![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

77 Cards in this Set

- Front

- Back

- 3rd side (hint)

|

What is is meant by financial system |

Exchange of funds between lenders, investors and borrowers |

|

|

|

What is the medium of exchange in financial systems 3 |

Money, credit and finance |

|

|

|

Components of financial system 4 |

Financial institutions, financial markets, financial instruments, financial services |

|

|

|

What is stability of financial system |

Principal components of the system are jointly capable of absorbing adverse disturbances. Risks are efficiently managed. To facilitate smooth flow of funds between parties in the system, stability of the system is very crucial. |

Confidence leads to stability. |

|

|

Why we need financial system stability? |

to create a favourable environment for efficient financial intermediation to promote investment and economic growth. . Capable of mobilizing Savings and allocating them to productive investments, managing risks and settling payments without materially affecting economic growth and development. |

|

|

|

participants of financial system |

Central Bank licensed banks licensed Finance Companies and registered leasing companies licensed microfinance companies primary dealers in government securities cooperative banks and societies insurance companies Mutual Funds stock brokers |

|

|

|

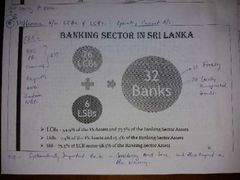

how many banks are there in Sri Lanka |

32 |

|

|

|

Number of licensed commercial banks and licensed specialised banks in Sri Lanka |

26 licensed commercial banks and 6 licensed specialised banks |

|

|

|

what is a systematically important Bank |

Controlling acid base and their impact on the economy major banks selected and considered as systematically important banks. Currently systematically important banks consists of 57 % of total banking sector assets |

|

|

|

Assets of LCB sector |

LCBs accounts to 54.9 percent of financial sector assets and 75.7 percent the banking sector assets |

|

|

|

Regulatory framework of banks |

.Monetary Law Act Number 58 of 1949 .banking act number 30 of 1988 .Directions circulars and guidelines issued by cbsl .foreign exchange act number 12 of 2017 . rules and regulations issued by securities and exchange Commission (sec) .accounting standards issued by Institute of Chartered Accountants of Sri Lanka |

|

|

|

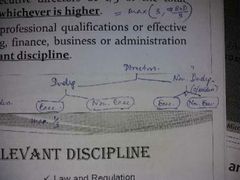

organisation chart of a bank |

board of directors then board sub committees Then CEO and other key management persons

|

|

|

|

organisation chart of a bank |

board of directors then board sub committees Then CEO and other key management persons

|

|

|

|

what is the limit for the number of members in board of directors |

minimum 7 maximum 13 |

|

|

|

Which key management persons are not reporting to CEO or General Manager |

chief internal auditor compliance officer chief risk officer |

|

|

|

What are the 4 mandatory board subcommittees |

. board audit committee . board human resource and remuneration committee .board nomination committee .board integrated Risk Management Committee |

|

|

|

Who can directly involved in day to day operations in a bank |

CEO or General Manager |

|

|

|

Can directors involved in day-to-day operations |

no |

|

|

|

What are the differences of a balance sheet of a bank with other organisations |

It starts with high liquid assets 60 to 70% of Bank's assets are loans 20-25% of bank's assets Investments( bills bonds and treasuries)

Banks have to maintain 20% of their assets as liquid assets 55 to 65% of Bank's liabilities are deposits 15% of Bank's liabilities are equity 10% of banks liabilities are borrowings |

|

|

|

what is the main income source of a bank |

interest income |

|

|

|

Why banks charge higher interest rate margin |

To compensate risks and cover its overheads |

|

|

|

Factors to select a bank to deposit your money |

1. statuary liquid asset ratio 2. Credit rating 3. NPL ratio 4. Profitability |

|

|

|

What are financial soundness indicators |

Financial soundness indicators are used to to monitor the soundness of a financial institution detect risks to the financial system as a whole |

|

|

|

Main types of financial soundness indicators |

.Asset quality . Capital adequacy . Liquidity . Earnings and profitability . Asset funding structure |

|

|

|

corporate governance |

A set of relationships between a company's management, its board, it's shareholders and other stakeholders which provides the structure through which the objectives of the company are set and the means of attaining the objectives and monitoring performance. . |

