![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

55 Cards in this Set

- Front

- Back

|

An audit opinion on cash basis financialstatements is an example of an opinion on financial statements that follow aspecial purpose financial reporting framework. |

True |

|

|

The balance sheet for an individual may betitled a Statement of FinancialCondition. |

True |

|

|

The auditors should take exception to assetspresented at their estimated current values in personal financialstatements. |

False |

|

|

Personal financial statements may be compiled orreviewed, but they should notbe audited. |

False |

|

|

A compilation of financial statement provideslimited assurance regarding the financial statements. |

False |

|

|

Compiled financial statements may omit notedisclosures. |

True |

|

|

The auditors must issue a compilation report ifthey prepare a client's financial statements and submit them to a client whointends to use them for external purposes. |

True |

|

|

The auditors should not accept an engagement toissue a compilation report on financial information presented in a prescribedform. |

False |

|

|

Letters to underwriters should not contain negativeassurances. |

False |

|

|

When a U.S.-based organization preparesfinancial statements which are for use in another country, a U.S. report,modified to reflect the accounting principles of the other country, may beissued. |

True |

|

|

Which of the following is correct relating tocompiled financial statements when third party reliance upon those statementsis anticipated? A. A compilationreport must be issued.B. Omission of notedisclosures is unacceptable. C. A written engagementletter is required.D. Each page of thefinancial statements should have a restriction such as "Restricted forManagement's Use Only". |

A. A compilation report must be issued. |

|

|

A compilation report is not required whencompiled financial statements are expected to be used by: A. Management only. B. Management and thirdparties. C. Third parties only. D. A compilation reportis required whenever financial statements are compiled. |

A. Management only. |

|

|

It is the end of the client's first quarter andBill Smith, CPA has been engaged to perform a compilation and to issue acompilation report on the financial statements. The client does not wish topresent notes to the financial statements. The appropriate reportincludes: A. Qualified opinion("subject to" the omission of the notes). B. Compilation reportwith an adverse opinion due to inadequate disclosure. C. Standard compilationreport.D. Compilation reportwith an indication that all required disclosures under GAAP may not bepresented with the statements. |

D. Compilation report with an indication that all required disclosures under GAAP may not be presented with the statements. |

|

|

An accountant's standard report issued aftercompiling the financial statements of a nonpublic entity should statethat: A. I am not aware of any material modificationsthat should be made to the accompanying financial statements. B. A compilationconsists principally of inquiries of company personnel and analyticalprocedures. C. A compilation islimited to presenting in the form of financial statements information that isthe representation of management. D. A compilation issubstantially less in scope thanan audit in accordance with GAAS, the objective of which is the expression ofan opinion. |

C. A compilation is limited to presenting in the form of financial statements information that is the representation of management. |

|

|

Which of the following procedures is usually thefirst step in reviewing the financial statements of a nonpublic entity? A. Make preliminaryjudgments about risk and materiality to determine the scope and nature of theprocedures to be performed. B. Obtain a generalunderstanding of the entity's organization, its operating characteristics, andits products or services.C. Assess the risk ofmaterial misstatement arising from fraudulent financial reporting and themisappropriation of assets. D. Perform a preliminaryassessment of the operating efficiency of the entity's internal controlactivities. |

B. Obtain a general understanding of the entity's organization, its operating characteristics, and its products or services. |

|

|

Which of the following would be used on a reviewengagement? A. Examination of boardminutes.B. Confirmation of cashand accounts receivable.C. Comparison ofcurrent-year to prior-year account balances. D. Recalculation ofdepreciation expense. |

C. Comparison of current-year to prior-year account balances. |

|

|

Which of the following is correct concerningfinancial statements prepared in the United States for use in anothercountry? A. The auditor mustfollow GAAP of both the United States and of the other country. B. The type of auditreport issued depends upon whether it is for use primarily outside the UnitedStates. C. The audit must onlyfollow US GAAP.D. Auditors from theother country must be involved with the audit to assure adequate performance ofthat country's standards. |

B. The type of audit report issued depends upon whether it is for use primarily outside the United States. |

|

|

For a CPA, a client imposed scope limitationduring a review of financial statements is most likely to result in: A. Resignation fromthe engagement.B. Issuance of adisclaimer of opinion.C. Issuance of anadverse opinion. D. Only an explanatoryparagraph added to report, with no change in the assurance provided. |

A. Resignation from the engagement. |

|

|

Interim information of public companies: A. Must be ascomprehensive as that filed annually with the Securities and ExchangeCommission. B. Must be reviewed byCPAs before it is filed with the Securities and Exchange Commission.C. Must be reviewedcontinuously by CPAs using continuous auditing techniques.D. Requires noaccountant association until it becomes a part of the companies' annualfinancial information. |

