![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

26 Cards in this Set

- Front

- Back

|

Aggregate demand |

Total demand for the goods and services of a nation at a given price level and a given period of time. AD=C+I+G+(X-M) |

|

|

Why is aggregate demand downward sloping? |

Wealth effect: higher price levels reduce purchasing power or real value of the nations households and savings;public feels poorer at higher levels so demand is lower. Interest rates: When price levels rise, banks raise IR. At higher rates QD of products to borrow decreases as higher rates are unattractive to borrowers. Net export: As price levels decrease exports become more competitive, imports less competitive as they’re more expensive to domestic consumers and goods in the country more attractive to foreigners which decreases M. |

|

|

Determinants of consumption |

Level of real disposable income Interest rates/availability of credit Consumer confidence Asset prices/Wealth Household indebtedness |

|

|

Consumption |

Total spending by households on goods and services in an economy |

|

|

Wealth |

The total value of the accumulated assets owned by an individual, household, community, or country, minus all of its liabilities. |

|

|

MPC: Marginal propensity to consume |

Willingness of a household to spend any extra income that they’ve earned |

|

|

Investmenf |

Firms spending on capital goods to increase productive capacity |

|

|

Determinants of Investment |

Interest rates Business confidence Corporation tax Spare capacity Level of competition Price of capital |

|

|

Determinants of Government spending |

Current spending: maintains public services and paying public sector wages. Capital spending: infrastructure projects. Welfare spending: benefits and pensions. (Injections) Debt interest payments. (Leakage) |

|

|

Determinants of net exports |

Real disposable income abroad Income at home Strong/Weak exchange rates (SPICED or WIDEC) Protectionism at home and abroad Relative inflation level at home (higher inflation means less exports and less revenue and more imports because price is lower). |

|

|

Aggregate supply |

Total supply of goods and services available to a particular market from producers. |

|

|

Aggregate supply |

Total supply of goods and services available to a particular market from producers. |

|

|

SRAS determinants |

Costs of production: Wages Raw material prices Oil prices Business tax (VAT) Import prices (change with exchange rates) |

|

|

Aggregate supply |

Total supply of goods and services available to a particular market from producers. |

|

|

SRAS determinants |

Costs of production: Wages Raw material prices Oil prices Business tax (VAT) Import prices (change with exchange rates) |

|

|

Long run aggregate supply |

LRAS the economy produces 1 level of output in the long run. Max output an economy can produce using all factors of production sustainably. Full employment level of output, we are at this level at the natural rate of unemployment (4-5%) |

|

|

Aggregate supply |

Total supply of goods and services available to a particular market from producers. |

|

|

SRAS determinants |

Costs of production: Wages Raw material prices Oil prices Business tax (VAT) Import prices (change with exchange rates) |

|

|

Long run aggregate supply |

LRAS the economy produces 1 level of output in the long run. Max output an economy can produce using all factors of production sustainably. Full employment level of output, we are at this level at the natural rate of unemployment (4-5%) |

|

|

LRAS determinants |

Quantity or quality of factors of production Productive efficiency: Labor productivity Investment (tech) Infrastructure (transportation becomes more efficient) Quantity of labor Competition New resource discoveries |

|

|

When SRAS and AD are below YFE |

Recessionary and deflationary gap |

|

|

When SRAS and AD are below YFE |

Recessionary and deflationary gap |

|

|

AD/AS above YFE |

Inflationary gap |

|

|

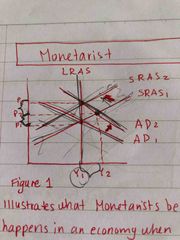

Monetarist theory |

AD increases=inflation=economy adjusts by increasing costs of production or wages etc or accepting lower ones and return back to YFE |

|

|

Monetarist theory |

AD increases=inflation=economy adjusts by increasing costs of production or wages etc or accepting lower ones and return back to YFE |

|

|

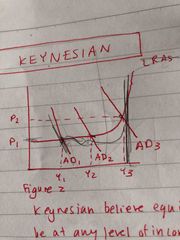

Keynesian |

Keynesian believe equilibrium can be at any level of income where AD=AS. AD doesn’t have to be inflationary as long as there is spare capacity. Past YFE inflationary pressure is built. Because wages are sticky |