![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

172 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

The six steps in the Financial Planning Process are:

|

1.Establishing the client-planner relationship

2.Gather client data and determine clients goals and objectives 3.Analyze Information and determine clients financial status 4.Developing and presenting the financial plan 5.Implementing the financial plan 6.Monitoring the financial plan -EGADIM (Every Good Analysis Does Include Measuring) |

EGADIM

|

|

|

The 7 Principles of Ethics and Prosessional Responsibility

|

Principle 1 Integrity

Principle 2 Objectivity Principle 3 Competence Principle 4 Fairness Principle 5 Confidentiality Principle 6 Professionalism Principle 7 Diligence |

IOCFCPD

|

|

|

What things are found on a balance sheet?

|

Assets and liabilities at FMV (Full market value) / Net Worth

|

|

|

|

What are the three types of assets in the Balance Sheet?

|

1. Cash

2. Invested Assets 3. Personal Use Assets (residence, furniture) |

|

|

|

What are the two catagories of liabilities listed in LIABILITIES on Balance Sheet

|

"1. Current Liabilities (credit card balances)

2. Long-term liabilities (auto loans, mortgages) |

|

|

|

What are examples of things that increase / decrease Net Worth on balance sheet?

|

INCREASE

Shares of S&P 500 Index fund increse in value with market DECREASE Interest rates have a substatial increase and the client has a big bond portfolio |

|

|

|

What are examples events which have NO impact (increase or decrease) of Net Worth?

|

"1. Paying off debt with cash (repayment of a loan using funds from a savings account)

2. Buying an asset with cash (purchase of an auto 75% financed and 25% down payment - addition of auto increases assets - 25% / down payment decreases cash - 75% / financing increases liabilities - again a wash" |

|

|

|

To determine if A / L should be on balance sheet it should have 3 characteristics:

|

1. A/L fixed and determinable amount

2. Receipt or payment NOT contigent on occurence of particular event 3. Receipt or payment does NOT require future performance or service |

|

|

|

Be familiar with examples of liquidity (in order of liquidity)

|

1. Mutual Funds

2. Cash value life insurance 3. Real Estate residence 4. Jewelry keep in mind what kind of primary and secondary markets exist for each asset listed |

|

|

|

Statement of Financial Condition (Balance Sheet).

Use specific date or range? |

Specific Date At OR As of December 31 2005 NOT Period beginning / ending Dec. 31

|

|

|

|

Cash Flow statement: Specific date OR ranges?

|

Ranges Cash Flows are snapshots of ranges such as year or quarter

|

|

|

|

What are INFLOWS on Cash Flow Statements

|

1. Gross Salaries

2. Interest Income 3. Dividend Income 4. Rental Income 5. Refunds due (Tax) 6. Other incoming tax flows 7. Alimony recieved |

|

|

|

What are OUTFLOWS on a Cash Flow Statement

|

1. Savings & Investment - by item

2. Fixed outflows (non-discretionary) 3. Fixed outflows (discretionary) 4. Variable outflows (non-discretionary) 5. Variable outflows (discretionary) |

|

|

|

EXAMPLES of Fixed Non-discretionary outflows

|

House payments Auto payments Taxes

|

|

|

|

EXAMPLES of Fixed discretionary outflows

|

Club dues Utilities

|

|

|

|

EXAMPLES of Variable Non-discretionary outflows

|

Food

|

|

|

|

EXAMPLES of variable discretionary outflows

|

Vacations Entertainment

|

|

|

|

Inflows - Outflows =

|

Net Discretionary Cash Flow

|

|

|

|

What does a Pro forma statement do?

|

It forecasts future balance sheets and cash flow statements

|

|

|

|

Budget: Adjustable or firm?

|

A budget should be adjusted monthly

|

|

|

|

Important consideration in preparing a budget is:

|

Inflation

|

|

|

|

Individuals close to retirement use budgeting to figure what out?

