![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

74 Cards in this Set

- Front

- Back

|

What is the purpose of an audit? |

an audit provides financial statement users with an opinion on whether the statements are presented fairly and in accordance with acceptable framework |

|

|

A1 Auditing Standards Who issues the auditing standards for non public companies? |

ACIPA's Auditing Standards Board (ASB) |

|

|

A1 What is the makeup of the PCAOB? |

Five full-time members - Two members must be CPA or have been CPA, other 3 must not be cpa or have been cpa - CPA can be chair if they have not practiced in the past 5 years - No member can received payment from a public accounting firm except for pension payments. |

|

|

A1 True or False: Public accounting firms must register with the PCAOB in order to audit a public company? |

True |

|

|

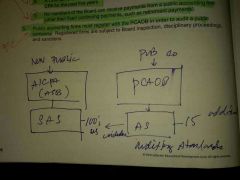

A1 Digram the relationship between the SAS (statement on Auditng Standards) from ASB and the AS (Auditing Standards) from PCAOB |

|

|

|

A1 What is the ethical requirements for conduiting an Audit? |

- Auditor should in independence in both fact and appearance. - No direct investment, no matter how small. (materiality does not matter) |

|

|

A1 When should the audit report be dated? |

Audit report be dated no earlier than the date on which the auditor had obtained sufficient appropiate audit evidence. |

|

|

A1 What are the parts of an unmodified opinion audit report? |

1. Report on the Financial Statements - Intro 2. Managements Responsibility for the F.S 3. Auditors Responsibility 4. Opinion

|

|

|

A1 Recite or write: Report on the Financial Statements (Intro) paragraph? |

We have audited teh accompany's financial statements of ABC company, which comprise the balance sheet as of December 31, 20x1, and the related statements of income, changes in |

|

|

A1 Recite or Write: Management's Responsibility for the Financial Statements |

Management is reponsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and mainenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material mistatement whether due to fraud or error. |

|

|

A1 Recite or Write: Auditor's Resonsibility |

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require the we plan and perfom the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor's judgement, including the assessment of the risks of material mistatement of the financial statements, whether due to fraud or error. In making, those risk assessments, the auditor considers internal control relevant to the entity's preparation and fair presentation of the financial statements in order to design audit procedures that are appropiate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity's internal control. Accordingly, we express no such opinion. An audit also includes evaluating the approprateness of accounting policies used and the reasonablness of significant accounting estimates made by management as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropiate to provide as basis for our audit opinion. |

|

|

A1 Recite or write: Opinion |

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of ABC company as of December 31, 20x1, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. |

|

|

A1 PCAOB AS #1 requires auditor's report to include a reference to what" |

"We conducted our audit in accordance with auditing standards generallyy accepted in the United States of America." |

|

|

A1 What is the difference btw ISA and GAAS regarding the "preparation and fair presentation of the F.S or the preparation of F.S that give a true and fair view" |

GAAS does not include any references to "true and fair view" |

|

|

A1 What is the difference btw ISA and GAAS on the inductory paragraph of the auditors report to refer to the summary of significant accounting policies and other explanatory information? |

GAAS does not include the explanatory information because notes to the finicial statemennts are an integral part of F.S, so it does not need to be called out. |

|

|

A1 What is the difference btw ISA and GAAS regarding ISA's requirement to include auditor comply with ethical requirements in the Auditors Reponsibilites section? |

GAAS does not contain the requirment to include that the auditor comply with ethical requirements, because the title indicatin that the report of an indepedent auditor affirms the auditor enthical requirement. |

|

|

A1 Requirement for GAAS and not for ISAs regarding managements responsibilities? |

A requirement that the description of managment's reponsibilities for the F.S. in the auditor's report should not be referenced to a separate statement by management about such responsibilities. |

|

|

A1 Differences between GAAS and ISA regarding management's internal control? |

GAAS requires the auditor's report to state that this responibility includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the financial statements. |

|

|

A1 What 4 things group engagement team must understand about each component auditor? |

1. Component auditor is independent 2. professional competence of the component auditor 3. extent to which engagement team will be involved with comp. auditor 4. whether engagement team will be able to get information needed for the consolidation process from the component auditor |

|

|

A1 True of False The group auditor must make reference to components audits in their reports? |

False: Group auditor does not need to make reference but, group auditor directs and reviews work of component auditor |

|

|

A1 What type of work should group team deterimine for comp auditor when assuming responsibility? |

