![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

35 Cards in this Set

- Front

- Back

|

Openness in goods market |

The ability of consumers and firms to choose between domestic goods and foreign goods. |

|

|

Openness in financial markets |

The ability of financial investors to choose between domestic assets and foreign assets. |

|

|

Openness in fator markets |

The ability of firms to choose where to locate production, and of workers to choose where to work. |

|

|

Tariffs |

A tax imposed on imported goods and services. Tariffs are used to restrict trade, as they increase the price of imported goods and services, making them more expensive to consumers. |

|

|

Tradable goods |

Goods that compete with foreign goods in either domestic markets or foreign markets. Ex: cars, computers. As opposed to non-tradable goods: most medical services, haircuts, meals at restaurants. |

|

|

Real exchange rate |

The price of domestic goods relative to foreign goods. It is constructed by multiplying the domestic price level by the nominal exchange rate, and then dividing by the foreign price level. Greek lower case epsilon =EP/P* =(€/pound)x(pound/units of UK goods)/€/unit of euro area goods) =units of euro area goods/units of UK goods |

|

|

Nominal exchange rate |

The price of the domestic currency in terms of foreign currency. Denoted by E. (From a UK viewpoint:) E=1.23 dec 2012 One pound was worth €1.23 |

|

|

Appreciation (nominal) |

An appreciation of the domestic currency is an increase in the price of the domestic currency in terms of a foreign currency. Given our definition of the exchange rate, an appreciation corresponds to an increase in the exchange rate, E. It is a strengthening of the currency. |

|

|

Depreciation (nominal) |

A depreciation of the domestic currency is a decrease in the price of the domestic currency in terms of a foreign currency. Given our definition of the exchange rate, depreciation of the domestic currency corresponds to a decrease in the exchange rate, E. It is a weakening of the currency. |

|

|

Fixed exchange rate |

A system in which two or more countries maintain a constant exchange rate between their currencies. In this system, increases in the exchange rate (however infrequent) are called revaluations, and decreases are called devaluations. |

|

|

Real appreciation |

An increase in the real exchange rate - an increase in the relative price of domestic goods in terms of foreign goods. |

|

|

Real depreciation |

A decrease in the real exchange rate - a decrease in the relative prices of domestic goods in terms of foreign goods. |

|

|

Bilateral exchange rates |

Real exchange rate between two countries.* |

|

|

Multilateral exchange rates |

Reflects the composition of trade with many different countries. * |

|

|

Multilateral real exchange rates |

By weighing each country by how much each country trades with (ex) the UK, and how much it competes with the UK in other countries, we get a variable called the multilateral real exchange rate, or real exchange rate for short. |

|

|

Foreign exchange |

Buying or selling foreign currency. |

|

|

Balance of payments |

A country's transactions with the rest of the world, including both trade flows and financial flows, are summarized in a set of accounts called the balance of payments. |

|

|

Above the line |

A country's payments to and from the rest of the world, paced above the line in the balance of payments, called the current account transactions. |

|

|

Current account |

Transactions above the line on a country's balance of payments: imports, exports, trade balance, investment income, investment income paid, net investment income, net transfers received and current account balance. |

|

|

Investment income |

(In this case) UK residents who hold foreign assets receive investment income. Likewise, foreign residents receive investment income from the UK on their holdings of UK assets. |

|

|

Net transfers received |

A country's receiving or giving of foreign aid. |

|

|

Current account balance |

The sum of net payments to and from the rest of the world. |

|

|

Current account surplus |

If net payment from the rest of the world are positive, the country is running a current account surplus. |

|

|

Current account deficit |

If the net payment from the rest of the world are negative, the country is running a current account deficit. |

|

|

Capital account transactions |

Transactions below the line. The net result of public and private international investments flowing in and out of a country. |

|

|

Net capital flows/capital account balance |

A capital account is a national account that shows the net change in asset ownership for a nation. The capital account is the net result of public and private international investments flowing in and out of a country.* From investopedia |

|

|

Capital account surplus |

Positive net capital flows. |

|

|

Capital account deficit |

Negative net capital flows. |

|

|

Statistical discrepancy |

The difference between current and capital account transactions. A reminder that, even for rich countries, economic data are far from perfect. |

|

|

Gross Domestic Product -GDP |

A measure that corresponds to value added domestically. It is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. Though GDP is usually calculated on an annual basis, it can be calculated on a quarterly basis as well. GDP includes all private and public consumption, government outlays, investments and exports minus imports that occur within a defined territory. Put simply, GDP is a broad measurement of a nation’s overall economic activity. |

|

|

Gross National Product -GNP |

A measure that corresponds to the value added by domestically owned factors of production. Gross National Product (GNP) is an economic statistic that includes GDP, plus any income earned by residents from overseas investments, minus income earned within the domestic economy by overseas residents. |

|

|

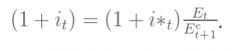

Uncovered interest parity relation/interest parity condition |

Financial investors want to hold only the asset with the highest expected rate of return. If both US and UK bonds are to be held, the expected rate of return for both must be the same according to the uncovered interest parity condition: |

|

|

Capital controls |

Capital control is any measure taken by a government, central bank or other regulatory body to limit the flow of foreign capital in and out of the domestic economy. This includes taxes, tariffs, outright legislation and volume restrictions, as well as market-based forces. |

|

|

Demand for domestic goods |

Z=C+I+G-(IM/ε)+X Some of the demand for domestic goods comes from foreigners, and some from citizens within the country. |

|

|

Domestic demand for goods |

Z=C+I+G The demand for goods within a country. Some of this demand will fall on foreign goods, depending on, for example, interest rates and real exchange rates. |