![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

97 Cards in this Set

- Front

- Back

|

Give three reasons the description of real property is essential.

|

1. To specifically identify and locate areas of real property

ownership. 2. To satisfy buyers who are interested in the precise dimensions and area of their property. 3. Tominimize land description disputes between neighbors by establishing set boundary lines. |

|

|

Where can the descriptions of real property be found?

|

recorded descriptions usually can be obtained

from title insurance policies, deeds, deeds of trust, or mortgages. |

|

|

(Fill in the blank) the law requires that every

parcel of land sold, mortgaged, or leased must be properly described or identified. Legal descriptions are usually based upon the field notes of _______? |

a civil engineer or a surveyor.

Engineers and surveyors establish exact directions and distances by means of transits and measuring devices. Aerial photography and Global Positioning Systems (GPS) are also used in modern mapping. |

|

|

Two ways survey methods were used in early California real estate history to measure land.

|

One early method of land measurement employed two

people on horseback. Each rider dragged an end of a cord or rawhide strip, called a thong, which was about 100 varas in length. (A vara is about 33 inches.) One rider remained stationary while the other rode past. When the length of the thong was reached, the process was repeated by the other rider until one of them arrived 21 at the end of the property. The number of thong lengths passed was counted, and the dimensions of the property were determined. In another early method, the circumference of a wagon wheel was measured. A leather strip was tied to a spoke, and then, by rolling the wheel on the ground, the revolutions of the wheel were counted and the distance recorded. |

|

|

What are the three major methods used today to legally describe and locate land?

|

1. Lot, block, and tract system.

2. Metes and bounds system. 3. U.S. government survey, commonly called theU.S. section and township system. |

|

|

What is subdividing?

|

Dividing a large parcel of land into smaller parcels

|

|

|

Where can a map of each subdivision be found?

|

The California Subdivision Map Act requires that all new

subdivisions be either mapped or platted. A map of each subdivision is recorded in the recorder’s office of the county in which the land is located. At the time a subdivision map is filed in the county recorder’s office, it is assigned a tract name and/or number. Once subdivision maps are recorded, legal descriptions are created by making reference to a particular lot in the block in that tract in which the property is located. Example: “All of lot 4 in Block A of Tract number 2025 in the city of Bellflower, Los Angeles County, California. As per map recorded in Book 76 page 83 of maps in the office of the recorder of said county.” This type of identification is commonly found in urban areas of California, where extensive subdividing has taken place. |

|

|

What is the metes and bounds system and when is it best to use it?

|

The metes and bounds system of land location is used most often when the property in question is not covered by a recorded subdivision map or when the property is so irregular in shape that it is impractical to describe under the section and township system.

Metes refer to the measurement of length, using items such as inches, feet, yards, rods, meters, and miles. Bounds refer to the use of boundaries, both natural and artificial, such as rivers, roads, fences, boulders, creeks, and iron pipes. So the term metes and bounds means to measure the boundaries. This system is one of the oldest methods used to describe land, and it is used in both rural and urban areas. Here is a legal description using the metes and bounds method. “Beginning at a point on the southerly line of Harbor Ave., 200 ft. westerly of the southwest corner of the intersection of Harbor Ave. and 8th St.; running thence due south 300 ft. to the northerly line of Cribbage St.; thence westerly along the northerly line of Cribbage St., 200 ft.; thence northerly and parallel to the first course, 300 ft. to the southerly line of Harbor Ave.; thence easterly along the southerly line of Harbor Ave., 200 ft. to the point of beginning.” |

|

|

What is a benchmark?

|

A common term used in the metes and

bounds system. A benchmark is a mark on a fixed or enduring object, such as a metal stake or rock, and it is often used as an elevation point by a surveyor. |

|

|

What are Angular Lines?

|

Many surveys using metes and

bounds descriptions are based on angles and directions from a given north–south line, which is obtained with a compass. Angles are a deflection from this north–south line. Deflections are to the east or west of the north–south line. |

|

|

What are three important points of the metes and bounds method?

|

1. Youmust start at a given point of beginning.

2. Youmust follow, in detail, the boundaries of the land in courses, distances, and directions fromone point to another. 3. Youmust return to the point of beginning, thus enclosing the boundary lines. |

|

|

What is a major weakness of the metes and bounds method?

|

One major weakness in using a metes and bounds system is that

markers or points of beginning often disappear or are moved or replaced. In later years, this makes it difficult to find the exact corners of a parcel. |