B. Must be reviewed by CPAs before it is filed with the Securities and Exchange Commission. |

|

|

In which of the following types of reports dothe auditors express negative assurance? A. Letters forunderwriters. B. Reports on audits offinancial statements on a basis other than generally accepted accountingprinciples. C. Reports on audits ofspecified accounts.D. Reports on summaryfinancial statements. |

A. Letters for underwriters. |

|

|

An assertion that is particularly difficult toaudit with respect to personal financial statements is: A. Existence. B. Rights. C. Completeness. D. Legality. |

C. Completeness. |

|

|

In which of the following types of reports doaccountants provide no explicit assurance? A. Compilations. B. Reviews. C. Examinations. D. Audits. |

A. Compilations. |

|

|

Which of the following types of services is mostlikely to result in a report whose use is restricted to specifiedparties? A. Compilations. B. Reviews. C. Agreed-uponprocedures. D. Audits. |

C. Agreed-upon procedures. |

|

|

Which of the following does not result in amodification of a compilation report? A. A lack ofindependence on the part of the auditors. B. A departure fromgenerally accepted accounting principles. C. A lack of adequatedisclosure in the financial statements. D. A lack ofconsistent application of generally accepted accounting principles. |

D. A lack of consistent application of generally accepted accounting principles. |

|

|

A practitioner's report on agreed-uponprocedures that is in the form of procedures and findings should contain: A. Negative assurancethat the procedures did notnecessarily disclose all reportable conditions. B. An acknowledgment ofthe practitioner's responsibility for the sufficiency of the procedures. C. A statement ofrestrictions on the use of the report. D. A disclaimer ofopinion on the entity's financial statements. |

C. A statement of restrictions on the use of the report. |

|

|

Which of the following statements is correctwith respect to an audit report issued for financial statements to be usedprimarily outside of the United States? A. The report shouldfollow the U.S. format, modified as appropriate. B. The report shouldfollow the format of the other country. C. The report mayfollow either the U.S. format, modified as appropriate, or may follow theformat of the other country. D. The report shouldfollow the attestation examination report format. |

C. The report may follow either the U.S. format, modified as appropriate, or may follow the format of the other country. |

|

|

A "comfort letter" to an investmentbanking firm will normally not: A. Express negativeassurance. B. Be included with theregistration statement for the securities. C. Include the CPA'sopinion as to whether the audited financial statements comply in all materialrespects with applicable requirements of the related securities acts.D. Include a statementas to the auditors' independence. |

B. Be included with the registration statement for the securities. |

|

|

When the auditors have performed an audit andare asked to report on the client's compliance with aspects of contractualagreements, which of the following is correct? A. They may do so andprovide reasonable assurance as to compliance. B. They may do so andprovide negative assurance as to compliance. C. They only may do sowhen details of the contracts have been audited. D. They may not do so. |

B. They may do so and provide negative assurance as to compliance. |

|

|

Which of the following is accurate relating toaudit reports on tax basis financial statements? A. No emphasis of matterparagraph is included in the audit report. B. Use of the reportneed not be restricted.C. The purpose of thefinancial statements should be described in the audit report.D. Only reports withmodified opinions are appropriate.an> |

B. Use of the report need not be restricted. |

|

|

Which of the following requires modification ofa review report? A. A change inaccounting principles. B. A substantial doubtabout a company's ability to continue as a going concern. C. A departure fromgenerally accepted accounting principles. D. A change in anaccounting estimate. |

C. A departure from generally accepted accounting principles. |

|

|

Which of the following is correct when a companyis issuing summary financial statements developed from audited financialstatements? A. Such summarystatements should always have a CPA's report associated with them when auditedfinancial statements exist.B. The CPA may issue areport on whether the summary information is fairly stated in all materialrespects in relation to the basic financial statements. C. The CPA shouldperform a compilation and review of the summary financial statements.D. The CPA who hasaudited the financial statements who is asked to report on the summarystatements should decline the engagement because the summary statements do notinclude all disclosures necessary under generally accepted accountingprinciples. |

B. The CPA may issue a report on whether the summary information is fairly stated in all material respects in relation to the basic financial statements. |

|

|

Financial statements that are developed from andsummarize the overall information presented in audited financial statements arereferred to as: A. Agreed-upon procedurefinancial statements.B. Compiled financialstatements. C. Summary financialstatements. D. Reviewed financialstatements. |

