![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

36 Cards in this Set

- Front

- Back

|

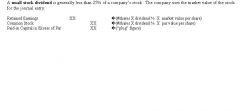

What is the journal entry for a small stock divident?

|

See above

|

|

|

What is the journal entry for a large stock dividend?

|

See above

|

|

|

What is the primary source of financing for a business, and what is it called?

|

A corporation finances its business with equity. The owners’ claims to the assets of the firms are called shareholders-equity or stockholders’ equity.

|

|

|

What are the components of the shareholder's equity section of the balance sheet?

|

There are two parts to the shareholders’ equity section –contributed capital and retained earnings.

|

|

|

What are the four categories of shares of stock?

|

There four Categories of Shares of stock. They are authorized, issued, outstanding and treasury stock.

|

|

|

Define authorized stock.

|

Authorized stock – maximum number of shares of stock a firm is authorized to offer to the public as specified in the corporate charter.

|

|

|

Define issued stock.

|

Issued stock – shares of stock that have been offered and sold to stockholders.

|

|

|

Define outstanding stock.

|

Outstanding stock – shares of stock that are owned by shareholders rather than by the corporation; issued shares minus treasury shares.

|

|

|

Define Treasury stock.

|

Treasury stock – shares of stock that firm has bought back via the stock market. The stock is issued but not outstanding.

|

|

|

Define common stock.

|

Common stock is the most common type of capital stock representing ownership in a corporation.

|

|

|

What basic rights do common shareholders' have?

|

Common shareholders have five basic rights. Those rights are the right to:

Vote for members of the board of directors. Share in the corporation’s profits. Share in any assets left if the corporation has to dissolve. Acquire more shares when the corporation issues new stock, often referred to as the preemptive right. |

|

|

How is the value of common stock established, and where/when does it show up on the balance sheet?

|

The corporate charter determines a fixed per-share amount called the par value of the stock. Par value is added to the common stock account every time a share is issued.

|

|

|

Define paid-in-capital.

|

Any excess over par value received for a share of stock is added to additional paid-in-capital

|

|

|

What is preferred stock, and how is it different from common stock?

|

Preferred stock is a second type of capital stock. It is a special type of ownership in a corporation. Preferred stockholders don’t get to vote for the board of directors, but they do get their dividends before the common shareholders

|

|

|

What is a distibution to the shareholders called?

|

The distributions shareholders receive from the earnings of the corporation are called dividends.

|

|

|

What dates are important to cash dividends?

|

There are three important dates related to cash dividends: These dates are declaration date, record date and payment date.

|

|

|

What is the declaration date and how does this date affect the corporation's books?

|

Declaration date – the date on which the board of directors declares a dividend will be paid and announces it to the shareholders. Retained Earnings is debited and Dividends Payable is credited.

|

|

|

What is the record date and how does it affect the corporation's books?

|

Record date – this is the date used to determine exactly who will receive the dividends. There is no journal entry on this date.

|

|

|

What is the record date and how does it affect the corporation's books?

|

Record date – this is the date used to determine exactly who will receive the dividends. There is no journal entry on this date.

|

|

|

Who receives dividends?

|

Dividends must be divided between preferred and common shareholders.

|

|

|

What is special about cumulative preferred stock?

|

Cumulative preferred stock – stock whose holders must receive past, unpaid dividends before a company can pay any current dividends to any shareholders.

|

|

|

What happens to undeclared and unpaid dividends on cumulative preferred stock?

|

Any dividends owed to holders of cumulative preferred stock from past years but undeclared and unpaid are called dividends in arrears. Dividends in arrears are shown in the notes to the financial statements.

|

|

|

Define Treasury Stock.

|

Treasury Stock is the term given to common stock that has been issued and subsequently purchased by the company that issued it.

|

|

|

Why would a company buy its own stock?

|

To have stock to distribute to employees for compensation plans.

To return cash to the shareholders in a way that is more flexible for both the firm and the shareholders than paying cash dividends. To increase the company’s earnings per share. To reduce the amount of dividends to be paid in the future. To reduce chances of a hostile takeover. |

|

|

What is a stock dividend?

|

A stock dividend is a company’s distribution of new shares of stock to the company’s current stockholders

|

|

|

How does a stock dividend affect the shareholder's ownership in the company?

|

Stock dividends do not increase any shareholder’s percentage of ownership in the company.

|

|

|

What happens to the value of a share of stock, and the number of shares issued and outstanding, when you have a stock dividend?

|

Stock splits occur when a corporation increases the number of shares and proportionately decreases the par value. No new shares are issued. The current shares of stock are divided by a specific multiple to increase the number of shares. No journal entries are made.

|

|

|

How doe you calculated Retained Earnings?

|

Retained Earnings is the total amount of net income (minus net losses) minus all dividends paid since the company began.

|

|

|

What does the term return on equity mean?

|

Return on equity is a measure of income the firm earns for each dollar of investment from the common shareholders.

|

|

|

How do you calculate return on equity?

|

It is calculated by subtracting preferred dividends from net income and then dividing by average common shareholders’ equity

|

|

|

What is earnings per share?

|

Earnings per share is the per share portion of net income of each common shareholder.

|

|

|

How do you caluclate earnings per share?

|

It is calculated by subtracting preferred dividends from net income and then dividing that number by weight average number of share outstanding.

|

|

|

What are the two types of earnings per share?

|

There are two numbers shown for earnings per share: They are Basic earnings per share and Diluted earnings per share.

|

|

|

How do you arrive at basic earnings per share?

|

Basic earnings per share is a straightforward calculation of earnings divided by the weighted average number of shares outstanding.

|

|

|

What does diluted earnings per share mean?

|

Diluted earnings per share is a “what if” calculation. What of all the potential securities that could have been converted into common stock actually had been converted to common stock at year-end?

|

|

|

How can the risks of stock ownership be controlled?

|

Minimize the risks of stock ownership by diversifying your investments.

Implement controls that monitor the behaviors and decisions of managements – such as having an independent boards of directors and independent audits. |