![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

25 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Npv, irr, payback, discounted payback, average accounting rate of return, profitability index( benefit cost ratio)

Sunk cost, opportunity cost, incremental cash flow, externality |

Aar = AVG net income/AVG book value, 1+ npv/initial investment( pv/ initial investment) ( value u receive for unit of currency)

Externality= effect of decision other than investment eg cannibalisation. |

|

|

|

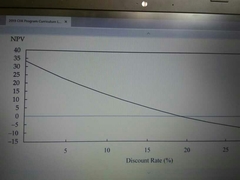

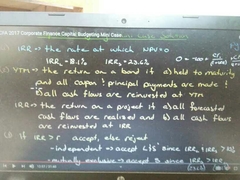

Npv profile, why financing costs are ignored? , Why Accounting net income is not used |

In calculating wacc required rate of return these costs are included there . So Not in the project ,,,,, irr reinvestment at that rate is assumed ? |

|

|

|

Cannibalisation, straight-line, accelerated depreciation methods, |

Terms |

|

|

|

1+ nominal rate |

(1+real rate)( 1+inflation rate) |

|

|

|

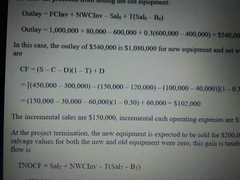

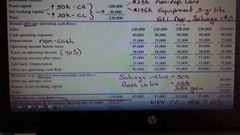

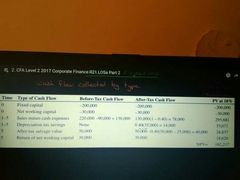

Outlay, cashflow and terminal year after tax non operating cash flow Non operating cashflow if EBIT( 1-T) + D |

|

|

|

|

Expansion project, replacement project, independent, mutually exclusive , project sequencing and capital rationing , Operating income after taxes and add back Depreciation = after tax operating cashflow Accelerated depreciation increases the npv |

|

|

|

|

Irr and ytm |

|

|

|

|

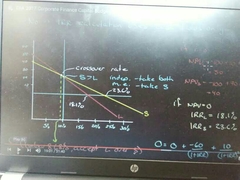

If cost of capital decreases, then irr wont be affected unlike Npv , but it may result in selection of other project over present project |

Irr uses cash flow only |

|

|

|

Cause of ranking conflict, cash flows and r |

Lower r favours greater sum of CF( as zero r results in Npv of sum of cash flow) Higher r favours sooner cashflow |

|

|

|

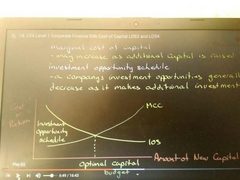

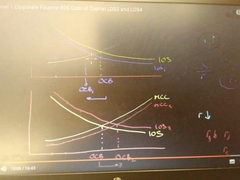

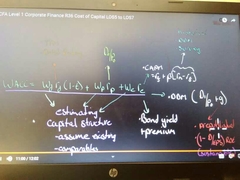

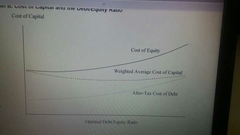

Cost of capital,wacc (marginal Cost of capital),

capital structure

Investment opportunity schedule (fig) Optimal capital structure( hint) |

High tax countries company prefer to raise through debts as cost of debt decreases Explicitly wants to attain that structure |

Ocb increases if rate decreses |

|

|

Cost of capital complete overview |

|

|

|

|

Current asset, cl

Inflationary effect on Depreciation , coupon payments

Project analysis and evaluation, 1. Mutually exclusive project with unequal lives 1.1 LCM of lives and 1.2 equal annuity Capital rationing |

Use of funds and source of funds

Zero

|

|

|

|

Stand alone dispersion of risk: Sensitivity analysis, scenario analysis, Monte Carlo MARKET risk: security market line |

