![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

32 Cards in this Set

- Front

- Back

|

Def of circular flow of income |

This explains how money circulated in an economy between firms, households and government |

|

|

Name the types of economies |

1) closed economy 2) open economy |

|

|

Def of closed free economy + formula |

This involves firms and households. This is the icone that individual can use or invest

Y= C+ S/I |

|

|

Def of closed mixed economy |

This included households, firms and government Y= C+I + G |

|

|

Assumptions in the circular flow of income in a closed free economy |

We assume that all the income received is spent. However, in reality, this might not be the case |

|

|

Assumptions in a closed mixed economy |

In this case, not all income received will be spent. Some households will spend on Consumption, some will save and some will be taxed by the government While, firms income received by firms such as profit will be taxed. However, firms will also create new investment. Therefore, from the circular flow of income, it will cause leakages (withdrawals) and injections (J) |

|

|

Def of leakages |

These are the money that flow out of the circular flow of income. Therefore, they reduce the size of the circular flow of income, such as taxes, savings |

|

|

Def of injections |

These are the money that flow into the circular flow of income. Therefore, they increase the size of the circular flow of income. Such as Investment, Gov spending |

|

|

Def of injections |

These are the money that flow into the circular flow of income. Therefore, they increase the size of the circular flow of income. Such as Investment, Gov spending |

|

|

Def of open economy + formula |

This consists of households, firms, government and foreign trade Y= C+I+G+ (X-M) |

|

|

Def of injections |

These are the money that flow into the circular flow of income. Therefore, they increase the size of the circular flow of income. Such as Investment, Gov spending |

|

|

Def of open economy + formula |

This consists of households, firms, government and foreign trade Y= C+I+G+ (X-M) |

|

|

Describe what will happen in leakages and injections in an open economy and their relationship |

Leakages will then consist of Taxes+ Savings+ Imports Injections : Government spending, Investments + Exports For every leakages, there must be a corresponding injections (T=G) (S=I) ( M=X) |

|

|

Def of injections |

These are the money that flow into the circular flow of income. Therefore, they increase the size of the circular flow of income. Such as Investment, Gov spending |

|

|

Def of open economy + formula |

This consists of households, firms, government and foreign trade Y= C+I+G+ (X-M) |

|

|

Describe what will happen in leakages and injections in an open economy and their relationship |

Leakages will then consist of Taxes+ Savings+ Imports Injections : Government spending, Investments + Exports For every leakages, there must be a corresponding injections (T=G) (S=I) ( M=X) |

|

|

Def of equilibrio national income |

T+S+M= G+I+X |

|

|

Def of injections |

These are the money that flow into the circular flow of income. Therefore, they increase the size of the circular flow of income. Such as Investment, Gov spending |

|

|

Def of open economy + formula |

This consists of households, firms, government and foreign trade Y= C+I+G+ (X-M) |

|

|

Describe what will happen in leakages and injections in an open economy and their relationship |

Leakages will then consist of Taxes+ Savings+ Imports Injections : Government spending, Investments + Exports For every leakages, there must be a corresponding injections (T=G) (S=I) ( M=X) |

|

|

Def of equilibrio national income |

T+S+M= G+I+X |

|

|

Def of average propensity to consumption |

This is the proportion of the total income spent on consumption APC= C\Y |

|

|

Describe the relationship of APC in rich and poor countries and draw conclusions |

The higher the income, the lower the APC (viceversa) In terms of APC, Lower incomes have a higher APC |

|

|

Describe the relationship of APC in rich and poor countries and draw conclusions |

The higher the income, the lower the APC (viceversa) In terms of APC, Lower incomes have a higher APC |

|

|

Def of Average Propensity ti savings + Formula |

This is the propensity of the total income saved APS= S\Y |

|

|

Relationship between APS |

The higher the income, the higher the APS (viceversa) In terms of APS, the higher the income, the higher the APs |

|

|

Relationship between APS |

The higher the income, the higher the APS (viceversa) In terms of APS, the higher the income, the higher the APs |

|

|

Def of Marginal propensity to consume + formula |

This is the proportion of additional income spent on consumption MPC= change in consumption/ change in income |

|

|

Relationships of MPC in rich and poor income Groups |

MPCis lower in higher income groups, while MPC is higher in lower income groups.

At low-income levels, an increase in income is likely to see a high marginal propensity to consume; this is because people on low incomes have many goods/services they need to buy. However, at higher income levels, people tend to have a greater preference to save because they have most goods they need already. |

|

|

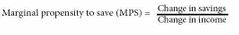

Def of marginal propensity of savings |

This is the proportion of additional income saved |

|

|

Why is MPS + MPC always equal to one? |

If we ignore taxes and imports, i.e. assume a closed economy. Eith we send money or save it. If we gain an extra £10, and spend £8, by definition the extra £2 is saved.

MPS = 1-MPC

The marginal propensity to save is related to the marginal propensity to consume. Ignoring taxes and imports, the marginal propensity to save (mps) = 1-mpc |

|

|

Importance of marginal propensity to save |

multiplier-formula

Influences the size of multiplier. A high marginal propensity to save will lead to a smaller multiplier effect. With a high mps, extra income does not ‘trickle down’ to other elements of the economy but gets saved. It reduces the effectiveness of fiscal policy

Marginal propensity to withdraw MPW is the extra income that is withdrawn from the circular flow. Withdrawals = saving, import and tax. |