![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

190 Cards in this Set

- Front

- Back

|

Relationship between Growth and Trade

|

Data shows that countries that have higher growth tends to be more open to trade.

|

|

|

What do we mean by "growth" graphically?

|

The PPF grows outward/shifts to the right

|

|

|

Two kinds of causes of growth

|

1. Factors of Production

2. Technology |

|

|

Increase in Factors of Production (examples)

|

1. Growth in labor force

2. accumulation of physical capital 3. accumulation of human capital (education) 4. accumulation/new find of mineral resources |

|

|

How do changes in factor supplies affect quantities of production?

|

Rybczynski Theorem

|

|

|

Rybczynski Theorem:

|

Suppose economy's supply of capital increases (holding labor constant) then, holding relative prices constant, economy will produce more of a capital intensive good and less of the labor intensive good. {and vice versa K<-->L)

|

|

|

Rybczynski Theorem: results graphically

|

-The PPF shifts out but it is BIASED towards the capital-intensive good (if capital supply increased)

-So the input that grows at a faster rate makes the PPF shift in a biased direction toward the good that is intensive in the faster growing input. |

|

|

What are the two endpoints of the new PPF of the Rybcynski Theorem represent?

|

-given that the factor that good x is intensive in increased,

-The point at which we would only produce good y (increased very little) and if we were only producing good x (increased a lot) |

|

|

graphically, what does it mean to "hold relative prices constant"?

|

stick to the same price line; i.e. slope does not change

|

|

|

How does Growth affect Trade?

|

ex. China and U.S.

-if China's K increased, then the incentive to trade is reduced since the degree of comparative advantage is reduced; reduces import demand for capital intensive goods from U.S. which leads to a reduced production in labor intensive goods, therefore exports to U.S. is also reduced |

|

|

Effects of changes in world demand and supply of K-intensive vs. L-intensive goods...

|

work to reduce the international price of K-intensive goods relative to L-intensive goods

|

|

|

"terms of trade"

|

imports relative to exports

"improvement" and "deterioration" |

|

|

Immiserizing Growth

|

case in which extremely biased growth in direction of export good causes such a big deterioration in TOT that welfare is LOWER after growth compared to pre-growth

(graphically, relative price reduced and lower IC) |

|

|

How does trade affect growth?

|

(recently opened topic)

Trade libralization: -made firms more productive/efficient -but also caused less efficient firms to drop out of the market/exit the market |

|

|

Possible reasons for results of trade liberalization

|

1. transfer of technology

2. reverse engineering 3. better allocation of resources (i.e. higher skilled workers not working in factories) |

|

|

Rybczynski Theorem (GRAPH)

|

PPF shifts out but it is BIASED towards the capital-intensive good

|

|

|

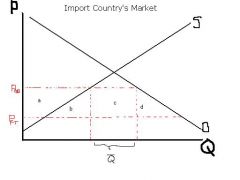

Graphs of Importing Country: Include Import Demand Curve, Free Trade, label Imports

|

Import demand curve initial price set at the equilibrium price w/o trade

|

|

|

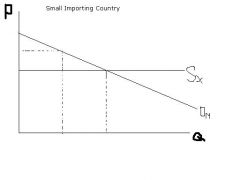

Small Importing Country: Draw Import Demand Curve and Export Supply curve

|

-export supply curve is flat because they are "price-takers"

|

|

|

Import quotas

|

a legal limitation on the quantity (value) of a good that can be imported per period of time

|

|

|

quota distorted price

|

the price at which the amount of imports demanded equals what the law says we can import

|

|

|

"quota rent"

|

monopoly profit/not a normal rate of return on investment

|

|

|

Ways to allocate licenses

|

1. Randomly give away

2. Auction off licenses (then govt gets "c") 3. Have to PROVE worthy of license (not completely all shown on graph) |

|

|

amount of import quota has to equal

|

the total # of licenses

|

|

|

Two major types of Non-Tariff Barriers

|

1. Import Quotas

2. "Voluntary" Export Restraints (VERs) |

|

|

"Voluntary" Export Restraints (VERs)

|

"voluntarily" limit how much they choose to export

|

|

|

What does VER do for competition

|

it is almost as if the competition is taken away since guaranteed market through export restrains

|

|

|

Who are the losers and winners of VERs?