|

The best wage replacement ratio for retirement

|

|

|

|

Consumer Debt Ratio

|

Consumer debt (credit cards auto loans and the like) should not exceed 20% of net income (gross income - taxes)

|

|

|

|

Housing Payment Ratio

|

Monthly payments on a home (PI

|

|

|

|

Total Payment Ratio

|

The total monthly payments on all debts should be no more than 38% of gross montly income

|

38%

|

|

|

Renters expense - less than?

|

30% of gross monthly income

|

30%

|

|

|

Savings and Investment should equal at least:

|

5% to 10% of gross income

(not including reinvested dividend and income) |

|

|

|

Bankruptcy - Chapter 11

|

Allowed to reorganize

Debtor remains in possession of assets subject to oversight of court |

|

|

|

Bankruptcy - Chapter 13

|

Allowed to set up repayment plan

Allowed to hold on to property as long as making regular payments file for 13 if faced with foreclosure debts that cannot be discharged through chapter 7 can be done through 13 |

|

|

|

Bankruptcy - Chapter 7

|

It has to do with liquidation (voluntary or involuntary)

It extinguishes debtors and is responsible for DISCHARGING debt |

|

|

|

What kind of debt is NOT dischargable through Chapter 7 bankruptcy?

|

1. Back taxes (3 years)

2. Those based on fraud 3. Alimony & Child support 4. Student loans |

|

|

|

Supreme Court ruled recently that creditors cannot take what kind of asset from debtors in bankruptcy?

|

Retirement plan assets

|

|

|

|

Lifetime Learning credit allows how much of a credit per return?

|

up to $2,000

(20% of first $10,000 of qualified tuition expense) |

|

|

|

The Lifetime Learning credit is avaliable for what level of education?

|

It is available for all years of postsecondary education and for courses to acquire or improve job skills

|

|

|

|

The Lifetime Learning Credit is avaliable for how many years?

|

Unlimited

|

|

|

|

The Lifetime Learning Credit qualified expenses include tuition. What is not qualified?

|

Books and supplies do not qualify unless it is a condition of enrollment

|

|

|

|

What is the maximum credit available under the HOPE credit?

|

Up to $1,650 credit per eligible student

|

|

|

|

How long can the HOPE Credit be taken? (2006)

|

1st & 2nd year of undergraduate studies

(Must be enrolled at least part-time) |

|

|

|

Coverdell (ESAs) must be withdrawn by what age?

|

30

|

|

|

|

Coverdell (ESAs) maximum contribution amount?

|

$2,000

(on a per beneficiary basis, NOT account) |

|

|

|

Savings Bonds interest is exempt from what, if used for qualified education costs in same year cashed in?

|

FEDERAL TAX

The interest is always excempt from State Tax |

|

|

|

Quanitative Data

|

The data tells you where the client is and what it will take to get him where he wants to go. It is a fact finding interview

|

|

|

|

Qualatative Data

|

The data tells you why the client wants to reach the goal. It is found using a goals and objectives interview

Emergency Fund Planning: It is the marketability and the ease with which an asset may be bought or sold |

|

|

|

Emergency Fund Planning:

Liquidity |

It is the ease with which assets can be converted into cash with little risk to the principle

|

|

|

|

Emergency Fund Planning:Real Estate

Is it liquid? Is it marketable? |

1) Considered illiquid because it may take a while to sell and asking price need to be lowered

2) Marketable because it is relatively easy to sell a house if priced below market value |

|

|

|

Emergency Fund Planning: Adequacy of reserves -

One-income family? Two-income family? |

One-income family - 6 months

Two-income family - 3 months |

|

|

|

What are the four life cycle phases?

|

1) Accumulation

2) Consolidation 3) Spending 4) Gifting (may mirror spending phase) |

|

|

|

Pell Grants

|

1) given on basis of financial need

2) maximum of $3750 (undergrads only) |

|

|

|

Federal Supplemental Education Opportunity Grants (FSEOGs)

|

1) given on basis of financial need

2) max amount $4,000 |

|

|

|

Perkins Loans

|

1) funded by Feds administered by schools

2) limit $4000 undergrads 3) limit $6000 grads 4) 5% w/ 9 mo grace period |

|

|

|

College Sure CD

|

1) Gauranteed to keep up with cost of college

2) Minimum 4% 3) if scholarship, parents recieve their money back |

|

|

|

Education Savings:

