![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

100 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What are the Capital evaluation factors? |

-the level & quality of Capital & the overall financial condition

-the ability of Mngt to address emerging needs for additional Capital

-the nature, trend, & volume of problem assets & the adequacy of the ALLL

-BS composition, nature & amount of intangibles, market risk, concentration risk, & risk associated w/ nontraditional activities

-risk exposure from off-BS activities

-quality & strength of Earnings & the reasonableness of dividends

-prospects & plans for growth, experience in managing growth

-Access to capital mkts & other sources of capital, including support from the parent company |

|

|

|

Capital rating 1 |

Strong Capital level relative to the risk profile strong capital level relative to the institution’s risk profile. |

Strong |

|

|

Capital rating 2 |

Satisfactory Capital level relative to the risk profile satisfactory capital level relative to the financial institution’s risk profile. |

Satisfactory |

|

|

Capital rating 3 |

< satisfactory level of Capital that doesn't fully support the risk profile.

Needs improvement, even if meets minimum regulatory capital ratios less than satisfactory level of capital that does not fully support the institution’s risk profile. The rating indicates a need for improvement, even if the institution’s capital level exceeds minimum regulatory and statutory requirements. |

< satisfactory

Does not fully support

Need for improvement |

|

|

Capital rating 4 |

Deficient level of Capital,

viability of bank may be threatened.

Assistance from shareholders or other external sources of financial support maybe needed deficient level of capital. In light of the institution’s risk profile, viability of the institution may be threatened. Assistance from shareholders or other external sources of financial support may be required |

Deficient Viability Assistance may be required |

|

|

Capital rating 5 |

Critical level of Capital,

viability is threatened,

immediate assistance from SHs or other external sources if financial support is required critically deficient level of capital such that the institution’s viability is threatened. Immediate assistance from shareholders or other external sources of financial support is required. |

Critically deficient Viability threatened Immediate assistance |

|

|

Purpose of Capital |

• Absorbs losses

• Promotes public confidence

• Helps restrict asset growth

• Provides protection to depositors & DIFs |

P—R—A—P

Promotes Restrict Absorbs Protection |

|

|

T1 Capital is the sum of_____+_______ |

Common equity T1 capital + add'l T1capital |

|

|

|

TC = |

T1 + T2 |

|

|

|

Components of Common Equity T1 capital |

Sum of:

• Qualifying C/S

• Surplus net of T/S & unearned ESOP shares

• RE

• Certain AOCI (if didn't opt-out)

• +\- deductions or adjustments

• Qualifying T1 minority interests

|

C/S Surplus AOCI CET1 minority interests Adjustments Deductions |

|

|

Deductions (fully) from Common Equity T1 Capital |

• G/W

• DTAs that arise from NOLs & Tax Credit C/Fs

• Other Intangibles (except 4 MSAs)

• Gains on the sales of securitization exposures

• Certain investments and other financial institutions capital instruments

• Identified losses (usually from other than loans) |

|

|

|

What are the CET1 capital threshold deductions for 3 specific types of assets ? |

1. MSAs

2. DTAs related to temporary timing differences

3. Significant investments in another unconsolidated financial institution's common stock

Must deduct the amount of exposure to these types of assets by category that exceeds 10% of the base CET1 Capital calculation.

&

There is a 15% aggregate limit on these 3 threshold deduction items

The amounts that are not deducted will be assigned a 250% risk weight |

1. MSAs 2. DTAs 3. Investments in another financial institution |

|

|

What is included in additional T1 capital? |

-Qualifying noncumulative perpetual preferred stock & related Surplus

-Bank issued small business lending fund (SBLF) and troubled asset relief program (TARP) instruments that previously qualified for tier 1 capital &

-qualifying T1 minority interests (that is not already included in CET1 Capital) less certain investments in other unconsolidated financial institutions instruments |

P/S SBLF & TARP instruments T1 minority interests |

|

|

What is included in T2 capital? |

• ALLL up to 1.25% of RWAs

• Qualifying P/S (including related surplus)

• Subordinated debt (w/ a min. Maturity of at least 5 years — last 5 years reduced by 20% of the original amount &!excluded when the maturity is less than 1 year)

• if make an AOCI opt-out election, 45% of pretax net unrealized gains on AFS P/S classified as an equity security & AFS equity exposures)

• Qualifying T2 minority interests less any deductions in the T2 instruments of an unconsolidated financial institution

•SBLF & TARP that originally qualified for T2 capital |

ALLL P/S Subordinated debt Qualifying T2 minority interests |

|

|

What determines if an investment (C/S, P/S, subordinated debt, & trust preferred securities) in another financial institution is significant or nonsignificant? |

If ownership consist of 10% or less of the other banks common shares, then that investment is nonsignificant. |

10% or less |

|

|

In many cases where will deductions be made from? |

The deductions will be made from the tier of capital for which an investment would otherwise be eligible.

