![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

41 Cards in this Set

- Front

- Back

|

Factors that shape an accounting information system include the

a. nature of the business. b. size of the firm. c. volume of data to be handled. d. All of these answer choices are correct. |

All of these answer choices are correct.

|

|

|

The process of transferring figures from the book of original entry to the ledger accounts is called

a. adjusting. b. balancing. c. ledgering. d. posting. |

posting.

|

|

|

Debit always means

a. the right side of an account. b. an increase. c. a decrease. d. None of these answer choices are correct. |

None of these answer choices are correct.

|

|

|

An accounting record into which the essential facts and figures in connection with all transactions are first recorded is called the

a. ledger. b. account. c. trial balance. d. None of these answer choices are correct. |

None of these answer choices are correct.

|

|

|

A trial balance

a. proves that debits and credits are equal in the ledger. b. supplies a listing of open accounts and their balances that are used in preparing financial statements. c. is normally prepared three times in the accounting cycle. d. All of these answer choices are correct. |

All of these answer choices are correct.

|

|

|

Which of the following is a real (permanent) account?

a. Goodwill b. Service Revenue c. Accounts Receivable d. Both Goodwill and Accounts Receivable |

Both Goodwill and Accounts Receivable

|

|

|

Which of the following is a nominal (temporary) account?

a. Unearned Service Revenue b. Salaries and Wages Expense c. Inventory d. Retained Earnings |

Salaries and Wages Expense

|

|

|

Nominal accounts are also called

a. temporary accounts. b. permanent accounts. c. real accounts. d. None of these answer choices are correct. |

temporary accounts

|

|

|

The double-entry accounting system means

a. Each transaction is recorded with two journal entries. b. Each item is recorded in a journal entry, then in a general ledger account. c. The dual effect of each transaction is recorded with a debit and a credit. d. None of these answer choices are correct. |

The dual effect of each transaction is recorded with a debit and a credit.

|

|

|

When a corporation pays a note payable and interest,

a. the account notes payable will be increased. b. the account interest expense will be decreased. c. they will debit notes payable and interest expense. d. they will debit cash. |

they will debit notes payable and interest expense.

|

|

|

Stockholders’ equity is not affected by all

a. cash receipts. b. dividends. c. revenues. d. expenses. |

cash receipts.

|

|

|

The debit and credit analysis of a transaction normally takes place

a. before an entry is recorded in a journal. b. when the entry is posted to the ledger. c. when the trial balance is prepared. d. at the end of the accounting cycle. |

before an entry is recorded in a journal.

|

|

|

The accounting equation must remain in balance

a. throughout each step in the accounting cycle. b. only when journal entries are recorded. c. only at the time the trial balance is prepared. d. only when formal financial statements are prepared. |

throughout each step in the accounting cycle.

|

|

|

The difference between the accounting process and the accounting cycle is

a. the accounting process results in the preparation of financial statements, whereas the accounting cycle is concerned with recording business transactions. b. the accounting cycle represents the steps taken to accomplish the accounting process. c. the accounting process represents the steps taken to accomplish the accounting cycle. d. merely semantic, because both concepts refer to the same thing. |

the accounting cycle represents the steps taken to accomplish the accounting process.

|

|

|

An optional step in the accounting cycle is the preparation of

a. adjusting entries. b. closing entries. c. a statement of cash flows. d. a post-closing trial balance. |

a post-closing trial balance.

|

|

|

Which of the following criteria must be met before an event or item should be recorded for accounting purposes?

a. The event or item can be measured objectively in financial terms. b. The event or item is relevant and reliable. c. The event or item is an element. d. All of these must be met. |

All of these must be met.

|

|

|

Which of the following is a recordable event or item?

a. Changes in managerial policy b. The value of human resources c. Changes in personnel d. Payment of monthly payroll. |

Payment of monthly payroll. |

|

|

Which of the following is not an internal event?

a. Depreciation b. Using raw materials in the production process c. Dividend declaration and subsequent payment d. All of these are internal transactions. |

Dividend declaration and subsequent paymen |

|

|

External events do not include

a. interaction between an entity and its environment. b. a change in the price of a good or service that an entity buys or sells. c. improvement in technology by a competitor. d. using buildings and machinery in operations. |

using buildings and machinery in operations. |

|

|

A trial balance may prove that debits and credits are equal, but

a. an amount could be entered in the wrong account. b. a transaction could have been entered twice. c. a transaction could have been omitted. d. All of these answer choices are correct. |

All of these answer choices are correct.

|

|

|

A general journal

a. chronologically lists transactions and other events, expressed in terms of debits and credits. b. contains one record for each of the asset, liability, stockholders’ equity, revenue, and expense accounts. c. lists all the increases and decreases in each account in one place. d. contains only adjusting entries. |

chronologically lists transactions and other events, expressed in terms of debits and credits. |

|

|

A journal entry to record the sale of inventory on account will include a

a. debit to Inventory. b. debit to Accounts Receivable. c. debit to Sales Revenue. d. credit to Cost of Goods Sold |

debit to Accounts Receivable. |

|

|

A journal entry to record a payment on account will include a

a. debit to Accounts Receivable. b. credit to Accounts Receivable. c. debit to Accounts Payable. d. credit to Accounts Payable. |

debit to Accounts Payable. |

|

|

A journal entry to record a receipt of rent in advance will include a

a. debit to Rent Revenue. b. credit to Rent Revenue. c. credit to Cash. d. credit to Unearned Revenue. |

credit to Unearned Revenue. |

|

|

Which of the following errors will cause an imbalance in the trial balance?