Ownership of assets - Financial Aid What is the methodology for the formula known as Expected Family Contribution (EFC)? |

Parents

- as much as 47% of income - only 5.6% of assets Students - 35% of assets |

|

|

|

Section 2503(c) Minors Trust

|

*Allows the transferred trust property to be treated as if it were a gift of present interest to child

|

|

|

|

Why is a 2503(c) Minors Trust used?

|

* Grantors income tax bracket is high and recipients tax bracket is low

* Grantor doesnt want an appreciated asset included in his gross estate |

|

|

|

How is 2503(c) taxed?

|

If income is distributed every year

- tax to recipientIf income accumulates - taxed to the trust |

|

|

|

Opportunity cost

|

the cost of foregone income that results from making an economic decision to purchase a piece of equipment

|

|

|

|

Margin cost

|

the cost to produce one more unit of product

|

|

|

|

Variable cost

|

It is a fluctuating cost

|

|

|

|

Fixed costs

|

costs that do not change as a result of producing additional units (e.g. rent)

|

|

|

|

Cost of Capital

|

It is the internal measure of the cost to the company for borrowing from stockholders or outside creditors

|

|

|

|

Law of demand

|

the lower the price the more consumers will buy

|

|

|

|

LAW OF DEMAND

As the price of a product increases what happens |

Consumer will be able to find more substitutes and will be more responsive to price when more viable substitutions are avaliable

|

|

|

|

LAW OF DEMAND

What is the difference between the change in Demand vs. the change in Quantity Demanded? |

The change in demand is a shift in the entire demand curve

The change in the quantity demanded is a movement along the same demand curve in response to the change in price |

|

|

|

LAW OF DEMAND

What are examples of Change in Demand? (shift in curve) |

Changes in:

consumer income consumer expectations demographic changes consumer taste and preferences Dependant upon the number of consumers in a market |

|

|

|

LAW OF DEMAND

What are examples of Change in quantity demanded (movement along demand curve)? |

Gasoline consumption increases as taxes on gasoline is lowered

|

|

|

|

Law of Supply

|

The higher the price the more producers will produce

|

|

|

|

LAW OF SUPPLY

Elasticity is... |

...when the demand for a product is greatly influenced by the economy and price(think of rubber band)

|

|

|

|

LAW OF SUPPLY

Inelasticity is... |

...when the economy and price has little effect on the demand for a product.

(Ex. food, medicine, tobacco) |

|

|

|

"LAW OF SUPPLY

Factors that SHIFT the supply curve include: |

(a) Changes in resource prices

(b) Changes in technology (c) Natural disasters (d) other disruptive events |

|

|

|

LAW OF SUPPLY

An inferior good will have: |

negative income elasticity

(as income increases the quantity demanded will decrease) |

|

|

|

LAW OF SUPPLYA normal good will have:

|

positive income elasticity

(as income increases the quantity demanded will increase) |

|

|

|

Price controls

|

Price controls are the attempt to adjust the balance between supply and demand

|

|

|

|

Market price

|

In an arms length transaction, it is the amount that a buyer is willing to pay for an item and a seller is willing to sell the item.

|

|

|

|

Supply-side economics

|

a belief that offering incentives to produce can accomplish stated results

|

|

|

|

Monetary Policy

|

The Federal Reserve Bank (Fed) controls the supply of money enabling it to significantly impact interest rates

|

|

|

|

Who controls Monetary policy?