|

|

U.S.Government Section andTownship System

|

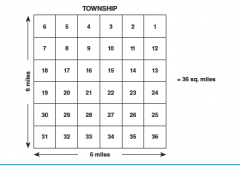

primarily to describe agricultural or rural land. The system originated

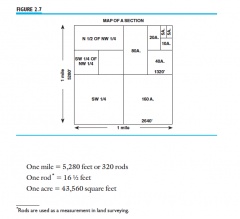

in the late 1780s with a survey of public lands made by the U.S. surveyor general. The U.S. government survey system establishes monuments as points of beginning. The monuments are intersected by two imaginary lines: one running east and west, called a base line, and another running north and south, called a meridian line. Because of its peculiar shape, the state of California requires three of these principal base lines and meridians, as shown in Figure 2.4. They are as follows: 1. Humboldt Base Line andMeridian, which is the point of beginning for describing land in the northwestern part of California. The actual point of beginning is onMt. Pierce, just south of Eureka, California. (See Figure 2.4.) 2. Mt.Diablo Base Line andMeridian, which is the point of beginning for describing land in the central and northeastern part of California. The actual point of beginning is onMt.Diablo, near Walnut Creek, California. FIGURE 2.3 Harbor Ave. Cribbage Street 8th Street 100' 100' 100' 100' 150' 150' W E N S 2.1 Land Descriptions 3. San Bernardino Base Line andMeridian, which is used to describe land in southern California. The actual point of beginning is the intersection ofBase Line Street andMeridianAvenue in the city of San Bernardino, California. Range lines run parallel to the principal meridians at six-mile intervals. Township lines (sometimes referred to as tier lines) run parallel to the principle base lines at six-mile intervals. The result is a grid of squares, or townships, each township containing approximately thirty-six square miles. To identify each of these townships, a numbering system utilizing an assignment of two location numbers was devised. The identity of each township is determined by its position north or south of the base line and east or west of the meridian line. An example of a legal descriptionmight be “Township 2North, Range 3 East, San Bernardino Base Line andMeridian. (T2N, R3E, SBBL &M).” The X indicates the township. (See Figure 2.5.) Townships are, in turn, divided into sections. Each township contains thirty-six squares, or sections. Each section is one mile square. These sections are uniformly numbered from1 to 36, with Section 1 located in the northeast corner of the township. Not only is each section one mile square, but also each contains 640 acres. Each section can be divided into smaller parcels of land, as follows: A quarter of a section 160 acres A quarter of a¼section 40 acres A quarter of a¼of a¼section 10 acres The division can be smaller and smaller until the size of the parcel is identified. The division need not be in quarters; it can also be in halves. (See Figures 2.6 and 2.7) |

|

|

What is a pitfall of the U.S. Government Section and Township system?

|

Because of the earth’s curvature, some sections in townships are

distorted and may not contain a full 640 acres; thus, computing acreage under the U.S. government system provides approximate figures. An accurate measure of actual acreage is best left to licensed civil engineers and surveyors. |

|

|

How many acres are in: A quarter of a section, A quarter of a ¼ section, A quarter of a ¼ of a ¼ section 10 acres?

|

A quarter of a section 160 acres

A quarter of a ¼ section 40 acres A quarter of a ¼ of a¼section 10 acres |

|

|

How many feet are in one mile, one rod, and one acre?

|

One mile 5,280 feet or 320 rods

One rod* 16½feet One acre 43,560 square feet |

|

|

What three types of wills does California law recognize?

|

A witnessed will is a formal typewritten document signed by the individual who is making it, wherein he or she declares in the presence of at least two witnesses that it is his or her will. The two witnesses, in turn, sign the will. This document should be prepared by an attorney.

A holographic will is a document written, dated, and signed in its entirety in the handwriting of the maker. It requires no witnesses. A statutory will is a preprinted form approved by the state in which a person merely fills in the blanks, usually without formal legal assis- tance. This statutory will requires at least two witnesses. At one time, another will—an oral will in contemplation of death, called a nuncupative will—was occasionally recognized. But today oral dying declarations are, for the most part, ignored by the probate courts. |

|

|

What is another word for a "will"?

|

testament

|

|

|

What is a Testator/Testatrix?

|

Testator: Male person who makes a will.

Testatrix: Female person who makes a will. |

|

|

What is an Executor/Executrix?

|

Executor: Male person named in the will by the maker to handle the estate of the deceased.

Executrix: Female person named in the will by the maker to handle the estate of the deceased. |

|

|

What is an administrator/administratrix?

|

Administrator: Male person appointed by the court to handle the estate when no will is left.

Administratrix: Female person appointed by the court to handle the estate when no will is left. |

|

|

What is a devise/devisee?

|

Devise: A gift of real property by will.

Devisee: Person receiving real property by will. |

|

|

Explain what a bequest, legacy/legatee are.

|

Bequest, legacy: A gift of personal property by will.

Legatee: Person receiving personal property by will. |

|

|

What does "codicil" mean?

|

Codicil: A change in a will.

|

|

|

What does intestate/testate mean?

|

Intestate: A situation in which a person dies without leaving a will; he or she is said to have died intestate.

Testate: A situation in which a person dies leaving a will. |

|

|

What is the purpose of a probate hearing?

|

Legal title to property being acquired by will is subject to the control of the probate court. The purpose of a probate hearing is to identify the creditors of the deceased and to pay off these creditors. Then if any property remains, the probate court determines the identity of the rightful heirs and distributes the remaining property.

|

|

|

What does the law require upon the death of an (home) owner?

|

The law requires that upon the death of the owner, all property is subject to the temporary possession of an executor (or execu- trix, if female) or an administrator (or administratrix).

|

|

|

Where does probate action take place?

|

Probate action takes place in superior court, and the estate prop- erty may be sold during the probate period for the benefit of the heirs or to cover court costs.

|

|

|

What are the guidelines if a probate sale takes place?

|

1. Theinitialofferinaprobaterealestatesalemustbeforatleast 90 percent of the appraised value of the property.

2. Oncetheinitialofferismade,thecourtispetitionedtoconfirm the sale, and at the hearing, the court may accept additional bids. 3. The first additional bid must be an increase of at least 10 per- cent of the first $10,000 of the original bid and 5 percent of any excess. For example, if the original bid is in the amount of $259,000, the first overbid would be 10% of the first $10,000, which is $1,000, and the remaining excess of $249,000 is then multiplied by 5% which would be $12,450. The first overbid would then be $272,450. Subsequent bids may be for any amount set by the court. 4. Thecourtconfirmsthefinalsaleandsetsthebroker’scommis- sions if a broker is involved. Probate fees paid to executors, administrators, and attorneys are set by the courts and vary depending on the size and complexity of the estate. Certain types of property holdings need not be pro- bated. |

|

|

What is the Independent Administration of Estate act?

