![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

28 Cards in this Set

- Front

- Back

|

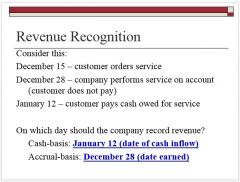

How are revenues and expenses recorded in cash-basis accounting? |

Record revenues when cash is received

Record expenses when cash is paid |

|

|

How are revenues and expenses recorded in accrual-basis accounting? |

Record revenues when earned

Record expenses in period the benefit is received |

|

|

What is the definition of the revenue recognition principle? |

Record revenue when earned |

|

|

|

|

|

Define Matching principle |

All costs that are used to generate revenue are recorded as expenses in the period the revenue is recognized. |

|

|

Why is accrual-basis preferred over cash-basis?(3 reasons) |

1. Truer recognition of assets and liabilities 2. Better matching of revenues and expenses 3. Better indication of future cash flows |

|

|

Generally, all companies use what kind of accounting, accrual or cash basis? |

Accrual-basis |

|

|

What are the 3 types of adjusting entries? |

1. Deferrals 2. Accruals 3. Depreciation |

|

|

What are deferrals? What are the two types? |

Deferrals: Paid or received cash in advance - Prepaid expenses: paid cash for the purchase of an asset before incurring the expense. - Unearned revenues: received cash and recorded a liability before earning the revenue.

|

|

|

What are accruals? |

Accruals: the opposite of deferrals - Accrued expenses: paid cash after incurring the expense and recording a liability - Accrued revenues: received cash after earnings the revenue and recording an asset. |

|

|

REVIEW ADJUSTING ENTRIES SLIDES STARTING AT CHAPTER 3A POWERPOINT SLIDE 19 |

REVIEW ADJUSTING ENTRIES SLIDES STARTING AT CHAPTER 3A POWERPOINT SLIDE 19 |

|

|

REVIEW TRIAL BALANCE AND ADJUSTED TRIAL BALANCE SLIDES STARTING AT CHAPTER 3A POWERPOINT SLIDE 46 |

REVIEW TRIAL BALANCE AND ADJUSTED TRIAL BALANCE SLIDES STARTING AT CHAPTER 3A POWERPOINT SLIDE 46 |

|

|

All _________ ____________ accounts represent activity over the entire life of the company |

balance sheet |

|

|

All ________ _________ (and dividend) accounts represent activity for the current period only. |

income statement |

|

|

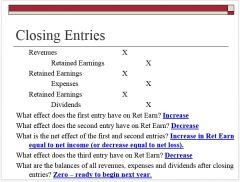

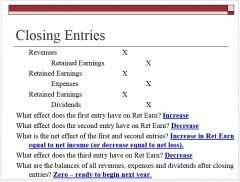

What kind of accounts must be closed to get them ready for the next period(start at zero)? |

Temporary Accounts |

|

KNOW THIS SLIDE FOR CLOSING ENTRIES(SLIDE 31 CHAPTER 3B PPT) |

KNOW THIS SLIDE FOR CLOSING ENTRIES(SLIDE 31 CHAPTER 3B PPT) |

|

|

What accounts are temporary and need to be closed at the end of the year?(Slide 34 Chapter 3B PPT) |

1. Revenues 2. Expenses 3. Dividends |

|

|

When closing all temporary accounts, where is everything transferred?(Slide 35 Chapter 3B PPT) |

Into Retained Earnings a permanent account |

|

|

LEARN HOW TO DO CLOSING ENTRIES AND HOW TO ADD THEM INTO RETAINED EARNINGS WITH THE T ACCOUNT(Slide 35-38 Chapter 3B PPT) |

LEARN HOW TO DO CLOSING ENTRIES AND HOW TO ADD THEM INTO RETAINED EARNINGS WITH THE T ACCOUNT(Slide 35-38 Chapter 3B PPT) |

|

|

What is liquidity? |

How quickly an item can be converted to cash |

|

|

What is the classified balance sheet used for? |

Classify assets and liabilities as current or long-term based on liquidity |

|

|

In the Classified Balance sheet, how are assets and liabilities categorized? |

Assets: Current Assets Long-Term Assets Intangible Assets

Liabilities Current Liabilities Long-Term Liabilities |

|

|

In the Classified Balance sheet, how are assets classified from most liquid to not liquid? |

Cash Most Liquid Accounts Receivable Very Liquid Inventory Somewhat Liquid Property,Plant,& Equipment Not Liquid |

|

|

Accounting Cycle, quick 3 step process:(Slide 18 Chapter 3b PPT)

|

|

|

|

What is the full 10 step accounting cycle in order?(Slide 15 Chapter 3b PPT) |

|

|

|

Net working capital ratio equation and what does it show? |

Networking capital = current assets - current liabilities

This ratio shows operating liquidity, higher amount = higher liquidity |

|

|

current ratio equation and what does it show? |

current ratio = current assets/current liabilities

This ratio shows the ability to pay current debt, higher ratio = lower risk |

|

|

Debt ratio equation and what does it show? |

debt ratio = total liabilities/total assets

This ratio shows the proportion of resources financed with debt, higher ratio = higher risk |