a. Omission of a transaction in the journal. b. Posting an entire journal entry twice to the ledger. c. Posting a credit of $720 to Accounts Payable as a credit of $720 to Accounts Receivable. d. Listing the balance of an account with a debit balance in the credit column of the trial balance. |

Posting a credit of $720 to Accounts Payable as a credit of $720 to Accounts Receivable. |

|

|

Which of the following is not a principal purpose of an unadjusted trial balance?

a. It proves that debits and credits of equal amounts are in the ledger. b. It is the basis for any adjustments to the account balances. c. It supplies a listing of open accounts and their balances. d. It proves that debits and credits were properly entered in the ledger accounts. |

It proves that debits and credits were properly entered in the ledger accounts. |

|

|

An adjusting entry should never include

a. a debit to an expense account and a credit to a liability account. b. a debit to an expense account and a credit to a revenue account. c. a debit to a liability account and a credit to revenue account. d. a debit to a revenue account and a credit to a liability account. |

a debit to an expense account and a credit to a revenue account. |

|

|

Which of the following is an example of an accrued expense?

a. Office supplies purchased at the beginning of the year and debited to an expense account.b. Property taxes incurred during the year, to be paid in the first quarter of the subsequent year. c. Depreciation expense d. Rent recognized during the period, to be received at the end of the year |

Property taxes incurred during the year, to be paid in the first quarter of the subsequent year. |

|

|

Which of the following statements is true about the accrual basis of accounting?

a. The timing of cash receipts and disbursements is emphasized. b. A minimal amount of record keeping is required in accrual basis accounting compared to cash basis. c. This method is used less frequently by businesses than the cash method of accounting. d. Revenues are recognized in the period the performance obligation is satisfied, regardless of the time period the cash is received. |

Revenues are recognized in the period the performance obligation is satisfied, regardless of the time period the cash is received. |

|

|

An adjusting entry to record an accrued expense involves a debit to a(an)

a. expense account and a credit to a prepaid account. b. expense account and a credit to Cash. c. expense account and a credit to a liability account. d. liability account and a credit to an expense account. |

expense account and a credit to a liability account. |

|

|

The failure to properly record an adjusting entry to accrue an expense will result in an

a. understatement of expenses and an understatement of liabilities. b. understatement of expenses and an overstatement of liabilities. c. understatement of expenses and an overstatement of assets. d. overstatement of expenses and an understatement of assets. |

understatement of expenses and an understatement of liabilities. |

|

|

Which of the following properly describes a deferral?

a. Cash is received after revenue is recognized. b. Cash is received before revenue is recognized.c. Cash is paid after expense is incurred. d. Cash is paid in the same time period that an expense is incurred. |

Cash is received before revenue is recognized. |

|

|

The failure to properly record an adjusting entry to accrue a revenue item will result in an

a. understatement of revenues and an understatement of liabilities. b. overstatement of revenues and an overstatement of liabilities. c. overstatement of revenues and an overstatement of assets. d. understatement of revenues and an understatement of assets. |

understatement of revenues and an understatement of assets. |

|

|

The omission of the adjusting entry to record depreciation expense will result in an

a. overstatement of assets and an overstatement of owners' equity. b. understatement of assets and an understatement of owner's equity. c. overstatement of assets and an overstatement of liabilities. d. overstatement of liabilities and an understatement of owners' equity. |

overstatement of assets and an overstatement of owners' equity. |

|

|

Adjustments are often prepared

a. after the balance sheet date, but dated as of the balance sheet date. b. after the balance sheet date, and dated after the balance sheet date. c. before the balance sheet date, and dated before the balance sheet date. d. before the balance sheet date, and dated after the balance sheet date. |

after the balance sheet date, but dated as of the balance sheet date. |

|

|

At the time a company prepays a cost

a. it debits an asset account to show the service or benefit it will receive in the future. b. it debits an expense account to match the expense against revenues recognized. c. its credits a liability account to show the obligation to pay for the service in the future. d. it credits an asset account and debits an expense account. |

it debits an asset account to show the service or benefit it will receive in the future. |

|

|

How do these prepaid expenses expire?

Rent Supplies a. With the passage of time Through use and consumption b. With the passage of time With the passage of time c. Through use and consumption Through use and consumption d. Through use and consumption With the passage of time |

With the passage of time Through use and consumption |

|

|

Recording the adjusting entry for depreciation has the same effect as recording the adjusting entry for

a. an unearned revenue. b. a prepaid expense. c. an accrued revenue. d. an accrued expense. |

a prepaid expense. |

|

|

Unearned revenue on the books of one company is likely to be

a. a prepaid expense on the books of the company that made the advance payment. b. an unearned revenue on the books of the company that made the advance payment. c. an accrued expense on the books of the company that made the advance payment. d. an accrued revenue on the books of the company that made the advance payment. |

a prepaid expense on the books of the company that made the advance payment. |

|

|

To compute interest expense on a note for an adjusting entry, the formula is (principal × annual rate × a fraction). The numerator and denominator of the fraction are:

Numerator Denominator a. Length of time note has been outstanding 12 months b. Total length of note 12 months c. Length of time until note matures Total length of note d. Length of time note has been outstanding Total length of note |

a. Length of time note has been outstanding 12 months

|

|

|

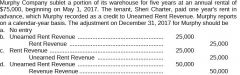

test |