|

Losers: US Consumers

Winners: US and Japanese Producers |

|

|

"Quality Upgrading"

|

-unintended effect of VER

-since limitation on quantity exported, only export highest mark-up car (with biggest profit) |

|

|

Unintended effects of VERs

|

1. Quality Upgrading

2. RENAMING of products (Playing games with categorizing things to avoid restrictions: better for U.S. consumers, worse for U.S. automakers) |

|

|

Other NTBs (Non-Tariff Barriers)

|

1. Healthy and Safety Regulations (ex. EU, US and beef; prescription drugs)

2. Red Tape (Regulations that are confusing and complicated) 3. Gov't procurement practices |

|

|

Red Tape

|

-Regulations that are confusing and complicated

1. raise cost of business transactions 2. make transactions uncertain example: France and VCRs, one port |

|

|

VER deadweight lost =

|

(1/2)*(Q imports reduced)*(increased price)

|

|

|

ad valorem

|

fixed percentage tariff rate

|

|

|

deadweight loss for ad valorem tariff

|

(1/2)*(price increase due to the tariff)*(Reduction in Q of imports)

note: price increase due to the tariff = t*Pft |

|

|

DWL as share of GDP

|

= (1/2)*(t)*(Reduction in Q of imports)*(Value of imports/GDP)

|

|

|

so how big is the DWL as share of GDP in the real world?

|

probably less than 1% of GDP...relatively small

|

|

|

"Most Favored Nation"

|

clause in WTO agreement

no country can discriminate against other countries of the WTO |

|

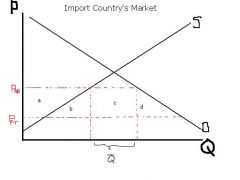

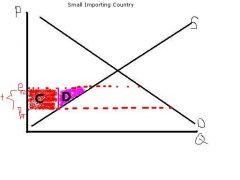

Complete the diagram to show an Import Quota

|

At Pqd, amount that we want to import is exactly the amount we are legally allowed to do

|

|

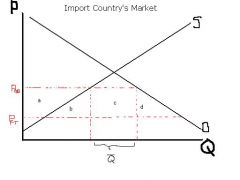

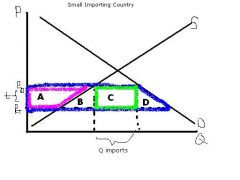

Complete to show the DWL due to tariff; how do we calculate the DWL

|

A = (1/2)*(Q imports reduced)*(Increased price)

|

|

|

Draw a diagram to show the effects of an import quota on an import country's market like the U.S.

|

Pqd = quota distorted price

Q bar = amount of import quota |

|

What are a, b, c, d for Import Quota?

|

a = increase in producer surplus

a + b + c + d = loss of consumer surplus c = the value of the right to import the product; Quota Rent |

|

What is the relationship between "c" and Q bar?

|

total # licenses have to add up to Q bar; "c" is representative of the licenses

|

|

What is the net effect of welfare for Import Quota?

|

If all licenseholders are U.S., then the net effect of welfare is loss of b+d

|

|

What are the losses/gains if this is for Volutnary Export Restraint?

|

area c is earned by exporters

loss to consumers: a + b + c + d losers: U.S. consumers Winners: U.S. and Japanese Producers |

|

What are the implications on price with a flat Export Supply Curve?

|

If the price is less than Pft then export everything to us

If price is greater than Pft then no exports to us PRICE TAKERS |

|

|

specific tariff

|

tax levied on good PER UNIT of import

|

|

|

ad valorem

|

% value tariff

(ex. sales tax) |

|

|

Pft =

|

free trade price

|

|

|

Ptd =

|

tariff distorted price

= Pft + t |

|

|

Ptd - Pft =

|

tariff

|

|

|

How does tariff affect economic welfare? (Think only about importing country)

|

1. Higher prices --> consumers worse off

2. Higher price --> benefit Domestic Producers 3. Govt collects revenue (better off) |

|

|

Consumer surplus is

|

everything under Demand Curve but above P

|

|

|

Producer Surplus is

|

above the Supply curve but above the price line

|

|

|

To a small importing country, government revenue is

|

a GOOD thing

|

|

|

Government Revenue =

|

tariff * Quantity of Imports

|

|

|

b =

|

production effect/distortion

small since the country has a comparative DISadvantage, inefficient use of resources |

|

|

d =

|

consumption effect/distortion

represents loss to consumers who don't buy as much due to increase in price |

|

|

off-setting gain

|

where there is a loss AND a gain; i.e. comes out of consumers' pockets and into producers'/govts' pockets

|

|

|

For a small importing country, what is the effect of tariff on welfare?

