

|

|

An Increase in Current Income for the Consumer

|

Current and future consumption increase.

Saving increases. The consumer acts to smooth consumption over time. |

|

|

Equation : Decomposing the change in saving for the consumer:

|

|

|

|

Observed Consumption-Smoothing Behavior

|

Aggregate consumption of non-durables and services is smooth relative to aggregate income, but the consumption of durables is more volatile than income.

This is because durables consumption is economically more like investment than consumption. |

|

|

An Increase in Future Income for the Consumer

|

Current and future consumption increase.

Saving decreases. Again, these results are explained by the consumer’s motive to smooth consumption over time. |

|

|

Figure 8.7 An Increase in Future Income

|

|

|

|

Temporary and Permanent Increases in Income

|

As a permanent increase in income will have a larger effect on lifetime wealth than a temporary increase, there will be a larger effect on current consumption.

A consumer will tend to save most of a purely temporary income increase. |

|

|

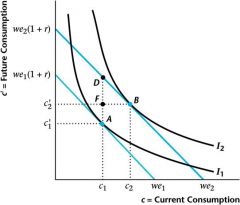

Figure 8.11 An Increase in the Real Interest Rate

|

|

|

|

An Increase in the Market Real Interest Rate

|

An increase in the market real interest rate decreases the relative price of future consumption goods in terms of current consumption goods – this has income and substitution effects for the consumer.

|

|

|

Figure 8.14 Example with Perfect Complements Preferences

|

|

|

|

Equation 8.10: With perfect complements, the ratio of future consumption to current consumption is constant.

|

|

|

|

Equation 8.11: The consumer’s lifetime budget constraint must also hold.

|

|

|

|

Equation 8.12: The consumer’s lifetime wealth:

|

|

|

|

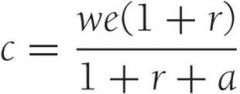

Equation 8.13: With perfect complements we can solve explicitly for current consumption:

|

|

|

|

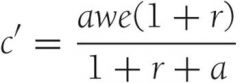

Equation 8.14: We can also solve explicitly for future consumption:

|

|

|

|

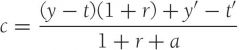

Equation 8.15: Substituting for lifetime wealth gives:

|

|

|

|

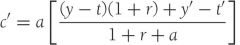

Equation 8.16: After substituting for lifetime wealth:

|

|

|

|

Equation 8.17: The government’s current-period budget constraint:

|

|

|

|

Equation 8.18 The government’s future-period budget constraint:

|

|

|

|

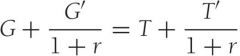

Equation 8.19: The government’s present-value budget constraint:

|

|

|

|

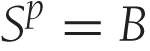

Equation 8.20: Credit Market Equilibrium Condition

|

Total private savings is equal to the quantity of government bonds issued in the current period

|

|

|

Equation 8.20: Credit Market Equilibrium Condition

|

Total private savings is equal to the quantity of government bonds issued in the current period

|