![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

66 Cards in this Set

- Front

- Back

|

Accounting Definition |

The process of identifying, measuring, and communicating economic information to various users. |

|

|

What is financial accounting? |

Branch of accounting concerned with the preparation of financial statements for outsider use. Reports the economic events of the corporation to the owners and other interested parties. |

|

|

What role does financial accounting play in the capital markets? |

Financial accounting contributes to efficient allocation of scarce resources in the capital markets. - Disseminates economic performance information - Allows investors to make informed decisions |

|

|

SEC |

Securities and Exchange Commission - Federal agency with the ultimate authority to determine the rules for preparing statements for companies whose stock is sold to the public |

|

|

FASB |

Financial Accounting Standards Board - Private sector group with authority to set accounting standards |

|

|

GAAP |

Generally Accepted Accounting Principles - The various methods, rules, practices, and other procedures that have evolved over time in response to the need to regulate the preparation of financial statements - Established by the FASB/IASB |

|

|

Who prepares and uses financial statements? |

- Preparation: company managers - Use: --- Investors --- Creditors --- Government/regulators --- Employees --- suppliers/business affiliates --- Customers --- Competitors |

|

|

What are the major financial statements? |

- Balance Sheet - Income Statement - Statement of Cash Flows - Statement of Retained Earnings |

|

|

How are the numbers in various financial statements interrelated? |

1) Income Statement shows the amount earned in a period (net income) 2) Statement of Retained Earnings takes net income and subtracts out dividend payments to arrive at retained earnings 3) Statement of Cash Flows shows how the firm used its cash during the period, ending with a balance for the year 4) Retained Earnings and Cash balance both recorded on the Balance Sheet |

|

|

What do we do with financial statements? |

We use them to make informed decisions. |

|

|

Definition of Balance Sheet |

The financial statement that summarizes the assets, liabilities, and owners' equity at a specific point in time. |

|

|

Definition of Asset and Classification

|

An asset is a future economic benefit to an entity. - Cash - Inventory - Receivables (balances on credit sales) - Investments - Prepaid expenses - Property, Plant, and Equipment - Intangibles (patents, goodwill, etc.) |

|

|

Definition of Liability and Classification |

A liability is a future sacrifice of economic benefits arising from present obligations. - Accounts Payable/Notes Payable - Unearned Revenue (payment in advance of product or service) - Accrued Liabilities (interest, salaries, taxes, etc.) - Current Maturities of Long-Term Debt - Long-term Bonds, Notes, or Deferments |

|

|

Definition of Owners' Equity and Classification |

Residual interest in the assets of the entity that remains after deducting liabilities. - Capital Stock (par value of shares) - Additional Paid-In Capital (excess amounts paid for shares above par value) - Retained Earnings |

|

|

Classified Balance Sheet |

Separates both assets and liabilities into current and noncurrent. |

|

|

Accounting Equation (basic) |

Assets = Liabilities + Owners' Equity |

|

|

Accounting Equation (expanded) |

Assets = Liabilities + Common Stock - Dividends + Pain-in Capital - Treasury Stock + Revenues - Expenses Splits equity into its four main elements: owners' capital, owners' withdrawals, revenues, and expenses. |

|

|

Definition of Income Statement |

Statement that summarizes revenues and expenses. |

|

|

Elements of Income Statement |

Above the Line: 1) Sales and operating revenues 2) Cost of Goods Sold 3) Operating expenses 4) Non-operating items 5) Provision for income taxes Below the Line: 6) Special and separately reported items: (a) Discontinued Operations (b) Extraordinary Items |

|

|

Cash vs Accrual Basis Income |

1) Cash: Income = Cash Inflow - Cash Outflow -- Not reported as income under GAAP -- Reported in Statement of Cash Flows as net cash flow from operating activities 2) Accrual Basis: Income = Revenue - Expenses + Gains - Losses -- Revenue recognized when earned -- Expenses matched with revenue |

|

|

Single-step Income Statement Format |

- Revenues are presented together as are expenses - Useful for service-based firms |

|

|

Multiple-step Income Statement Format |

- Divides operating and non-operating activities - Matches expenses with related revenues - Useful for goods-based firms |

|

|

Discontinued Operations |

1) Separately identifiable segment of firm which is being disposed of: -- major class of business -- assets, liabilities, revenues, expenses 2) Two components on income statement: -- income/loss from operations -- gain/loss from disposal Always shown as net of tax! |

|

|

Extraordinary Items |

Events and transactions that are distinguished by their unusual nature and infrequency of occurrence. - Must be beyond the control of management AND not reasonably expected to occur/recur (ex. earthquake in Syracuse) Always shown as net of tax! |

|

|

Transitory Earnings |

- Non-recurring earnings - Usually listed below "income from continuing operations" |

|

|

Permanent Earnings |

- Recurring earnings - Make up "income from continuing operations" |

|

|

Definition of Financial Statement Analysis |

All the techniques employed by users of financial statements to highlight important relationships in the financial statements. |

|

|

What is the purpose of financial statement analysis? |

To better inform decision making by uncovering trends and highlighting important relationships in financial statements. |

|

|

Ratio Analysis |

Expresses the relationship among selected items of financial statement data. |

|

|

Major Categories of Ratios |

- Liquidity: can we make payments currently? - Activity: how efficiently are assets and liabilities managed? - Coverage: can the firm cover its interest payments? - Financial Leverage: right mix of debt and equity? - Profitability: do sales prices exceed unit costs and are sales high enough? |