|

introducing a tariff ALWAYS reduces welfare (assume everthing else is going OK in economy)

|

|

|

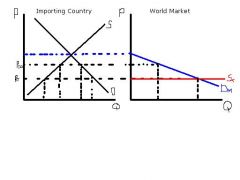

Difference between small importing country and large importing country?

|

upward sloping export supply curve in world market

|

|

|

Large importing country

Ptd = |

t + Pexport

(tariff + the export country price) |

|

|

How do we begin to look at tariff effects on large importing country?

|

we have to start on the right side with the world market

|

|

|

Effects of tariff on Large Importing country

|

1. higher prices --> loss to CS

2. higher prices --> gain to domestic PS 3. tax revenue --> (tariff*Q import) SAME AS SMALL IMPORTING COUNTRY |

|

|

TOT for large importing country and tariff

|

If the Price of import decreases, then TOT better

|

|

|

Show change in price in both a small importing country and world market for a tariff

|

Ptd = Pft + tariff

tariff = Ptd - Pft |

|

Describe the effects of tariff on consumer surplus of small importing country

|

loss of CS = A + B

A = loss to all consumers who were already in the market B = loss to consumers who are unable to purchase because of expensive prices |

|

Show the tariff effects on PS of small importing country

|

C + D = gain in producer surplus

C = gain to producers who had already been in market D = new producers entering market or existing producers producing more |

|

Show government revenue of tariff on small importing country

|

Government Revenue = tariff*Q of imports

|

|

Show ALL effects of tariff on small importing country -- PS, CS, revenue

|

A+B+C+D= loss of CS

A=PS Gain C=govt revenue (gain) B+D = representation of loss to economy; net effect of tariff B = production effect/distortion D= consumption effect/distortion |

|

Show welfare, restricted imports and free trade imports

|

World DWL = (1/2)*(reduction in imports)*(tariff rate)

|

|

|

Draw the graphs to show a large importing country, world market, and effects of tariff

|

Ptd = t + Pexport

Pexport = the export country price Price of free trade determined by WORLD MARKET |

|

What are the gains/losses of the tariff?

|

Consumer loses: A+B+C+D

Producer gains: A Govt gains: C+E After offsets, left w/ B, D, E |

|

What are the implications of the region "E" and welfare?

|

"E" = measurement of the value of TOT improvement

If E > (B+D) then welfare increases If E < (B+D) then welfare decreases |

|

|

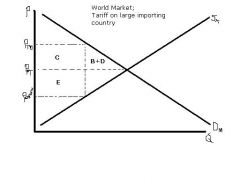

Show graphically the effects of tariffs on the WORLD MARKET when talking about large importing country

|

Note that the tariff is equal to Ptd-Pexport

|

|

What does each part represent?

|

C = part of tariff how much we import

E = TOT loss from exporters view; TOT gain to importing country |

|

|

What is the reason for trade?

|

Comparative advantage

|

|

|

What are two implications of comparative advantage?

|

1. trade is motivated by differences amongst countries

2. trade involves exports of some goods in return for imports of totally different goods. |

|

|

What is Interindustry trade?

|

trade that involves exports of some goods in return for imports of totally different good

(i.e. import corn, export cars. No mistake that the goods are different) |

|

|

Import demand curve is derived from

|

underlying ordinary demand curves

|

|

|

Autarky

|

situation of self-sufficiency; no trade

|

|

|

Producer Surplus?