For example, if the bank's investment is an instrument that qualifies as T2 capital, it is deducted from T2 capital |

|

|

|

What happens if the bank does not have sufficient tier of capital to absorb a deduction? |

Then the excess about is deducted from additional T1 capital or from CET1 capital if there is insufficient additional T1 capital |

|

|

|

What are the two approaches that Part 324 prescribes for risk waiting assets? |

1. The standardized approach which is generally designed for Community Banks. 2. The advanced approach is used by larger more complex institutions. |

|

|

|

Under the standardized approach, what are the risk weightings? |

Balance sheet assets and credit equivalent amounts of off-balance-sheet items are generally assigned to one of four risk categories according to the obligor, or if relevant the guarantor or the nature of the collateral |

|

|

|

What are the four general risk categories (now there are add'l categories) under the standardized approach? |

0 20 50 100 |

|

|

|

What are the new risk weights under the standardized approach? |

-High volatility commercial real estate loans (HVCRE)

-past due asset exposures

-securitizations or structured investments

-Equity exposures &

-collateralized and guaranteed exposures |

|

|

|

What are high volatility commercial real estate loans (HVCRE) loans? |

Refers to a subset of acquisition, development, and construction loans that are assigned a risk-weighting of 150%.

Does NOT include 1 to 4 family residential ADC projects, loans to finance agricultural properties, or community development projects

Does NOT include ADC projects where the loan to value is at or below supervisory maximums,

NOT include if the borrower contributed at least 15% of the as completed value in cash or unencumbered marketable assets, and

NOT include if the contributed capital is contract fully required to remain throughout the project life |

CRE ADC loans get 150% RWing if LTV > supervisory limits & borrower did NOT contribute at least 15% in cash or securities & minimum equity required throughout the project was NOT maintained |

|

|

What is the risk weighting for assets that are 90 days or more past due or on non-accrual? |

150%

Does NOT apply to past-due 1 to 4 family residential real estate loans, HVCRE, and the portion of the loan balances with eligible guarantees or collateral where the risk weight can vary. |

|

|

|

What are some examples of securitization exposures? |

-Private label collateralized mortgage obligations (CMOs), -trust preferred collateralized debt obligations, -asset-backed securities (provided there is tranching of credit risk) |

|

|

|

What are the 2 approaches required by Part 324 to calculate the RW of securitization exposures? |

1. Gross-up approach 2. Simplified supervisory formula approach (SSFA)

Typically use one or the other approach consistently across all securitization exposures |

|

|

|

How is the gross-up approach applied? |

Capital is required on the credit exposure of the bank's investment in the subordinate tranche, as well as its pro rata share of the more senior tranche it supports. It calculates a capital requirement based on the weighted average RWs of the underlying exposures in the securitization pool |

|

|

|

How is the SSFA approach designed? |

Assigns a lower RW to more senior-class securities & higher RWs to support tranches.

The formula adjusts the RW for a securities underlying collateral based on key risk factors such as nonperforming loans, incurred losses, & the ability of the subordinate tranches to absorb losses.

A securitization is assigned at least a minimum RW of 20% |

|

|

|

What are the structural features that should be considered when conducting an analysis of securitization exposures?

Securitization due diligence is required per Section 324.41(c) |

-credit enhancements -performance of servicing organizations -deal-specific definitions of default -any other features that could materially impact the performance of the exposure |

|

|

|

What relevant performance information of the underlying credit exposures should be assessed?