#It helps to define the way that authority and responsibility allocated and how corporate decisions are made |

|

|

why capital is needed |

To absorb of losses and for initial investment |

|

|

|

Main reasons of financial crisis 4 |

Too little capital was maintained . poor governance practices . excessive risk taking . excessive remuneration promoting high risk taking |

|

|

|

Why corporate governance is important |

Corporate governance processes and practices shall deemed to be the management Framework that facilitates the conduct of the banking business in a responsible and an accountable manner so as to promote the safety and soundness of the individual banks thereby leading to the stability of the overall banking sector |

|

|

|

What are the regulations on corporate governance |

corporate governance : banking act Direction number 11 of 2007 integrated risk management Framework: banking act Direction number 7 of 2011 |

|

|

|

Mention key responsibilities of board of directors |

Compliance, policies and procedures Board of directors are supposed to ensure the policies and procedures are implemented properly. Therefore chief internal auditor compliance officer and Chief risk officer has been assigned to get an independent feedback . Board of directors never get involved in operations |

|

|

|

responsibilities of The Board |

. Approve and oversee the bank's strategic objectives and corporate values . Identify principal risks and implement systems to manage the risk .Review adequacy and integrity of internal control systems and management information system .Approve implementation of a communication policy with all stakeholders .Identification and designate key management personnel KMP .Ensure availability of appropriate succession plan for KMP s

|

Internal control systems have to be documented. Communication policy means who should go to media who can talk to external parties. All these have to be documented |

|

|

responsibilities of the board continued |

* Understand the regulatory environment * avoid any conflict of interest such as related party transactions .Ensure appropriate oversight of the affairs of the bank by KMPS and consistent with board approved policies . Periodically assess the effectiveness of its on governance practices .Meet regularly on a needs basis with KMPs .Exercise due diligence in hiring and oversight of external auditors . Appoint Chairman and CEO and define and approve the functions and responsibilities for them . Appoint a board/ Company Secretary . Publish annual corporate governance report India annual report . Ensure the bank is capitalised at levels as required by monetary board .Undertake annual self assessment by each director

|

Its board of director's responsibility to make sure the independence of auditors

|

|

|

board meetings |

.Meet regularly - at least 12 times a year . Board members should actively participate for board meetings . Enable directors to include matters in the agenda . 7 days prior notice to be given for regular meeting Quorum- more than 50% of the number of directors present should consist of non executive directors |

|

|

|

How position of a director can be ceased |

Director was not attended at least two third of the meetings in the period of 12 months immediately preceding or not attended immediately preceding three consecutive meetings held shall cease to be a director. . the board secretary should maintain the board meeting minutes and open for inspection by any director |

|

|

|

Board composition |

. number of directors not less than 7 and not more than 13 . total period of service of a director 9 years except CEO . executive directors should not exceed one third of number of directors of the board . independent non-executive directors : at least three independent non executive directors or one third of the total number of directors Which ever is higher . Possess academic or professional qualifications or effective experience in Banking, Finance, business administration of any other relevant discipline . . . . . |

|

|

|

What is the required capital adequacy ratio for a commercial bank |

. 14% if the Asset base is greater than 500 billion . . 12.5% if the Asset base is less than 500 billion |

|

|

|

Requirement of tier 1 capital ratio |

10% |

|

|

|

Statuary liquid asset ratio requirement |

20% |

|

|

|

liquidity coverage ratio requirement |

Hundred percent |

|

|

|

Minimum Capital requirement for an LCB |

10 billion ( will be 20 billion after 31st December 2020) |

|

|

|

Minimum Capital requirement for LSB |

5 billion (will be 7.5 billion after 31st December 2020) |

|

|

|

CORPORATE GOVERNANCE; |

. A set of relationships between a company’s management, its board, its shareholders and other stakeholders which provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance. |

It helps to define the way that authority and responsibility are allocated and Corporate decisions are made. |

|

|

responsibilities of the board ** at least 5 |

. Aprove and oversee the Bank's strategic objectives and corporate values . Identify principal risks and implement systems to manage the risk . Review adequacy and integrity of internal control systems and management information system . Approve implementation of a communication policy with all stakeholders . Identification and designation key management personnel KMPs . Ensure availability of appropriate succession plan for KMP s |

|

|

|

A person should not be considered for independent non executive director if |

.Direct or indirect shareholding of more than 1% of the bank. .Any Business transactions with the bank during the 2 years period immediately preceding the appointment as a rector exceeding 10% of the regulatory capital of a bank). .Had been employed by the bank during the 2 year period immediately preceding the appointment as a director. .Has a close relation (spouse or financially dependent child) of director or CEO or a member of KMP or material shareholder of the bank or another banks. .Represent a specific shareholder of the bank.