|

return of the specialized input; (not)profit

|

|

|

Horizontal Export Supply curve represents

|

Infinitely elastic S curve

|

|

|

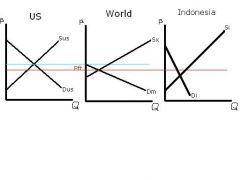

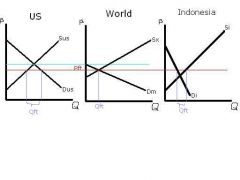

Draw the three graphs of the US, World and Indonesian T-shirt market with free trade

|

-the US equilibrium price sets the price for the Import Demand curve in the world

-Pft is below autarky for the US but above autarky for Indonesia (the export country) |

|

Show the quantity of imports at free trade

|

Note that Qft = imports for US and exports for Indonesia

ALL EQUAL |

|

|

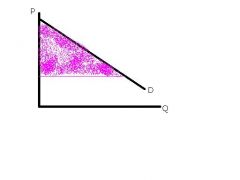

(graph) show total CS with just a demand curve

What is the rltnsp between price and CS? |

If Price goes down, CS goes up

If Price goes up, CS goes down |

|

What does the height of the demand curve represent?

|

Height of Demand Curve represents marginal consumer's maximum willingness to pay

|

|

|

(Graph) Show CS with demand curve only when U.S. opens up to trade

Explain differentiation within CS |

Whole shaded in area is increase in CS

Square = Gain to consumers already in the market Triangle = gain to expanded market/market entrants |

|

|

(Graph) Show producer surplus with Supply curve only

What is the rltnsp between price and PS? |

Supply curve is the lowest acceptable price to bring quantity into the market

When Price increases, PS increases When Price decreases, PS decreases |

|

|

(Graph) Show change in producer surplus when open up to trade

Differentiation within PS |

Total shaded area equals loss of producer surplus

Square = loss to producers who remain in market triangle = loss to producers forced to exit market |

|

|

(Graph) Show change in CS and PS together for importing country and net gain from trade

|

Purple triangle area = net gain from trade (to the US)

|

|

|

(Graph) Show change in CS and PS for exporting country like Indonesia when open to free trade

|

Note that consumers lose, Producers gain

Pft ABOVE autarky |

|

|

What is General Equlibrium Analysis?

|

Looks for the equilibrium between all markets simultaneously (recognize links between markets)

|

|

|

What is Partial Equilibrium analysis?

|

ex. look at one market --> i.e. t-shirts

|

|

|

2 Assumptions for General Equilibrium Analysis

|

1. Assume 2 goods (Bread, Cheese)

2. 1 input (labor) |

|

|

Ricardian model of trade (assumptions:)

|

1. 2 goods

2. 1 input/factor of production (Others) 3. Perfect Competition 4. labor mobility between sectors 5. Assume 2 countries; labor cannot move between countries |

|

this stands for

|

= amount of labor used to produce one unit of bread

|

|

|

How do you find the total labor used to produce good B? (equation)

(Ricardian Model) |

Alb * Qb = total labor used to produce B

(Amt labor used to produce 1 unit * # units) |

|

|

How do you find the supply of labor?

(Ricardian Model) |

Alb*Qlb + Alc*Qc = L

(find the sum of total labor used to produce both goods) |

|

|

Draw a Production Possibilities Frontier for a Ricardian Model Economy

|

Note that (L/alc) derived from original formula for total labor used to produce good c

|

|

|

What does the Ricardian Model say about the wage rate?

|

It's the same in both sectors

|

|

|

Why is the wage rate the same for both sectors? (Ricardian)

|

since labor is mobile between sectors there is only one wage rate

|

|

|

Price =

|

cost per unit

|

|

|

Pb derived from (in terms of wage rate, etc)

(Ricardian) |

Pb = Alb * w (amt labor required to produce one unit * wage rate)

|

|

|

Pb/Pc =

(Ricardian) |

Alb/Alc

|

|

|

relative price =

(in rltnsp to PPF) |

absolute value of the slope of PPF

|

|

|

(Ricardian Model) Show the cycle between relative prices and Home, Foreign that lead to the situation where relative prices are the same for both countries

|

Note direction of arrows: Home has comparative advantage in bread, which is why bread is being exported from home to foreign and vice versa

|

|

|

(Graph) Show changes when opened up to trade if the new equilibrium of relative price of bread to cheese is 3

RICARDIAN MODEL |

Note that we are looking at CONSUMPTION POSSIBILITIES WITH TRADE (not production)

|

|

What will Home end up selling now?