Group should determine significant components. (a) significant due to individual financial significance or (b) significant due to significant risks of material misstatement |

|

|

A1 What should group team do with components that are not signifcant? |

Group team should perfom analyical procedures for not significant components. |

|

|

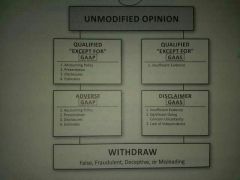

A1 *** Types of Opinions Diagrams for Unmodified opinion |

|

|

|

A1 What is the difference btw EMPHASIS OF MATTER and OTHER MATTER paragraphs in an unmodified opinion? |

emphasis of matter call out to communications in already disclose by management on the footnotes of the F.S Other matter paragraphs are communications not found on F.S |

|

|

A1 What are the report requirements for and EMPHASIS OF MATTER? (3) |

1. place emphasis of matter paragraph immediately AFTER the opinion paragraphs 2. use the EMPHASIS OF MATTER heading 3. indicate that the auditors opinion is not modified with respect to the matter emphasized. |

|

|

A1 When is a EMPHASIS OF MATTER use required? (3) |

1. auditor concludes that there is substantial doubt about the entity's ability to continue as a going concern for a reasonable period of time.

2. to describe a justified change in accounting prinicple that has a material effect on the entity's financial strength

3. F.S are prepared in accordance with an applicable special purpose framework |

|

|

A1 When is EMPHASIS OF MATTER use may be necessary? (4) |

1. an uncertainty related to the outcome of litigations or regulatory action (unusually)

2. a major catastrophe having a significant effect on the entity's financial position

3. significant related to party transactions

4. unusually important subsequent events |

|

|

A1 What are the report requirements for Other-Matter paragraphs (2)? |

1. Place the other-matter paragraph immediately after the opinion paragraph and after any emphasis-of-matter paragraph. 2. use the heading, "Other-Matter" |

|

|

A1 When is Other-Matter paragraphs required use? (2 important) |

1. anytime the auditor includes an alert in the audit report that restricts the use of the auditors report. 2. Prior to the audit report date, the auditor indentifies a material inconsistency in other information that is included in a document containing audited financial statements 3. to refer to required supplementary information that a designated accounting standards setter requires to accompany an entity's basic financial statements. |

|

|

A1 When is other-matter paragraphs may be use? |

To describe the reasons why the auditor cannot withdraw from an engagement |

|

|

A1 How should the auditor consider the entity's ability to continue as a going concern? |

if there is substantial doubt, the auditor should 1. consider the adequacy of disclosure 2. include a emphasis of matter paragraph in the auditor's report (one year from balance sheet date) |

|

|

A1 GAAS vs ISA on entity's ability to continue as a going concern? |

ISA requires the auditor to consider the same period that was used by management in making its assessment. The period must be at least, but not limited to 12 monnths from balance sheet date. |

|

|

A1 What are the Procedures (7) that the auditor should perform to obtain evidence to determine entity's ability for going concern? |

A. Analytical procedures D. Debt compliance - (review terms of debt and loan agreements) M. Minutes from board meetings I. Inquiry of client's legal counsel T. Third parties - confirm the details of financial support arrangements. S. Subsequent events review (ADMITS) |

|

|

A1 What are the conditions and events (4) that are indicative of substantial doubt about entity's ability to continue as a going concern? |

F. Financial difficulties I. Internal Matters -- work stoppages, labor difficulties N. Negative trends E. External matters -- e.i legal proceedings, new legislation |

|

|

A1 What must the mitigating factors to address the entity's ability to continue as a going concern include (2)? |

Mitigating factor must include INTENT and ABILITY to carry out planned procedures. |

|

|

A1 T or F Should Disclosure of alleviation of doubt when going concern is alleviate be disclose by auditor? |

T. Auditor should disclose the conditions and events that gave rise to the substantial doubt |

|

|

A1 Emphasis of matter vs Disclaimer regarding entity's ability going concerm. |

Auditor can choose diclaim an opinion do to a going concern uncertainty |

|

|

A1 What two terms must be included in a emphasis of matter paragraph? |

1. substantial doubt 2. going concern |

|

|

A1 What term must be included in ISA emphasis of matter paragraph? |

"significant doubt" |

|

|

A1 What must the auditor include in the report if there is substantial doubt? (5) |

A. the conditions or events that gave rise to the substantial doubt B. Any mitigating factors that the auditor considers significant. C. Audit work performed to evaluate management's plans. D. The auditor's conclusion about whether subtantial doubt remains or is alleviated; and E. The effect of the auditor's conclusion on the evaluation of the F.S and related disclosures, and on the resulting auditor's reportA |

|

|

A1 What should the auditor do if the going concern disclosures are inadequate, a departure from GAAP exists? |

