![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

33 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

Vertical Common-Size Income Statement Ratios |

Vertical Common-Size Income Statement Ratios = Income Statement Account÷Sales |

You divide the income statement item by the same number as you do to get: Gross Profit Margin, net profit margin etc. |

|

|

Vertical Common-Size Balance Sheet Ratios |

Vertical Common-Size Balance Sheet Ratios = Balance Sheet Account ÷ Total Assets |

|

|

|

[Define] Activity Ratios |

Measures efficiency of day-to-day tasks/ operations.

|

|

|

|

[Define] Liquidity Ratios |

Measures ability to pay short-term liabilities.

|

|

|

|

[Define] Solvency Ratios |

Measures ability to pay long-term liabilities.

|

|

|

|

[Define] Profitability Ratios |

Provide information on how well the company generates operating profits and net profits from its sales/ asset base.

|

|

|

|

[Define] Valuation Ratios |

Quantity of assets of flow of assets associated with an ownership claim. Examples: Sales per share, earning per share etc. |

|

|

|

Activity Ratios

|

|

|

|

|

Activity Ratios

|

|

|

|

|

Activity Ratios

|

Note: Purchases = ending inventory - beginning inventory + COGS |

|

|

|

Activity Ratios |

Working capital turnover = Revenue ÷ Avg. working capital

|

Measures how effectively a company is using its working capital (A measure of asset utilization) |

|

|

Activity Ratios

|

|

|

|

|

Liquidity Ratios

|

|

1. If the Current ration > 1, paying of liabilities with current assets will increase the current ratio. |

|

|

Liquidity Ratios Defensive Interval Ratio |

Defensive Interval Ratio = (Cash+receivables+short-term marketable securities) ÷ Daily cash expenditure **Measures the number of days of avg. cash expenditure the firm could pay with its current liquid assets. |

|

|

|

Liquidity Ratios Cash Conversion Cycle |

Cash conversion cycle= (Days of sales outstanding) + (days of inventory on hand) - (number of days of payables) **The length of time it takes to turn the firm's cash investment in inventory back into cash. |

|

|

|

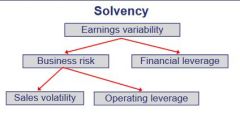

Solvency (graphical representation) |

|

|

|

|

Solvency Ratios

|

**Total debt = Long-term debt+interest bearing short-term debt *Capital= All short-term and long-term debt plus preferred stock & equity |

|

|

|

Solvency Ratios

|

*Uses avg. (even though it's a pure BS ration b/c it's part of the DuPont analysis) **Total debt = Long-term debt+interest bearing short-term debt |

The higher the leverage ratio is the more levered a company is (i.e. the higher the assets are in relation to its equity, the more leverage in its capital structure) |

|

|

Solvency Ratios

|

**EBIT= Earning before interest and tax (proxy for operating income) |

|

|

|

Profitability Ratios

|

*Operating Income = EBIT (proxy). Gross profit = net sales- COGS Net Income= earning after tax but before dividend |

|

|

|

Profitability Ratios

|

*EBT=Earning before tax but after interest |

|

|

|

Profitability Ratios

**Regular and modified |

** use the regular ROA equation if not specified otherwise |

|

|

|

Profitability Ratios

|

|

|

|

|

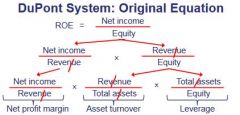

DuPont System: Original Equation (3-stage) |

Breaks ROE down to Net Profit Margin, Asset turnover & Leverage ratio. If ROE is low at least one of the following is true, the company: 1. has poor profit margin 2. has poor asset turnover 3. too little leverage |

|

|

|

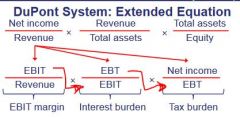

DuPont System: Extended Equation (5-stage) |

Breaks down ROE further by breaking down net profit margin to (1-3). ROE becomes: (1) EBIT Margin, (2) Interest Burden, (3) Tax burden, (4) Asset turnover, (5) Leverage. |

|

|

|

Valuation Ratios (per share)

|

|

2. P/CF - a low ratio indicates an undervalued stock (i.e. a blue stock) 4. P/BV - a higher ratio indicates higher growth (i.e. a growth stock) |

|

|

Per-share quantities

|

|

|

|

|

Per-share quantities

|

|

|

|

|

Dividend related quantities

|

|

1. A high dividend payout ratio indicates a more mature, slow growing company. |

|

|

Business Risk Ratios

|

|

|

|

|

Segments Ratios

|

**EBIT = proxy for profit above |

|

|

|

LONG LIVED ASSETS

|

*PP&E net of acc. depr. |

|

|

|

More long lived asset:

|

|

|