![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

63 Cards in this Set

- Front

- Back

|

Materiality |

–The magnitude of an omission or misstatement of accounting information that, in light of surrounding circumstances, make it probable that the judgment of a reasonable person relying on the information would have been changed or influenced by the omission or misstatement. |

|

|

Two Stages we look at Materiality |

Planning and Evaluation |

|

|

Two main approaches to determining Preliminary Materiality: |

(1) Rule of Thumb and (2) Using Pre-designed Tables |

|

|

Pros and Cons of rule of Thumb for Determining Preliminary Materiality |

-Easy to Use -Common -Less Conservative |

|

|

How do we Determine Preliminary Materiality (from a Qualitative standpoint)? |

•Size of the company (quantitative) •History of misstatement •History of relationship with client •Nearness to critical points –Breakeven point –Debt covenants Qualitative –Bonus cutoffs –Trends –Analyst forecasts •Client’s riskiness |

|

|

Rule of Thumb Percentages |

-Assets/Revenues x 0-5% (private) -GM/Ni/Avg NI x 5-10% ( public -SEC has indicated that anything greater than 5% of NI is material -Often will use Revenue or Expense for Not-For Profit organizations |

|

|

Tolerable Misstatement |

-An Estimate of the maximum monetary misstatement that may exist in an account balance without causing the financial statements to be materially misstated |

|

|

Allocation of preliminary materialty |

-Allocating the overall materiality to account balances to give us tolerable misstatement levels from accounts |

|

|

Pros and Cons of Using Proportional method for Preliminary Materiality Allocation |

-More Accurate -More Conservative -More Complex -Does not account for qualitative factors |

|

|

Pros and Cons of using Pre-designed Tables for Determining Preliminary Materiality: |

-More Conservative -Do not account for qualitative factors |

|

|

How to use Rule of Thumb for Allocating Preliminary Materiality: |

•Allocate 50% to 75% of preliminary materiality to each account •Account’s TM could add up to 3 to 4 times the preliminary materiality •Why? –Not all accounts will be misstated by their TM –Simultaneous audit of accounts –TM as percentage of PM is usually a very small amount for large accounts –PM is a safety net –Achieve smaller TM during testing |

|

|

Steps in Evaluative Materiality: |

–Perform procedures and gather evidence –Identify misstatements –Are they material individually •Compare the misstatement found during testing to TM –Are they material in total •When added together do they exceed PM –Must consider both qualitative and quantitative aspects –Resolve with client (during negotiation process) |

|

|

Two Types of Materiality |

-Planning Materiality -Evaluative Materiality |

|

|

Two Types of Planning Materiality |

-Preliminary Materiality -Tolerable Misstatement |

|

|

Audit Plan Definition: |

•Document which is a result of the planning step of the audit •Outlines strategy for the audit •Created by the auditor |

|

|

3 Steps of the Audit Process: |

–STEP 1: Planning of the audit – ends with creation of audit plan –STEP 2: Performing the audit –STEP 3: Reporting |

|

|

Direct vs Indirect Tests |

Indirect à Test the controls NOT the balance (assuming if controls are correct then the balance will be correct) Direct à Don’t go through the controls – testing the balance |

|

|

Evidence Definition: |

•Anything that supports or refutes a management assertion •Anything that changes the auditor’s belief about consistency between a management assertion and reality. •Proof! |

|

|

Two controls to test effectiveness: |

-Operating Effectiveness – whether the control if designed properly is operating as expected Design Effectiveness – whether the control is designed appropriately |

|

|

Substantive Tests |

•Procedures designed to test for dollar misstatements in the F/S |

|

|

Test of Transactions Definition: |

– used to test the assertions related to transactions (e.g. occurrence, completeness) |

|

|

Substantive analytical procedures (SAP) definition: |

– comparisons of actual numbers to expectations developed by the auditor |

|

|

Tests of details/account balances definition: |

– focus on balances in the B/S and I/S |

|

|

Cost/Benefit analysis: -Test of Controls: |

•Indirect tests – testing how controls are working rather than doing the test myself – somewhat unreliable •Relatively low cost •If CR is assessed at 100% or high – no need for test of controls |

|

|

Cost/Benefit Analysis: -Substantive Analytical Procedures: |

•Not reliable •Low cost |

|

|

Cost/Benefit Analysis: -Test of Transactions: |

•Somewhat high cost •Direct tests – auditor performs him/herself – very reliable |

|

|

Cost/Benefit Analysis: -Test of Details |

•High cost •Direct tests - reliable |

|

|

Assurance Bucket |

-Substantive analytical procedures -Tests of details/transactions -Test of controls |

|

|

Evidence |

–Anything that supports or refutes a management assertion –Anything that changes the auditor’s belief about consistency between a management assertion and reality. –Proof! |

|

|

Two parts of Sufficiency (quantity): |

(1) number of procedures and (2) sample sizes |

|

|

Appropriateness (quality) definition: |

•relates to degree of relevance and reliability. |

|

|

Relevance definition: |

–Relates to the strength of the link between the evidence and the management assertion |

