![]()

![]()

![]()

Use LEFT and RIGHT arrow keys to navigate between flashcards;

Use UP and DOWN arrow keys to flip the card;

H to show hint;

A reads text to speech;

79 Cards in this Set

- Front

- Back

|

Commercial annuity |

Sold by LI companies, provided payments over fixed period of time or duration of 1 or more lives |

|

|

Annuity |

Series of periodic payments for specified period of time |

|

|

Longevity risk |

Aka Superannuation problem. Living too long so that outlives assets |

|

|

True or false? Annuitant must also be owner |

False. But if annuitant not owner then also not party to contract (can’t make decisions re contract) |

|

|

Annuitizing the contract |

Insurance company makes the periodic payments |

|

|

What happens to annuity at death of annuitant or owner? Taxes? |

Named beneficiary gets death benefit or any unpaid value. Taxable even if name someone other than estate |

|

|

2 phases of deferred annuities and biggest advantage |

1. Accumulation - single or multi premium payments invested in annuity 2. Annuitization aka distribution or liquidation - payout of benefits. No more premiums invested but earned income on investments added to account Biggest advantage - earnings accumulate tax-deferred |

|

|

Immediate versus deferred annuity |

Immediate - payment begins one payment interval after purchase. Payments can be monthly, quarterly, semi annually, or annually. The higher the frequency, the lower the payment amount Deferred - start payout more than one interval after purchase |

|

|

Single premium annuity versus periodic premium annuity |

Single premium - paid as lump sum. Can be immediate or deferred Periodic premium - aka flexible premium. Paid over several months or years. Can only be deferred |

|

|

Single life annuity vs joint life annuity vs joint and survivor |

Single life - duration of only 1 annuitant’s life determines how long benefit payments continue Joint life - Benefit payments continue until first of 2/3 annuitants die. joint and survivor life - benefit payments continue while either of annuitants alive. Often used to provide smaller periodic benefit to survivor after first death. Can continue payments to family or trust |

|

|

Pure annuity versus refund annuity — what’s the difference as you age? |

Pure life - 1 annuitant, benefit payments made while annuitant lives, no payments after death Refund life - Refund of premium when annuitant dies sooner than expected and benefit payments have been less than amount of premiums Older you are, the bigger the diff b/w amounts. Pure life amount only based life expectancy. Shorter time to live = pure life amounts higher. Refund life amount increases much more slowly because not entirely based on life expectancy. |

|

|

Qualified annuity vs nonqualified annuity |

Qualified - funded with pre-tax $, benefit payments fully taxable

Nonqualified - funded with after-tax $, earnings tax-deferred during accumulation phase. At annuitization, part of each payment taxed (earnings distribution), part tax-free (principal previously taxed) |

|

|

Fixed annuity versus variable annuity |

Fixed - specified dollar payment Variable - payment varies with investment success |

|

|

Annuitization option 1/6 - pure or straight life. Definition, pros and cons. |

Payments continue until death. Nothing after. Pros: Greater monthly payment than all other annuitization options because forfeit principal if premature death increases payout to surviving annuitants. Cons: no inflation protection, lack of liquidity in annuitization phase, chance of losing bet (premature death) |

|

|

Annuitization option type - refund annuity |

At death, beneficiary gets difference between total premiums paid and benefit payments. Paid as lump sum or monthly |

|

|

Annuitization option 2/6 - life with cash refund |

At death, beneficiary gets lump sum payment of part of principal amount promised minus amount received by annuitant |

|

|

Annuitization option 3/6 - life with installment refund |

At death, beneficiary gets installment payments equal to principal amount promised minus amount received by annuitant |

|

|

Annuitization option 4/6 - Life with period certain |

If annuitant dies before certain # of years, beneficiary gets payments for remainder of minimum period. Longer the guarantee period, more expensive it is = lower benefit payments |

|

|

Annuitization option 5/6 - period certain |

Payments continue for certain period of time. Not contingent on death |

|

|

Annuitization option 6/6 - temporary annuity |

Payments for shorter period of time or until death. No beneficiary |

|

|

Traditional fixed annuity - how it works |

Benefit payments known in advance because cost elements of mortality, expenses and interest credits guaranteed. Premiums go into insurance company’s general investment account. Company bears investment risk by guaranteeing minimum interest rate. If annuitant outlives life expectancy, payments consist of survivorship/insurance benefit. Payments do not increase with inflation |

|

|

Participating annuity |

Annuity pays dividend |

|

|

Variable annuities – accumulation phase |

Premiums buy accumulation units in subaccounts, separate from insurance companies general investment account. Dividends used to purchase additional units. Clients can choose subaccounts |