|

HOME will sell ONLY bread because they will receive 3 cheese for every 1 Bread

end up SPECIALIZING in bread |

|

|

RICARDIAN model of comp adv: How do we justify that everyone benefits from trade?

|

since everyone is alike/the same: when one worker benefits, everyone benefits

|

|

|

RICARDIAN: what role does comp. adv. have in trade?

|

it determines WHAT we trade

|

|

|

How is "absolute advantage" reflected?

|

reflected in the WAGE RATE: HOME workers have higher wages (labor is more productive) --> higher wage but also higher productivity

|

|

|

What are the different names of the H-O model?

|

Heckscher-Ohlin Model (H-O)

Heckscher-Ohlin-Samuelson (H-O-S) 2x2x2 model Factor Endowment Model Factor Proportions Model |

|

|

Assumptions of H-O model

|

1. 2 goods (x, y)

2. 2 Factors of production (K&L) 3. 2 countries (Home, Foreign) 4. Perfect Competition 5. Factors can move btwn sectors 6. Both countries have same technology **7. Assume that preferences are the same in all countries |

|

|

Weaknesses of Ricardian model of comparative advantage

|

1. always lead to specialization

2. leads to over-specialization: (1 country, 1 good) 3. Everyone benefits from trade (there is no harm) 4. everyone is alike |

|

|

Differences between assumptions of Ricardian and H-O model

|

1. 2 factors of production (in Ricardian only 1 --> Labor)

2. H-O: Both countries have same technology; Ricardian: diff countries have diff technologies as shown by diff. labor productivity |

|

|

What does the PPF for the HO model look like?

|

"concave toward the origin"

bends toward origin Increasing opportunity cost of producing good x (the more x we produce, the more costly the opp cost is) |

|

|

Properties of concaved PPF in rltnsp with opp. cost

|

inreasing marginal cost/opportunity cost of producing good goes both ways (x, y)

|

|

|

Law of Diminishing Marginal Returns

|

Each extra unit of variable input adds less to output than the unit before it.

|

|

|

where do relatively capital-intensive/labor-intensive sectors come from?

|

using inputs (K, L) in different proportions

|

|

|

Community Indifference Curve -

|

all combinations of x & y that leave economy at same level of satisfaction/welfare

|

|

|

Properties of Indifference Curves

|

downward sloping

convex towards origin do not intersect |

|

|

State the Heckscher-Ohlin Theorem:

|

The capital abundant countries will have a comparative advantage in the capital intensive good. (The Labor abundant country has a comparative advantage in Labor Intensive good)

|

|

|

Factor-Price Equalization Theorem

|

free trade leads to the same real wage rate for labor (of a given type or skill) in different countries. Separately, it also says that free trade leads to the same real rental rate (for a given type of land) in different countries

|

|

|

Stolper-Samuelson Theorem

|

an increase in the price of the capital-intensive good relative to the price of the labor-intensive good will cause real income of capital owners to increase and real wage to fall. (LR)

|

|

|

Does the Stolper-Samuelson Theorem address short run or long run changes?

|

Long-run result: In the LR, the affect of trade on real income depends on WHO you are, not WHERE you are (also doesn't matter where you spend your income)

|

|

|

What are the 4 theorems we learned?

|

1. Ricardian Model of Comparative Advantage

2. Heckscher-Ohlin Theorem 3. Factor-Price Equalization Theorem 4. Stolper-Samuelson Theorem |

|

|

How does real income increase?

|

1. prices stay same, wage goes up

2. wage stays same, price goes down |

|

|

Is the H-O Theorem talking about LR or SR?

|

H-O theorem predicts LONG RUN results since Capital and Labor are able to move between sectors

|

|

|

In the H-O Theorem, what kinds of people are there? Who are they?

|

2 kinds of people:

1. workers - earn wages 2. capital-owners/land-owners - earn rental income |

|

|

Short run model: Specific Factors Model

|

In the short run factors are mainly tied to their initial industries, because there is limited mobility between industry. decreasing-price industry initially lose earnings (both K and L) and rising-price industry initially tend to gain earnings

|

|

|

In the Short Run, what does the impact of trade on real income depend on?

