![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

20 Cards in this Set

- Front

- Back

|

Personal Qualities (6)

|

Qualifications

Skills Motivation Entrepreneurship Cultural Background Gender |

|

|

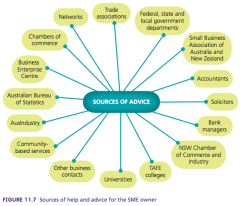

Sources of Information

|

+ Professional Advisers and Government Agencies

|

|

|

A business idea...

|

describes the core activities of the business, and the specific features and value of the goods or services it provides.

|

|

|

A business opportunity...

|

is something an entrepreneur can see as an avenue to success.

|

|

|

Competition is...

|

rivalry among businesses that seek to satisfy a market.

SME owners must decide how to make a business competitive. |

|

|

Establishment Options (2)

|

Scratch

Purchasing existing business |

|

|

Market Considerations

|

Businesses fail without a market for their goods or service; therefore they must always undertake market analysis.

Market analysis involves collecting, summarising and analysing information about the state of the market, |

|

|

Price (4)

|

Percentage Mark-ups

Recommended Retail Price Price Leadership and Competition What The Market Will Bear |

|

|

Significance of Location

|

Different types of businesses will be suited to different locations and the business owner must consider a number of factors when determining the most appropriate location for their particular business.

|

|

|

Online Presence

|

The business is no longer limited to dealing with people who can physically visit its premises.

|

|

|

Types of Finance (2)

|

* The business owner can contribute their own funds (equity or capital), which is an internal source of funds.

* The business can also obtain loans (debt) from external sources. There are advantages and disadvantages associated with each source of finance. |

|

|

Financial Requirements

|

* The business owner must begin by listing the main expenses in setting up the business 0 establishment costs.

* The business owner then needs to estimate the running costs for a full year's operation - operating costs. * The business owner is then in a position to calculate how much finance will be needed to commence and operate the business for the first year. * One of the main reasons SMEs fail is due to cash flow problems which makes these calculations important. |

|

|

Business Name Registration

|

Business Names Act 1962

|

|

|

Zoning

|

Local government controls zoning regulations. It ensures that activities such as industry and residential are kept separate.

|

|

|

Health Regulations

|

Each local council supplies businesses with the requirement and standards to meet in order to receive a license to operate.

* A health inspector will ***** premises regularly and often without warning to ensure the business owner/operator maintains standards. |

|

|

Trade Practices

|

Trade Practices Act 1974 - protect consumers and businesses.

* Protect consumers from deceptive practices such as misleading packaging or misrepresentation of the place of promotion. * Also deals with safety and the conditions and warranties associated with products. |

|

|

Human Resources

|

One of the most important influences when establishing a SME is staffing.

If an SME owner decides to hire staff, many sources are available. The overriding recruitment objective is to attract a pool of qualified applicants with the most suitable skills. Skilled employees are more productive and create wealth for a business. On-costs are payments for non-wage benefits, including long service leave, workers compensation and annual leave loading. |

|

|

Taxation is...

|

the compulsory payment of a proportion of earnings to the government.

SME owners should structure their records and finances in such a way that they have the necessary information and money to efficiently manage their taxation obligations. |

|

|

Goods and Services Tax

|

GST is a broad-based tax of 10 per cent on the supply of most goods and services consumed in Australia. Any business with an annual turnover of $75 000 or more operating within Australia must register for the GST.

|

|

|

The Australian Business Number (ABN)

|

The ABN is a single identifying number that a business uses when dealing with government departments and agencies.

|