|

The Federal Reserve (Fed)

|

|

|

|

MONETARY POLICY

Easy Monetary Policy |

The Fed will follow a loosen or ease

|

|

|

|

MONETARY POLICY

Tight Monetary Policy |

In times of inflation and when its wants to contrict the supply of moneythe Fed will follow a tight monetary policy

|

|

|

|

MONETARY POLICY

The Fed has 3 methods of controlling the money supply: |

(1) Reserve Requirements

(2) Reserve Discount Rate (3) Open Market Operations |

|

|

|

MONETARY POLICY

Reserve Requirements: |

Minimum amount that a bank is allowed to have in its reserves

The reserves have been remained at 10% since 1992 |

|

|

|

MONETARY POLICY

Open Market operation: |

Buys and sells government securities

|

|

|

|

MONETARY POLICY

Reserve discount rate: |

Adjusts discount rate which is the interest rate chanrged to member banks when they borrow money from the FED

|

|

|

|

MONETARY POLICY

Prime Rate |

THE FED DOES NOT USE PRIME RATE TO CONTROL THE MONEY SUPPLY

|

|

|

|

MONETARY POLICYEASY OR TIGHT?

Reserve Requirements: |

Easy money

- when this ratio is lowered mony supplies increase Tight - when this ratio increases money supplies shrink |

|

|

|

MONETARY POLICYEASY OR TIGHT?

Open Market Operations: |

Easy money

- Buy Treasuries (more $ supply to street) Tight - Sell Treasuries (less $ supply to street) |

|

|

|

MONETARY POLICYEASY OR TIGHT?

Reserve discount rate |

Easy

- lower rate Tight - raise rate |

|

|

|

Fiscal Policy

|

It is the influence on the economy by Federal Government through raises and lowering government spending and taxes

|

|

|

|

FISCAL POLICY

Expansionary fiscal policy = |

Increase spending and lower taxes = Increased GDP and price levels

|

|

|

|

FISCAL POLICY

Restrictive fiscal policy = |

Decrease spending and raise taxes = Lower GDP and price levels

|

|

|

|

FISCAL POLICY

Deficit spending |

occurs when expenditures exceed revenues of the govt.

|

|

|

|

FISCAL POLICY

Effects of deficit spending: |

by selling securities to the public to finance deficits

Treasuries compete with other securities (drives prices down - decrease in price causes yields to rise) |

|

|

|

SUPPLY OF MONEY M-1

|

1) currency in circulation

2) checkable deposits 3) Traveler's checks |

|

|

|

SUPPLY OF MONEY M-2

|

1) includes everything in M-1

2) plus savings deposits 3) plus time deposits less than $100k 4) plus money market mutual fund shares |

|

|

|

SUPPLY OF MONEY

What happens if individuals shift money from savings accounts to checking accounts? |

money supply is increase to narrow M-1 but unaffected under more braod M-2

|

|

|

|

The National Bureau of Economic Research (NBER) tablulates a series of economic indicators. The 10 leading indicators are

|

1) Stock prices (S&P 500)

2) Average weekly work hours 3) Average unemployment claims 4) Manafacturers new consumer goods orders 5) Manafacturers new orders for non-defense capital goods 6) Vendor performance (companies recieving slower deliveries) 7) New building permits 8) Interest rate spread (difference between the 10yr Treasury and Fed Funds rate) 9) Inflation-adjusted M-210) Consumer expectations from Univ of Mich |

|

|

|

BUSINESS CYCLE THEORIES

Peak: |

1) accompanied by increased rate of inflation

2) results in a period of rising unemployment 3) declining naitonal output |

|

|

|

BUSINESS CYCLE THEORIES

Recession: |

period when Real GDP decliens for two more more successive quarters

|

|

|

|

BUSINESS CYCLE THEORIES

Depression: |

Depression is a prolonged and very severe recession

|

|

|

|

BUSINESS CYCLE THEORIES

What is the most common means of measuring economic activity |

GDP

|

|

|

|

BUSINESS CYCLE THEORIES

What do most economists use to determine the phase of the business cycle? |

unemployment rate

|

|

|

|

CPI (Consumer Price Index)

|

The Bureau of Labor Statistics measures the cost of a basket of goods and services over time

|

|

|

|

PPI (Producers Price Index)

|

The US Dept of Labor measures wholesale cost of goods over a period of time

|

|

|

|

Disinflation

|

It is manifested when the rate of inflation decreases; prices are still rising but at a slower pace

|

|

|

|

Recession

|

Real GDP declines for more than two successive quarters

|

|

|

|

What will the Fed do to try to get economy out of recession?