(When conducting securitization due diligence analysis) |

-past due pmts -prepmt rates -property types -ave LTV ratios -geographic & industry diversification -relevant mkt data, such as bud-ask spreads -recent sales prices -trading volumes -historic price volatility -implied mkt volatility -size, depth, & concentration level of the mkt for the securitization |

|

|

|

For re-securitization, what should the analysis include? |

Assess the performance on the underlying securitization exposures |

|

|

|

What should Mngt if not able to demonstrate sufficient understanding of the securitization exposure? |

Assign the exposure of 1,250% RW |

|

|

|

What RW should be assigned for significant investments in the common shares of an unconsolidated bank that are not deducted from CET1 capital? |

250% (once Basel III is fully phased in) |

|

|

|

What is the RW range for publicly traded equities? |

100% - 300% |

|

|

|

What is the RW for non-publicly traded equity exposures? |

400% |

|

|

|

RW for investments in a hedge fund or investment fund that has > immaterial leverage? |

600% |

|

|

|

If the aggregate adjusted Carrying value of certain equity exposures is not > 10% of the bank's TC then what RW may be applied? |

100% |

|

|

|

RW for FRB stock (equity security)? |

0% |

|

|

|

RW for FHLB stock (equity security) |

20% |

|

|

|

RW for community exposures: e.g. Community Development Financial Institutions |

100% |

|

|

|

Financial collateral that can be used to reduce the RBC requirements associated w/ collateralized transactions? |

-Cash on deposit,

-gold bullion,

-UD Government Securities

-certain investment grade securities,

-Publicly traded convertible bonds, &

-certain money market fund shares |

|

|

|

Simple approach to recognizing financial collateral for RW purposes? |

Generally allows substituting the RW of the financial collateral for the RW of the exposure |

|

|

|

Simple approach to recognizing financial collateral for RW purposes? |

Generally allows substituting the RW of the financial collateral for the RW of the exposure |

|

|

|

Requirements to use the Simple approach (substituting) to recognizing financial collateral for RW purposes? |

-Collateral must be subject to a collateral agreement for at least the life of the exposure (no maturity mismatch),

-the collateral must be revalued at least every 6 months,

-the collateral (other than gold)

& the exposure must be denominated in the same currency (no currency mismatch) |

|

|

|

Collateral haircut (discount) approach (collateralized transaction) allows a bank to? |

Calculate the exposure for repo-style transactions, eligible margin loans, collateralized derivative contracts, & single-product netting sets if such transactions using a mathematical formula & supervisory haircut factors |

|

|

|

What are some examples of substituting the RW of an eligible guarantor or guarantee? |

-if a loan is guaranteed by an eligible guarantor such as --depositor institutions & holding companies --the International Monetary Fund --FHLBs --the Federal Agricultural Mortgage Corporation --Entities w/ investment grade debt --sovereign entities --foreign banks |

|

|

|

What are some examples of substituting the RW of an eligible guarantor or guarantee? |

-if a loan is guaranteed by an eligible guarantor such as --depositor institutions & holding companies --the International Monetary Fund --FHLBs --the Federal Agricultural Mortgage Corporation --Entities w/ investment grade debt --sovereign entities --foreign banks |

|

|

|

How are RW amounts for all off-BS items determined? |

By a 2-step process: 1. The "credit equivalent amount" is determined by multiplying the face value or notional amount by a credit conversion factor. 2. The credit equivalent amount is assigned to the appropriate risk category, like any other BS asset |

|

|

|

What are the minimum regulatory capital ratios? |

-T1 Cap/TAs = 4% (T1 Leverage Ratio) -CET1 Cap/TRWAs = 4.5% -T1 Cap/TRWAs = 6% -Tot Cap/TRWAs = 8%

(Minimum T1 Leverage ratio is 3% for fundamentally sound, well-managed, no significant growth, "1" rated institutions) |

4% 4.5% 6% 8% |

|

|

When will banks be required to maintain a capital conservation buffer to avoid restrictions on capital distributions and other pmts? |

1/1/2016 |

|

|

|

What is the phase-in for the capital conservation buffer implementation? |

2016 - 0.625% 2017 - 1.25% 2018 - 1.875% 2019 - 2.50% |

|

|

|

PCA Well Capitalized category for all 4 Ratios? |

Total RBC Ratio = 10% T1 RBC Ratio = 8% CET1 RBC Ratio = 6.5% T1 Leverage = 5% |

10% 8% 6.5% 5% |

|

|

PCA adequately capitalized? |

Total RBC Ratio = 8% T1 RBC Ratio = 6% CET1 RBC Ratio = 4.5% T1 Leverage = 4% |

|

|

|

PCA undercapitalized? |

Total RBC Ratio = <8% T1 RBC Ratio = <6% CET1 RBC Ratio = <4.5% T1 Leverage = <4% |

|

|

|

PCA significantly undercapitalized? |

Total RBC Ratio = <6% T1 RBC Ratio = <4% CET1 RBC Ratio = <3% T1 Leverage = <3% |

|

|

|

PCA significantly undercapitalized? |

Total RBC Ratio = <6% T1 RBC Ratio = <4% CET1 RBC Ratio = <3% T1 Leverage = <3% |

|

|

|

PCA critically undercapitalized? |

Tangible Equity/TA = 2% |

|

|

|

What items might be determined to be deducted from CET1 capital (based in examination findings)? |