C. Summary financial statements. |

|

|

Which of the following is not an example of financial statements thatuse a special purpose financial reporting framework? A. Of a partnershipwhich follows accounting practices used to file its tax return.B. Prepared for limitedpurposes such as relating to a contract a company has entered into. C. Of an organizationthat has limited the scope of the auditor's examination. D. Of an organizationthat follows procedures of a regulatory agency that oversees the company andits operations. |

C. Of an organization that has limited the scope of the auditor's examination. |

|

|

Whenever a report filed on a printed formdesigned by authorities, call upon the independent auditors to make anassertion that the auditors believe is not justified, the auditors should: A. Submit a short-formreport with explanations. B. Reword the form orattach a separate report. C. Submit the form withquestionable items clearly omitted. D. Withdraw from theengagement. |

B. Reword the form or attach a separate report. |

|

|

During a review of the financial statements of anon-public entity, the CPA finds that the financial statements contain amaterial departure from generally accepted accounting principles. If managementrefuses to correct the financial statement presentations, the CPA should: A. Disclose thedeparture in a separate paragraph of the report. B. Issue an adverseopinion. C. Attach a noteexplaining the effects of the departure. D. Issue a compilationreport.p |

A. Disclose the departure in a separate paragraph of the report. |

|

|

The accountants' compilation report should bedated as of the date of: A. Completion offieldwork. B. Completion of thecompilation. C. Transmittal of thecompilation report. D. The latest subsequentevent referred to in the notes to the financial statements. |

B. Completion of the compilation. |

|

|

A modification of the CPA's report on a reviewof the interim financial statements of a publicly-held company would benecessitated by which of the following? A. An uncertainty. B. Lack of consistency. C. Reference to anotheraccountant.D. Inadequatedisclosure. |

D. Inadequate disclosure. |

|

|

A CPA should not normally refer to which one of thefollowing subjects in a "comfort letter" to underwriters? A. The independence ofthe CPA. B. Changes infinancial-statement items during a period subsequent to the date and period ofthe latest financial statements in the registration statement. C. Unaudited financialstatements and schedules in the registration statement.D. Management'sdetermination of line of business classifications. |

D. Management's determination of line of business classifications. |

|

|

Inquiry and analytical procedures ordinarilyperformed during a review of a nonpublic entity's financial statementsinclude: A. Analytical proceduresdesigned to identify reportable conditions related to internal control. B. Inquiriesconcerning actions taken at meetings of the stockholders and the board ofdirectors. C. Analytical proceduresdesigned to test the accounting records by obtaining corroborating evidentialmatter. D. Inquiries ofknowledgeable outside parties such as the client's attorneys and bankers. |

B. Inquiries concerning actions taken at meetings of the stockholders and the board of directors. |

|

|

Which of the following would not be included in aCPA's report based upon a review of the financial statements of a nonpublicentity? A. A statement thatthe review was in accordance with generally accepted auditing standards. B. A statement that allinformation included in the financial statements are the representations ofmanagement. C. A statementdescribing the nature of the procedures performed. D. A statementdescribing the auditor's conclusions based upon the results of the review. |

A. A statement that the review was in accordance with generally accepted auditing standards. |

|

|

The objective of a review of interim financialinformation is to provide the accountant with a basis for reportingwhether: A. A reasonable basisexists for expressing an updated opinion regarding the financial statementsthat were previously audited.B. Materialmodifications should be made to conform with generally accepted accountingprinciples. C. The financialstatements are presented fairly in accordance with standards of interimreporting. D. The financialstatements are presented fairly in accordance with generally acceptedaccounting principles. |

B. Material modifications should be made to conform with generally accepted accounting principles. |

|

|

If the auditor believes that financialstatements prepared on the entity's income tax basis are not suitably titled,the auditor should: A. Issue a disclaimer ofopinion. B. Explain in the notesto the financial statements the terminology used. C. Issue a compilationreport. D. Modify theauditor's report to disclose any reservations. |

D. Modify the auditor's report to disclose any reservations. |

|

|

An auditor's report on financial statementsprepared in accordance with a special purpose financial reporting framework ofaccounting other than generally accepted accounting principles should includeall of the following except: A. Reference to the noteto the financial statements that describes the basis of preparation of thefinancial statements.B. Disclosure that theaudit was performed in accordance with generally accepted auditing standards. C. An opinion as towhether the basis of accounting used is appropriate under the circumstances. D. An opinion as towhether the financial statements are presented fairly in conformity with thebasis of accounting described. |