|

Put more money into circulation and expand the supply of credit

|

|

|

|

What will Federal Government do to get economy out of a recession?

|

Expansionary policy = increased spending - lower taxes

|

|

|

|

What kind of assets should one obtain during inflationary times?

|

AVOID

- interest-sensitive securities and long-term debt instruments ACQUIRE - short term instruments (US Treas) / common stocks of firms with real assets (oil, metals, etc.) |

|

|

|

What kind of assets should one obtain during inflationary times?

|

AVOID

- tangible asset prices will decline (real estate, collectibles, and precious metals) |

|

|

|

The Yield Curve

|

Is a graph showing the relationship between term to maturity and yield to maturity(relationship between interest rates and time)

|

|

|

|

BUSINESS ORGANIZATIONS

Sole Proprietorship |

Business owned by an individual who is personally liable for the obligations of the business

|

|

|

|

BUSINESS ORGANIZATIONS

Sole Proprietors:Special forms needed to start SP / special tax forms to file? |

No special forms to file.

Files a Schedule C with tax forms |

|

|

|

BUSINESS ORGANIZATIONS

General Partnership - Liabilities(tort brought) |

If a tort is brought against the partnership all partners are jointly and severally liable

|

|

|

|

BUSINESS ORGANIZATIONS

General Partnership - Pay of GP's |

Not entitled to Salary - entitled to a share in the profits

|

|

|

|

BUSINESS ORGANIZATIONS

General Partnership - GP's commings and goings: |

"nanimous consent of all partners for admission

Partnership dissolved if: Partner dies Goes into bankrupt Dissolved by a termination provision |

|

|

|

BUSINESS ORGANIZATIONS

General Partnership - Tax forms required: |

For 1065 to establish Schedule K-1 for each partner yearly

|

|

|

|

BUSINESS ORGANIZATIONS

Limited Partnership - How is it organized: |

One GP and at least one other LP

|

|

|

|

BUSINESS ORGANIZATIONS

Limited Partnership - What is role of LP? (3) |

1) Cannot participate in managing business

2) no authority to bind business 3) cannot use last name in name of partnership |

|

|

|

BUSINESS ORGANIZATIONS

Limited Liability Partnership - (LLP) |

1) usually professional partnership (CPA, atty)

2) partners limited liability except personally to malpractice |

|

|

|

BUSINESS ORGANIZATIONS

Limited Liability Company - (LLC) |

1) owners (members) have limited liabilities for debts and claims of business even while participating in mgmt.

2) some states prohibit single member LLCs |

|

|

|

BUSINESS ORGANIZATIONS

Limited Liability Company - (LLC) - LLCs can be taxed as any of the following: |

1) Sole Prop

2) Partnership 3) S Corp 4) C Corp |

|

|

|

BUSINESS ORGANIZATIONS

C Corp may be required to pay one of the following taxes in addition to regular federal income tax: |

1) Personal holding company tax

2) Accumulated earnings tax |

|

|

|

BUSINESS ORGANIZATIONS

S Corporation - Definition: |

Corporation with LESS THAN or EQUAL TO 100 shareholders

1) All individuals (US no aliens) 2)Certain estates or trusts 3)NO partnerships or corporations as shareholders 4) no more than one class of stock |

|

|

|

BUSINESS ORGANIZATIONS

S Corporation - Taxation: |

1) IRS treats shareholders as partners

2) pro rata shares / flow through 3) avoid double taxation |

|

|

|

BUSINESS ORGANIZATIONS

Professional Corporation (PC)Definition: |

1)Similar to commercial corperation - ownership is restricted to members of a certain profession