|

|

Reliability Definition: |

–Relates to sources independence and competence, as well as quality of the internal controls, and the closeness to events |

|

|

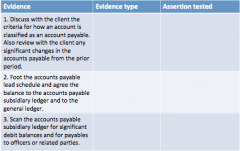

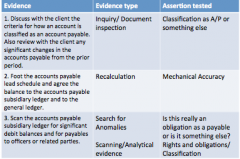

4 Types of Audit Evidence: |

-Inspection -Inquiry -Reperformance -Seacrh for Anomalies |

|

|

3 parts of Inspection: |

1. Inspection of Tangible Assets 2. Inspection of documents/records 3. Inspection of process (observation) |

|

|

2 types of Inquiry: |

1. Inquiry - verbal communication with the client 2. Confirmation |

|

|

2 types of Reperformance |

1. Reperformance 2. Recalculation

|

|

|

2 types of Search for Anomalies |

1. Analytical Procedures 2. Scanning |

|

|

Inspection of Tangible Assets = Physical Examination (High Reliability) |

–Great for physical/tangible assets –Great for existence and valuation assertions –Really persuasive evidence |

|

|

Inspection of Documents (Moderate Reliability) |

–Good for most assertions (best for rights and obligations) –Internal vs. external documents –Inventory – inventory ledger, purchase orders, invoices |

|

|

Directional Tests |

Subset of inspection of documents

Ledger to Source Document = Existence or Occurrence Source Document to Ledger = Completeness |

|

|

Inspection of Process- Observation (Low Reliability) |

–Looking at behavior –Primarily used for tests of controls –Inventory observation – observing people dealing with inventory |

|

|

Inquiry (Low to moderate reliability) Definition: |

– generally oral communication with the client –IT IS NEVER SUFFICIENT EVIDENCE Must have other corroborating evidence |

|

|

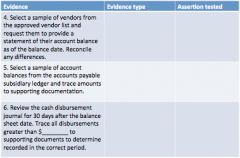

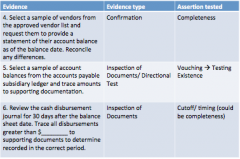

Confirmation (Moderate to High Reliability) Definition: |

-generally written communication with third parties outside the client

–Great for existence, completeness, rights and obligations, valuation assertions –Persuasive –Involves outside independent party

|

|

|

Recalculation (High Reliability) Definition: |

–Recomputing ( e.g., allowance for bad debt, depreciation, income tax) –Footing – add inventory items and compare to ending balance –Agreeing – agreeing the checks with bank reconciliation –Good for mechanical accuracy |

|

|

Reperforming (High Reliability) Definition: |

–Reperform aging of receivables or IC |

|

|

Analytical Evidence (Low to moderate Reliability): |

•Develop expectations •Compare to actual •Investigate material discrepancies •Conclude –Great for existence, completeness, valuation, understandability assertions |

|

|

Scanning (Low to Moderate Reliability): |

-Scan through numbers |

|

|

|

|

|

|

|

|

2 Major Reasons for Audit Documentation |

(1) To Aid: Planning, Performing, and Supervision of the audit (2) To support the audit report

|

|

|

Audit Plan Defintion: |

-–prepared during planning – outlines strategy for the audit •Understanding of the client •Risks •Budget |

|

|

Audit Program Definition: |

–program – procedures to be performed – also can serve as checklist as procedures are performed |

|

|

Working Trial Balance definition: |

– list of general ledger accounts with their amounts |

|

|

Types of Audit Documents: |

-Audit Plan -Audit Program -Working Trial Balance •Adjusting and reclassification entries •Supporting schedules such as: account analysis; audit memos; outside documentation etc. |

|

|

Audit Program Definition: |

•The overall development of the audit program should demonstrate appropriate “linkage” between: –Management assertions –Controls –Risks –Types of audit evidence desired and data gathering technique – procedures planned, sample size, items to select –Timing, extent and person performing the test |

|

|

3 Things an auditor must do: |

–Confirm Cash –Confirm A/R –Count Inventory |

|

|

Rules Related to audit documentation: |

–Ownership – auditor owns the documents •Cannot show to outside parties without permission of the client (confidentiality rule) •Exception – subpoena by a court as legal evidence –Retention of documents (AS 3) •Retain for minimum of 7 years from the date of the completion of the engagement •Retain even documents inconsistent with the conclusion of the audit |

|

|

Last two parts to completing the Audit: |

–Wrap up procedures

–Reporting |

|

|

Unqualified Opinon: |

No material problems |

|

|

Material Deviations from GAAP opinions: |

–Not pervasive - qualified –Pervasive - adverse |

|

|

Material Scope Limitations: |

–Not pervasive - qualified –Pervasive - disclaimer (we cannot give an opinion) |

|

|

Information to Report to Internal Oversight Bodies: |

•Information regarding internal control –material weaknesses –significant deficiencies •Information regarding the accounting –Policies, choices, estimates, uncertainties, etc. –overall "quality" of the accounting, •Details regarding the audit itself –misstatements, fraud –problems working with management –consults (opinion shopping) |