|

|

Variable annuities – annuitization phae |

Accumulation units exchange for annuity units. Annuitant chooses fixed or variable monthly amount. |

|

|

How is variable annuity variable monthly amount determined? |

Benefit payment unit = value of total assets supporting the benefit payment units divided by OUTSTANDING total number of benefit payment units |

|

|

Variable annuity rider - Guaranteed minimum income benefit |

Guarantees minimum income amount in annitizatuion phase. Protects insured if value of subaccounts falls drastically. Usually 10 years before annuitized, can’t be withdrawn as lump sum. Amount of premiums usually compounded at specified interest rate vs staying fixed OR benefit base stepped up to account balance at certain anniversaries (this option less likely to keep up with inflation). Rider usually 60-80 basis points per year (can increase)

|

|

|

Variable annuity rider - Guaranteed minimum withdrawal benefit |

Guarantees owner’s investment at a minimum and may guarantee investment amount plus interest. Promises minimum amount even if annuity cash value falls to 0. Unlike guaranteed minimum income benefit rider, does not require annuitization to get benefits, no waiting period before withdrawals can begin. 70-90 basis points, up to 120 over time. |

|

|

Variable annuity rider for enhanced death benefit |

If annuitant dies during accumulation phase, death benefit will be greater of a) current account value or b) highest anniversary value. |

|

|

Variable annuity rider for enhanced death benefit |

If annuitant dies during accumulation phase, death benefit will be greater of a) current account value or b) highest anniversary value. Third optional value based on specified percentage increase per year |

|

|

Variable annuity rider - enhanced death benefit |

If annuitant dies during accumulation phase, death benefit will be greater of a) current account value or b) highest anniversary value. Third optional value based on specified percentage increase per year. 35-115 basis points/year |

|

|

Variable annuity rider - guaranteed lifetime withdrawal benefit |

Guarantees partial withdrawals of limited amounts for owners lifetime or joint lifetime |

|

|

Advantages of variable annuities |

-some hedge against inflation -tax deferral investment income during accumulation and some during annuitization period -professional management of investment money -Dollar cost averaging -diversification |

|

|

Disadvantages of variable annuities |

-investment risk, no minimum guaranteed interest rate and potential loss of value when subaccounts in down stage of market cycle -Complexity of investment portfolios -total cost can be substantial with fees like sales charges, management fees, insurance costs, etc. |

|

|

Equity-indexed annuities |

Guarantees minimum interest of a traditional fixed annuity but additional potential growth based on growth of index fund. More risk but potential for greater return than fixed annuity. Less and less potential return than variable annuity. |

|

|

Participation rate in equity-indexed annuities |

Specified percentage of the gain and the index determines return to annuity owner. Time for measuring index varies, could be one year or average over several years. |

|

|

What typically happens if index decreases in equity-indexed annuity? |

Minimum guaranteed interest-rate is credited to the account, usually 1 to 3% paid on 90% of total payments made |

|

|

Asset fee in equity-indexed annuities |

Sometimes called spread or margin. If spread is 2% and gain in the index is 10%, then 8% is used as the gain in index. Contract may specify cap on interest |

|

|

Two reasons equity–indexed annuity should be viewed as long-term investment |

1. Some contracts allow ins company can change participation rate, interest, or spread at each policy anniversary 2. If contract terminated before end of interest crediting term, index credit lost |

|

|

Regulation of annuities |

State insurance commissions regulate FIXED. Not considered securities do not subject to FINRA or SEC reg VARIABLE regulated by SEC. Anyone selling must hold FINRA series 6 or 7 AND insurance licenses. Prospectus required. INDEX may or may not be considered security. If security camera registered with the SEC. If considered fixed, regulated by state insurance commission. |

|

|

CFP requirements for selling variable annuity or life ins |

1. Provide documentation of plan recommendations and any product disclosures 2. Current prospectus 3. Any compensation that may be received upon sale of anybody including commissions and trailing commissions from 12b-1 fees for variable product |

|

|

How are contributory plans taxed versus non-contributory plans? |

Non-Contributory plans only have pre-tax dollars so employee has no cost basis. Full amount of annuity payments included in gross income. Contributory plans have after-tax dollars. Employee has cost basis. Only part of annuity payments included in gross income. |

|

|

How are qualified (funded with pre-tax $) annuity tax-excluded amounts determined? Individual versus joint and survivor |

Individual - Employee cost basis/total investment divided by number of payments based on employee age Joint and survivor - Employee cost basis/total investment divided by number of payments based on employee and spouse combined age |

|

|

How are nonqualified (funded with after-tax $) annuity tax-excluded amounts determined for under age 59-1/2 during accumulation period? |