-Identified losses such as items classified as Loss (typically not loan loss),

-any provision expenses that are required to replenish the ALLL to an adequate level,

-estimated losses in contingent liabilities,

-differences in accounts which represent shortages,

-liabilities not shown on books |

|

|

|

How is ORE Loss handled when ORE reserves are adequate to cover ORE properties classified as Loss? |

No deduction from CET1 Capital

Only deducted if the reserves are not adequate to cover all the Loss. The excess Loss not covered would be deducted from CET1 capital-under assets other than held for investment loans and Leases classified loss |

|

|

|

If a bank fails to meet minimum capital ratios what is the bank subject to? |

The bank is subject to capital directives or other formal enforcement action by the FDIC to increase capital. (usually no worse than a composite 1 or 2 rating) |

|

|

|

Minimum capital ratios are generally viewed as the minimum acceptable standards for what kind of bank? |

For a bank who's overall financial condition is fundamentally sound, which is well-managed, and has no material or significant financial weaknesses |

|

|

|

What composite ratings generally require more capital than the minimum regulatory requirements? |

Composite ratings of 3, 4, or 5.

These higher levels of capital should normally be addressed through informal actions, such as a memorandum of understanding, between the Fdic and the bank.

Use formal enforcement actions if there is more pronounced risk. |

|

|

|

What banks are generally required to submit a capital plan to the Fdic (usually in conjunction with a formal enforcement action) |

Banks with insufficient capital (undercapitalized) in relation to the risk profile |

|

|

|

How does a bank raise capital ratios? |

By either

• increasing capital levels or

• by reducing asset growth —to the point that the capital formation rate exceeds asset growth |

|

|

|

What are the two ways a bank can increase earnings retention? |

By increasing earnings and/or lower cash dividend rates |

|

|

|

What is a risk to the bank that is intentionally shrinking assets to improve capital ratios? |

By disposing of short term, marketable assets and allowing volatile liabilities to run off, may result in a strained liquidity posture |

|

|

|

When should an estimated loss from a loss contingency (for example, pending or threatened litigation) be recognized? |

It should be recognized if it is probable that an asset has been impaired or a liability incurred and the amount of the loss can be reasonably estimated |

|

|

|

What is an example of a category 1 contingent liability? |

Loan commitment or a letter of credit |

|

|

|

What is an example of a category one contingent liability? |

Loan commitment or a letter of credit |

|

|

|

What is an example of a category 2 contingent liability? |

Pending litigation in which the bank is defendant or claims arising from trust operations |

|

|

|

Capital adequacy is based on what factors? |

The financial condition, The quality of Capital, emerging needs for additional capital, problem assets, balance sheet composition, Off-balance-sheet risk exposures, earnings and dividends, asset growth, access to capital sources, Others |

|

|

|

CET1 Minority interest includable in the CET1 Capital of the bank? |

CET1 minority interest of the consolidated bank subsidiary

minus

the % of the subsidiary's CET1 capital that is NOT owned by the bank

Multiplied by The difference

Between the T1 capital of the subsidiary & the lower of:

The amount of CET1 capital the subsidiary must hold

Or

The standardized total RWAs that relate to the subsidiary

Multiplied by

The CET1 ratio needed to avoid restrictions on dividends/distributions/ & bonus payments |

|

|

|

What is the RW for US government Sovereign exposures, its Central Bank, or a US government agency?