|

WHERE you work --> graphically, SR is where we didn't move on PPF

(so if you work in a sector subject to income-competition, then the income-competition will drive down your real income) |

|

|

In the Short Run, what is the impact of trade on factors employed in import competing sectors?

|

Factors employed in import competing sectors will be HARMED by an expansion of trade [i.e. lower real income]

|

|

|

In the Short Run, what is the impact of trade on factors employed in export-oriented sectors

|

they BENEFIT from an expansion of trade [trade increases real income]

|

|

|

what does the affect of trade on real income depend on in the long run?

|

In the LR, the affect of trade on real income depends on WHO you are, not WHERE you are

|

|

|

Factor-Price Equalization Theorem (in class)

|

2 countries freely trade, no barriars/no costs; THEN the wage rate for labor will be the same for all countries and the return to capital will be the same for all countries

|

|

|

What is intraindustry trade?

|

imports and exports of the same products

comparative advantage cannot explain intraindustry trade |

|

|

What is the Grubel-Lloyd index of intraindustry trade?

|

this is for one industry.

for the whole economy (group of industry) just sum up |

|

|

Looking at 1 industry, what would a GLI of 0 mean?

|

It means that there is no intraindustry trade; only interindustry trade

|

|

|

Looking at 1 industry, what would a GLI of 1 mean?

|

This means all trade in this industry is characterized as intraindustry trade

|

|

|

What is economies of scale?

|

more you produce(more output) then the average cost to produce decreases

|

|

|

What does Economies of Scale and Product Differentation lead to?

|

1. limited # locations of firms

2. diff. preferences mean that both import and export cars to fit consumers' prefs even though cost to produce are similar |

|

|

Model of Monopolistic Competition

|

1. easy entry and exit from industry

2. because product is differentiated, each FIRM faces downward-sloping demand curve (they are not a price-taker) |

|

|

In the Model of Monopolistic Competition, how sensitive is demand to price?

|

More variety of goods, the less ability to raise price w/o losing lots of customers

(assume that more varieties lead to greater competition |

|

|

What happens to the avg. cost to produce as more varieties are available?

|

1. assume total market size is fixed

2. If there are n firms, each sells to 1/n of market (all firms same size) More you sell, less AC; lsess you sell, higher AC AC INCREASES AS # FIRMS IN MARKET INCREASE |

|

|

CC curve =

|

Average cost to produce as a function of the number of firms in the market

|

|

|

PP curve =

|

profit-maximizing price curve

|

|

|

What happens when you introduce TRADE into the Model of Monopolistic Competition?

|

Market size increases by allowing trade.

CC curve shifts to the right; AC decreases |

|

|

Effects of increase in market size (total demand)

|

1. AC falls for firms

2. # firms increase 3. P, AC decrease |

|

|

Who benefits from trade in monopolistic competition?

|

Consumers: 1.) more choice 2.) lower price

Producers: Economic profits still 0, but in equilibrium each firm gets bigger and lower AC |

|

|

Model of Global Oligopoly

|

Small # firms, economic profit is possible in equilibrium

location matters for welfare (i.e. Boeing wants all econ. profits because we are Americans) |

|

|

Economies of Scale EXTERNAL to the Firm

|

doesn't matter how big the firm is, it matters how big the industry is

(i.e. computer chips, film-making) *combine with proximity --> agglomeration economies again, the location is random |

|

|

How can immiserizing growth occur?

|

Immiserizing growth can occur if growth in the country leads the country to want to trade more, and the country's terms of trade deteriorate by a large amount. If a country's trade has almost no impact on world prices, then its growth will have almost no impact on its terms of trade, and immiserizing growth is very unlikely.

|

|

|

socially optimal tariff

|

tariff rate at which social welfare is maximized; above that under both autarky and free trade

|

|

|

Prohibitive tariff

|

tariff rate at which price is so high that it prohibits/eliminates trade: welfare is same as in autarky

|

|

|

Problems with the argument FOR a tariff

|

1. we may not be a large country

2. Other countries raise tariff also, (tariff wars) volume of trade decreases |

|

|

Marginal External Benefit (MEB)

|

the additional benefits bestowed upon the economy for producing one extra good

|

|

|

infant industry argument

|

we don't have the resources to compete in larger market

|

|

|

3 types of "unfair" trade practices

|

1. unfair trade practices implemented by firms themselves

2. implemented by governments and applied to perfectly competitive industries 3. implemented by govts and applied to oligopoly |

|

|

Define "Dumping"

|

a firm that sells its product in a foreign market at an "unfairly low " price (lower than firm's domestic price, lower than AC)

|

|

|

Define an "unfairly low" price

|

1. a price lower than the price that the firm charges its own country's consumers ("international price discrimination")