Auditor can offer either a qualified or adverse opinion |

|

|

A1 What happens to the emphasis of matter paragraph is the entity's going concern are removed in the subsequent period? |

The emphasis of matter paragraph need not be repeated. |

|

|

A1 Passkey for going concern issues |

|

|

|

A1 How should the Auditor's Responsibility Paragraph be modified when expressing and qualified or adverse opinion? |

Paragraph should be amended to state that the auditor believes that the audit evidenced obtained is sufficient and appropriated to provide a basis of the auditor's modified audit opinion. |

|

|

A1 Where should the basis for modification paragraph fit into the audit report? And how should it be titled? |

It should be BEFORE the opinion paragraph and should use the heading "Basis for Qualified Opinion" of "Basis for Adverse Opinion" |

|

|

A1 How should the auditor state a qualified opinion in the opinion paragraph? |

state that, in the auditor's opinion, EXCEPT of the effects of the matter(s) described in the basis for qualified opinion paragraph, the F.S are presented fairly in all material respects.... |

|

|

A1 How is an adverse opinion paragraph stated differently than a qualified opinion paragraph? |

adverse opinion states "because of the significance of the matter(s) described in the basis for adverse opinion paragraph, the F.S are not presented fairly in accordance with applicable Financial reporting framework. |

|

|

A1 The auditors report expressing a qualified opinion? |

Intro Managedments Responsibility Auditors Responsibilty "We believe that the audit evidence we have obtained is sufficient and appropiate to provide a basis for our qualified opinion. Basis for Qualified Opinion Qualified Opinion ".., except for omission of the information described in the Basis of Qualified Opinion paragraph." |

|

|

A1 Format of Auditor's Report for an Adverse Opinion? |

Same as Unmodified opinion except for the following: Add: Last paragraph to Auditor's Responsibility paragraph; "we believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our ADVERSE audit opinion." Add: Basis of adverse opinion paragraph |

|

|

A1 How is the introductory paragraph of audit report modified for a DISCLAIMER opinion? |

The introductory paragraph is amended to state:"We were engaged to audit.." |

|

|

A1 Explain the modifications of Auditor's Report for a qualified opinion for GAAS. |

ADD: Orphan paragraph to end of Auditor's Responsibility stating: "We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our qualified audit opinion." ADD: Basis of Qualified Opinion paragraph ADD: Qualified Opinion paragraph State... "except for the possible effects of the matter described in the basis for Qualified Opinion paragraph..." |

|

|

A1 Explain the modifications of Auditors report for Disclaimer of Opinion. |

Amend: Open paragraph "We were engaged to audit...." Change: Auditor's Responsibility paragraph "Our responsibility is to express an opinion on these financial statements based on conducting the audit in accordance with auditing standards generally accepted in the United States of America. Because of the matters described in the Basis for Disclaimer Opinion paragraph, however, we were not able to obtain sufficient appropriated evidence to provide a basis of an audit opinion. ADD: Basis for Disclaimer Opinion |

|

|

A1 What is the Auditor's Responsibility paragraph for a disclaimer of opinion? |

"Our responsibility is to express an opinion on these financial statements based on conducting the audit in accordance with auditing standards generally accepted in the United States of America. Because of the matters described in the Basis for Disclaimer Opinion paragraph, however, we were not able to obtain sufficient appropriated evidence to provide a basis of an audit opinion. |

|

|

A1 What are the criteria (4) when the report of predecessor auditor for prior period financial statements is presented? |

1. Read the statements for the current period 2. Compare the statements audited with the current period statements. 3. Obtained a letter of representation from the successor auditor. 4. Inquire of and obtain a letter of representation from management at or near the date of reissuance. |

|

|

A1 what are the 4 criteria when the predecessor audit report for prior period F.S is not presented? |

Express in other-matter paragraph: 1. that the F.S of the prior period were audited by a predecessor auditor. 2. the type of opinion expressed by the predecessor auditor and, if the opinion was modified, the reasons for modification. 3. the nature of any emphasis of matter of other matter paragraph included in the predecessor audit's report 4. the date of the predecessor auditor's report. |

|

|

A1 True of False The predecessor auditors should be name in the when the report of the predecessor is not reissued. |

False, predecessor auditor should not be named unless they where acquired by or merged with that of successor. |

|

|

A1 What are the 4 criteria to included in a prior period statements reviewed or complied? |

A. the service (review or complied) performed in the prior period. B. the date of the prior period report C. a description of any material modifications described in the report; and D. a statement that the service was less in scope than an audit and does not provide the basis for expressing an opinion on the F.S |

|

|

A1 What is a Recognized Type1 Event? (Subsequent event) |

Subsequent events with conditions existing on or before a balance sheet date.