Including the portion of an exposure that is directly and unconditionally guaranteed by the US government, it's central bank, or a US government agency |

0 |

|

|

|

How do you calculate the CET1 RBC ratio? |

CET1 / Total RBC |

|

|

|

How do you calculate the CET1 RBC ratio? |

CET1 / Total RBC |

|

|

|

What is Total RBC? |

CET1 + AT1 + T2 |

|

|

|

What are some ways to increase RBC ratios? |

• lower RWAs (adjust the portfolio)

• less loans or more cash secured or more 1-4 family 1st liens

• more US Treasuries and General Obligations, rather than Revenue Bonds

• GNMAs instead of other Gov't sponsored agency issues |

|

|

|

When a bank is inadequately capitalized,

Do you cite a violation or

A contravention of policy? |

• Violation if under 3 or 4%

(Violation of Part 325 is considered for leverage standards)

• contravention if undercapitalized due to any of the RBC ratios (contravention to Appendix A to Part 325)

(Contravention is cited for failure to meet RBC guidelines) |

|

|

|

How are the intangibles:

• MSAs, • purchased C/C relationships, & • Non MSAs

valued? |

• The lesser of 90% of the FV

or

100% of the remaining unamortized BV |

|

|

|

How are the intangibles:

Purchased C/C Relationships AND Non MSAs

Valued? |

Limited to 25% of tier 1 capital |

|

|

|

How are the intangibles,

DTAs,

valued? |

Limited to the

lesser of the amount of DTA which can be recognized in the next four rolling quarters

or

10% of T1 capital |

|

|

|

Purpose of the capital conservation buffer? |

Encourage capital conservation using a 2.5% buffer + adequately capitalized requirements

adequate CET1 + 2.5% = 7% |

|

|

|

capital conservation buffer? |

Encourage capital conservation using a 2.5% buffer + adequately capitalized requirements

adequate CET1 + 2.5% = 7% |

|

|

|

What payments are restricted for institutions with inadequate capital conservation buffers? |

1. Dividends

2. Share buybacks

3. discretionary payments on T1 instruments

4. discretionary bonus payments |

|

|

|

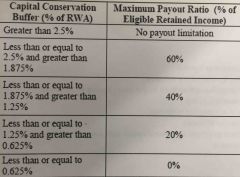

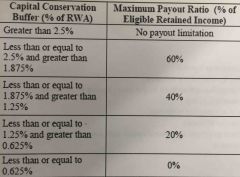

What are the buffers and associated payout ratios? |

Back (Definition) |

|

|

|

an institution with a camels composite rating of 1 is allowed to have and what minimum leverage capital ratio? |

3% |

|

|

|

Double leveraged HC may be __________ able to provide additional capital |

Less |

|

|

|

True or False:

• The FDIC can only issue a directive to a State Nonmember Bank |

True |

|

|

|

True or False:

Capital Directives are issued by the Regional Director |

False |

|

|

|

True or False:

• A Capital Directive is equivalent to a Cease and Desist Order |

True |

|

|

|

True or False:

• A Capital Directive is issued to a bank that fails to maintain capital at or above ltheminimum leverage capital requirement |

True |

|

|

|

Ex Calc Of T2 Capital |

Loan Loss identified comes out of ALLL in T2 Capital |

|

|

|

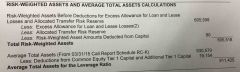

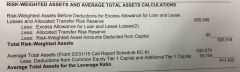

Ex RWAs adjusted for loan losses deducted |

Back (Definition) |

|

|

|

Ex RWAs adjusted for loan losses deducted |

Back (Definition) |

|

|

|

Ex Ave TAs adjusted for deductions from CET1 & AT1 Capital |

G/W & intangibles other than MSAs |

|

|

|

Where in Capital is Loss from Loans deducted? |

From the ALLL

Which ALLL is included in T2 Capital — so the Loss reduces ALLL included in T2 |

|

|

|

Where in Capital is loss from OREO deducted? |

To the extent ORE reserves adequately cover the risks inherent in the ORE portfolio as a whole, including any individual ORE properties classified Loss, there would NOT be a deduction from common equity tier 1 capital.

The ORE Loss in excess of ORE reserves should be deducted from common equity tier 1 capital under Assets Other Than Held-for-Investment Loans and Leases Classified Loss. |

|

|

|

Options for increasing Capital? |

• increase earnings retention

• sale of capital stock

• reduce asset growth |

|

|

|

Where is deduction from capital made if the ALLL is deemed inadequate? |

When the amount of provision expense needed to replenish the ALLL to an adequate level is significant, an adjustment is made to CET1 |

|

|

|

Where is deduction from capital made for loan losses if the ALLL is deemed adequate? |

From the ALLL which ALLL is included in T2 capital limited by 1.25% of Gross RWAs. |

|

|

|

What are some ways that a bank could increase its RBC ratios? |

Adjust portfolio to include lower risk weighted assets Less loans or more cash secured or 1‐4 family 1st liens More USTs and GOs, rather than revenue obligations GNMAs instead of other government sponsored agency issues |

|