|

Under this act, if all heirs agree in advance, the complicated open- court probate sale rules mentioned above are avoided. Under the Independent Administration of Estate Act, the executor/executrix or administrator/administratrix can sell the property directly to a specific buyer, similar to a regular real estate sale. The sale is still subject to court approval, but no open-court hearing for other potential bidders is required. But if all heirs do not agree, which is occasionally the case, the previously described open-court sale rules apply.

|

|

|

What does "succession" mean?

|

Succession means the handing down of property to another per- son.

|

|

|

What happens when a person dies intestate?

|

When a person dies intestate, the property of the deceased is divided into two categories: separate property and community property. The laws of intestate succession are different for each of these categories. When a person dies without a will and leaves sep- arate property, this means that the surviving spouse or registered domestic partner, a person, other than a spouse, with whom one cohabits, did not have an interest in said property. If a person leaves community property, this means a surviving spouse or regis- tered domestic partner has a one-half interest in the property.

When separate property is involved, the following disposition of property is made: 1. Whenadeceasedpersonleavesaspouseorregistereddomestic partner and one child, the separate property is divided one-half to the spouse or registered domestic partner and one-half to the child. 2. Whenadeceasedpersonleavesaspouseandtwoormorechil- dren, the spouse/registered domestic partner receives one-third and the children equally divide the other two-thirds. 3. Otherdivisionsaremadebythecourtsintheeventthataperson dies leaving no spouse or registered domestic partner and no children. The usual rule is that the property goes to the next of kin, such as parents, brothers, sisters, and so on. When a person dies intestate and leaves community property, the deceased person’s community interest passes to the surviv- ing spouse or registered domestic partner. The children, if any, get nothing. |

|

|

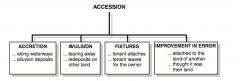

What are examples of accession?

|

Examples include (1) accretion, (2) avulsion, (3) addition of fixtures, and (4) improvements made in error.

|

|

|

What is the process of accession?

|

You may acquire title to property that is added to your existing real estate. This process is called accession.

|

|

|

What is "accretion"?

|

The gradual accumulation of soil on property bordering a stream, a river, or an ocean shoreline is called accretion. The soil thus de- posited is referred to as alluvion or alluvion deposits. The gradual wearing away of land by the action of water and wind is known as erosion. Reliction occurs when the waterway, sea, or river recedes permanently below the usual water line. When this takes place, the owner of the property that borders on the waterway, sea, or river may acquire title to the newly exposed land.

|

|

|

What is "avulsion"?

|

Avulsion occurs when a river or stream, during a storm or earth- quake, carries away a part of the bank and bears it to the opposite bank or to another part of the same bank. The owner of the part carried away may reclaim it within one year after the avulsion. However, the owner must reclaim the title by applying some act of ownership, such as cultivation of the soil, within one year; if not, the land belongs to the owner of the property to which the land is now attached.

|

|

|

Explain addition of fixtures as related to the process of accession.

|

Addition of fixtures occurs when a person affixes something to the land of another without an agreement permitting removal. The thing so affixed may then become the property of the landowner.

|

|

|

Explain improvements made in error as related to the process of accession.

|

An improvement made in error occurs when a person, in good faith, erroneously affixes improvements to the land of another. In some cases, these erroneous improvements may pass to the land- owner. But in most cases, the person who made the improvements in error is permitted to remove the improvements and pay the cost to restore the property to its original condition.

|

|

|

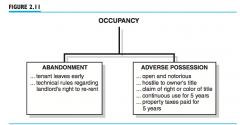

Acquiring Property by occupancy

|

Real property or the use of real property may be gained through (1) abandonment and (2) adverse possession.

|

|

|

Explain Abandonment as related to acquiring property by occupancy.

|

A party who holds a leasehold interest (the tenant) in a piece of property may abandon his or her interest or any improvements made thereon. If this should occur, the landlord may reacquire possession and full control of the premises. In other words, when a tenant leaves before the lease expires, the landlord may reacquire the use of the property at that time and in some cases not be obligated to refund rental payments or return any improvements made on the property. There are technical rules regarding the landlord’s right to re-rent the property. If a tenant abandons the premises and leaves personal property, the landlord may, after due notification, dispose of such personal property.

|

|

|

Explain Adverse Possession as related to acquiring property by occupancy.

|

Adverse possession is the process by which title to another’s property is acquired without compensation. Ownership may develop into legal title if five conditions are met.

|

|

|

What are the 5 elements of adverse possession?

|

Five elements of adverse possession

1. Theremustbeactualoccupation,openandnotorious.This means the claim of possession must not be kept a secret. In other words, if the present owner inspects the property, the possession or use by another person should be apparent. You do not actually have to reside on the property, but you must show your inten- tions of holding and possessing the land through some type of improvement to the land. For example, if the property were farmland, the cultivation of crops, the grazing of cattle, or the fencing of the property might constitute possession. 2. Theremustbeoccupancyhostiletothetrueowner’stitle (wishes). Hostile does not mean physical confrontation. Hostile means a person is using the property without permission and not making rental payment of any kind to the owner. Permission to use the property defeats the hostile use and prevents acquiring title by adverse possession. 3. Theremustbeaclaimofrightorcoloroftitle.Underclaimof right, the claimant enters as an intruder and remains; under color of title, claimants base their right on some court decree or upon a defective written instrument. 4. There must be continuous and uninterrupted possession for a period of five years. 5. There must be the payment by the possessor of all real property taxes levied and assessed for a period of five consecutive years. The fact that the true owner is also paying the taxes does not neces- sarily defeat the rights of the adverse possessor, as long as the possessor pays the taxes first. Adverse possession is not common in California because of the five requirements listed previously. It is not possible to obtain title by adverse possession to public lands or against an incompetent private landowner. Title insurance and marketable title cannot be obtained until a court, under a quiet title action, rules that the adverse possession vested valid title. In short, if you acquire title by adverse possession, it will be difficult to finance or sell the prop- erty without first going to court. |

|

|

What is the most common method of acquiring property?