|

|

|

|

Criteria to decide whether an independent non executive director is independent or not |

.Is an employee or a director or a material shareholder in acompany or business organization; that Currently has business. transactions with the bank, exceeding 10% of the regulatory capital of the bank, or Any of other directors of the bank are employed or are directors or are material shareholders, or Any of other directors of the bank have a transactions, exceeding 10% of the regulatory capital of bank.

|

|

|

|

How to check Fitness and propriety of directors? |

. Should not exceed 70 years of age. .Should not hold directorships in more than 20 entities including; subsidiaries and associate companies. .All directors will submit annually the affidavit and declaration to Director of Bank Supervision for reappointment.

|

|

|

|

Disqualification for being appointed as a Director |

.Committed or involve fraud, deceit, dishonesty or any other improper conduct . .Subject to an investigation or inquiry of a charge involving fraud, deceit, dishonesty or other similar criminal activity. .Convicted by any court in respect of a crime committed in connection with financial management or any offence. .Insolvent or has been declared bankrupt. .Failed to satisfy any judgment or order of any court to repay a debt. .Has been declared as unsound mind. .Removed or suspended by an order of a regulatory authority from serving as a director, CEO or other officer. .Person has been a director, CEO or held any other position of authority in any bank or financial institution; whose license has been suspended or cancelled; or which has been wound up or is being wound up, or Which is being compulsorily liquidated. .A director or an employee of a LCB shall not be appointed, elected or nominated as a Director of another LCB or a LSB (except such LCB or LSB is a subsidiary company or an associate company).

|

|

|

|

Bank Chairperson |

.The chairman to be a non executive director . Preferably independent . The role of Chairman and CEO shall be separate . Provide leadership to the board . Ensure effective functioning of the board and discharge its responsibilities . Ensure the key and appropriate issues are discussed by the board in a timely manner

# board acts on behalf of shareholders. chairman should ensure that views of shareholders are properly communicated to the board

|

|

|

|

Responsibilities of chairman |

.Approving the agenda of the Board meeting. .Ensure that all directors are properly briefed on issues arising at board meetings and ensure receive adequate information in a timely manner. .Encourage all directors to make full and active contribution to the Board affairs and ensure Board acts in the best interests of the bank. .Facilitate effective contribution of non-executive directors. .Shall not engage in activities involving direct supervision of KMPs. .Ensure effective communication with shareholders and that views of shareholders are properly communicated to the Board. |

|

|

|

Management functions delegated by the board |

.Functions can be delegated to Board Committees, CEO, executive directors or KMPs. . Avoid delegation of matters which significantly hinders or reduces the ability of the Board to discharge its functions. . Directors should study and understand the delegation arrangements. . Review the delegation process on a periodic basis. |

|

|

|

Board audit committee |

Chairman of the Board audit committee should be . Independent and non-executive director . Should process qualification and experience in accountancy and/or audit * All members shall be none executive directors |

|

|

|

Responsibilities of board audit committee on external auditors |

.Make recommendations on the apointment of the external auditor. .Review and monitor the external auditor’s independence and objectivity .Before the audit commences, discuss and finalise with the external auditors the nature and scope of the audit. .Develop and implement a Policy on the engagement of an external auditor to provide non-audit services. .Review the external auditor’s management letter. .Review the financial information of the bank, in order to monitor the integrity of the financial statements of the bank.

|

|

|

|

Responsibilities of board audit committee on Internal Audit Function |

.Ensure the independence of internal audit function. .Review the adequacy of the scope, functions and resources. .Review the internal audit programme and results of the internal audit. .Review performance of Chief Internal Auditor and senior staff members. .Recommend any appointment or termination of Chief Internal Auditor and senior staff members.

**The committee shall meet at least twice a year with the external auditors without the executive directors being present.

|

|

|

|

Definition Oversight of risk management |

The responsibility of understanding the risks faced by the bank and ensuring that the risks are appropriately managed are vested with the Board of Directors.

|

|

|

|

Measures under Oversight of risk management |

1. Establish a robust and pervasive risk culture and Clear policies and procedures. 2 .Establish risk limits based on risk appetite of the bank. 3. Ensure senior management of the bank: .establishes an integrated risk management framework. .monitor the bank’s risk exposures. .effectively communicate all policies and procedures throughout the bank.4.Adopt strong internal controls.