|

|

Liquidity Ratio: Current |

Current Ratio = Current Assets/Current Liabilities Shows a firm's ability to cover its current liabilities with its current assets |

|

|

Liquidity Ratio: Acid-test (Quick) |

Quick Ratio = (Cash + Marketable Securities + Accounts Receivable)/Current Liabilities Shows a firm's ability to cover its current liabilities with its most liquid assets (ignores inventory). |

|

|

Activity Ratio: Receivables Turnover |

Receivable Turnover Ratio = Annual Net Credit Sales / Average Receivables Measures how many times in a period a firm collects its accounts receivable. |

|

|

Activity Ratio: Payables Turnover |

Payable Turnover Annual Credit Purchases / Average Accounts Payable Measures how many times in a period a firm pays its suppliers. In general, purchases = CoGS + change in inventory |

|

|

Activity Ratio: Inventory Turnover |

Inventory Turnover = Cost of Goods Sold / Average Inventory Measures how many times in a period a firm sells its inventory. |

|

|

Activity Ratio: Asset Turnover |

Asset Turnover = Net Sales / Average Total Assets Measures the overall effectiveness of the firm in utilizing its assets to generate sales. |

|

|

Financial Leverage Ratio: Debt-to-Equity |

Debt-to-Equity = Total Debt / Shareholders Equity Measures the proportion of debt (total liabilities) to equity. |

|

|

Financial Leverage Ratio: Debt-to-Asset |

Debt-to-Asset = Total Debt / Total Assets Measures the proportion of assets financed with debt. |

|

|

Coverage Ratio: Times Interest Earned |

Times interest earned = Net Income Before Interest and Taxes / Interest Expense Measures the number of times a company can make its interest payments. |

|

|

Profitability Ratio: Gross Profit Margin |

Gross Profit Margin = Gross Profit / Net Sales Indicates the efficiency of operations and firm pricing policies. Gross Profit = Revenue - CoGS |

|

|

Profitability Ratio: Net Profit Margin (or Return on Sales) |

Net Profit Margin = Net Income / Net Sales Indicates the firm's profitability after taking account of all expenses and income taxes. |

|

|

Profitability Ratio: Return on Investment (or Return on Assets) |

ROI = Net Income / Average Total Assets A measure of profitability, based on the assets of the firm, after all expenses and taxes. |

|

|

Profitability Ratio: Return on Equity |

ROE = Net Income / Average Shareholders' Equity A measure of overall profitability, based on equity invested, after all expenses and taxes. |

|

|

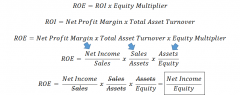

DuPont Framework |

Splits ROE into its three components to determine impacts of each: 1) Profitability 2) Asset Use Efficiency 3) Financial Leverage |

|

|

Vertical Analysis |

Compares each item in a financial statement to a base number set to 100%. All values on the balance sheet and income statement are converted to percentage of a base. - For income statements: sales - For balance sheets: assets |

|

|

Common Size Financial Statements |

Vertical analysis reported for a number of periods to allow for comparison |

|

|

Market Based Method: Price-to-Earnings Ratio |

P/E = Stock Price / Earnings per Share Earnings per Share = (Net Income - Dividends on Preferred Stock) / Number of Shares of Common Stock |

|

|

Market Based Method: Price-to-Book Ratio |

Price-to-Book = Stock Price / Book Value Book Value = Assets - Liabilities - Par Value of Outstanding Preferred Stock |

|

|

Managerial Accounting |

The branch of accounting concerned with providing management with information to facilitate planning and control. |

|

|

Economic Entity Concept |

Assumption that an entity for which you're making a financial disclosure can be identified with a particular unit of accountability. |

|

|

Going Concern |

Assumption that an entity for which you're making financial disclosure will have an indefinite life. |

|

|

Monetary Unit |

Assumption that money is the common denominator of economic activity. |

|

|

Time Period Assumption |

Assumption that the economic activities of an enterprise can be divided into artificial time periods. |

|

|

Historical Cost Principle |

Common practice that most assets and liabilities are accounted for and reported on the basis of acquisition price. |

|

|

Revenue Recognition Principle |

Generally, revenue is recognized when it is (1) realized or realizable, and (2) earned. |

|

|

Matching Principle |

The recognition of resources / efforts / expenses should match with their benefits / accomplishments / revenues. |

|

|

Full Disclosure Principle |

Requires the presentation of any information that is of sufficient importance to influence the judgment of an informed decision maker. |

|

|

Conservatism |

When in doubt, and when equally acceptable accounting methods are available, the method that is least likely to overstate income and assets should be chosen. |

|

|

Cost-Benefit Relationship |

The costs of providing the information must be weighed against the benefits that can be derived from using the information. |

|

|

Materiality |

Only those items / events above a certain monetary threshold should be separately reported or disclosed in the financial statements. |

|

|

Industry Practices |

The peculiar nature of some industries and business concerns sometimes requires departure from basic theory. |

|

|

Current Assets |

Cash or those assets expected to be consumed or converted into cash within one year or one operating cycle, whichever is longer. |

|

|

Current Liabilities |

Claims against assets that must be satisfied in one year or one operating cycle, whichever is longer. |

|

|

Comparability |

The quality that allows a user to analyze two or more companies and look for similarities and differences. |

|

|

Consistency |

The quality that allows a user to compare two or more accounting periods for a single company. |

|

|

Retained Earnings Equation |

Retained Earnings = Retained Earnings from Prior Period + Net Income - Dividends |