|

Acquiring Property by Transfer. Without question, the most common method of acquiring prop- erty is by transfer. When property is conveyed from one person to another by act of the parties or by act of law, title is acquired by transfer. There are five basic types of property transfers: (1) private grant, (2) public grant, (3) gift, (4) public dedication, and (5) court action (or involuntary transfer). (See Figure 2.12.)

|

|

|

What is a private grant?

|

Private grant occurs when an owner voluntarily conveys his or her ownership rights to another. The basic instrument used in this trans- action is a deed.

|

|

|

What is a public grant?

|

When a governmental agency deeds property to an individual or institution, it is called a public grant. In the early years of U.S. history, public grants were made through laws enacted by Congress.

The Preemption Act of 1862 allowed persons living on federal land, who were known as squatters, to acquire 160 acres of land at a small fee. The Homestead Act of 1862 allowed vast stretches of public land to be homesteaded. Heads of families or persons over twenty-one years of age could obtain 160 acres. They had to file a declaration of homestead with the county recorder or at a land of- fice and had to agree to occupy and improve the land. After resid- ing on it for five years and paying a small fee, they received a document from the government called a patent, which conveyed the title from the government to the homesteader.Other public grants were made by the government for railroads, educational in- stitutions, national parks, cities, and towns. |

|

|

Explain a "gift" transfer.

|

A property owner may voluntarily transfer property to a private person or an organization without giving or receiving any consid- eration or compensation. In the case of real property, the transfer normally is evidenced by a gift deed. Depending on the value of the gift, there may or may not be a gift tax liability. The person who gives the gift is called the donor; the person who receives the gift is called the donee.

|

|

|

Explain Public Dedication.

|

A property owner may also give land to a public body for a partic- ular use such as a street, a park, bridges, schools, playgrounds, and so on. This act is called public dedication. The dedication is valid only if the public body accepts the property.

|

|

|

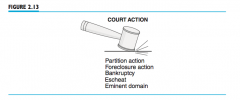

Explain what happens in a court action situation (involuntary transfer).

|

A court of law may be called upon to transfer legal title in a variety of situations. The most common of these involuntary transfers are partition action, foreclosure action, bankruptcy, escheat, and emi- nent domain. (See Figure 2.13.)

|

|

|

What is a Partition action?

|

Partition action is a court action wherein the co-owners of property may sue other co-owners for severance of their respective interests. If the property cannot be physically divided, the court can order a sale and divide the proceeds among the former owners.

|

|

|

What is a foreclosure action?

|

Foreclosure action takes place when a person holding a delin- quent lien on a property institutes proceedings requesting the forced sale of property. In California, delinquent real estate loans are foreclosed using a process called a trustee’s sale. Bankruptcy can be either voluntary or involuntary. When an in- dividual cannot meet credit obligations, he or she may voluntarily file bankruptcy or may be adjudged bankrupt by the courts. Title to real property is then vested in a court-appointed trustee, who sells the property to pay the claims of creditors. Under certain cir- cumstances, a family home can be protected against forced sale by the bankruptcy court.

|

|

|

What does "escheat" mean?

|

Escheat is the legal process whereby ownership of property re- verts to the state due to lack of heirs or want of legal ownership. The probate courts do all in their power to locate possible heirs. After escheat proceedings are instituted, the title is held in trust by the state for a set time. If at the end of that time no heirs have been located, title to the property transfers to the state. Every year, millions of dollars’ worth of property escheats to the state of California because of the lack of heirs.

|

|

|

What is eminent domain?

|

Eminent domain is the power of the state to take land from private ownership by due process of law. Use of eminent domain is often referred to as condemnation proceedings. These proceedings may be instituted by all levels of government and by public utilities or railroads.

|

|

|

What Two conditions are legally required to use the power of emi- nent domain:

|

1. The property must be taken for a public use, *as found to be the case in Kelo v. New London (Connecticut), a U.S. Supreme Court ruling.

2. The owner must be paid just compensation. Most courts have ruled that the “fair market value” based on an appraisal is the proper method for determining just compensation. |

|

|

What is a deed?

|

A deed is a written document by which (when properly exe- cuted, delivered, and accepted) title to real property is transferred from one person, called a grantor, to another person, called a grantee.

|

|

|

What is a grantor/grantee?

|

The grantor is the person who gives title, and the grantee is the person who receives title. In a real estate sale, the grantor is the seller and the grantee is the buyer.

To understand these terms, remember this rule: The or ending denotes the giver, and the ee ending indicates the receiver. |

|

|

What elements must a deed contain to be valid?

|

1. Thedeedmustbeinwriting.Legalinstrumentsrequiredtobe in writing come under the Statute of Frauds. According to this statute, when the title to real property is to be voluntarily con- veyed, it must be accomplished by an instrument in writing, usually a deed.

