![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

10 Cards in this Set

- Front

- Back

Reliability: High

Type: Reversal |

Abandoned Baby: A rare reversal pattern characterized by a gap followed by a Doji, which is then followed by another gap in the opposite direction. The shadows on the Doji must completely gap below or above the shadows of the first and third day

|

|

Reliability: High

Type: Reversal |

Dark Cloud Cover: A bearish reversal pattern that continues the uptrend with a long white body. The next day opens at a new high then closes below the midpoint of the body of the first day.

|

|

|

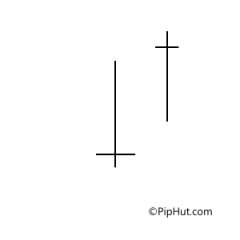

Doji: Doji form when a security's open and close are virtually equal. The length of the upper and lower shadows can vary, and the resulting candlestick looks like, either, a cross, inverted cross, or plus sign. Doji convey a sense of indecision or tug-of-war between buyers and sellers. Prices move above and below the opening level during the session, but close at or near the opening level.

|

|

Reliability: Medium

Type: Continuation |

Downside Tasuki Gap: A continuation pattern with a long, black body followed by another black body that has gaped below the first one. The third day is white and opens within the body of the second day, then closes in the gap between the first two days, but does not close the gap.

|

|

Reliability: Medium

Type: Reversal |

Dragonfly Doji: A Doji where the open and close price are at the high of the day. Like other Doji days, this one normally appears at market turning points.

|

|

Reliability: Medium

Type: Reversal |

Engulfing Pattern: A reversal pattern that can be bearish or bullish, depending upon whether it appears at the end of an uptrend (bearish engulfing pattern) or a downtrend (bullish engulfing pattern). The first day is characterized by a small body, followed by a day whose body completely engulfs the previous day's body.

|

|

Reliability: High

Type: Reversal |

Evening Doji Star: A three day bearish reversal pattern similar to the Evening Star. The uptrend continues with a large white body. The next day opens higher, trades in a small range, then closes at its open (Doji). The next day closes below the midpoint of the body of the first day.

|

|

Reliability: High

Type: Reversal |

Evening Star: A bearish reversal pattern that continues an uptrend with a long white body day followed by a gaped up small body day, then a down close with the close below the midpoint of the first day.

|

|

Reliability: High

Type: Continuation |

Falling Three Method: A bearish continuation pattern. A long black body is followed by three small body days, each fully contained within the range of the high and low of the first day. The fifth day closes at a new low.

|

|

Reliability: Medium

Type: Reversal |

Gravestone Doji: A doji line that develops when the Doji is at, or very near, the low of the day.

|