2. when a firm sells its product in a foreign market at a price lower than its "full" average cost of production |

|

|

2 main motivations for dumping

|

1. Predatory Dumping

2. Persistent Dumping |

|

|

Predatory Dumping

|

a firm will take artificially low price in order to drive competitors out of the market

|

|

|

Persistent Dumping

|

international price discrimination

it is the profit maximizing thing to do demand elasticity different so charge diff. prices --> that's why its profit maximizing |

|

|

Point at which firms maximize profit:

|

when Mariginal Revenue = Marginal Cost

|

|

|

Marginal Revenue is always

|

with a slope twice as steep as demand curve

|

|

|

what does a flat MC curve mean?

|

that the extra cost of producing is ALWAYS the same

|

|

|

If MC > MR then

|

sell less

|

|

|

if MC < MR then

|

sell more

|

|

|

Two-Part Test against dumping

|

1. prove that dumping actually occuring

2. show that somehow hurting your industry |

|

|

U.S. Commerce Dept's role in two-part test

|

Finding of Fact

(almost always answers "yes" dumping occuring) |

|

|

U.S. International Trade Commission (USITC) role in two-part test

|

look to see if domestic industry is being injured by dumping (losing profit, losing employment, losing market share)

|

|

|

What are the two government depts involved in the two-part test for dumping?

|

1. U.S. Commerce Dept (fact)

2. U.S. International Trade Commission (USITC) |

|

|

Who authorizes the "Anti-Dumping Duty"

|

US Commerce Department

|

|

|

Effects of Anti-Dumping Duty (as long as not predatory behavior)

|

reduces world volume of trade

hurts U.S. consumers |

|

|

What is an export subsidy?

|

given by govt to firms

payment for the actual activity of selling your product to another country |

|

|

What is consumption distortion?

|

higher prices artificially reduce demand

|

|

|

what is production distortion?

|

higher prices artificially stimulates production more than what we have a comparative advantage in

|

|

|

Net effect of export subsidy on small country (perf. comp)

|

welfare loss

|

|

|

Net effect of export subsidy for large country

|

world price driven down due to increased exports

deterioration in TOT for exporter since price decreases DETERIORATION in export country's TOT; and net loss is even BIGGER than it would be for a small country |

|

|

Most Favored National Principle (MFN)

|

Principle of non-discrimination (countries are prohibited against discriminating each other if both members of GATT/WTO)

|

|

|

2 exceptions to MFN

|

1. industrialized developed countries are allowed to give preferential/favorable treatment to developing countries ("Generalized System of Preferences" GSP)

2. Preferential Trading Arrangements (PTA) --. Trading blocs; Free trade areas and customs Unions |

|

|

"Generalized System of Preferences" (GSP)

|

industrialized developed countries are allowed to give preferential/favorable treatment to developing countries

|

|

|

2 types of Preferential Trading Arrangements (PTA)

|

1. free trade areas (FTA)

2. customs unions (CUs) |

|

|

Difference between FTA and CU

|

FTA: Each member has independent policy towards non-members (ex. NAFTA)

CU: all members share same policy toward non-members (EU) |

|

|

Common Market

|

CU + Free mobility of productive factors

ex. EU |

|

|

Full economic union

|

Common Market + single monetary/fiscal policy, social welfare programs

ex. U.S. |

|

|

"Trade Deflection"

|

Process of trying to circumvent high tariff by going through a low-tariff FTA country

|

|

|

Trade Creation

|

creation of PTA stimulates more trade from member countries

|

|

|

Trade Diversion

|

creation of PTA changes trade pattern...substituting member country imports for non-member country

|

|

|

Conditions for when trade creation is larger than trade diversion

|

small comp. adv between suppliers

large tariff |