2. Partiesmustbecorrectlydescribedandidentified.Foradeedto be valid, the parties must be properly described. This means that the grantor (seller) and the grantee (buyer) must be certain and absolute. Because so many individuals have like or similar names, the parties to a deed must be identified as clearly as possible to avoid any later con- fusion as to true identity. If possible, the full legal name should be used and the legal status of the individual should be shown. Remember, the full name includes middle name or initial, if any, and the legal status refers to the rela- tionship between parties, such as husband and wife. 3. Grantormustbecompetenttoconveyandgranteecapableofre- ceiving title. Everyone is competent to convey except: a. Minors:personsundertheageofeighteenyears,unlessthe minor is classified as emancipated, in which case a minor can legally contract for real estate. An emancipated minor is nor- mally a person under eighteen years who is married or in the armed services. b. Incompetents: persons of unsound mind, judicially declared incompetent. c. Convicts: persons imprisoned for life or under a death penalty. 4. Descriptionofthepropertymustbeclear.Thepropertyinthedeed must be correctly described; this means any description that clearly identifies the property so it can be located with certainty meets the test of the law. In most cases, the legal description is a lot, block, and tract; a metes and bounds; or a U.S. government survey description. 5. Theremustbeagrantingclause.Agrantingclausemeansthedeed must contain words indicating the intention of the owner to convey the property. The exact words are not specified; however, the words I hereby grant, I hereby convey, or I hereby transfer satisfy the requirements of a granting clause. 6. Deedmustcontainthesignatureofthegrantor.Tobevalid,adeed must be signed by all grantors named in the deed. If there is more than one owner, all owners must sign. For instance, both hus- band and wife must sign a deed to convey community property. Only the grantor(s) sign a deed, not the grantee(s). Under certain guidelines, state law allows a grantor’s name to be signed by an attorney in fact, a person acting under a valid power of attorney. California permits a person who is unable to sign his or her name to sign by mark as long as two witnesses are present. One of the witnesses then signs the deed according to the manner pre- scribed by law. |

|

|

Can an infant take title to real property?

|

Yes, an infant can receive title by gift or inheritance but

cannot convey title without a guardian or other court approval. |

|

|

Can a person take title under an assumed

name? |

Yes, but upon resale, he or she may have difficulty

proving identity for a notary public. |

|

|

A deed is not effective unless it is ________________________ and _________________?

|

A deed is not effective unless it is delivered to and accepted by the grantee. This does not mean a mere turning over of the physical pos- session of the document. The grantor must have a clear and honest intention to pass title immediately, before there is a legal delivery.

1. Evidenceofdelivery.Thebestevidenceisactuallyhandingthe deed to the grantee. However, manual delivery is not necessary, as a deed may be delivered to a third party for the benefit of the grantee—for example, depositing the deed in escrow. Again, manual delivery does not in itself constitute delivery; the proof lies in the intent of the grantor to pass title. Recording of the deed, if and when it happens, presumes valid delivery. 2. Timeofdelivery.Tobeeffective,adeedmustbedeliveredtothe grantee during the grantor’s lifetime. It cannot be used to take the place of a will. A deed that is delivered to a grantee with the condition that it is not to take effect until the death of the grantor is not valid because the intent to pass title would not occur during the lifetime of the grantor. 3. Dateofdelivery.Adeedispresumedtobedeliveredasofitsdate of writing or execution. If no date exists on the deed, the legal date is presumed to be the date of delivery. The lack of a date on the deed does not invalidate the deed. 4. Conditionaldelivery.Deliveryofadeedmustbeabsolute.It cannot be delivered to a grantee subject to conditions. For ex- ample, in an attempt to avoid the cost of probate, A gives a deed to B, telling B she is not to record the deed until A dies. This is a conditional delivery and is not a valid deed or transfer. Acceptance: The deed must be accepted by the grantee, and this acceptance must be voluntary and unconditional. Acceptance is usually accomplished by words, acts, or conduct on the grantee’s part that lead to the presumption of voluntary acceptance. An example of acceptance is the recording of the deed by the grantee. |

|

|

What is an acknowledgment in regards to a deed?

|

A deed is a real estate document that need not be recorded to be valid. However, if the grantee wishes to record the deed, it must first be acknowledged.

An acknowledgment is a formal declaration before a duly au- thorized officer (usually a notary public) by the person who signed a document, stating that the signature is voluntarily given and that he or she is the person whose signature appears on the document. |

|

|

What are the Nonessentials in a Deed?

|

Many of the items listed previously are essential for a deed to be valid. Some items, however, are not legally required but are com- monly found in a deed.

Legally, a deed does not need to contain but commonly has (1) an acknowledgment, (2) a date, and (3) a recording number issued by the county. |

|

|

A deed is void or invalid if....?

|

1. grantorisincompetent. 2. deedissignedinblank. 3. deedisnotdelivered. 4. deedisaforgery.

5. granteedoesnotexist(fictitiousordeceased). 6. deedisalteredinescrow. |

|

|

list the types of deeds.