Accumulation grows tax-deferred. Withdrawals taxed on last in first out basis (earnings distributed first) if annuity purchased or funded after August 13, 1982. Earnings subject to ordinary income tax + 10% premature distribution penalty for Annuitant under age 59 1/2 - only on part of distribution subject to tax If purchased or funded on or before August 13, 1982, no tax until more than purchase amount withdrawn. |

|

|

How are nonqualified (funded with after-tax $) annuity tax-excluded amounts determined for under age 59-1/2? |

Ss |

|

|

How are nonqualified (funded with after-tax $) annuity tax-excluded amounts determined for older than age 59-1/2? |

Ss |

|

|

How are nonqualified (funded with after-tax $) annuity tax-excluded amounts determined for older than age 59-1/2 during accumulation period? |

Amount withdrawn subject to ordinary income tax if gain |

|

|

How is nonqualified annuity taxed withdrawal of $25k at age 60 if $50k invested, grows to $70k? |

If purchased after 8/13/82, $20k taxed. $5k principal not taxed. LIFO (last in, first out). If purchased on or before 8/13/82, no tax. No tax until $50k withdrawn. FIFO (first in, first out). |

|

|

How is nonqualified annuity taxed withdrawal of $25k at age 56 if $50k invested, grows to $70k during accumulation period? |

$20k subject to income tax + $2k excise tax for being under age 59-1/2 (10% on early withdrawals on amount subject to income tax) |

|

|

4 scenarios when early distributions NOT taxed (before age 59-1/2) during accumulation period |

1. Wait for annuitization period instead of withdrawing 2. Owner dies or disabled 3. Distributions made as substantially equal periodic payments as per section 72(q) of tax code 4. Annuity purchased as qualified funding asset from personal injury settlement (structured settlement) |

|

|

IRS annuity aggregation rules |

All unities purchased from same insurer by same person in same year considered 1 contract. So that owners don’t cheat on taxes paid on withdrawals |

|

|

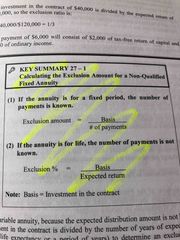

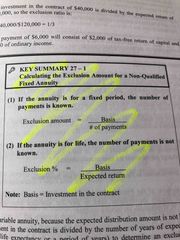

What amount is excluded from tax in non-qualified annuities annuitzation period? |

1. Cost basis divided by number of payments = amount Excluded from tax of each payment 2. For fixed annuities: cost basis divided by IRS annuity table with estimated expected return = exclusion ratio/Percentage of each payment excluded from tax |

|

|

What amount is excluded from tax in non-qualified fixed annuity annuitzation period? |

1. Fixed # payments: Cost basis divided by number of payments = amount Excluded from tax of each payment 2. Payments for life: cost basis divided by IRS annuity table with estimated expected return = exclusion ratio/Percentage of each payment excluded from tax |

|

|

What amount is excluded from tax in non-qualified FIXED annuity annuitzation period? |

1. Fixed # payments: Cost basis divided by number of payments = amount Excluded from tax of each payment 2. Payments for life: cost basis divided by IRS annuity table with estimated expected return = exclusion ratio/Percentage of each payment excluded from tax |

|

|

What amount is excluded from tax in non-qualified VARIABLE annuity annuitzation period? |

Cost basis divided by expected # payments = amount of each payment excluded from tax |

|

|

How is the annuity taxed at owner death? |

Beneficiary pays tax on gains (no step up in basis). Can set up benefit as life annuity but must be made within 60 days of death and first distribution taken by first anniversary of owner death |

|

|

Two scenarios allowed in section 1035 exchange |

1. Exchange one annuity for another if same annuitant and trustee to trustee transfer between insurance companies 2. Part of funds from annuity transferred to a new annuity in nontaxable partial exchange |

|

|

When can annuity distributions be used to pay for long-term care tax free? |

DEFERRED - Partial 1035 exchange from nonqualified annuity to the long-term care insurance company. Funds paid directly from 1 ins co to other. For same insured. Single premium immediate - income paid to LTC insurer traded as partial assignment of income in 1035 exchange and tax free. Funds paid directly from 1 ins co to other. For same insured. Not all LTC companies accept 1035 exchanges. 1035 exchange to long-term care only for nonqualified annuities. |

|

|

What part of annoyed he does beneficiary receive at owner death? |

Account balance or amount of premiums paid |

|

|

Rules when annuity owner dies and annuitant is different person |

1. If payments haven’t begun, interest must be distributed within 5 years of death 2. If payments have begun, remaining amount must be distributed at least as quickly as what owner set up. 3. If bene is spouse, can treat annuity as own. Can delay distribution or continue. 4. If bene an entity (not person), interest must be distributed within 5 years of death |