Requires a f.s. adjustment |

|

|

A1 What is a Nonrecognized (type 2) Event (subseqent event) |

Subsequent events where conditions exists after the balance sheet date. May require footnote disclosures. |

|

|

A1 What procedures should be perform to understand managements procedure to established subsequent events |

PRIME P - Post balance sheet transactions. Review for proper cutoff . R - Representation letter should be obtained from management. I - Inquire of management and those in charged with governance subsequent event occurence. M - Minutes of stockholders, directors, and committees should be read. E - Examine latest available interim f.s: compare with f.s under audit. |

|

|

A1 How can adjustments of disclosures made after the original date of auditors report treated? |

Auditor can dual date the report and extend the responsibility only for the particular subsequent event. |

|

|

A1 If the auditor chooses to choose a later date for the report instead of dual dating the report, what are consequences? |

Auditor will extend their responsibility for all subsequent events to the later date. |

|

|

A1 What does any auditor do when there are subsequent discovery of facts after the report release date that would material affect report? |

1. Advise the client to reissue F.S along with new audit report 2. Advise the client to make necessary disclosures and revisions to any imminent f.s 3. If the effect of the f.s cannot be determined on a timely basis, then provide notification that the f.s and auditor's report should not be relied upon. |

|

|

A1 what are the steps auditor should take if client refuses advice on discovery of subsequent facts after report release date. |

1. should notify each member of the board of directors. 2. Notify the client that the auditor's report must no longer be associated with the f.s 3. Notify any regulatory agencies having jurisdiction over client that the report should no longer be relied on. 4. Notify persons known relying or likely to rely on the f.s that the auditor's report should no longer be relied on. |

|

|

A1 What happens if omitted audit procedures are discovered after a audit report date? |

Auditor should determined whether other audit procedures were adequate to compensate for the omitted audit procedures. if so, no further action is necessary. |

|

|

A1 What happens if the omitted audit procedures impaired the auditor's ability to support the previously issued opinion? |

The auditor should undertake to apply the omitted procedures or alternative procedure. |

|

|

A1 What happens if there is material inconsistence btween the other information on the document containing the f.s. and the f.s? what should the auditor do? |

Auditor should include in the other matter paragraph of the auditor's report the material inconsistence found. |

|

|

A1 How might an auditor disclaim an opinion on other information found in f.s. that they have not audited? |

Auditor can offer disclaimer in the other matter paragraph referencing the other information. |

|

|

A1 What are the two objectives when an auditor is engaged to report on supplementary information in relation to the f.s.? |

1. the evaluate the presentation of the supplementary information in relation to the f.s as a whole; and 2. to report on whether the supplementary information is fairly stated, in all material respects, in relation to f.s. |

|

|

A1 What two audit procedures is necessary for an auditor reporting on supplementary information? |

A. compare and reconcile the information to the audited f.s and underlying accounting records. B. Obtain written representations from management regarding the information. |

|

|

A1 True and False Can a reporting accountant report on the applicaiton of accountingprincples to a hypothetical transactions? |

No. A reporting accountant can no report on transactions not involving facts, or circumstances of a specific entity. |

|

|

A1 T or F The reporting accountant is required to be independent of the entity. |

F. Reporting accountant is not required to be independent of the entity. |

|

|

A1 What is included (7) in the reporting accountant's report? |

1. a brief description of the nature of the engagement 2. a statement that the engagement adhere to AICPA standards 3. an indentification of the specific entity 4. a statement describing the appropriate application of the requirements of the applicable financial reporting framework. 5. a statement that preparers of the f.s, who should consult with their continuing accountants, are responsible for proper accounting treatment. 6. a statement that any difference in the facts, circumstances, or assumptions presented may change the report 7. a separate paragraph at the end of the report RESTRICTING its use to a specified parties. |

|

|

A1 How should the auditor report on F.S prepared in accordance accounting principles generally accepted in other countries that is to be distributed in U.S? |

Auditor shoud report using US form report with an emphasis of matter paragraph containing: a. identifie the financial reporting framework b. refers to the note in the f.s that describes the framework, and c. indicates that the framework differs from accounting principles generally accepted in the U.S |