|

Grant Deed

In California, the grant deed is the most commonly used instru- ment for transferring title to real estate. A grant deed carries two implied warranties—meaning that although the warranties are not written in the deed, the law says they apply. An example of a grant deed is shown in Figure 2.14. The implied warranties in a grant deed are that 1. thegrantorhasnotalreadyconveyedtitletoanyotherperson. 2. theestatebeingconveyedisfreefromencumbrancesmadebythe grantor or any other person claiming under the grantor, other than those disclosed to the grantee. Notice that these implied warranties do not state that the grantor is the owner or that the property is not encumbered. Rather, they state that the grantor has not deeded to others and that the property is free of encumbrances made by the grantor. This is why a potential buyer should insist that a policy of title in- surance be issued as a condition of the purchase. In addition to transferring legal ownership, a grant deed can be used to create easements and land use restrictions. A grant deed also conveys any after acquired title. After acquired title means that after the grantor deeds the property to the grantee, if the grantor should later acquire an additional interest in the property, that interest automatically passes to the grantee. Quitclaim Deed A quitclaim deed provides the grantee with the least protection of any deed. A quitclaim deed carries no implied warranties and no after acquired title provisions. Under a quitclaim deed, the grantor merely relinquishes any right or claim he or she has in the property. If the grantor has absolute ownership, that is what is conveyed. If the grantor has no claim or ownership right, this type of deed transfers what the grantor has—nothing! In other words, a quit- claim deed merely says, “Whatever interest I have in the property is yours; it may be something, or it may be nothing.” The quitclaim deed is usually used to remove certain items from the public record, such as the removal of an easement or a recorded restriction. It is not normally used in a buy-and-sell transaction. Sheriff’s Deed The court may order an owner’s property sold after a lawsuit and the rendering of a money judgment against the owner. The successful bidder at this type of sale receives a sheriff’s deed, which contains no warranties. In some courts, this sale is conducted by a commissioner instead of the sheriff, and the deed issued is called a commissioner’s deed. Gift Deed A person who wishes to give real estate to another may convey title by using a gift deed. The legal consideration given in a gift deed is usually “love and affection.” A gift deed is valid unless it is being used to defraud creditors, in which case the creditors may institute legal action to void the deed. Tax Deed A tax deed is issued by the tax collector after the sale of land that previously reverted to the state because of nonpayment of property taxes. The tax sale procedure is presented in Chapter 13. Warranty Deed A warranty deed is seldom used in California. Under a warranty deed, the grantor is legally responsible to the grantee for the con- dition of the title. Sellers in California are reluctant to assume this liability and rarely sign warranty deeds. Instead, sellers sign grant deeds and leave the legal responsibility for the condition of the title to title insurance companies. Trust Deed (or Deed of Trust) A trust deed conveys “bare legal title” (but no right of use or pos- session) to a third party called a trustee. This deed differs from others in that title is held by the trustee merely as security for a loan (lien) until such time as the loan is paid off or until the bor- rower defaults on his or her payments. Trust deeds are financing instruments, and they are explained in Chapter 7. Deed of Reconveyance This deed is executed by the trustee to the borrower (trustor). When a beneficiary (the lender) notifies the trustee that the trustor has repaid a loan, the trustee reconveys the title back to the trustor using a deed of reconveyance. This instrument is also involved with the financing of real estate and is discussed in Chapter 7. Trustee’s Deed This deed conveys title to a successful bidder at a trustee’s sale (foreclosure). A trustee’s deed contains no warranties. |

|

|

Explain California's recording system.

|

The recording of a deed and many other title instruments, although not required by law, protects the new owner’s rights. Under the Spanish and Mexican governments, there were no recording laws in California. Shortly after California became a state, the legislature adopted a recording system by which evidence of title or interest in real property could be collected and held for public view at a convenient and safe place. This safe public place is the county recorder’s office.

|

|

|

To be accepted for recording by a county recorder, the deed must have...?

|

1. Anacknowledgment(benotarized)

2. Nameandaddresstowhichfuturetaxstatementscanbemailed 3. Basisforcomputingthetransfertax 4. Namesofallpartiesinvolvedinthetransaction 5. Anadequatelegaldescription 6. Payment of a recording fee Once a document is recorded, it is said that the world has con- structive notice of the contents of the document. |

|

|

What is a chain of title?

|

The recording system also shows sequential transfers of prop- erty from the original owner to the present owner. This successive list of owners is called a chain of title.

|

|

|

What are grantor–grantee indexes?

|

Recorded documents are filed in books called grantor–grantee indexes. Most counties have reduced their title records to microfilm or microfiche for easy handling and storage. These title records are frequently transferred by title companies to computers, making it easier for the title company to research a property.

A general rule says, “The first to record is the first in right.” |

|

|

What are the two exceptions to the rule: “The first to record is the first in right.”

|

1. Ifapartyorgranteeisthefirsttorecord,butisawareofanother party (an earlier grantee for example) who has an interest in the property, the first party to record would be second to the interest of the other earlier party.

2. Ifthefirstpartyfailedtorecordbuttookpossessionoftheprop- erty, the possession by an unrecorded owner can defeat a later recorded deed by another person. |

|

|

AdeedstoB,whodoesnotrecord,butBtakesphysical possession of the property. A then deeds to C, who does not make a physical inspection of the property. C then records the deed. Who will probably win?

|

B, because physical possession gives actual notice to all parties, including C, that B has a prior interest in the property.

Moral: Always physically inspect a property before you pur- chase. Do not rely on the public records only! |

|

|

What are the three major types of land descriptions:

|

lot, block, and tract; metes and bounds; and the U.S. government survey system.

|

|

|

What are 5 ways of acquiring title to property?

|

by will, succession, ac- cession, occupancy, and transfer.

|

|

|

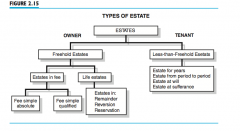

What is the definition of an estate?

|

An estate is defined as the degree, quantity, nature, and extent of interest a person has in property. If the estate is in real property, you have a real estate interest.

|

|

|

Real property estates fall into which two major classifications?

|

freehold estates and less-than-freehold estates.

|

|

|

What is a freehold estate?

|

A freehold estate refers to one’s interest as an owner of real prop- erty. Freehold estates can be subdivided into fee estates and life estates.

|

|

|

Fee estates or fee simple estates can be divided into the following:

|

a. Fee simple absolute, which the owner holds without any

qualifications or limitations, such as private deed restrictions. All government ordinances and limitations still apply. This is the highest form of interest an individual can have in land. b. Fee simple qualified (defeasible), which the owner holds subject to special conditions, limitations, or private deed restrictions that limit the use of the property. |

|

|

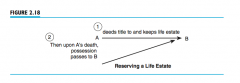

What is a life estate?

|

Life estates are created by deed or will for the life of one or more designated human beings. The life tenant has all the rights of possession, or income, during the life of the designated person(s). However, the holder of a life estate cannot deed or lease a prop- erty beyond the life of the designated person. If the person granting the life estate designates that the title is to go to some other person upon the death of the life estate holder, the person so designated is said to have an estate in remainder.