|

|

Tax rules for earnings when owner is not person (unless trust) |

Corporation/non natural person reports earnings or accruals as ordinary income in a year it is credited to contract (vs when benefits paid). Applies to all annuity types |

|

|

Structured settlement |

Agreement for receiving large lump sum payment to instead receive periodic payments. Often used in injury settlements like car accident. Annuity purchased by ins co insuring defendant |

|

|

Text treatment of structured settlements |

Compensatory payments and wrongful deaths tax free. punitive payments and employment discrimination, and pure emotional distress taxable. |

|

|

3 ways to use annuities to solve superannuation in retirement planning |

1. Immediate annuity make up for shortfall in income for essential expenses after SS and pension income. Investments cover discretionary expenses. 2. Deferred annuity for later age for higher payout amount 3. Variable with guaranteed minimum withdrawal benefit rider so don’t have to trade longevity for lifestyle and do so with low risk |

|

|

Qualified longevity annuity contract |

Employees can carve out lesser of $125,000 or 25% of qualified defined contribution plans’ account balance to purchase QLAC (deferred annuity). (Aggregate amount as of 12/31 for IRAs, which are not qualified defined contribution plans.) Must begin no later than age 85. Before annuitization/payments begin, QLAC amount excluded from balance used to determine RMDs.

|

|

|

Hybrid annuiry |

Annuity with LTC rider. Payments increase if LTC needed. $$$. Regular LTC policies provide better benefits for the money (but nothing paid out if LTC never used and premiums can increase). Section 1035 tax-deferred exchange sometimes allowed if want to make annuity a hybrid. |

|

|

Evaluate annuities for what |

1. Financial strength of ins co - use ratings by A.M. Best, S&P, Moody’s, Fitch... 2. Bonus rates and Ins co’s renewal rate - does renewal rate drop to guaranteed minimum rate after bonus period expires or renews at rates above minimum? 3. Guaranteed minimum withdrawal benefits - simplicity over complexity 4. Annuitization timing - what are interest rates? If low, can clients delay annuitizing? 5. Avoid anchoring (fixate on 1 characteristic to exclusion of all other factors) when evaluating 6. Annuitize or take withdrawals as needed? Taxes, when money is needed, etcfscitd |

|

|

Factors to consider - annuitize or take withdrawals? |

- tax implications - LIFO for withdrawals, part of annuity tax-free - immediate need for cash or lifetime income? - withdrawals will deplete amount in annuity - total paid after annuitization will be higher than withdrawal - client ok with annuity costs for additional risks taken by ins co? - client gives up flexibility of withdrawals with annuity - annuity at end of life may not have enough to leave much to heirs - client may want to preserve Medicaid eligibility |

|

|

12b-1 fees |

Annual distribution or marketing fee applied to sub accounts of variable annuities and mutual funds. Can be used to provide ongoing comp to sales as well |

|

|

403(b) |

Retirement plan established by tax exempt organizations and public school districts |

|

|

457 plan |

Retirement plan established by a governmental units, agencies and tax exempt organizations |

|

|

Defined contribution plan |

Qualified retirement plan established by employer in which individual accounts are establish for participating employees. Employer contributes % of each employee’s compensation. Benefits based on amounts contributed to each participant’s account and returns earned on accounts |

|

|

Dollar cost averaging |

Investment strategy requiring investor to purchase same dollar amount at regular intervals like monthly or quarterly instead of investing a lump sum at one time. Investments spread over time to reduce risk of buying at wrong time. Doesn’t illuminate risk but lowers potential for lower average cost per share |

|

|

FINRA |

Financial Industry Regulatory Authority. Self regulatory organization that oversees broker dealers. Writes and enforces rules for sale of securities and those who sell them. |

|

|

NAIC |

National Association of Insurance Commissioners. National organization of state officials responsible for regulation and supervision of insurance. No official power but fosters uniformity of insurance laws and regulations among states |

|

|

NAIC |

National Association of Insurance Commissioners. National organization of state officials responsible for regulation and supervision of insurance. No official power but fosters uniformity of insurance laws and regulations among states |

|

|

Probate |

Legal process through which decedent’s well is validated, claims against estate paid and assets distributed to beneficiaries |

|

|

Qualified retirement plans |

Retirement plans establish my employers in order to receive special tax treatment such as ability to deduct contributions made and tax-deferred growth prior to when distributions are made to employees |

|

|

SEC |

Securities and Exchange Commission. Government agency that enforces securities laws and regulate stock exchanges and other key participants in the securities industry |

|

|

Relationship between variable annuities and cost of living |

Proponents say that over the long term, Dividends and market prices of common stocks tend to very directly with changes in cost of living. Helped client maintained purchasing power during distribution period |