2) Continuity beyond death - trasnferred shares or bought up by PC |

|

|

|

BUSINESS ORGANIZATIONS

Professional Corporation (PC)Liability? |

Big advantage is that all members retain limited liability for own actions as well as for those of people directly under their supervision

|

|

|

|

SELECTION OF BUSINESS

When to use Sole Prop: |

1) Single owner in state that does not permit single member LLC

2) when adequate liability insurance is avaliable at acceptable cost 3) owner not concerned with transferring future interests |

|

|

|

SELECTION OF BUSINESS

When to use GP: |

1) in start-up losses can be passed through to partners without being restrictions of C Corp. Income gain

|

|

|

|

Federal Truth-In-Lending Act (Consumer Credit Protection Act) is administered by:

|

The Federal Reserve board, Fair Credit Billing Act ammends what older Act?

|

|

|

|

The Truth-In-Lending Act

|

Equal Credit Opportunity Act:

Prohibits discrimination based upon: 1) race 2) religion 3) national origin 4) color5) sex 6) marital status 7) age 8) receipt of certain types of income |

|

|

|

Investment Advisers Act of 1940

|

Easy as "A-B-C"

Requires registration with SEC if: A) Advice B) in the Business C) Compensation |

|

|

|

ALL ELEMENTS MUST BE PRESENT

Investment Advisers Act of 1940 (EXCEPTIONS) |

1) Bank or holding company that is not investment comp.

2) lawyer, accountant |

|

|

|

Registered Investment Advisors (RIAs) Obligations:

|

1) Disclose conf of interest

2) Fiduciary status 3) Performance fees only if managing $750k of clients assets or NW over $1.5 Million 4) Brochure rule (deliver 48 hrs)DO NOT USE INITIALS RIA |

|

|

|

Insider Trading & Securities Fraud Enforcement Act of 1988

|

Amended Advisers Act of 1940

1) prevents misuse of material 2) non-public information by reg IA or anyone associated with him |

|

|

|

NASD Rules of Fair Practice

|

Prohibits registered rep from engaging in a private securities transaction (can't sell away for compensation)

|

|

|

|

National Association of Securities Dealers (NASD)

|

1) NOT ASSOCIATED WITH SEC

2) Started by securities industry in attempt to regulate self 3) anyone selling stocks and bonds |

|

|

|

Consumer Credit Protection Act

|

1) must give "true" rate - APR

2) max liability for stolen CC - $50 3) 3 day right of recission |

|

|

|

Kiddie Tax

|

earned income in excess of $1,700 per year (2006) of a child under 14 is taxable at parents top rate

|

|

|

|

GDP =

|

GDP = C + I + G + Xn

C = Consumption I = Investment G = Govt Spending Xn = Net exports (Exports - Imports) |

|

|

|

Definition of GDP

|

the total MARKET VALUE of all FINAL goods and services PRODUCED in an economy in one year

|

|

|

|

Securities Act of 1933

|

Primarily concerned with new issues of securities (IPOs)Also prospectus

|

|

|

|

Securities Act of 1934

|

Establishment of SEC

|

|

|

|

Glass-Stegall Act (1933)

|

prohibited commercial banks from acting as investment bankers

|

|

|

|

Gramm-Leach-Bliley Act (1999)

|

Repealed most of Glass-Stegall

|

|

|

|

What are the two most important steps in the financial planning process?

|

2) Gathering the client data

3) Analyzing the data and determining the client's financial status |

|

|

|

What does the term "client" denote?

|

A client denotes a person, persons, or entity who engages a practitioner and for whom professional services are rendered.

|

|

|

|

When is a "practitioner" engaged?

|

A practitioner is engaged when an individual, on the basis of the relevant facts and circumstances, reasonably relies on information or a service profivided by the practitioner.

|

|

|

|

When does a financial planning engagement exist?

|

A financial planning engagement exists when a client, on the basis of the relevant facts and circumbstances, reasonably relies on information or services provided by a CFP board designee using the financial planning process.

|

|

|

|

What does "financial planning" denote?

|

Personal financial planning or financial planning denotes the process of determining whether and how and individual can meet life goals through the proper management of financial resources.

|

|

|

|

What are the only ways the Certified Financial Planner Board of Standards, Inc. allow the certification marks to be used?

|

Furthermore, the term CFP may only be used as an adjective and NOT as a noun, for fear of making the term generic.

|

|

|

|

What is Quantitative Data?

|

Quantitative data (or objective data) are those data that are measurable or conveyed as a quantity.