If the property is to be returned to the person who gave the life estate or to his or her heirs, that person is said to have an estate in reversion. nother possibility is a grant reserving a life estate. Among life estates, this is probably the most common situation. |

|

|

Why are freehold estates sometimes called estates of inheritance?

|

freehold estates, both fee simple and certain parts of life estates, are considered durable and capable of being transferred by inheritance upon death. Therefore, freehold estates are sometimes called estates of inheritance.

|

|

|

What is a less-than-freehold estate?

|

Less-than-freehold estates are interests held by tenants who rent or lease property. Tenants are also called lessees or leaseholders and are discussed in detail in Chapter 11.

|

|

|

What is ownership in severalty?

|

When a person acquires real property and holds title solely in his or her own name, it is technically known as ownership in severalty. In other words, he or she alone enjoys the ownership benefits, in- cluding the complete bundle of rights, and “severs” his or her re- lationship with others.

|

|

|

A person can hold title in severalty in one of the following ways, depending on the owner’s legal status...

|

As single

As unmarried As married As a registered domestic partner As a widow or widower A person who wishes to indicate separate property ownership can add the words sole and separate property to any of the choices listed. A corporation can hold title in severalty, such as “Acme Company, a California Corporation.” |

|

|

Concurrent ownership is when....?

|

two or more people hold title to- gether. There are numerous types of concurrent ownership, but the most important are joint tenancy, tenancy in common, com- munity property, and tenancy in partnership.

|

|

|

Joint tenancy exists when...?

|

two or more persons are joint and equal owners of the same undivided interest in real property. To create and maintain a valid joint tenancy, four unities must exist:

1. Unityoftime.Thismeansthattheownersmusthaveacquired their interest at the same time. 2. Unityoftitle.Thismeansthatallownersmustcomeintotitleonthe same document. Consider this example: A and B are joint tenants. B sells her interest to C. A and C are tenants in common because they each took title on a different document at a different time. 3. Unityofinterest.Thismeansthatallownersmusthaveequal shares or interest in the property. For example, if there are two owners, each must have a one-half interest; with four owners, each must have a one-quarter interest; with eight owners, each must have a one-eighth interest; and so on. 4. Unityofpossession.Thismeansthatallownersmusthaveequal rights of possession. No one owner can be prevented from using the property by the other owner(s). If any of these unities are missing, the joint tenancy is invalid and the rules of tenancy in common apply. |

|

|

What is the most important characteristics of joint tenancy?

|

the right of survivorship. This means that if one tenant dies, the surviving joint tenant(s) acquire the deceased’s interest without a court action such as a probate.

|

|

|

In addition to the four unities (time, title, interest, and possession) and the right of survivorship, joint tenancy has these important characteristics:

|

1. Youcannotwillyourinterestinjointtenancyproperty.

2. Interestinthepropertyisundivided.Inotherwords,eachowner can use every square foot, and he or she cannot say, “This is my half and this is yours.” 3. Noprobateprocedureisrequiredtodistributetheinterest upon the death of one of the owners. The interest goes to the surviving co-owners. However, some paperwork is required to shift the remaining interest to the surviving joint tenant. But this paperwork is minor in comparison to a complete probate. 4. Ajointtenantmaysellorconveyhisorherinterestwithout approval of the other tenant(s). This action may break the joint tenancy and create a tenancy in common. For example; A , B and C are joint tenants. C sells his interest to X. A and B are still joint tenants with each other but now they are also tenants in common with X. 5. A corporation is not allowed to hold title as a joint tenant because, in theory, a corporation never “dies.” 6. Asurvivingtenantacquirestheinterestofthedeceasedjoint tenant and is free from the debts created individually by the deceased joint tenant. |

|

|

When two or more persons are owners of an undivided interest in property, they can hold title as tenants in common. Tenancy in common has these characteristics:

|

1. Thereisnorightofsurvivorship,meaningthatuponthedeathof a tenant in common, his or her interest passes to the heirs, not the surviving co-tenants. This requires a probate proceeding.

2. Eachownermayholdanunequalinterest;thatis,heorshemay own unequal shares. Example: A,B,C,andDholdtitleastenantsincommon.These owners might share their interest as follows: A might own one-quarter interest. B might own one-eighth interest. C might own one-eighth interest. D might own one-half interest. Contrast this with joint tenancy, which requires all owners to have equal shares or interest. 3. Eachownerhasequalrightsofpossessionandmustpayhisorher share of the expenses, such as property taxes. 4. Eachownermaywillhisorherinteresttohisorherheirs,and upon death, the heirs take their place along with the other owners as tenants in common. 5. Eachco-tenantmaysell,convey,orencumberhisorherinterest without the consent of the co-tenants. |

|

|

A and B are joint tenants. If B dies, who gets what?

|

B’s interest passes to A, who now holds title in severalty.

|

|

|

A and B are joint tenants. If B sells to C, what is the relationship between A and C?

|

A and C are tenants in common.

|

|

|

A and B are tenants in common. If B dies, who gets what?

|

A and the heirs of B are tenants in common.

|

|

|

A and B and C are joint tenants. C sells his interest to D. What is the relationship between A and B and D?

|

A and B are joint tenants to each other and tenants in common with D.

|

|

|

When does Tenancy in partnership exist?

|

when two or more persons, as part- ners, pool their interests, assets, and efforts in a business venture, with each to share in the profits or the losses. This type of business organization includes general partnerships and limited partner- ships, and many rules and regulations are involved. The following discussion outlines only the real estate aspects of partnerships, not the legal or accounting aspects.

|

|

|

What real estate characteristics does tenancy in partnership have?

|

1. Each partner has an equal right with other partners to possession of specific partnership property for partnership purposes. This means a partner only has the right to use the property for busi- ness, not for personal purposes, unless the other partners agree to the personal use.