C. An opinion as to whether the basis of accounting used is appropriate under the circumstances. |

|

|

When an auditor reports on financial statementsprepared on an entity's income tax basis, the auditor's report should: A. Disclose that theincome tax basis is a basis of accounting other than generally acceptedaccounting principles. B. Disclaim an opinionon whether the statements were examined in accordance with generally acceptedauditing standards. C. Not express anopinion on whether the statements are presented in conformity with the basis ofaccounting used. D. Include anexplanation of how the results of operations differ from the cash receipts anddisbursements basis of accounting. |

A. Disclose that the income tax basis is a basis of accounting other than generally accepted accounting principles. |

|

|

An auditor's report would be designated as areport on financial statements following a special purpose financial reportingframework for financial statements when they are: A. For an interim periodand are subjected to a review. B. Unaudited and areprepared from a client's accounting records. C. Prepared inaccordance with a regulatory basis of accounting other than generally acceptedaccounting principles. D. Purported to be inaccordance with generally accepted accounting principles but do not include apresentation of the statement of cash flows. |

C. Prepared in accordance with a regulatory basis of accounting other than generally accepted accounting principles. |

|

|

The underwriter of a securities offering mayrequest that an auditor perform specified procedures and supply certainassurances concerning unaudited information contained in a registrationstatement. The auditor's response to such a request is commonly called a: A. Report under federalsecurity statutes.B. Comfort letter. C. Review of interimfinancial information.D. Compilation reportfor underwriters. |

B. Comfort letter. |

|

|

Comfort letters are ordinarily signed bythe: A. Client. B. Client's lawyer. C. Independentauditor. D. Internal auditor. |

C. Independent auditor. |

|

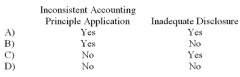

Which of the following circumstances requiresmodification of the accountant's report on a review of interim financialinformation of publicly held entity? |

C |

|

|

If compiled financial statements presentedin conformity with the cash receipts and disbursements basis of accounting do not disclose thebasis of accounting used, the accountant should: A. Disclose the basis inthe notes to the financial statements. B. Clearly label eachpage "Unaudited."C. Disclose the basisof accounting in the accountant's report. D. Recompile thefinancial statements using generally accepted accounting principles. |

C. Disclose the basis of accounting in the accountant's report. |

|

|

An auditor is reporting on cash basis financialstatements. These statements are best referred to in his opinion by which ofthe following descriptions? A. Financial positionand results of operation arising from cash transactions. B. Assets andliabilities arising from cash transactions, and revenue collected and expensespaid. C. Balance sheet andincome statement resulting from cash transactions. D. Cash balance sheetand the source and application of funds. |

B. Assets and liabilities arising from cash transactions, and revenue collected and expenses paid. |

|

|

Which of the following should not be included in anaccountant's standard report based upon the compilation of an entity'sfinancial statements? A. A statement that acompilation is limited to presenting in the form of financial statementsinformation that is the representation of management. B. A statement that thecompilation was performed in accordance with standards established by theAmerican Institute of CPAs.C. A statement that theaccountant has not audited or reviewed the financial statements.D. A statement thatthe accountant does not express an opinion but expresses only limited assuranceon the financial statements. |

D. A statement that the accountant does not express an opinion but expresses only limited assurance on the financial statements. |

|

|

Each page of the financial statements compiledby an accountant should include a reference such as: A. See accompanyingaccountant's notes.B. Unaudited, seeaccountant's disclaimer. C. See accountant'scompilation report.D. Subject tocompilation restrictions. |

C. See accountant's compilation report. |

|

|

During a review of the financial statements of anonpublic entity, the CPA finds that the financial statements contain amaterial departure from generally accepted accounting principles. If managementrefuses to correct the financial statement presentations, the CPA should: A. Disclose thedeparture in a separate paragraph of the report. B. Issue an adverseopinion. C. Attach a noteexplaining the effects of the departure. D. Issue a compilationreport. |

A. Disclose the departure in a separate paragraph of the report. |

|

|

Which of the following is an auditor least likely to inquire about whenperforming a review of a nonpublic company? A. Significanttransactions near the end of the period. B. Communications withregulatory agencies.C. That financialstatements are prepared in conformity with a special basis of accounting.D. Questions that havearisen in applying review procedures. |

C. That financial statements are prepared in conformity with a special basis of accounting. |

|

|

When performing a review of a nonpublic company,the auditors must obtain in a representation letter acknowledgement ofmanagement for its responsibility for each of the following except: A. Responsibility foridentifying illegal acts committed by employees. B. Responsibility forthe financial statements conforming with generally accepted accountingprinciples. C. Responsibility toprevent and detect fraud.D. Knowledge of anyactual or suspected fraud that is material. |

A. Responsibility for identifying illegal acts committed by employees. |