|

|

|

|

3 steps in Risk management process |

Identify and assess the potential risks. Develop and execute an action plan to deal with and manage risks. Continuously review and report the risk management practices.

|

|

|

|

2 types of credit risk |

1. Counterparty risk 2. Concentration risk |

|

|

|

Define counterparty risk |

The risk that customers would fail to repay the credit facilities/loans and advances obtained (that is default risk) |

|

|

|

Define concentration risk and give 2 concentration categories |

Risk arises due to imperfect diversification 1. Name concentration 2. Sector concentration |

|

|

|

Define Name concentration |

Credit portfolio has a material share allocated to a single counterparty or a group of related counterparties linked by specific ties (e.g. corporate group).

|

|

|

|

Sector concentration |

relates to imperfect diversification across systematic components of risk, namely sectoral factors. |

|

|

|

4 prudential risk limits stipulated to manage credit Risk |

Stipulate prudential risk limits: 1. Substantial exposure limits. 2. Single/ related party borrower limits. 3. Maximum exposure limits to industry, region, country, etc. 4.Benchmark financial ratios, i.e. ROE, DSR & interest covers .Periodic review/renewal of borrower exposures. .Establish a Loan Review Mechanism (LRM). |

|

|

|

Credit Risk management measures |

. Develop an internal credit-risk grading system. .Develop a scientific system to price the credit risk. .Set quantitative ceilings on aggregate exposure in specified rating categories. . Evaluate the rating-wise distribution of borrowers. . Undertake rapid portfolio reviews, stress tests and scenario analyses. |

|

|

|

3 areas of Regulations on credit Risk management |

1.Maximum amount of accommodation 2. classification of loans and advances 3.exposure to stock market |

|

|

|

4 limits Maximum amount of accommodation |

.Single borrower limit of 30% as a percentage of the banks capital base .Group borrower limit of 33% .Large exposures - 15% of the capital base .Aggregate limit of 55% of the total outstanding amount of accommodation for large exposures |

|

|

|

Classification of loans and advances and regulations on credit risk management |

Performing and performing income recognition and loan loss provisioning |

|

|

|

Exposure to stock market |

To maintain internal limits on margin trading and introduce proper internal controls |

|

|

|

Define Market risk |

refers to the risk to an institution resulting from movements in market prices, in particular, changes in interest rates, foreign exchange rates, and equity and commodity prices |

|

|

|

Measures to manage market risk |

1.Establish a Asset and Liability Management Committee (ALCO) ALCO, consisting of the bank’s senior management functions as the top- end operational unit for managing the balance sheet of the bank. One of the ALCO’s goals is ensuring adequate liquidity while managing the bank’s spread between the interest income and interest expense 2. Set up an independent Middle Office to track the magnitude of market risk on a real time basis.

|

|

|

|

Define liquidity |

Liquidity is the ability of a bank to fund increases in assets and meet obligations as they come due, without incurring unacceptable losses. |

|

|

|

Why liquidity risk management is important |

The fundamental role of banks in the maturity transformation of shortterm deposits into long-term loans makes banks inherently vulnerable to liquidity risk, both of an institution-speciflc nature and that which affects markets as a whole. Liquidity risk management is of paramount importance because a liquidity shortfall at a single institution can have system-wide repercussions. |

|

|

|

Give 3 ratios of regulatory requirements on liquidity risk management |

1.Statutory Liquid Asset Ratio (SLAR) - minimum requirement 20% 2.Liquidity coverage ratio (LCR) -minimum requirement and present 3.Net Stable Funding Fatio in (NSFR) - minimum requirement 90% |

|

|

|

Define Operational risk |

> The risk of loss resulting from inadequate or failed internal processes, people and systems or from external events such as political or economic events. .This definition includes legal risk, but excludes strategic and reputational risk. example: frauds

|

|

|

|

Define Reputational risk |

Refers to the potential adverse effects, Which can arise rom a Bank’s reputation being tarnished due to factors such as unethical practices, regulatory actions, customer dissatisfaction and complaints, negative/adverse publicity etc. |

|

|

|

3 Points in Regulations on operational risk management |

1. Customer charter 2. Outsourcing 3. Customer due diligence - Know Your Customer |

|

|

|

Related party Transactions |

Tee board should ensure that the bank does not engage in any transactions with related parties in a manner that will grant such parties more favourable treatment than other customers |

|

|

|

List related parties of a bank |

1. Bank's subsidiary companies 2. 3. 4. 5. 6. 7. 8. 9. |

|