Terms |

|

|

|

Real options timing , sizing ,flexibility , fundamental Only if we repeat abandment (22966) and non abandment( -9808) multiple times average probalility values are the 22966 and -9808( fig)

|

Sizing : venture capitalists by taking proof of concept

New npv = ols npv- cost of options + value of options

|

|

|

|

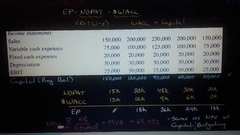

Economic income Accounting income read after doing fcra Economic profit MVA is npv nopat is ebit((1-t)) |

Depreciation based on historical cost and explicitly includes interedt expense |

|

|

|

Residual income |

|

|

|

|

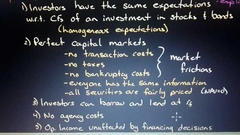

Modigliani miller |

|

|

|

|

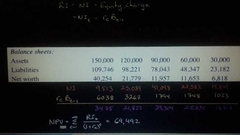

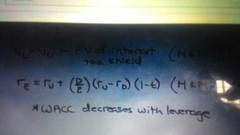

Levered and unlevered beta unlevered firm ( all equity firm) M&m proposition 1 Valuevof any firm=PV of cash flows = free cash flow = ebit(1-t) is the cashflow each year/ wacc ( assuming perpetuity) and discount rate as wacc Here we why ebit why not netincome????? |

Lev beta = unlev beta( 1 + d/e) Lev beta = unlev beta( 1 + d/e(1-t)) with tax Valuevof unlevered equals value if levered implication 1) is share price is constant 2) will wacc is constant Net income is for only shareholders to consider bond holders we should take ebit |

|

|

Financial leverage? Leverage? And unlevered? Increase in leverage increases equity risk Effects of leverage on EPs or roe ? ePs? And roe? EPs of unlevered and levered Vs ebit???? ( Hint) |

Total debt/shareholders equity Debt and zero debt Effect of leverage magnifies gain and loss and increases the equity risk EPs = net income / no of shares or ( ebit-interest)(1-t) / no of shares Roe= net income/equity |

|

|

|

Return ( cost of equity) increases with risk Return on assets (wacc)(Ra)

M&m 2nd proposition return /cost of equity increases with financial leverage |

Re=Ra +(Ra-Rd)(D/E)

|

|

|

Wacc of unlevered no tax firm is ?? |

Re of unlevered or Ro |

|

|

|

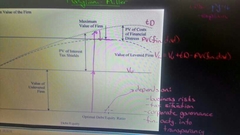

Leveraged recapitalisation M&m proposition 1 with taxes Calculation of PV for interest tax shield of perpetuity Or Permanent debt Temporary debt

|

Borrowing a nd repurchasing Vu( value of unlevered) + PV of the interest tax shield = Value of levered Vu( value of less levered) + PV of the interest tax shield = Value of more levered Interest tax shield cash flow /cost of debt Or Debt * tax rate PV of Interest tax shield cash flow |

|

|

Value of a firm (increases with debt):= fcf (:constant) / wacc (:decreses with more debt) (hint) Jensen free cash flow hypothesis Pecking order theory Optimal capital structure- static trade off theory |

Terms Tend to issue stocks when mgrs believe company is overvalued Optimal varies inter and intra company across various period Re≥ debt ≥ equity

|

|

|

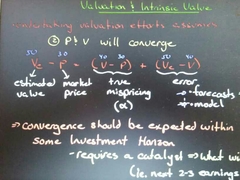

Grossman stiglitz paradox Abnormal return or alpha When it will converge Going concern Vs liquidation value Porter 5 forces Porter 3 corporate strategies One cannot capitalise on mispricing if ? Forecast to valuation 2 things |

If mkts are informationlly efficient.....,............ Excess risk adjusted return Corporate event catalyst Cost leadership, differentiation, focus. Catalyst doesn't exist Sensitivity analysis , situational adjustments |

|

|

|

Free cash flow cfo- capex- delta of working capital???? |

To read |

|