Ex. - assets, liabilities, copies of wills or trusts, list of current investments, etc. |

|

|

|

What is qualitative data?

|

Qualitative data (or subjective data) are those data that are concerned with the quality of a clien't life.

Ex. - financial goals and objectives, health status, and client's risk tolerance |

|

|

|

What are the three stages of the Life Cycle?

|

1)Asset accumulation stage (up to age 45)

2)Conservation or protection stage (ages 45 to 60) 3)Distribution or gifting stage (age 60 +) |

|

|

|

What do you have to do if you do not percieve yourself competent in an area?

|

According to Rule 301 of the Code of Ethics and Professional Responsibility, you must seek the cousel of others that are competent.

|

|

|

|

What is the Statement of Financial Position?

|

Also known as a Balance Sheet or a Net Worth Statement, it is a snapshot of the client's net worth based on a specific date.

|

|

|

|

In a balance sheet, how must assets be presented?

|

Assets are always presented at fair market value.

|

|

|

|

What is the definition of fair market value?

|

The IRS defines fair market value as the price that property will bring when offered for sale by a willing seller to a willing buyer, with neither being obliged to buy or sell.

|

|

|

|

How must liabilities be presented on the Statement of Financial Position?

|

Liabilities are always presented at their principal value withour regard to any interest obligation.

|

|

|

|

How are assets and liabilties shown on a properly prepared Statement of Financial Position?

|

The respective TITLING of the assets and liabilities are shown to ensure accuracy for estate planning.

|

|

|

|

Current Liabilties =

|

Liabiltieis that are due in less than one year.

|

|

|

|

What are current assets?

|

Current assets are cash and cash equivalents (investments that mature in less than a year)

|

|

|

|

Equation for the Statement of Financial Position?

|

Assets - Liabilities = Net Worth

|

|

|

|

Categories of assets on the Statement of Financial Position

|

1)Cash/Cash Equivalents

2)Investments 3)Personal Use Property |

|

|

|

What is discretionary cash flow?

|

It is the income remaining for investment purposes after payment of the client's monthly expenses, including tax bill.

|

|

|

|

What does the Cash Flow Statement summarize?

|

It summarizes the items of income that were actually received (cash inflows) and the expenditures actually made (cash outflows) during a specific period of time.

|

|

|

|

That are the three categories of cash flows?

|

1)cash inflows

2)cash outflows 3)cash surplus (discretionary income) |

|

|

|

That are the two types of cash outflows?

|

1)variable (food, clothing, utilities,etc.)

2)fixed (mortgage, insurance, property tax, etc.) |

|

|

|

How are taxes reported on the Cash Flow Statement?

|

Taxes are reported seperately from cash outflows for special emphasis.

|

|

|

|

The effects on the Balance Sheet and Cash Flow Statement when cash is used in a transaction?

|

1)Cash outflows are increased(Cash flow statement);

2)a client's assets are increased(balance sheet); and/or 3)a cleint's liabilities are decreased(balance sheet) |

|

|

|

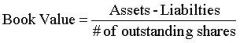

Book Value Formula

|

In other words it is shareholder's equity divided by the number of outstanding shares.

|

|

|

|

What is a pro forma income statement?

|

Similar to a business income statement, except that it reports the future instead of reporting the past.

|

|

|

|

What is the personal cash flow state known as in a business context?

|

The income statement or the profit and loss statement.

|

|

|

|

statement of cash flows

vs. personal cash flow statement |

Statement of cash flows is used by business to reconcile the income statement to changes between two balance sheets.

THEY ARE NOT THE SAME THING |

|