2. A partner’s right in the partnership property is not assignable except in connection with the assignment of rights of all the partners in the same property. 3. A partner’s right in the partnership property is not subject to attachment or execution, except on a claim against the partnership. 4. Thereisaformofsurvivorshipwhenonepartnerdies. |

|

|

What is a limited partnership?

|

Sometimes title to real estate is held by a limited partnership. Un- der a limited partnership, one or more general partners have unlim- ited liability and usually a series of limited partners have limited liability. Limited liability means that if all legal requirements have been met, the limited partners can lose only their investment and cannot be held liable for partnership debts. Most real estate syndi- cates hold title as a limited partnership.

|

|

|

What is community property?

|

Community Property

Community property ownership is another form of ownership held by more than one person, but in this case, the property can be held only by a husband and wife or by registered domestic part- ners. Community property is defined as all property acquired dur- ing a valid marriage or registered domestic partnership. California is a community property state; therefore, all California property ac- quired by a husband and wife or by registered domestic partners during marriage is presumed to be community property. However, there are a few exceptions. 1. Allpropertyownedbyhusbandorwifebeforemarriageorregis- tered domestic partnership can remain separate property after- marriage or registered domestic partnership as long as the property is not commingled with community property, causing it to lose its separate property identity. 2. Allpropertyacquiredbygiftorinheritancebyeitherspousedur- ing marriage or registered domestic partnership remains separate property as long as it is not commingled with community property. 3. Allincomeandprofitsfromseparatepropertyaswellasany property acquired from the proceeds of separate property remain separate property as long as said income and profits are not commingled with community property. In effect, a husband and wife are general partners, as are regis- tered domestic partners, each owning one-half of the community property. Each spouse or partner has equal management and control of the community property. Neither spouse or partner may convey or encumber real estate held as community property unless the other spouse or partner also signs the contracts or documents involved. Each spouse or partner has the right to dispose of his or her half of the community property by will to whomever he or she wishes. But if either spouse or partner dies intestate, the surviving spouse or partner receives all the property; the children, if any, get nothing. Another Choice Effective for deeds or documents recorded after July 2, 2001, a husband and wife or registered domestic partners may hold title as “community property with right of survivorship.” This means upon the death of one spouse or partner, the surviving spouse or partner receives title without a special spousal or partner probate. In short, married couples and registered domestic partners now have a choice. They may (1) hold title as regular community prop- erty and keep the right to will their separate interest or (2) hold title with the right of survivorship and automatically guarantee that upon death of one spouse or partner, the property will go to the surviving spouse or partner without any probate. In addition, there are some tax differences between the two choices. If a mar- ried couple acquired title as community property prior to July 2, 2001, and wish to switch, they need to discuss with their tax and legal experts the pros and cons of redeeding to take advantage of this more recent choice (see California Civil Code Sec.682.1). Community property does not need to be probated if the de- ceased spouse or partner leaves his or her interest to the surviving spouse or partner. But if the deceased spouse’s or partner’s interest is left to someone other than the surviving spouse or partner, the estate must be probated. |

|

|

For Married Couples or Registered Domestic Partners, Which is Best: Joint Tenancy or Community Property?

|

The answer is complicated and should be discussed with a tax at-

torney. Some of the main issues to compare are income tax basis upon death, estate taxes, and probate procedures (if any). Also, the trend toward deeding title into a living trust may need to be dis- cussed with a tax attorney. Real estate licensees and escrow officers are neither qualified nor allowed to give buyers and existing own- ers advice on how to hold title. |

|

|

What are the Cohabitation and Property Rights?

|

In 1976, in the famous Marvin v. Marvin case involving the late actor Lee Marvin, California courts held that unmarried persons who cohabitate may create property rights and obligations by oral agreement. The bottom line is that unmarried people who cohabitate might need to discuss this situation with an attorney. They may find it advisable to reduce to contract form an agreement on how to handle previously owned property and property accumulated during cohabitation, in the event they separate at a later date.

|

|

|

What is equity sharing?

|

Equity sharing is when an owner-occupant and a nonresident owner- investor pool their money to buy a home. The down payment is split according to an agreed percentage, and both parties are on the deed and mortgage. The owner-occupant pays rent to the nonresident owner- investor for a portion of the home owned by the investor. The nonresident owner-investor then uses the rent money to join with the owner-occupant to pay the monthly mortgage payments. The equity share contract spells out who is responsible for taxes, insurance, and upkeep. Some day in the future, the home is either refinanced or sold, and the parties split the net proceeds according to a prearranged percentage. Equity share arrangements are complicated and should not be undertaken without advice from legal and tax experts.

|

|

|

What is a living trust?

|

As the value of estates increases, the tendency is for people to look for ways to minimize the cost of probate. One trend has been to place all real estate and other valuable property into a living trust. The owner transfers the property to the trust and frequently names himself or herself as trustee with the right to change the terms and scope of the trust as he or she sees fit. While in the trust, he or she enjoys all the privileges of ownership. Upon death, title passes to the named beneficiaries without the time and delay of a probate. A living trust does not eliminate estate taxes but rather eliminates the cost of probate. A person should contact an attorney before entering into a living trust to discuss its pros and cons.

|